Navigating the roads as a delivery driver can be both rewarding and challenging, and ensuring you have the right insurance coverage is essential for your peace of mind. With the increasing demand for on-demand delivery services, it's crucial to understand the specific insurance needs that come with this profession. This paragraph will explore the various insurance options available to delivery drivers, helping them make informed decisions to protect themselves, their vehicles, and their livelihoods. From liability coverage to specialized policies, we'll delve into the key considerations to ensure you're adequately protected while on the job.

What You'll Learn

- Liability Insurance: Coverage for bodily injury or property damage to others

- Cargo Insurance: Protects against loss or damage to goods being transported

- Medical Insurance: Covers medical expenses for the driver and passengers

- Vehicle Insurance: Protects the driver's vehicle from accidents, theft, and damage

- Personal Injury Protection: Provides medical coverage for the driver in case of injury

Liability Insurance: Coverage for bodily injury or property damage to others

Liability insurance is a crucial component of coverage for delivery drivers, offering protection against potential claims arising from accidents or incidents caused by the driver's negligence. This type of insurance provides financial security and peace of mind, ensuring that drivers are not held personally responsible for damages or injuries they may inadvertently cause while on the job. The primary purpose of liability coverage is to safeguard against the financial burden of legal claims and settlements, which can be substantial and detrimental to a driver's financial well-being.

In the context of delivery work, drivers often operate large vehicles, such as trucks or vans, which can pose significant risks to others on the road. A minor collision or a more severe accident could result in bodily injuries to passengers, pedestrians, or other road users, as well as property damage to vehicles or other possessions. Liability insurance steps in to cover these potential liabilities, providing a safety net for drivers and their employers.

When purchasing liability insurance, drivers should consider the specific coverage limits and options available. These typically include bodily injury liability, which covers medical expenses, lost wages, and other related costs for individuals injured in an accident, and property damage liability, which compensates for damage to another person's vehicle or other property. It is essential to choose coverage limits that are sufficient to protect against potential claims, especially in regions with high-risk profiles or high-cost medical systems.

Furthermore, delivery drivers should be aware of the different types of liability coverage available. For instance, some insurance policies may offer additional protection for personal and advertising injury, which covers claims related to libel, slander, or copyright infringement. This is particularly relevant for drivers who use their vehicles for promotional activities or have a public-facing aspect to their work.

In summary, liability insurance is an indispensable tool for delivery drivers, offering financial protection against the potential consequences of accidents or incidents. By understanding the different coverage options and limits available, drivers can make informed decisions to ensure they are adequately protected while performing their duties. This type of insurance is a vital consideration when assessing the overall risk and safety aspects of a delivery driver's profession.

Chase Auto Loans: Gap Insurance Coverage

You may want to see also

Cargo Insurance: Protects against loss or damage to goods being transported

Cargo insurance is a specialized type of coverage designed to protect the interests of both carriers and shippers in the transportation of goods. It provides financial protection against potential losses or damages that may occur during the journey of the cargo. This insurance is crucial for delivery drivers, as it ensures that they are financially secure in the event of unforeseen circumstances that could lead to the loss or damage of the goods they are transporting.

The primary purpose of cargo insurance is to safeguard the value of the transported items. It covers a wide range of risks, including theft, damage due to accidents, natural disasters, and even errors in handling or processing. For delivery drivers, this means that if an accident occurs on the road, or if the goods are mishandled at a warehouse, the insurance policy will provide compensation to cover the loss or damage. This is especially important for high-value or fragile items, where the consequences of a loss could be significant.

When considering cargo insurance, delivery drivers should be aware of the various coverage options available. Standard cargo insurance policies typically offer two main types of coverage: actual cash value and replacement cost. Actual cash value coverage compensates the insured for the current market value of the lost or damaged goods, while replacement cost coverage covers the cost of replacing the goods with similar items of the same value. Understanding these options is essential to ensure that the insurance policy provides adequate protection for the specific needs of the delivery driver.

Furthermore, delivery drivers should also pay attention to the policy's terms and conditions, including any exclusions and limitations. For instance, some policies may not cover losses resulting from the inherent nature of the goods, such as perishable items or those with a high risk of damage. It is crucial to review these details to ensure that the insurance policy aligns with the specific risks associated with the type of cargo being transported.

In summary, cargo insurance is a vital consideration for delivery drivers to protect their financial interests. By understanding the different coverage options and reviewing policy details, drivers can ensure that they have the appropriate level of protection against potential losses or damages. This insurance provides peace of mind, allowing delivery drivers to focus on their work with the knowledge that their cargo is safeguarded.

Parking Tickets: How They Impact Your Insurance Premiums

You may want to see also

Medical Insurance: Covers medical expenses for the driver and passengers

When it comes to being a delivery driver, ensuring you have the right insurance coverage is crucial for your safety and financial well-being. One essential aspect of this coverage is medical insurance, which provides critical protection for both you and your passengers in the event of an accident or unexpected medical situation.

Medical insurance for delivery drivers typically covers a range of healthcare expenses. This includes emergency room visits, hospital stays, surgeries, and even prescription medications. In the unfortunate event of an accident, this insurance can cover the medical bills of both the driver and any passengers involved. It ensures that you and your team are not burdened with unexpected and potentially costly medical bills. For instance, if a delivery driver is involved in a minor collision, the medical insurance could cover the treatment for any injuries sustained, from a simple bandage to a more complex procedure.

The coverage often extends to various medical services, such as doctor's visits, diagnostic tests, and specialist consultations. It can also include mental health services, recognizing the importance of overall well-being for drivers. This comprehensive approach to medical insurance ensures that delivery drivers can access the necessary healthcare without the added stress of financial worries.

Furthermore, medical insurance for delivery drivers often provides coverage for accidents that occur outside of work hours, ensuring that you are protected even when you're not on the job. This is particularly important, as it covers any medical emergencies that might arise during personal time, providing peace of mind.

In summary, medical insurance is a vital component of a delivery driver's insurance portfolio. It ensures that drivers and their passengers are protected from the financial burden of medical expenses, offering a safety net that is essential for their overall well-being and peace of mind while on the road.

Texas Auto Insurance: Minimums Explained

You may want to see also

Vehicle Insurance: Protects the driver's vehicle from accidents, theft, and damage

Vehicle insurance is a crucial aspect of being a delivery driver, offering financial protection and peace of mind. As a driver, your vehicle is an essential tool for your work, and ensuring its safety and security is paramount. This type of insurance specifically covers your vehicle against various risks and unforeseen events that could occur during your deliveries.

In the event of an accident, vehicle insurance provides comprehensive coverage. It safeguards your car from potential damage caused by collisions with other vehicles, objects, or even pedestrians. Whether it's a minor fender-bender or a more severe crash, having this insurance means you won't have to worry about the financial burden of repairing or replacing your vehicle. The policy will cover the costs associated with repairs, ensuring you can get back on the road quickly without incurring significant expenses.

Theft is another concern for delivery drivers, especially when operating in unfamiliar areas. Vehicle insurance offers protection against theft, ensuring that if your car is stolen, you have a safety net in place. This coverage typically includes the cost of replacing your vehicle, providing financial relief in the unfortunate event of theft. Additionally, it may also cover any valuable items left inside the car, offering further protection against potential theft-related losses.

Furthermore, natural disasters, vandalism, and other unexpected incidents can cause significant damage to your vehicle. Vehicle insurance extends its coverage to protect against such damages, ensuring that your car remains in a drivable condition. This aspect of insurance is particularly important for delivery drivers, as it provides a safety net against various perils that could impact their ability to carry out their duties.

By investing in vehicle insurance, delivery drivers can focus on their work without constant worry about their vehicle's safety. It provides a sense of security, knowing that any unforeseen accidents, thefts, or damages will be financially manageable. This insurance is a vital consideration for anyone in the delivery business, ensuring that their vehicle remains protected and their operations can continue smoothly.

Gap Insurance vs. Warranty: What's the Difference?

You may want to see also

Personal Injury Protection: Provides medical coverage for the driver in case of injury

Personal Injury Protection (PIP) is a crucial component of insurance for delivery drivers, offering essential medical coverage in the event of an accident or injury. This type of insurance ensures that drivers are protected financially and can access necessary medical treatment without incurring significant out-of-pocket expenses. PIP is designed to cover a wide range of medical expenses, including emergency room visits, hospital stays, surgeries, medications, and rehabilitation costs. It provides a safety net that is particularly important for delivery drivers, who often face the risk of accidents and injuries due to the nature of their work.

When a delivery driver is involved in a collision or experiences a work-related injury, PIP kicks in to cover the associated medical bills. This coverage is comprehensive and typically includes not only emergency medical services but also follow-up care and long-term rehabilitation. By having PIP, drivers can focus on their recovery and getting back to work as soon as possible, knowing that their medical expenses are taken care of. This aspect of insurance is vital as it ensures that drivers can afford the necessary treatment, preventing financial strain during a challenging time.

The benefits of PIP extend beyond immediate medical costs. It provides peace of mind and financial security, knowing that you are covered for potential future medical needs arising from the accident. This is especially important for delivery drivers, who may face various health risks, from minor injuries to more severe ones. With PIP, drivers can have confidence in their ability to access quality healthcare without the added stress of financial burdens.

Furthermore, PIP coverage can be tailored to individual needs, allowing drivers to choose the level of protection that suits their circumstances. This customization ensures that drivers can find a policy that aligns with their specific requirements and budget. It is a flexible option that can be adjusted as the driver's situation changes over time.

In summary, Personal Injury Protection is an indispensable part of insurance for delivery drivers, offering comprehensive medical coverage and financial security. It ensures that drivers can access the necessary treatment and rehabilitation without financial worry, allowing them to recover and return to their work efficiently. With PIP, delivery drivers can drive with the knowledge that they are protected in case of injury, providing a sense of reassurance and peace of mind.

Driver Ed: Cheaper Auto Insurance

You may want to see also

Frequently asked questions

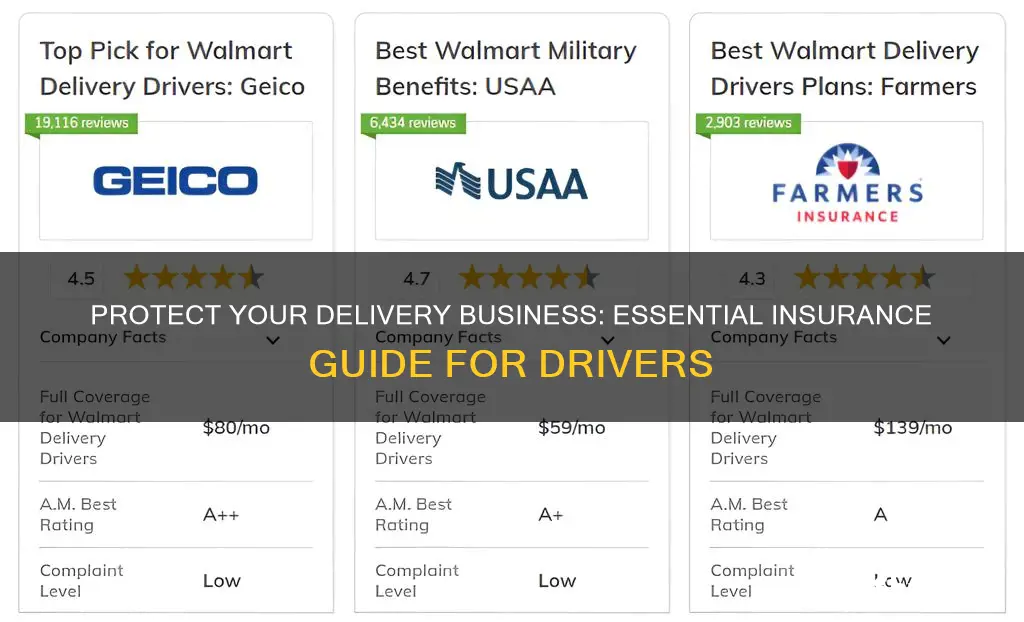

As a delivery driver, you should consider several types of insurance to protect yourself and your business. The primary coverage is typically Commercial Auto Insurance, which covers any vehicle you use for work. This policy includes liability coverage, which is essential to protect against potential lawsuits if you cause an accident. You may also need Workers' Compensation insurance if you have employees, and General Liability Insurance to cover any third-party claims.

When insuring your delivery vehicle, it's crucial to provide accurate information about the vehicle's usage. Insurers often categorize vehicles based on their primary use. For delivery drivers, this would be 'business' or 'commercial' use. Ensure you have the appropriate coverage for the vehicle's value and the potential risks associated with your work. Consider adding coverage for equipment and tools in your vehicle to protect your investment.

Independent delivery drivers often have more flexibility in choosing their insurance providers. However, it is still essential to meet the minimum legal requirements in your region. These requirements typically include liability coverage for your vehicle and, in some cases, workers' compensation if you hire employees. Review the insurance laws in your area to ensure compliance.

Underinsured/Uninsured Motorist coverage is a critical aspect of your insurance policy. It protects you in the event that the other driver involved in an accident has insufficient insurance. This coverage ensures that you are not left with significant out-of-pocket expenses if the at-fault driver cannot cover the damages. It provides an additional layer of financial protection for delivery drivers who may encounter various road conditions and potential risks.

Yes, you can obtain insurance coverage for your personal vehicle if you use it for delivery work. Many insurance companies offer personal auto policies with commercial endorsements. This type of policy allows you to use your personal vehicle for business purposes while still providing the necessary coverage. However, it's essential to inform your insurer about the extent of your commercial use to ensure adequate protection.