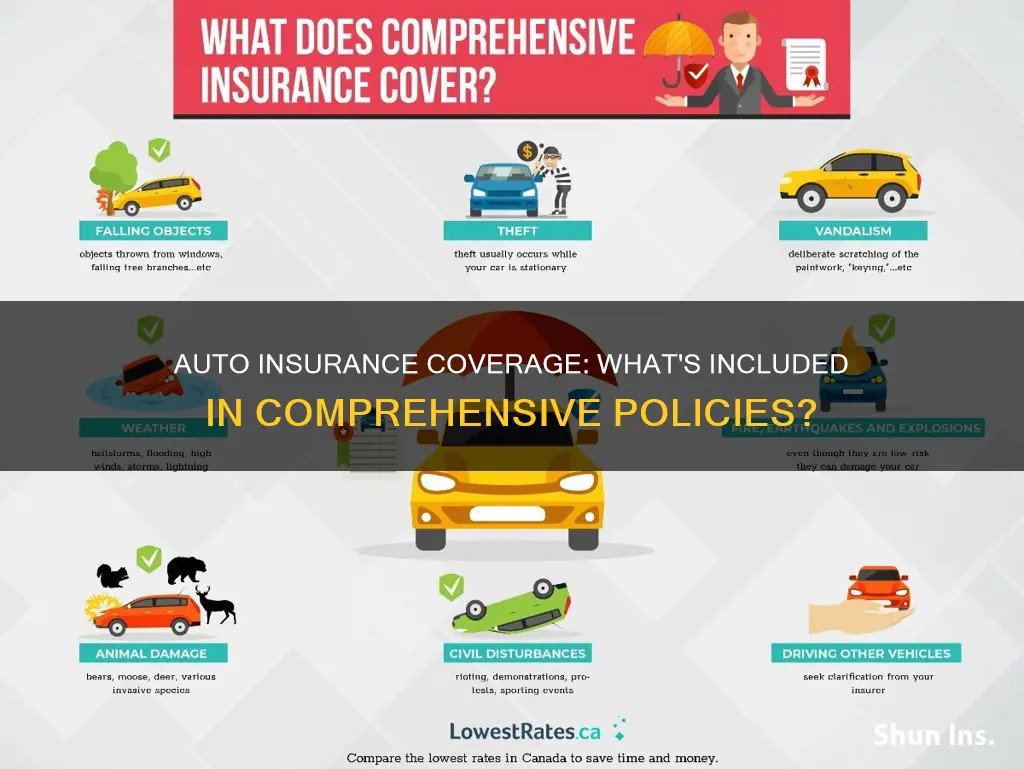

Comprehensive insurance is an optional coverage that protects your vehicle from damage caused by unexpected events that are not collisions. This includes theft, vandalism, fire, accidents with animals, weather damage, and other acts of nature. It's important to note that comprehensive insurance doesn't cover damage caused by a collision with another vehicle or object, and it also doesn't cover medical or legal expenses. The cost of comprehensive insurance varies depending on factors such as the value of the vehicle, location, and driving history.

| Characteristics | Values |

|---|---|

| Type of insurance | Optional coverage that protects against damage to your vehicle caused by non-collision events that are outside of your control |

| What it covers | Theft, vandalism, glass and windshield damage, fire, accidents with animals, weather, or other acts of nature |

| What it doesn't cover | Damages to another vehicle, medical expenses, legal expenses, personal property stolen from your vehicle, normal wear and tear |

| When to get it | If you have a new vehicle, live in an area prone to weather-related disasters or with high car theft, or can't afford to repair or replace your vehicle |

| Cost | Around $134 per year on average, but varies depending on the value of the vehicle, location, and driver's history |

Animal-related damage

Comprehensive insurance can also cover damage caused by your own pet or another person's pet. For example, if a dog scratches your car or a squirrel damages the underside of your car, comprehensive insurance may cover the cost of repairs. It is important to note that you will likely need to pay a deductible before the insurance company covers the damage.

In addition to animal-related damage, comprehensive insurance covers a range of other incidents that are not caused by collisions, such as theft, vandalism, fire, and weather damage. It is optional in most states but may be required by lenders and leasing companies.

To make a claim for animal-related damage, it is recommended to take pictures of any visible car damage, as well as any injuries to you or your passengers. If an animal was involved, look for evidence such as blood or fur on the vehicle. You should also get contact information from any witnesses and ask them to share their account with the police.

The Intersection of Health and Auto Insurance: Exploring Commonalities and Consumer Benefits

You may want to see also

Natural disasters

Comprehensive car insurance is an optional coverage that protects your vehicle from damage caused by events outside your control, such as natural disasters. This type of insurance is crucial as it covers what collision coverage doesn't. It is important to note that comprehensive coverage needs to be in place before a natural disaster occurs, as insurers might place restrictions on policy changes during an impending disaster.

- Earthquakes: Comprehensive coverage can pay for repairs or replacement of your vehicle if it is damaged by an earthquake.

- Floods: Floods can cause extensive damage to vehicles, especially electrical components. Comprehensive insurance covers flood damage, whether minor or major.

- Wildfires: Wildfires can spread quickly, and if your car is in the path of a wildfire, comprehensive coverage can help pay for a new car.

- Hurricanes: Hurricanes bring strong winds and heavy rain, which can lead to damage from falling objects and flying tree branches. Comprehensive coverage can pay for repairs or replacement of your vehicle if it is damaged by a hurricane.

- Hail: Large hail can cause dents, broken windows, and paint damage. Comprehensive coverage can pay to fix all forms of hail damage.

In addition to natural disasters, comprehensive coverage also protects against theft, vandalism, glass and windshield damage, fire, and accidents with animals. It is worth noting that comprehensive coverage has a deductible, which is typically between $250 and $1,000 for comprehensive claims.

Capital One Auto Insurance: What's Included and What's Not

You may want to see also

Theft

Comprehensive car insurance covers theft, including total or partial car theft. It is an optional coverage that protects against damage to your vehicle caused by non-collision events outside of your control. This includes theft, vandalism, glass and windshield damage, fire, accidents with animals, weather, or other acts of nature.

Comprehensive insurance covers the cost of repairing damage to your vehicle caused by theft or attempted theft, such as broken door locks or smashed windows. It also covers the cost of replacing your vehicle if it is stolen. However, it is important to note that comprehensive insurance does not cover the theft of personal property inside the car. For that, you will need to check your homeowners or renters insurance policies.

In the event of theft, it is important to file a police report and an insurance claim as soon as possible. The police will need basic information such as the make and model, plate number, and vehicle identification number. After contacting the police, you should then contact your insurance company to see if you are covered. If you believe personal items were left inside the car, you should also call your homeowners or renters insurance carrier.

Making these calls as soon as possible after discovering the theft can improve the odds that your car is found and that your insurance claim is processed quickly. If your car is recovered after you have filed an insurance claim, be sure to notify your insurance company right away. They will assess the vehicle to determine whether it is a total loss or whether they will pay for repairs.

Comprehensive insurance provides valuable protection against theft and can give you peace of mind as a vehicle owner. However, it is important to review the terms and conditions of your specific policy to fully understand what is covered and any limitations that may apply.

Michigan Auto Insurer: Is AAA the Most Expensive?

You may want to see also

Vandalism

Auto vandalism is when someone intentionally damages or defaces your vehicle. This can include:

- Slashed or damaged tires

- Broken windows, headlights, or taillights

- Dents or scratches, such as from someone keying your car

- Spray painting the car

- Glue in the locks

- Sugar or other substances in the gas tank

Comprehensive auto insurance covers vandalism. Comprehensive insurance covers damage to your car when it is not being driven, including vandalism, theft, and weather-related damage. Comprehensive insurance is optional and is not required by any state, but it is often included in full-coverage policies.

If you have comprehensive insurance, your insurer will cover the cost of repairs minus your deductible. Deductibles for comprehensive coverage typically range from $0 to $2,500, with the most common options being between $250 and $500.

It is important to note that comprehensive insurance will not cover any personal items stolen from your car during an act of vandalism. Coverage for stolen personal items would come from your renters or homeowners insurance.

When to File a Vandalism Claim

If your car has been vandalised, follow these steps:

- Record the damage: Take photos of the damage from multiple angles and make notes about what was damaged or stolen.

- File a police report: Contact your local police department and file a report. They will likely ask for information such as your driver's license number, vehicle registration, and details about the time and location of the incident.

- Contact your insurance company: Provide them with all the information you have, including the police report, photos, and notes. They will assign you a claims adjuster who will assess the damage.

- Decide whether to file a claim: Unless the damage is significant, it may not be worth filing a claim if the repairs cost less than your deductible. Filing a claim may also result in an increase in your insurance rates.

- Repair your vehicle: Many insurance companies have preferred repair shops, but you can also choose your own. If you are filing a claim, your insurer may ask you to use a specific shop.

How to Prevent Auto Vandalism

While vandalism is often a random act, there are some steps you can take to reduce the risk:

- Park in well-lit, populated areas, preferably a covered garage.

- Avoid parking near trucks, dumpsters, or anything else that obstructs visibility.

- Do not leave valuables visible inside your car.

- Install a car alarm system.

- Lock your vehicle and any garages or gates.

- Install motion-activated lights around your house.

In summary, comprehensive auto insurance covers vandalism, but it is important to weigh the cost of repairs against your deductible and the potential impact on your insurance rates before filing a claim.

Montana Auto Insurance: What Car Owners Need to Know

You may want to see also

Glass and windshield damage

Comprehensive insurance is an optional coverage that protects your vehicle from damage caused by non-collision events outside of your control. This includes glass and windshield damage, which can occur due to several reasons.

Causes of Windshield Damage

Windshields can be damaged by falling debris, such as a tree branch, or by rocks or other objects kicked up by passing cars. In some cases, windshields can also be damaged by hail or other severe weather conditions. If your windshield is damaged by falling debris, comprehensive insurance will typically cover the cost of repairs or replacement.

Repair or Replacement

Whether you need to repair or replace your windshield depends on the extent of the damage. Small chips or cracks can often be repaired by a glass professional without removing the entire windshield. However, if the damage is more extensive, replacement may be necessary to ensure the safety and integrity of the glass. It is important to act quickly, as even a small chip or crack can spread over time.

Cost of Repair or Replacement

The cost of repairing or replacing a windshield can vary depending on several factors, including the make and model of your car and the type of glass used. Basic windshield replacement can cost around $300 to $600, while replacement for high-tech cars with sensors can exceed $1,000. Repairing a windshield is generally less expensive than replacing it, as the cost of repair depends on how much of the glass needs to be fixed.

Insurance Coverage

Comprehensive insurance typically covers the cost of repairing or replacing a damaged windshield, minus your deductible. In some states, insurance companies offer a $0 deductible option for glass-only replacement claims. Additionally, some states, such as Florida, Kentucky, and South Carolina, are "zero-deductible" states, where carriers are not allowed to sell full glass coverage with a deductible. This means that if you live in one of these states, you may not have to pay a deductible for windshield replacement.

Filing a Claim

To file a claim for windshield damage, you should first assess the extent of the damage and determine whether repair or replacement is necessary. You can then file a claim with your insurance company online, over the phone, or through a local agent. Be sure to provide photos and measurements of the damage. After filing the claim, you can choose a glass and windshield specialist from the options provided by your insurance company.

Understanding Full Coverage Auto Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Comprehensive insurance coverage is optional and protects your vehicle from damage caused by events outside of your control, such as theft, vandalism, fire, and accidents with animals.

Comprehensive auto insurance covers damage to your car from accidents and disasters beyond car accidents. This includes damage from natural hazards, fire, weather, natural disasters, theft, and acts of vandalism.

Comprehensive auto insurance does not cover damage caused by a collision with another vehicle or object, liability when you are at fault for an accident, or injuries to passengers or other people. It also does not cover personal property stolen from your vehicle.

If your vehicle is damaged and covered by comprehensive insurance, you file a claim with your insurer. If approved, you pay your deductible, and your insurer covers the remaining expenses. The limit is usually based on the actual cash value of your vehicle at the time of the accident.

Comprehensive auto insurance is worth it if you have a new vehicle, live in an area prone to weather disasters or car theft, or cannot afford to pay for repairs or a replacement vehicle out of pocket.