Auto insurance is a complex instrument with a myriad of coverages and situations, often depending on what specific types of coverage a policyholder chooses. While different states mandate different types of insurance, most basic auto policies consist of six types of coverage: bodily injury liability, personal injury protection, property damage liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

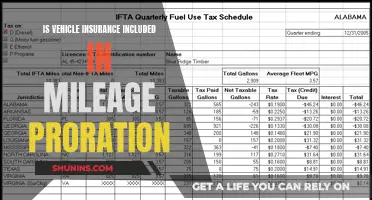

| Characteristics | Values |

|---|---|

| Bodily injury liability | Covers medical bills if you've injured someone in an accident |

| Property damage liability | Covers the cost of property damage you've caused in an accident |

| Personal injury protection | Covers medical expenses for you or your passengers after an accident |

| Uninsured/underinsured motorist | Covers the costs if you're in an accident caused by a driver with little or no insurance |

| Collision coverage | Covers damage to your car from a collision, no matter who was at fault |

| Comprehensive coverage | Covers damage to your car that isn't a collision, e.g. extreme weather, falling objects, vandalism, animals, glass damage |

What You'll Learn

Bodily injury liability

- Medical Expenses: This includes emergency care, hospital fees, follow-up visits, medical equipment, surgeries, and doctor's visits for the injured party.

- Lost Wages: If the injured person is unable to work due to their injuries, bodily injury liability can cover their lost income during their recovery.

- Funeral Costs: In tragic cases where accidents result in fatalities, this coverage can help pay for funeral and burial expenses.

- Pain and Suffering: If the injured individual experiences long-lasting emotional trauma or pain related to the accident, this coverage can provide compensation.

- Legal Fees: In the event of a lawsuit, bodily injury liability can cover legal expenses, including attorney fees and court costs.

Who is Covered by Bodily Injury Liability?

State Requirements for Bodily Injury Liability:

Why You Need Bodily Injury Liability Coverage:

This coverage is essential to protect yourself financially and legally in the event of an accident. Without it, you may be held financially responsible for the other party's medical expenses, lost wages, and other related costs. Additionally, you could face legal consequences, such as license suspensions and fines, if found at fault in an accident without sufficient coverage.

While state minimums provide a baseline, experts recommend purchasing higher limits to ensure adequate protection. Consider increasing your coverage limits to at least $100,000 per person and $300,000 per accident to better address the risks associated with today's litigious environment.

In summary, bodily injury liability coverage is a vital component of auto insurance, safeguarding you from financial and legal repercussions in the event of injuries caused to others in a car accident. By understanding what this coverage entails and the recommended limits, you can make informed decisions about your auto insurance policy.

The Auto Insurance Conundrum: Affordability for Young Adults

You may want to see also

Personal injury protection

In addition to medical costs, PIP can cover lost wages if the injured person is unable to work. This benefit also applies to self-employed individuals who need to hire temporary workers to perform tasks. PIP can also help pay for services that the injured person would normally perform, such as childcare and housecleaning.

PIP coverage may also extend to situations where the policyholder is not driving. For example, if the policyholder is injured as a pedestrian by a passing car, their PIP coverage may help pay for their injuries.

In the event of the policyholder's death in an auto accident, PIP insurance can help replace lost income for their surviving dependents and cover funeral, burial, or cremation expenses.

It is important to note that PIP requirements vary from state to state, and not all states require PIP coverage. Some states mandate it, while others make it optional.

Becoming an Auto Insurance Broker: Steps to Independence

You may want to see also

Property damage liability

For example, if you rear-end a car, pushing it into two other cars, and the damage to all three cars exceeds your policy limit, you will be responsible for paying the difference. In this case, you may want to consider raising your coverage limit or adding an umbrella insurance policy, which can provide additional coverage.

Georgia Gap Insurance: Cooldown Periods Explained

You may want to see also

Collision coverage

When choosing collision coverage, it's important to consider the value of your vehicle and your ability to pay for repairs or replacement out of pocket. Collision coverage can provide peace of mind, knowing that you won't have to bear the full financial burden in the event of an accident. Additionally, collision coverage can also cover hit-and-run accidents, rollovers, and damage caused by uninsured or underinsured drivers.

The cost of collision coverage can vary depending on factors such as the value of your vehicle, your chosen deductible, and your driving record. A higher deductible can lead to lower monthly premiums, but it's important to weigh this against the potential out-of-pocket expenses in the event of an accident. Collision coverage typically doesn't cover damage to another person's vehicle or property, medical costs, or personal belongings inside your car.

Gap Insurance: One-Time Payment?

You may want to see also

Comprehensive coverage

Comprehensive insurance is designed to protect your vehicle from unexpected events and provide peace of mind. It is important to note that comprehensive coverage has a deductible, which is the amount you agree to pay before the insurance company starts paying for damages. The deductible amount can vary, and it is essential to review the specific terms and conditions of your policy to understand what is covered and what your financial responsibility is in the event of a claim.

Unseen Damage: Auto Insurance Adjusters and the Hunt for Hidden Structural Issues

You may want to see also

Frequently asked questions

Auto insurance covers financial protection for you after an accident. It can pay for things like medical bills, property damage and expenses that you could be held financially responsible for after a car crash.

Part A of auto insurance, also known as bodily injury liability, covers the costs of injuries to other people involved in an accident where you are at fault. This includes medical expenses for the other driver as well as passengers in the other car.

Part B of auto insurance, also known as property damage liability, covers the costs of damage to the property of others in an accident where you are at fault. This includes damage to the other driver's car as well as other property such as fences, buildings or structures.