Gap insurance, or guaranteed asset protection, is an optional coverage that helps pay the difference between the actual cash value of your vehicle and the remaining auto loan balance in the event of a total loss. It is usually added to full-coverage car insurance and can be purchased from auto insurance companies, car dealerships, banks, credit unions, or standalone gap providers. While it is not always required, gap insurance may be needed if you have a large car loan or a vehicle that depreciates quickly. The best gap insurance companies include Erie, Nationwide, Liberty Mutual, The Hartford, Travelers, Allstate, and Progressive.

| Characteristics | Values |

|---|---|

| Average annual cost | $61 |

| Average monthly cost | $3-5 |

| Cheapest provider | Progressive |

| Widely available | Liberty Mutual |

| Best for customer service | Amica |

| Best for seniors | The Hartford |

| Best for newer cars | Travelers |

| Best value | Erie |

| Cheapest | Nationwide |

What You'll Learn

- Gap insurance is optional but may be required by lenders or leasing companies

- You can buy gap insurance from car insurance companies, car dealerships, lenders, banks, and credit unions

- Buying gap insurance from a car insurance company is usually cheaper than buying it from a car dealership

- Gap insurance is worth it if your loan balance is higher than your car's value

- You can cancel gap insurance if it's no longer needed

Gap insurance is optional but may be required by lenders or leasing companies

Gap insurance is worth considering if you fall into one of the following categories:

- Those who paid a small down payment: A lower down payment means you owe more on your vehicle.

- People who lease a car: If your lease doesn’t come with gap insurance, you should consider gap coverage as leases have low monthly payments, and thus, a larger gap between the amount owed and the value of the car.

- Drivers who have other products on their auto loan: If your loan includes other products like an extended warranty or debt from other vehicles, you’ll owe much more than the value of your vehicle.

- People who drive sports cars or luxury vehicles: Sports cars and more expensive vehicles tend to depreciate faster, so gap insurance will help you stay financially protected in the event of a major collision.

Gap insurance is typically available from insurance companies, car dealerships, and lenders/finance companies. It can be purchased as a stand-alone policy or as an add-on to an existing insurance policy. When deciding where to purchase gap insurance, it is important to consider the cost and convenience.

Purchasing gap insurance from an insurance company may be the most cost-effective option, as it can often be added to an existing policy for a relatively low price. On the other hand, buying gap insurance from a dealership or lender may be more convenient, as it can be rolled into your loan payments. However, this option may be more expensive in the long run, as you will be paying interest on the cost of the gap insurance over the life of the loan.

Ultimately, the decision to purchase gap insurance depends on individual circumstances and financial situations. It is important to carefully consider the pros and cons of gap insurance and consult with a trusted financial advisor or insurance professional before making a decision.

Auto Insurance Rates: Unfair Hikes?

You may want to see also

You can buy gap insurance from car insurance companies, car dealerships, lenders, banks, and credit unions

If you're looking to buy gap insurance, there are several options available to you. You can buy gap insurance from car insurance companies, car dealerships, lenders, banks, and credit unions.

Car Insurance Companies

Many major auto insurers, including State Farm, Nationwide, Progressive, Allstate, USAA, AAA, and Esurance, offer stand-alone gap insurance or coverage as an add-on to your existing policy. However, not all insurers offer gap insurance, so you may need to shop around and compare quotes to find the best option for you. Adding gap insurance to your existing policy is typically the cheapest option and can result in significant savings compared to purchasing separate coverage from a dealership or financing company.

Car Dealerships

The dealer from whom you purchase your vehicle may also offer gap insurance, providing convenient one-stop shopping. However, it will likely be more expensive than adding it to an existing insurance policy, as the cost of the coverage may be bundled into your loan amount, resulting in higher interest payments.

Lenders

You can also purchase gap coverage from a car loan lender or finance company. However, similar to dealerships, this option may be more costly than buying coverage from your auto insurance company.

Banks and Credit Unions

Banks and credit unions are another source for gap insurance. In some cases, they may include free gap insurance automatically when you take out a car loan.

When considering where to purchase gap insurance, it is important to compare prices, coverage limits, and other factors to ensure you are getting the best value for your needs.

Leasing vs Financing: Insurance Costs

You may want to see also

Buying gap insurance from a car insurance company is usually cheaper than buying it from a car dealership

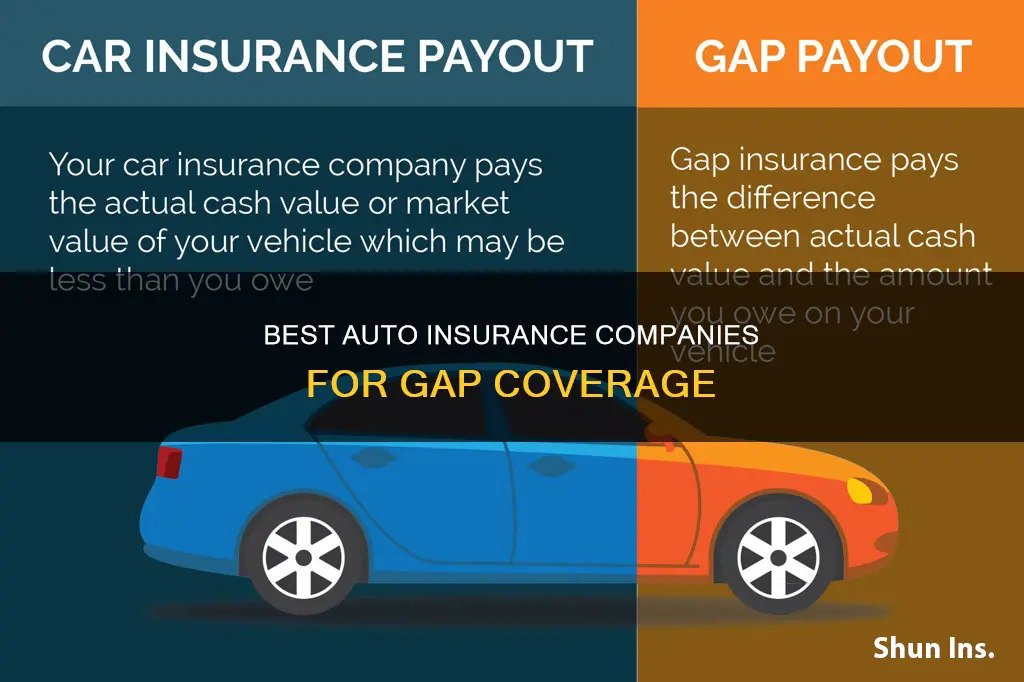

When buying a new car, many drivers end up making auto loan or lease payments for years. However, a new car's value can drop significantly, especially within the first year. If your new car is totaled in an accident, a full-coverage car insurance policy will only cover up to the vehicle's current market value. So, if you still owe more than what your car insurance will cover, you are responsible for paying off the remaining loan amount. This is where gap insurance comes in.

Gap insurance, or guaranteed asset protection, is an optional coverage that pays the difference between what your vehicle is worth and how much you owe on your car loan at the time it's stolen or totaled. This coverage supplements a comprehensive or collision car insurance payout, which can only be as high as your car's value.

You can buy gap insurance from a car dealership or an insurance company. However, buying gap insurance from a car insurance company is usually cheaper than buying it from a car dealership. Gap coverage purchased from a car dealership is often hundreds of dollars more expensive than gap insurance from an insurance company. Additionally, the cost of coverage from a dealership is factored into your total loan amount, meaning it will be included in the total interest paid on your car loan. As a result, not only are you paying more for the coverage, but you'll also see an increase in your car's loan payments.

On the other hand, gap insurance from an insurance company is typically much cheaper, with an average annual cost of $61, according to Forbes Advisor's analysis. When purchased through your insurer, your premium will increase only slightly when you add the coverage, and you can choose to remove it when it no longer makes sense.

Therefore, it is generally recommended to buy gap insurance from an insurance company rather than a car dealer to get the same coverage at a much lower cost.

Autonomous Vehicles: Insurable Future?

You may want to see also

Gap insurance is worth it if your loan balance is higher than your car's value

Gap insurance is a type of optional auto insurance that covers the difference between the value of your car and the balance of your loan in the event of theft or a total loss. It is worth it if your loan balance is higher than your car's value, as it can help you avoid paying out of pocket for a car you can no longer drive.

Gap insurance is typically inexpensive, costing on average $61 a year according to Forbes Advisor, though it can be more expensive if purchased through a dealership. It is also usually only available for new vehicles or used vehicles that are less than a few years old.

When deciding whether to purchase gap insurance, consider the following:

- The size of your down payment: A smaller down payment means you owe more on your vehicle.

- The length of your loan: The longer your loan, the higher the chance of owing more than your vehicle is worth.

- The rate of depreciation: Some vehicles depreciate faster than others.

- The inclusion of other products in your loan: The inclusion of other products, like an extended warranty, will increase the amount you owe.

- The make and model of your car: Sports cars and luxury vehicles tend to depreciate faster.

If you decide to purchase gap insurance, you can typically do so through your auto insurance company or your car dealership. However, it is important to note that gap insurance is usually only available as an add-on to your existing policy, and not all insurance companies offer it. Additionally, gap insurance does not cover your deductible costs.

Understanding the Uber Insurance Policy: What You Need to Know

You may want to see also

You can cancel gap insurance if it's no longer needed

Yes, you can cancel gap insurance if you no longer need it. Gap insurance covers the difference between your car's value and the balance of your car loan in the event of a total loss. It is usually added to a full-coverage car insurance policy and can be purchased from car insurance companies, banks, credit unions, dealerships, and lenders.

If you have paid for gap insurance upfront and then decide to cancel it, you may be able to get a refund for the unused portion of the coverage. The amount of the refund will depend on the cost of the premium and the length of time left on the policy. To cancel your gap insurance, contact your insurance company and request that they cancel your policy and issue a refund for any unused coverage. Be prepared to provide information and documents, such as proof that your vehicle has been sold or traded and verification of its current mileage.

It is important to note that there may be a cancellation fee associated with terminating your gap insurance policy, and this fee can vary depending on the insurer and the type of policy. Additionally, make sure to have a new policy in place before cancelling your existing gap insurance to ensure there is no lapse in coverage.

Auto, Home, and Boat Insurance via AARP

You may want to see also

Frequently asked questions

Gap insurance, or Guaranteed Asset Protection, covers the difference between the remaining loan balance and your vehicle's value in the event of a total loss.

Gap insurance covers the difference between what you owe on a car lease or loan and the amount paid out in a total loss settlement from an auto insurer, minus your deductible.

It is recommended to buy gap insurance at the time of purchasing your vehicle or as soon as possible after buying a new car.

You can buy gap insurance from auto insurance companies, car dealerships, lenders, banks, and credit unions.

Gap insurance costs an average of $61 per year, but the price varies depending on the insurance company and your vehicle.