List-billing is a process where the insurance carrier generates an invoice for premiums and sends it to the employer. The invoice details the employees, rates, and premiums. The employer is then responsible for paying the amount stated on the invoice to settle the transaction. List-billing can also be used to split a premium over multiple entities and locations. This is done by creating a master policy billed to multiple locations and/or related accounts. The master policy provides insurance coverage for all locations and/or related accounts insured under the policy.

What You'll Learn

List-billing is used for group insurance plans

List-billing is a process used for group insurance plans, where the insurance carrier generates an invoice for premiums and sends it to the employer. This is in contrast to self-billing, where the employer creates and sends the invoice to the insurance carrier.

In list-billing, the invoice details the list of individuals enrolled, the coverage they have chosen, the rate or premium due for each person, and the total premium due by the employer. The employer is then responsible for paying the total premium, usually through payroll withholding, and facilitating premium payments for their employees. It is important to note that the employer does not contribute to the premium and is merely a facilitator.

List-billing is commonly used for group health insurance plans, which are offered by employers or member organisations to their employees or members. These plans are typically more affordable than individual plans as the risk to the insurer is spread across multiple members. Group health insurance plans can also be extended to cover family members and dependents for an additional cost.

List-billing is a popular method for managing employee benefit plans as it simplifies the process of paying premiums on time and ensures employees receive their benefits.

The Nuances of Car Insurance: Understanding the Difference Between Short and Long-Term Policies

You may want to see also

The insurance carrier generates an invoice for premiums

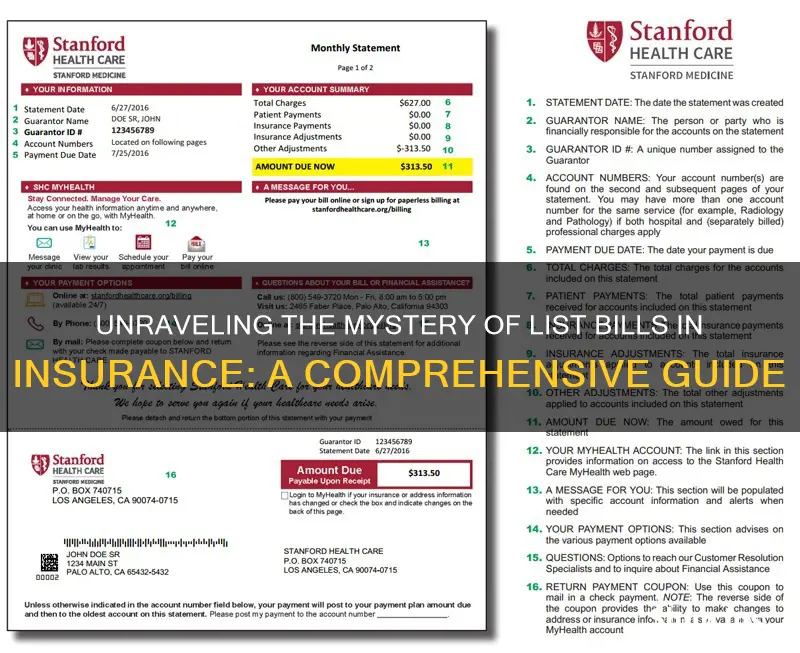

List-billing is a process where the insurance carrier generates an invoice for premiums and sends it to the employer. The data for the invoice is taken from the enrollment system and may be manually entered into a carrier website, or larger employers may transmit the data directly to the carrier. The employer is then responsible for paying the amount stated on the invoice to settle the transaction.

In the context of employee benefit plans, list-billing is an important process for managing premiums. It involves the insurance carrier creating an invoice for premiums and sending it to the employer. This invoice details the costs associated with the insurance coverage provided to the employees.

The insurance carrier will typically use information from the enrollment system to generate the invoice. This data can be manually entered into the carrier's website, or in the case of larger employers, transmitted directly to the carrier. The invoice will include information such as the list of individuals enrolled, the coverage they have selected, and the total premium due.

Once the invoice is generated and sent to the employer, it is the employer's responsibility to pay the stated amount to the insurance carrier. This transaction settles the premium payment for the employees' insurance coverage.

It is important to note that list-billing is different from self-billing, where the employer creates and sends the invoice to the insurance carrier along with backup detail information. The main distinction between the two processes lies in who creates and sends the invoice. List-billing is initiated by the insurance carrier, while self-billing is driven by the employer.

Navigating Mental Health Expenses: To Insure or Not to Insure?

You may want to see also

The employer is responsible for paying the invoice amount

List-billing is a process where the insurance carrier generates an invoice for premiums and sends it to the employer. The employer is then responsible for paying the invoice amount to settle the transaction. The data for the invoice is taken from the enrollment system and may be manually entered into a carrier website, or larger employers may transmit the data directly to the carrier.

The list bill will usually include the coverage the individual has enrolled in, the rate or premium due for that individual, and the total premium due by the employer. The list bill provides a means of splitting a premium over multiple entities and locations. It is comprised of one master policy billed to multiple locations and/or related accounts. The master policy provides insurance coverage for locations and/or related accounts insured on a policy.

The employer will want to note any variances in timing that occur for new hires or terminations after the statement generation date and the enrollment and/or payroll system to ensure these are resolved on the following month's invoice. Differences in premiums between the enrollment and payroll systems may also occur due to carrier invoicing calculation errors or configuration of payroll deduction and/or plan enrollment premium tables.

Most insurance companies bill most employers using a list bill published on the insurance carrier's website. The employer is responsible for paying the amount stated on the invoice, and insurance companies usually publish the list bill on their website.

Psychiatry Practice Management: Navigating Insurance Coding and Reimbursement

You may want to see also

List-billing can be used for employee benefit plans

List-billing is a process where the insurance carrier generates an invoice for premiums and sends it to the employer. The employer then pays the amount stated on the invoice to settle the transaction. This is in contrast to self-billing, where the employer creates and sends the invoice to the insurance carrier.

List-billing is a useful method for managing employee benefit plans as it saves time and resources for both the employer and the insurer. It also ensures that the employer is not contributing to the premium, which is federally mandated in the US under List-Billing. This means that group policy requirements do not apply, and the individual is covered by the terms of their own policy.

However, list-billing can also be problematic. To eliminate overbilling, companies often have to reconcile the insurance list bill by comparing it to their internal enrollment data, which can be a manual and time-consuming process.

Overall, list-billing is a useful tool for managing employee benefit plans, but it is important to be aware of the potential issues that may arise.

Billing Insurance for Herpes-Related Eye Disease: A Comprehensive Guide

You may want to see also

List-billing can create potential HIPAA/ERISA violations for the employer

List-billing is a process where the insurance carrier generates an invoice for premiums and sends it to the employer. The employer is then responsible for paying the amount stated on the invoice to settle the transaction.

- Unauthorized access to or disclosure of PHI: List-billing involves the employer receiving and handling invoices that contain PHI. If the employer or its employees improperly access or disclose this information, it would be a violation of HIPAA.

- Inadequate employee training: If the employer's employees are not properly trained on HIPAA rules and the ins and outs of handling PHI, they may unintentionally leak PHI, resulting in a HIPAA violation.

- Lost or stolen devices: If the employer or its employees lose or have stolen devices that contain PHI, it would be a significant violation of HIPAA, inviting hefty fines.

- Unsecured patient information: If the employer or its employees leave patient information unsecured, such as on an unlocked screen, it would be a violation of HIPAA rules.

- Failure to conduct risk analysis: Under HIPAA, organizations are required to conduct regular risk assessments to identify vulnerabilities to PHI. If the employer fails to do this, it would be a violation.

To avoid potential HIPAA/ERISA violations, employers should ensure that they and their employees are properly trained on HIPAA rules and regulations and that they have appropriate safeguards in place to protect PHI.

Understanding the Fine Print: Navigating Insurance Policies and Their Terms and Conditions

You may want to see also

Frequently asked questions

A list bill is a means of splitting a premium over multiple entities and locations. It involves an insurance carrier generating an invoice for premiums and sending it to the employer.

A list bill involves the insurance carrier and the employer. The insurance carrier generates the invoice and sends it to the employer, who then pays the amount stated.

A list bill typically includes the coverage the individual has enrolled in, the rate or premium due for that individual, and the total premium due by the employer.

List-billing can create potential HIPAA/ERISA violations for the employer when used with HRPs. In this scenario, the employee purchases their own individual health insurance policy and pays the premium in full, usually through payroll withholding. The employer then transmits the payment to the insurance company on behalf of the employee.