Auto loan insurance, also known as credit insurance, is an optional insurance policy that covers your loan payments in the event that you die, lose your job, or become disabled. This type of insurance is designed to protect the lender's investment and is usually offered when financing a vehicle. While auto loan insurance is not required, it can provide financial peace of mind in the event of unforeseen circumstances. In addition to credit insurance, there are several other types of optional insurance coverages that individuals may consider when purchasing a vehicle, such as Guaranteed Asset Protection (GAP) insurance and extended warranties.

| Characteristics | Values |

|---|---|

| Credit insurance | Optional insurance that covers loan payments in the event of death, job loss, or disability |

| Credit life insurance | Pays off the loan in the event of death |

| Credit disability insurance | Also called accident and health insurance; covers loan payments if the insured becomes ill or injured and cannot work |

| Involuntary unemployment insurance | Covers loan payments if the insured loses their job through no fault of their own |

| Credit property insurance | Covers the value of the vehicle or the loan balance in the event of theft or destruction due to an accident or natural disaster |

| Full coverage | Includes state-minimum insurance, collision insurance, and comprehensive insurance |

| Collision insurance | Covers damage to the insured's vehicle, regardless of fault |

| Comprehensive insurance | Covers damage to the insured's vehicle due to non-collision events, such as theft, vandalism, or natural disasters |

| GAP insurance | Covers the remaining loan balance if the vehicle is totaled before the loan is paid off |

Credit insurance

Credit Life Insurance

This type of insurance pays off all or part of your loan in the event of your death. It is important to note that credit life insurance only covers the loan and not any other expenses. The payout goes directly to the lender, and the title of the vehicle is transferred to your beneficiaries.

Credit Disability Insurance

Also known as accident and health insurance, this type of insurance covers your loan payments if you become ill or injured and are unable to work. This ensures that your loan payments are made on time, even if you are unable to work temporarily.

Involuntary Unemployment Insurance

Involuntary unemployment insurance, also called involuntary loss of income insurance, covers your loan payments if you lose your job through no fault of your own, such as a layoff. This type of insurance provides financial protection during periods of unexpected unemployment.

Credit Property Insurance

Credit property insurance covers your vehicle if it is stolen, destroyed in an accident, or damaged in a natural disaster. This type of insurance typically pays the value of the vehicle or the balance of the loan, whichever is less. It is important to note that credit property insurance may be included in your regular automobile insurance policy, so it is essential to compare costs before purchasing separate credit property insurance.

When considering credit insurance, it is important to carefully review the terms and conditions of the policy to ensure it meets your needs. Credit insurance is not mandatory, and you have the right to cancel it at any time to reduce your costs. Additionally, you may be eligible for a refund if you sell, refinance, or prepay your auto loan.

Auto Insurance: Guaranteed Renewal, Explained

You may want to see also

Full coverage

When you take out an auto loan, your lender will likely require you to carry a full-coverage auto insurance policy until the loan is paid off. This is because, until you've paid off your loan, you don't technically own your vehicle—it's the property of your lender. Therefore, they'll want to protect their investment by making sure you have full insurance coverage.

Collision insurance covers damage to your vehicle, regardless of who is at fault for an accident. When you use your collision policy, you'll need to pay a deductible.

Comprehensive insurance covers non-collision types of damage or loss. This includes damage or loss from theft, fire, vandalism, or extreme weather. Like collision insurance, a deductible is usually required when using comprehensive insurance coverage.

In addition to collision and comprehensive insurance, full coverage auto insurance usually includes the following:

- Bodily injury liability: This covers injuries that you, the designated driver, or policyholder cause to someone else. It also covers you and your family members when driving someone else's car (with their permission).

- Property damage liability: This covers damage to another person's property or vehicle.

- Personal injury protection (PIP): This covers medical expenses, lost wages, and funeral costs for you and your passengers after an accident, regardless of who is at fault.

- Medical payments coverage (MedPay): This covers medical bills and funeral costs for you and your passengers after an accident, regardless of fault.

- Uninsured/underinsured motorist coverage: This covers damage to your property or bodily injuries sustained in an accident with a driver who doesn't have insurance or doesn't have enough coverage.

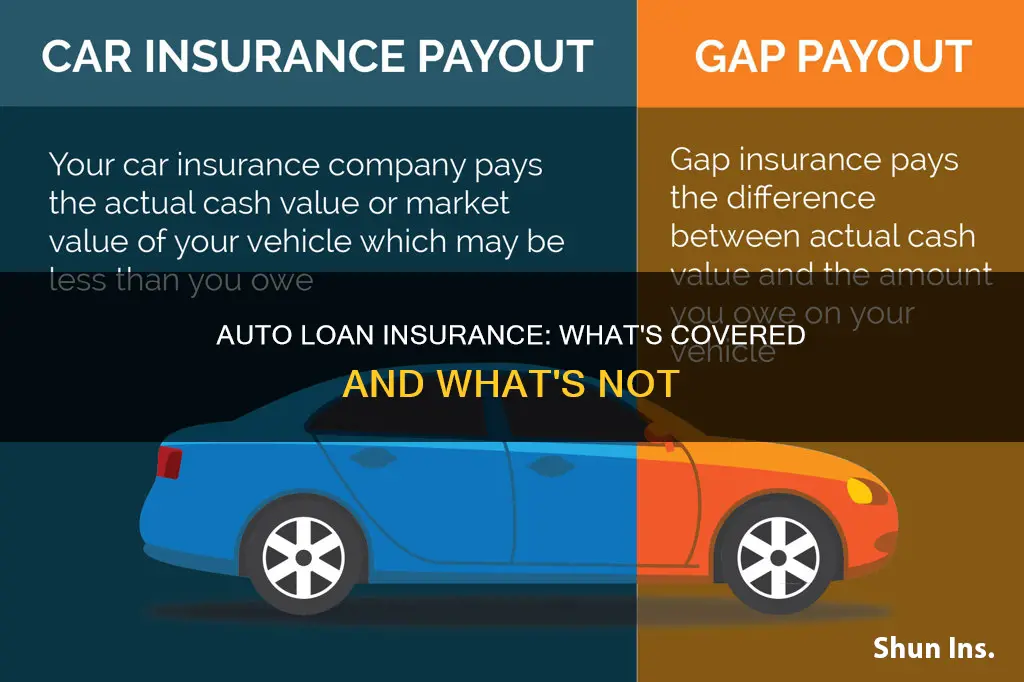

Some full-coverage insurance policies also include gap insurance, which can help pay off your car loan if your vehicle is totaled. Gap insurance covers the difference between the remaining balance on your car loan and the actual cash value of your vehicle.

Capital One: Gap Insurance Coverage

You may want to see also

GAP insurance

When you buy a new car, its value starts to decrease over time, sometimes significantly. This depreciation can create a "gap" between what you owe on your car loan and the car's actual value. This is where Guaranteed Asset Protection (GAP) insurance comes in.

While GAP insurance is not mandatory, it can provide valuable protection in certain situations. For instance, if you have a lease on your car, made a smaller down payment, have a longer financing term, or want protection against depreciation, GAP insurance might be a good option to consider.

Uncovering the Truth: Auto Insurance and DUI Disclosure

You may want to see also

Liability insurance

The bodily injury liability portion of liability insurance covers the medical expenses of those injured in an accident caused by the policyholder. This includes emergency and ongoing medical care, lost income, funeral costs, and legal fees if the accident results in a lawsuit. On the other hand, property damage liability covers the costs of repairing or replacing the vehicles and other property, such as fences, buildings, or government infrastructure, damaged by the policyholder in an accident.

Lenders typically require full-coverage auto insurance, which combines liability insurance with comprehensive and collision coverage, for financed vehicles. This comprehensive protection ensures that the lender's investment is safeguarded while also providing coverage for various scenarios, including damage to the policyholder's vehicle, regardless of fault.

It is important to note that liability insurance does not cover the policyholder's own medical bills or vehicle repairs. To ensure coverage for personal injuries and vehicle damage, additional insurance types, such as personal injury protection, health insurance, and collision insurance, need to be purchased.

The cost of liability insurance varies depending on factors such as age, driving record, vehicle make and model, and state regulations. However, it is recommended to have enough liability coverage to protect one's net worth, which includes cash, investments, and assets, minus any debt. In cases where the liability limits offered by auto insurance companies are insufficient, individuals can consider purchasing umbrella insurance to further expand their liability coverage.

Vehicle Insurance: VAT Included?

You may want to see also

Collision insurance

In the context of an auto loan, collision insurance is particularly important as it safeguards the lender's investment in your vehicle. When you finance a car, the lender requires assurance that their asset will be protected in case of accidents or other incidents. Collision insurance provides this assurance by covering the cost of repairs or replacement.

The specifics of collision insurance coverage can vary depending on the insurance company and your chosen policy. It is essential to carefully review the terms and conditions of your policy to understand the extent of your collision coverage. Some policies may have specific requirements, such as a maximum deductible amount, to ensure that you can adequately repair your vehicle after an accident.

In addition to collision insurance, comprehensive insurance is another critical component of auto loan insurance. While collision insurance covers accidents, comprehensive insurance protects against non-collision events, such as theft, fire, vandalism, extreme weather, and natural disasters. This type of insurance ensures that your vehicle is covered for a broader range of potential damages.

When taking out an auto loan, it is important to understand the requirements of the lender and the laws of your state. In most states, lenders will require you to carry full coverage insurance, which includes collision, comprehensive, and liability insurance. This ensures that all bases are covered in terms of protecting their investment and complying with legal requirements.

Full coverage insurance can be more expensive than simply carrying liability insurance. However, it is essential to remember that it provides valuable protection for your vehicle and your finances. Even after your vehicle is paid off, it is generally recommended to maintain full coverage unless you can easily afford to replace or repair your car in the event of an accident or other covered incident.

Gap Insurance: Job Loss Protection

You may want to see also

Frequently asked questions

Auto loan insurance is insurance that you take out on a vehicle that you have financed with a loan. It is required by lenders to protect their investment.

Auto loan insurance typically includes liability, collision, and comprehensive coverage. Liability coverage pays for damage and injuries that you cause to others. Collision coverage pays for damage to your own vehicle, regardless of who caused the accident. Comprehensive coverage pays for non-collision damage or loss, such as theft, fire, or vandalism.

Auto loan insurance is a type of auto insurance that is specifically required when you have financed a vehicle with a loan. It typically includes higher levels of coverage than regular auto insurance to protect the lender's investment.

If you have financed a vehicle with a loan, then auto loan insurance is typically required by the lender. In some cases, the lender may require additional coverages, such as gap insurance.

Gap insurance covers the gap between the amount you owe on your auto loan and the actual cash value of your vehicle. It is useful if you have a low down payment, a high-interest rate, or are early on in your loan term. While it is not required, it can provide valuable financial protection.