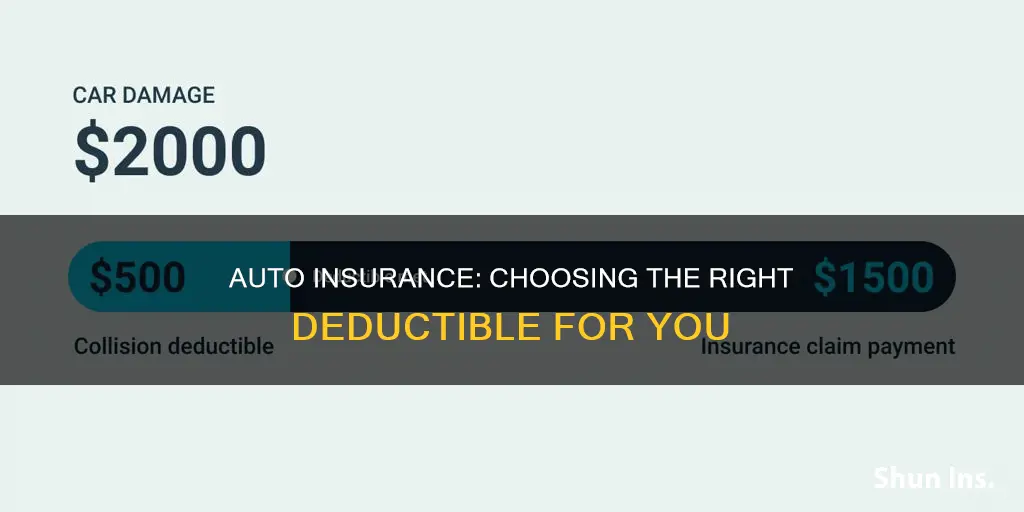

Choosing a car insurance deductible can have serious financial implications, so it's important to weigh the various options with the help of an insurance agent. The deductible is the amount you pay out of pocket before your insurance carrier starts paying for repairs. The average car insurance deductible is $500, but deductibles can range from $100 to $2,500. A good deductible for auto insurance is an amount you can afford after an accident or unexpected event.

| Characteristics | Values |

|---|---|

| What is a car insurance deductible? | The amount of money you pay out of pocket before your insurance carrier starts paying for repairs. |

| How does a deductible work? | You choose your deductible when you buy your policy. Policies with lower deductibles have higher premiums but lower out-of-pocket costs if you file a claim. |

| Average cost of a car insurance deductible | $500. |

| When do you pay the deductible for auto insurance? | Deductibles apply to some types of car insurance coverage but not to others. Collision, comprehensive, uninsured motorist property damage, and personal injury protection typically have a deductible attached to them. |

| What if you’re not at fault? | When another motorist is at fault for the accident, that driver’s insurance company is responsible for covering the cost of repairing your vehicle, and you will not need to pay a deductible to have your car fixed. |

| How do car insurance deductibles impact premiums? | The higher the deductible, the lower the premium. |

| How should I choose my car insurance deductible? | You should choose a deductible you can comfortably afford to pay in the event of a claim. |

What You'll Learn

Choosing a deductible based on your budget

Choosing a car insurance deductible that suits your budget is an important financial decision. Here are some key factors to consider when making your choice:

Understand the Relationship Between Deductibles and Premiums:

The deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible will generally lead to lower insurance premiums, as you are taking on more of the financial risk. Conversely, a lower deductible results in higher premiums but reduces your potential out-of-pocket expenses in the event of an accident.

Assess Your Financial Situation:

Consider your savings, emergency funds, and monthly budget. If you have sufficient savings and can afford a higher deductible, you may benefit from lower premiums. On the other hand, if a higher deductible would strain your finances, a lower deductible with higher premiums may be a safer choice.

Evaluate Your Risk Factors:

Think about your driving history, the area you live in, and the value of your car. If you live in an area with a high risk of accidents, extreme weather, or high crime rates, you may be more likely to file a claim. In this case, a lower deductible could be more suitable. Additionally, if your car is older or has a lower value, a lower deductible may make more sense, as a higher deductible could exceed the value of the car.

Calculate Potential Costs:

Compare the difference in premiums between high and low deductible plans. Consider how often you may need to file a claim and calculate your potential out-of-pocket expenses for both scenarios. This will help you determine which option is more cost-effective for your budget.

Consult with an Insurance Agent:

Discuss your options with a professional insurance agent. They can guide you through the process, provide quotes for different deductible amounts, and help you make an informed decision based on your financial situation and risk factors.

Gap Insurance: Australia's Ultimate Car-buying Protection

You may want to see also

Opting for a higher deductible for lower premiums

However, choosing a lower deductible means you'll pay less money upfront when disaster strikes. While you won't have to dip into your savings during an emergency, you will need to allocate more room in your budget for a higher insurance bill. This makes managing your expenses in times of crisis much easier as they are more predictable.

With auto insurance, you only pay a deductible towards comprehensive and collision coverage of your own property. That includes theft, vandalism, or accidents in which you are at fault. If you damage someone else's property or injure another person, there's no deductible, and your insurance policy will cover the entire cost of their repairs or medical care up to the policy limits. This is called liability coverage.

When choosing your deductible amount, consider how likely it is that you will need to file an insurance claim. The higher your risk, the more likely you are to be stuck with a large bill.

The most popular car insurance deductible is $500, but they can range from $0 to $2,000. Most insurers set the default deductible at $500, but it’s common to see $250, $1,000, or $2,000 deductibles.

Does American Family Insurance Cover Your Car Too?

You may want to see also

Selecting a deductible based on your car's value

The Relationship Between Deductible and Car Value

The value of your car plays a crucial role in determining the appropriate deductible. If your car is worth $10,000 and you have a $1,000 deductible, the insurance company will cover $9,000 in the event of a total loss. In this case, opting for a higher deductible makes sense. Conversely, if your vehicle is worth $3,500 and you have a $1,500 deductible, the insurer will only pay $2,000, making a lower deductible more favourable.

Older or Lower-Value Cars

If your car is older, say more than 15 years old, or has a low value, typically $1,000 to $3,000, choosing a plan without a deductible, such as minimum coverage, might be more advantageous. This is because older or devalued cars often have lower insurance payouts, and you may end up paying most or all of the repair bill even with a deductible.

Weighing the Financial Implications

When selecting a deductible, it's essential to consider the financial implications for your specific situation. If you have substantial savings, you may prefer a lower deductible to avoid a large, unexpected bill after an accident. On the other hand, if you're comfortable with taking on more risk and can afford a higher deductible, you'll benefit from lower monthly premiums.

Likelihood of Filing a Claim

Your driving history and habits are also key factors in choosing a deductible. If you have a history of accidents, frequently drive during rush hour, or live in an area with a lot of deer or inclement weather, you're more likely to file a claim. In this case, a lower deductible may be more suitable. Conversely, if you're a low-risk driver with a safe driving record, a higher deductible could be a good option to keep premiums low.

Emergency Funds and Risk Tolerance

Your emergency funds and risk tolerance should also be considered. If you don't have savings or an emergency fund to cover a high deductible, opting for a lower deductible policy might be wiser. Additionally, choosing a high-deductible plan assumes you won't have an accident, so it's a gamble that may not be suitable for everyone.

In conclusion, when selecting a deductible based on your car's value, it's important to weigh factors such as the car's worth, your financial situation, driving history, and risk tolerance. Remember that a higher deductible usually results in lower premiums, but you'll pay more out of pocket if an accident occurs. On the other hand, a lower deductible leads to higher premiums but provides more financial protection in the event of a claim.

Gap Insurance: NMAC Refund Policy Explained

You may want to see also

Considering your savings and emergency funds

When choosing a car insurance deductible, it's important to consider your savings and emergency funds. While a higher deductible typically leads to lower premiums, you need to ensure you can afford the higher out-of-pocket costs in the event of a claim.

If you don't have sufficient savings or an emergency fund, a lower deductible with higher premiums may be a better option. This way, you can avoid a large, unexpected bill after an accident. For example, if you can only afford to pay a maximum of $500 out of pocket, choosing a deductible higher than that amount may not be wise.

Additionally, consider the value of your car. If your vehicle is worth less, a lower deductible is generally preferable. This is because the insurance company will only pay up to the actual cash value of your car, so a higher deductible may result in a smaller payout.

In summary, when selecting a car insurance deductible, evaluate your financial situation, including your savings and emergency funds. Opt for a deductible that you can comfortably afford to pay in case of an accident, while also taking into account the value of your vehicle.

Auto Insurance and Healthcare: Unraveling the Maryland Licensing Conundrum

You may want to see also

Assessing the claim risk in your area

When it comes to auto insurance, insurance companies are all about assessing risk. They use several factors to determine how much of a risk you pose and what your premium should be.

Location

If you live in a high-crime area with a lot of car thefts, vandalism, or accidents, you are at more risk of filing an insurance claim. This is why drivers in cities generally pay more for insurance than those in small towns. If you live in or near a highly congested, densely populated area, such as New York City, your risk of an accident increases. Taking public transportation when possible can help to minimize this risk.

On the other hand, if you drive through heavily wooded areas, you are at risk of colliding with wildlife. Slowing down can ensure you have enough time to stop if an animal runs out in front of you.

Driving History

Your driving history is a significant factor in assessing your risk level. Accidents or moving violations reported to the Department of Motor Vehicle (DMV) will increase your premiums. If your record remains clean after your last infraction, your premiums will decrease.

Personal Information

Personal information such as age, gender, and marital status also play a role in determining risk. Statistically, younger drivers are more prone to accidents due to their lack of road experience, and males are more likely to be in an accident than females. Single drivers are also more likely to be in an accident than married drivers.

Credit Score

Individuals with bad credit scores may be deemed high-risk applicants since studies have shown that people with low credit scores tend to file more claims than those with good credit scores.

Vehicle

Insurance companies track statistics on vehicles. Before buying a car, check its safety rating and compare its likelihood of attracting car thieves to other models.

Best Auto Insurance Policies for Rental Car Coverage

You may want to see also

Frequently asked questions

A car insurance deductible is the amount of money you pay out of pocket for an accident before your insurance company pays the rest. For example, if you have a \$500 deductible and you’ve filed a claim that requires \$2,500 in car repairs, you’ll need to pay the mechanic \$500 before your insurer will cover the remaining \$2,000 in repair costs.

The most common deductible for car insurance is \$500, but what’s best for you depends on your budget and insurance needs. If you choose a low deductible, you’ll usually pay a higher insurance premium.

Choosing a higher deductible will almost certainly lower your car insurance premium, but be prepared to pay the higher amount in the event of a claim. WalletHub notes that you can save about 6% by choosing a \$2,000 deductible instead of a \$1,000 deductible.