Tort insurance is a system of auto insurance that allows drivers to recover damages from other parties at fault in an accident. In the US, 38 states follow the tort system, meaning the at-fault driver is financially responsible for damages and injuries caused to others. The remaining 12 states, plus Washington, D.C., are no-fault states, where drivers must purchase personal injury protection (PIP) to cover their medical bills, regardless of who caused the accident.

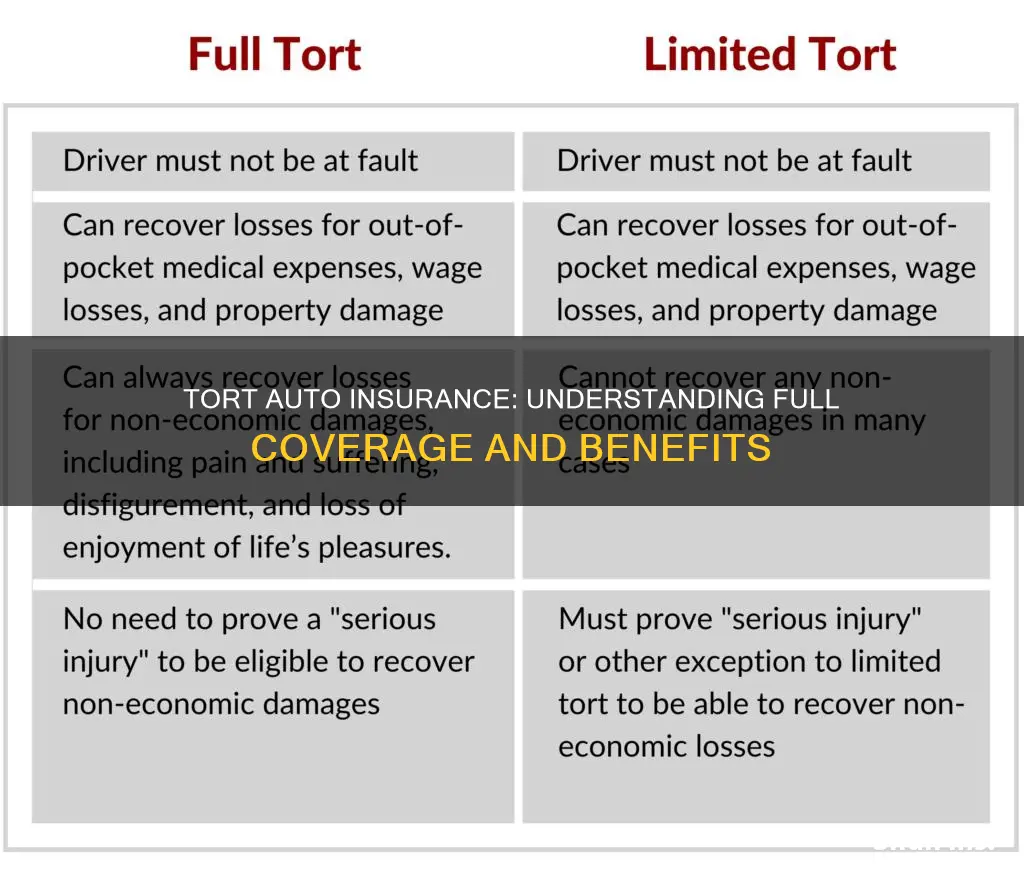

Three states—Pennsylvania, Kentucky, and New Jersey—are technically no-fault states but give drivers the option to choose between full and limited tort insurance. Full tort insurance is more expensive but allows the policyholder to sue for a wider range of damages, including pain and suffering, in the event of an at-fault accident. Limited tort insurance is cheaper but restricts the ability to sue for non-economic damages unless certain severity thresholds are met.

| Characteristics | Values |

|---|---|

| Definition | Full tort coverage allows the victim to file a claim for all damages, including medical costs, lost wages, as well as non-economic damages such as pain and suffering. |

| Comparison with limited tort coverage | Limited tort coverage allows the victim to file a claim for economic losses only. While limited tort coverage is typically less expensive than full tort coverage, it may also prevent the policyholder from obtaining substantial compensation. |

| States | Full tort coverage is available in Pennsylvania, New Jersey, and Kentucky. |

| Cost | Full tort coverage is more expensive than limited tort coverage. |

| Right to sue | Full tort coverage allows the victim to sue the at-fault driver without restrictions. |

What You'll Learn

- Full tort coverage allows victims to claim for all damages

- Limited tort coverage restricts victims to claiming economic losses only

- Full tort insurance is more expensive than limited tort insurance

- Tort laws are designed to help harmed parties receive compensation

- Full tort coverage allows victims to sue for pain and suffering

Full tort coverage allows victims to claim for all damages

Tort coverage addresses the ability to file a claim for damages in the event of injuries suffered in a motor vehicle collision. Full tort coverage allows victims to claim for all damages, including medical costs, lost wages, and non-economic damages such as pain and suffering.

Tort is a legal term that refers to an action that resulted in harm to another person. In the context of auto insurance, it means that the at-fault driver in an accident is financially responsible for the damages and injuries caused to the other party. This is known as the tort or fault-based system of car insurance and is in place in 38 states.

Full Tort Coverage

Full tort coverage gives the victim the right to sue the at-fault driver for all damages, including economic and non-economic losses. Economic damages include medical costs and lost wages, while non-economic damages refer to pain and suffering, emotional distress, loss of consortium, and loss of enjoyment of life. Full tort coverage provides the opportunity for broader financial reimbursement in the event of a serious accident.

Limited Tort Coverage

In contrast, limited tort coverage restricts the victim's right to sue and claim damages. With limited tort coverage, victims can only claim economic damages and are unable to seek compensation for pain and suffering unless they meet certain severity thresholds. These thresholds vary by state but generally include permanent disfigurement, serious impairment of bodily function, or a permanent injury.

Cost of Full Tort Coverage

Full tort coverage typically costs about 15% more than limited tort coverage. This is because full tort coverage offers unrestricted rights to sue for pain and suffering, while limited tort coverage limits this right. The increased cost for full tort coverage can range from $6 per month to more than $50 per month, depending on location and total coverage.

Geico Employee Perks: Unlocking the Auto Insurance Discounts

You may want to see also

Limited tort coverage restricts victims to claiming economic losses only

Tort insurance is available in at-fault states for drivers who want the flexibility to pursue legal action after a car accident. Limited tort coverage restricts victims to claiming economic losses only. This means that victims can only claim monetary damages, such as medical expenses, property damage, or lost wages. With limited tort coverage, victims forfeit the right to sue for non-economic damages, such as pain and suffering, unless specific criteria are met.

Limited tort coverage is typically less expensive than full tort coverage. However, it may prevent the policyholder from obtaining substantial compensation that they would otherwise be entitled to. The ability to sue for pain and suffering is excluded under limited tort coverage unless the victim's injuries are severe. Severe injuries that allow victims to sue for pain and suffering under limited tort coverage include permanent disfigurement, permanent disability, and injuries that prevent the victim from working for the rest of their lives.

In the states of Kentucky, New Jersey, and Pennsylvania, drivers can choose between full tort and limited tort coverage. In Pennsylvania, if individuals do not specifically elect the limited tort option, they will be given the full tort option by default when purchasing car insurance.

Finding Affordable Auto Insurance in Toronto

You may want to see also

Full tort insurance is more expensive than limited tort insurance

Tort insurance is a system of auto insurance that allows drivers to recover damages from other parties at fault in a car accident. In the US, 38 states follow the tort system, meaning the at-fault driver is responsible for paying damages and medical costs for the other party. The remaining 12 states, plus Washington, D.C., are "no-fault" states, where drivers must purchase personal injury protection (PIP) to cover their medical bills, regardless of who caused the accident.

Three states—Pennsylvania, Kentucky, and New Jersey—are technically no-fault states but give drivers the option to choose between full and limited tort insurance. Full tort insurance is more expensive than limited tort insurance, but it allows the policyholder to sue for a wider range of damages in the event of an at-fault accident.

Full tort insurance gives the victim unrestricted rights to sue the guilty party for pain and suffering and other non-economic damages, such as emotional distress, loss of consortium, and loss of enjoyment of life. On the other hand, limited tort insurance restricts the victim's right to sue and usually excludes the right to sue for pain and suffering unless the injuries are severe. Examples of severe injuries include permanent disfigurement, serious impairment of bodily function, and permanent injury.

The higher cost of full tort insurance is due to the unrestricted right to sue the guilty party for pain and suffering. This robust coverage can increase premiums by about 15% compared to limited tort insurance, which offers more limited coverage.

When deciding between full tort and limited tort insurance, it is essential to consider your budget, risk tolerance, and the likelihood of filing a lawsuit if injured in an accident. Full tort insurance may be worth the higher cost if you have a family dependent on your financial support or if you want the flexibility to seek broader financial reimbursement in the event of a serious accident. On the other hand, limited tort insurance may be more suitable if money is tight or if you are a young driver already facing higher insurance costs.

Auto Insurance: Choosing the Right Liability Coverage

You may want to see also

Tort laws are designed to help harmed parties receive compensation

Tort laws allow injured parties to seek redress and recover for their losses. Typically, a party seeking redress through tort law will ask for damages in the form of monetary compensation. This is known as compensatory damages, which are typically equal to the monetary value of the injured party's loss of earnings, loss of future earning capacity, pain and suffering, and reasonable medical expenses.

In some cases, courts may also award punitive damages in addition to compensatory damages to deter future misconduct. For example, in a case against a manufacturer for a defectively manufactured product, punitive damages may be awarded to compel the manufacturer to ensure more careful production in the future.

Tort laws can be split into three categories: negligent torts, intentional torts, and strict liability torts. Negligent torts are harms done to people through the failure of another to exercise a certain level of care, usually defined as a reasonable standard of care. Accidents are a standard example of negligent torts. Intentional torts, on the other hand, are harms that have been caused by the willful misconduct of another, such as assault, fraud, and theft. Strict liability torts, on the other hand, are not concerned with the culpability of the person doing the harm but rather focus on the act itself.

Full tort coverage, in the context of auto insurance, refers to the ability to file a claim for all damages in the event of injuries suffered in a motor vehicle collision. This includes economic damages such as medical costs and lost wages, as well as non-economic damages such as pain and suffering. Full tort coverage gives the victim unrestricted rights to sue the at-fault driver and seek compensation for their losses.

Strategies to Reduce Auto Insurance Costs After Traffic Tickets

You may want to see also

Full tort coverage allows victims to sue for pain and suffering

Tort insurance is available in at-fault states for drivers who want the most flexibility in pursuing legal recourse after a car accident. Thirty-eight US states follow the tort system for auto insurance, which gives injured parties more leeway to sue for damages. The other 12 states, plus Washington, D.C., are "no-fault" states, where drivers must purchase personal injury protection (PIP) to cover their medical bills, regardless of who caused the accident.

Full tort insurance, also known as full tort coverage, is an auto insurance option that gives you unrestricted rights to sue for damages, regardless of their severity, after an accident. This means that full tort coverage allows victims to sue for pain and suffering with no restrictions. Pain and suffering refer to non-economic losses after a car accident, including emotional distress or physical pain. This is distinct from medical bills covering injuries sustained in the accident.

Full tort coverage has no restrictions on the compensation you can get after a car accident caused by another driver. In contrast, limited tort coverage restricts how much compensation you can receive. Because of this, full tort insurance is about 15% more expensive than limited tort insurance.

Full tort insurance is more expensive, but it provides the opportunity for broader financial reimbursement if you're involved in a serious accident. A limited tort insurance policy is cheaper, but you can't sue for non-monetary expenses related to an accident.

Strategies to Negotiate a Fair Auto Insurance Claim Settlement

You may want to see also

Frequently asked questions

Full tort coverage allows the victim to file a claim for all damages, including medical costs, lost wages, and non-economic damages such as pain and suffering. Limited tort coverage restricts your ability to sue for pain and suffering unless your injuries are severe.

Full tort insurance gives you the unrestricted right to sue for damages, regardless of their severity. Full coverage is a term used to describe a combination of insurance policies that include liability, collision, and comprehensive coverage.

Pain and suffering refer to non-economic losses after a car accident. This includes emotional distress, physical pain, loss of consortium, and loss of enjoyment in life.

Full tort coverage is typically about 15% more expensive than limited tort coverage. This is because full tort coverage allows you to sue for pain and suffering without restrictions.