AARP, formerly the American Association of Retired Persons, has offered auto insurance plans through The Hartford Group since 1984. The Hartford provides auto insurance to AARP members over the age of 50 and offers special policy features to accommodate senior lifestyles that may not be found elsewhere. AARP auto insurance from The Hartford includes extra accommodations for seniors such as its RecoverCare coverage, which helps cover necessary home services after a covered accident.

What You'll Learn

Discounts for bundling home and auto insurance

- Potential savings: Bundling your home and auto insurance can result in significant savings on your premiums, with discounts ranging from 7% to 25% or more.

- Easy policy management: Having all your insurance policies in one place can simplify policy management, as you'll only need to deal with one insurance company, and you may be able to combine bills and manage your accounts through a single online portal or mobile app.

- Streamlined billing: By bundling your home and auto insurance, you may be able to combine bills and receive a single bill for both policies each billing cycle.

- Single deductible: In some cases, you may qualify for a single deductible, which means that if your vehicle and home are damaged in a single covered event, you will only need to pay one deductible instead of two.

When considering bundling, it's important to weigh the potential benefits against any drawbacks. For example, bundling may not always result in the lowest rates, as your current insurer may offer better rates for bundling, but you may find cheaper options by purchasing separate policies from different insurers. Additionally, not all insurers offer both home and auto policies, so bundling may not be an option with your preferred insurer.

To find the best bundling option, it's recommended to get quotes from multiple insurance companies and compare the discounts, coverage options, and customer service offered by each. It's also important to consider your specific needs and requirements when making your decision.

Credit Karma: Unlocking Your Auto Insurance Score

You may want to see also

RecoverCare coverage

The coverage limit for RecoverCare is $2,500 for six months, depending on the state, and it is available to AARP members over the age of 50. This feature is one of several unique benefits of AARP auto insurance, which also include new car replacement coverage, accident forgiveness, and a disappearing deductible.

AARP auto insurance is offered exclusively to AARP members through The Hartford and has been since 1984. AARP, formerly the American Association of Retired Persons, is a nonprofit membership organization for people aged 50 and older.

The Hartford has an A+ financial strength rating from AM Best and has received strong ratings from J.D. Power for claims satisfaction and customer satisfaction. However, it is important to note that The Hartford has a higher-than-average level of complaints filed with state insurance departments.

Overall, AARP auto insurance through The Hartford offers robust coverage options and discounts for seniors, making it a good option for those aged 50 and up.

The 25-Year-Old Insurance Myth: Why Rates May Not Drop

You may want to see also

New car replacement coverage

The cost of new car replacement coverage varies depending on factors such as the purchase price of your vehicle, your location, and other considerations. It is typically offered as an optional add-on to your comprehensive and collision insurance policies, and some insurers may offer it as part of a package of upgrades. While it provides valuable peace of mind, it is important to note that new car replacement coverage may not be available in all states or from all insurance providers.

AARP, in partnership with The Hartford, offers new car replacement coverage as part of their auto insurance program for members over the age of 50. This coverage option is included in their auto insurance policies at no extra cost, providing added value and financial protection for seniors. With this coverage, AARP members can have peace of mind knowing that they will be able to replace their new vehicle without incurring a significant financial burden if it is stolen or totalled within the first year of ownership or before reaching 15,000 miles.

The new car replacement coverage offered by AARP and The Hartford is a valuable benefit for older drivers, as it ensures that they will not have to worry about the financial implications of replacing their vehicle if an accident or theft occurs during the first year of ownership. This coverage option aligns with AARP's mission to serve the needs of older adults and provide specialized protections that cater to senior lifestyles. By including this coverage at no additional cost, AARP demonstrates its commitment to offering comprehensive and affordable auto insurance solutions for its members.

In summary, new car replacement coverage is a valuable optional add-on to your auto insurance policy, especially if you have recently purchased a new vehicle. It provides financial protection against the rapid depreciation of your car's value, ensuring that you can replace it with a brand-new model in the event of theft or total loss. AARP's inclusion of this coverage at no extra cost in their auto insurance policies for members over 50 underscores their dedication to providing tailored and cost-effective solutions for senior drivers.

U.S. Travel to Canada: Is Your USAA Auto Insurance Enough?

You may want to see also

Accident forgiveness

AARP car insurance offers a range of insurance options, including auto, RV, renters, condo, and home insurance. The Hartford also offers other types of insurance that are available to those without an AARP membership, such as employee benefits for businesses and commercial auto insurance.

AARP car insurance is a good option for those over 50, with its variety of discounts and coverage options. However, it is important to note that The Hartford has received a higher-than-average level of complaints filed with state insurance departments about its car insurance.

Marital Status and Auto Insurance: The Impact on Your Premiums

You may want to see also

Disappearing deductible

A "disappearing deductible" is an optional incentive offered by some insurance companies to reward accident-free drivers. The deductible is the amount you pay when you file a claim before your insurance coverage starts. With a disappearing deductible, your deductible decreases or "vanishes" the longer you go without an accident or violation.

The AARP Auto Insurance Program from The Hartford includes a disappearing deductible. For every year you are accident-free, your premium goes down by $50. Eventually, you could have no deductible at all. However, this program is not available to California policyholders, and New York policyholders can only reduce their deductible to $100.

To qualify for The Hartford's Disappearing Deductible program, you must not have any moving violations on your driving record within the past three years. Additionally, all drivers on the policy must have three consecutive years of accident-free driving while insured by The Hartford.

Other insurance companies that offer disappearing deductible programs include Nationwide, Allstate, and Liberty Mutual. The specifics of these programs vary, but they generally involve reducing your deductible by a set amount each year you are accident-free.

It's important to note that disappearing deductible programs may not be worth it for everyone. If you don't drive regularly or have a good driving record, you may not see the benefits of these programs. Additionally, if you do have an accident, your deductible may go back up to the starting amount.

Auto Insurance in Russia: What You Need to Know

You may want to see also

Frequently asked questions

AARP offers auto insurance to its members over the age of 50 through The Hartford Group.

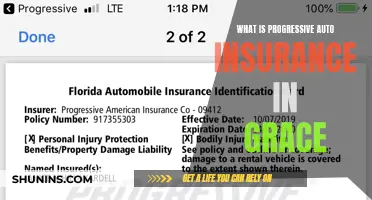

The auto insurance policy includes standard coverages such as liability, uninsured/underinsured motorist, personal injury protection, and comprehensive and collision coverage.

AARP auto insurance offers special policy features to accommodate senior lifestyles, such as RecoverCare coverage, which covers necessary home services after an accident. Other benefits include new car replacement coverage, accident forgiveness, and a disappearing deductible.

You can get a quote for AARP auto insurance by contacting The Hartford Group via phone, online, or by making an appointment with a local agent.