There are a multitude of factors that influence auto insurance rates, some of which are within the control of the driver, and some of which are not. These factors include age, gender, driving history, location, the type of car, and the level of insurance coverage.

Younger drivers, particularly teenagers, are considered to be more reckless and are involved in more accidents, and are therefore charged higher insurance premiums. Men, especially young men, are also considered to be more likely to take risks and are charged more than women.

Drivers with a history of traffic violations, DUIs, or accidents are considered high-risk and are charged higher rates. The location of the driver also plays a role, with urban drivers paying more due to higher rates of theft, vandalism, and accidents.

The type of car is another important factor, with sports cars, luxury vehicles, and electric cars often having higher insurance rates due to their higher price tags and specialized parts.

Finally, the level of insurance coverage is a major determinant of insurance rates. Higher levels of coverage lead to higher insurance costs, while lower coverage can result in assuming more risk.

| Characteristics | Values |

|---|---|

| Age | Younger and older drivers tend to pay more than those aged 25-65. |

| Gender | Men tend to pay more than women, especially at a younger age. |

| Marital status | Married drivers pay less than single, divorced, or widowed drivers. |

| Education | Drivers with college degrees pay less than those without. |

| Occupation | Some occupations are deemed more likely to make insurance claims and therefore pay more. |

| Location | Urban drivers pay more than rural drivers due to higher rates of theft, vandalism, and accidents. |

| Annual mileage | The more miles driven, the higher the insurance rate. |

| Driving record | A history of traffic violations and accidents increases insurance rates. |

| Credit score | A higher credit score leads to lower insurance rates. |

| Type of car | The cost, safety, and likelihood of theft of a car influence insurance rates. |

Driving record

A driver's record is a key factor in determining auto insurance rates. A clean driving record can result in substantial savings on insurance premiums, while accidents, traffic violations, and DUIs can lead to significantly higher costs.

Insurance companies view a driver's history as a predictor of future performance. Each moving violation, such as speeding, running a red light, or driving under the influence, adds up and increases the likelihood of an accident. These violations are typically recorded using a points system, with more severe infractions resulting in more points. For example, speeding 10 miles per hour over the limit might earn a few points, while driving 30 miles over could result in 10 points. Accumulating a certain number of points within a given period, usually 18 months, can lead to a suspended license.

The impact of a driving record on insurance rates is most significant when applying for a new policy. Minor violations can increase insurance premiums by 10% to 15%, and these violations may remain on record for up to three years. Major violations, such as DUIs or hit-and-run accidents, are often grounds for an insurance company to refuse or cancel a policy. A single DUI can increase insurance rates by over $1,000 per year, while accidents can add around $350 annually.

To maintain a clean driving record and avoid rate hikes, it is essential to drive safely and obey traffic laws. Taking a defensive driving course can help reduce points and may even lead to insurance discounts in some states.

Motorhome Insurance: Cheaper Than Auto Insurance?

You may want to see also

Age and experience

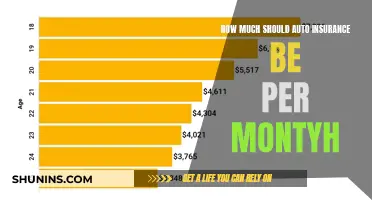

Auto insurance rates start to decrease when drivers reach their early 20s. By the age of 25, drivers typically see a significant reduction in their premiums. Insurance rates continue to decrease as drivers gain more experience and maintain a clean driving record.

However, as drivers reach their senior years, insurance rates may start to increase again. Aging-related factors such as vision or hearing loss and slowed response time can make older drivers more prone to accidents. Additionally, older adults tend to have a higher car crash death rate and are more vulnerable to injuries.

It's important to note that while age is a significant factor, insurance rates are also influenced by other factors such as gender, driving record, credit score, vehicle type, and location.

Auto Insurance Fraud: Criminal Offense or Not?

You may want to see also

Location

Urban vs. Rural Areas

Whether an individual resides in an urban or rural area can significantly impact their insurance premiums. Urban areas, with their high traffic density and crime rates, often result in higher insurance costs. The simple logic is that more cars mean more accidents. However, this is not a definitive rule, as some rural areas may have higher insurance costs due to the increased risk of wildlife collisions.

State and Zip Code

Insurance providers also consider the state and zip code of an individual's residence. The minimum auto insurance limits required by the state can increase rates. Additionally, if people in a particular zip code file numerous auto insurance claims, insurers may label that neighbourhood as high-risk, leading to higher premiums to offset potential costs.

Crime Rates

Crime rates, particularly car theft and vandalism, are crucial factors in determining insurance premiums. Urban areas, with their higher population density, often experience higher crime rates, resulting in increased insurance premiums. Conversely, rural areas generally have lower crime rates, leading to more affordable premiums.

Weather Patterns and Natural Disasters

Weather patterns and the likelihood of natural disasters can significantly impact insurance rates. Areas prone to harsh weather, such as heavy rain, hail, snow, hurricanes, floods, or earthquakes, often have higher insurance premiums. This is because severe weather can cause extensive vehicle damage, leading to costly insurance claims.

Traffic Patterns and Road Conditions

The volume of traffic and the number of intersections play a role in insurance rates. Highly populated urban areas typically have higher auto insurance rates due to the increased chance of collisions. Additionally, poorly designed or maintained roads, with potholes and dangerous intersections, can contribute to higher insurance costs.

Environmental Considerations

Different locations experience varying weather patterns and events. For example, some areas may be more prone to hailstorms, while others are at higher risk of earthquakes or wildfires. Living in an area susceptible to potentially damaging weather events can result in higher insurance premiums.

When Does Canceling Car Insurance Take Effect?

You may want to see also

Vehicle type

The type of vehicle you drive is a significant factor in determining your auto insurance rates. The make and model of your car influence the cost of insurance, with some vehicles being cheaper to insure than others. For instance, a truck is generally cheaper to insure than a sedan, and a Honda Accord is typically more expensive to insure than a full-size Ford pickup.

Insurance companies favour insuring safe vehicles as they are less likely to result in costly claims. Cars with high safety ratings can often earn you a discount on your insurance premium. Conversely, vehicles with poor safety records and those that are more likely to be stolen tend to be more expensive to insure.

The cost of repairs is another important consideration. If a car requires expensive components or repairs, insurance companies will often charge higher premiums. On the other hand, vehicles with safety measures in place, such as anti-lock brakes, electronic stability control, and theft prevention systems, usually cost less to insure as they are less susceptible to damage.

The size and weight of your vehicle also play a role in determining insurance rates. Larger and heavier vehicles often have higher insurance premiums because they have a greater potential for damage and pose a greater risk to other road users.

In addition, the brand and age of your vehicle are taken into account. Luxury cars, for example, tend to be more expensive to repair and have costlier components, resulting in higher insurance premiums. Older cars, on the other hand, are often cheaper to insure than newer models, with the exception of classic or collectible automobiles.

Understanding Auto Insurance When Moving States: A Comprehensive Guide

You may want to see also

Insurance history

Insurance companies will look at your insurance history to determine your rates. If you have had a lapse in coverage, you may be charged more to cover the additional risk. However, if you have continually maintained insurance, you will likely be seen as a lower risk and benefit from lower rates. Insurance companies prefer to do business with clients who handle their affairs, and having a current insurance policy in place is a favourable trait.

Insurance companies will also look at your previous insurance coverage when determining your rates. If you have had a lapse in coverage, this could work against you and result in higher rates. However, if you have continually maintained insurance coverage, it demonstrates responsible behaviour, and insurance companies will view you as a lower risk. As a result, you may be rewarded with lower insurance rates.

In addition to your insurance history, insurance companies will also consider other factors, such as your driving record, credit history, location, age, gender, and marital status. These factors, along with your insurance history, will help insurance companies assess your risk level and determine your insurance rates.

Auto Insurance Coverage for Moving Trucks and Vans: What You Need to Know

You may want to see also

Frequently asked questions

In general, auto insurance rates are higher for younger, less experienced drivers, especially teenagers, and lower for more mature drivers. Rates start to decrease after age 25 and reach their lowest point in a driver's mid-50s.

Statistically, women tend to have fewer and less serious accidents than men. As a result, women often pay less for auto insurance than men. However, it's important to note that the gender gap in insurance rates decreases significantly by age 30.

A clean driving record can help you get lower insurance rates, while accidents, traffic violations, and DUIs will typically increase your rates. Insurance companies usually consider your driving record from the past three to five years.

Urban drivers generally pay higher auto insurance rates than those in small towns or rural areas due to higher rates of vandalism, theft, and accidents. Insurance rates can also vary by state and ZIP code, taking into account factors such as crime rates, weather trends, and repair costs.