An appraisal gap is the difference between the fair market value of a property, as determined by an independent appraiser, and the amount the buyer agreed to pay for it. This gap can be a hurdle for buyers on their journey to owning their dream home, as it can mean spending more upfront or even losing the property.

| Characteristics | Values |

|---|---|

| Definition | The difference between the appraised value of a property and the purchase price or seller's asking price |

| Occurrence | More likely to occur when home prices are rising rapidly but can happen even when home values are falling |

| Appraisal Process | An independent appraiser analyzes a home and compares it to similar homes in the area to determine its fair market value |

| Appraisal Timing | Takes place after an offer has been made on the home |

| Appraisal Contingency | A clause in the contract that gives the buyer the right to cancel the contract if the appraised value is lower than the purchase price |

| Appraisal Gap Coverage | A clause in the contract that commits the buyer to continue with the purchase even if there is an appraisal gap |

| Appraisal Gap Guarantee Clause | A clause in the contract that requires the buyer to pay the purchase price regardless of the appraised value |

| Appraisal Gap Coverage Clause | A clause in the contract that limits the difference between the appraised value and the purchase price |

| Impact | Can cause issues in finalizing the sale of a home as it suggests the actual value of the property is less than the agreed-upon sale price |

| Solutions | Pay the difference in cash, renegotiate with the seller, request a review of the appraisal, apply with another lender, or walk away from the deal |

What You'll Learn

- Appraisal gap insurance is not an actual insurance policy

- It is a clause in the contract that binds the buyer to the purchase

- Buyers can back out of the contract using an appraisal contingency

- Appraisal gaps are common in a seller's market

- Appraisal gaps can be addressed by renegotiating the purchase price

Appraisal gap insurance is not an actual insurance policy

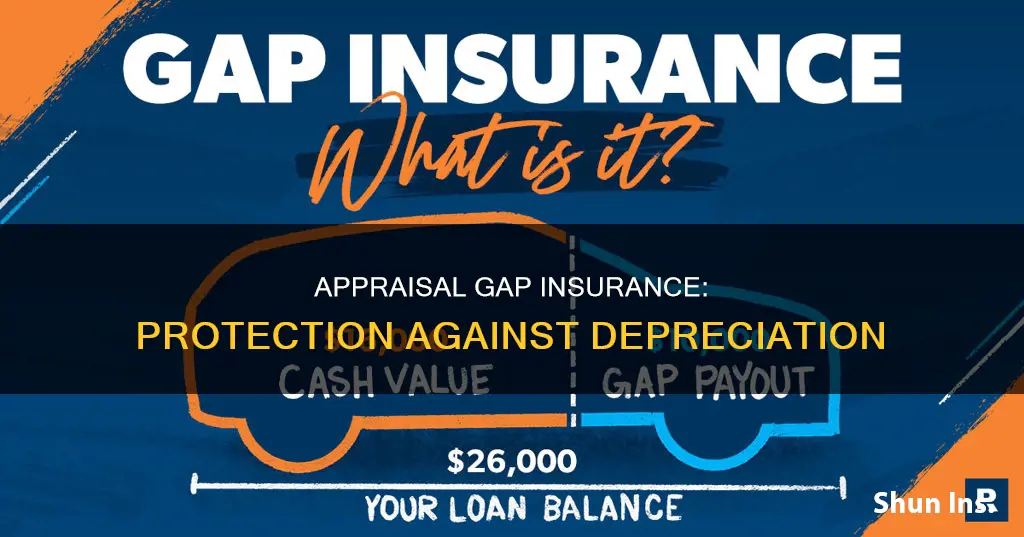

An appraisal gap is the difference between the fair market value of a home, as determined by an appraiser, and the amount agreed upon as the sales price. This gap can cause issues for the buyer, who may have to pay more upfront for the home or even question whether to buy the house at all.

Appraisal gap coverage is not an insurance policy, although it may sound like one. It is a clause in the contract that binds the buyer to purchasing the home, even if the appraisal comes in lower than the agreed-upon sales price. This is known as an appraisal guarantee clause. This clause is common in a seller's market, where there are more buyers than sellers, and sellers can dictate terms.

The appraisal guarantee clause states that the buyer will make up the difference if the appraisal is lower than the accepted offer. This can be a significant financial burden on the buyer, who may have to pay the difference out of pocket. Therefore, it is important for buyers to pay attention to this area of the contract and either request its removal or put a cap on how much they are willing to pay to cover an appraisal gap.

An alternative to the appraisal guarantee clause is the appraisal contingency, which allows the buyer to back out of the contract and keep their earnest money if the appraised value does not match the agreed-upon sales price.

Insurance Payouts: Total Loss Calculations

You may want to see also

It is a clause in the contract that binds the buyer to the purchase

An appraisal gap is the difference between the fair market value of a property, as determined by an appraiser, and the amount the buyer has agreed to pay for it. This gap can be a hurdle for buyers on their way to purchasing their dream home.

Appraisal gap coverage is a clause in the contract that binds the buyer to the purchase, even if the appraisal comes in lower than the agreed-upon price. This is common in a seller's market, where there are more buyers than sellers, and sellers have the upper hand. The clause states that the buyer will pay the difference between the appraised value and the purchase price, up to a certain amount. This gives buyers a competitive edge over other bidders and reassures the seller that the sale will go through.

However, this clause can be risky for buyers, especially if the appraisal gap is significant. In such cases, buyers may have to pay more than they can afford or take on additional loans to cover the difference. Therefore, it is essential for buyers to carefully consider their financial situation and set a realistic cap on the amount they are willing to cover.

While an appraisal gap coverage clause binds the buyer to the purchase, it is not the same as an appraisal guarantee clause, which requires the buyer to pay the full difference between the appraised value and the purchase price, with no upper limit. An appraisal gap coverage clause provides some protection for the buyer by setting a maximum amount they are willing to pay above the appraised value.

In summary, an appraisal gap coverage clause is a tool that buyers can use to make their offer more attractive to sellers, especially in a competitive market. However, it is important for buyers to carefully consider their financial situation and set an appropriate cap on the amount they are willing to cover to avoid taking on more debt than they can handle.

Leasing a Ford: Gap Insurance Included?

You may want to see also

Buyers can back out of the contract using an appraisal contingency

An appraisal gap is the difference between the appraised value of a property and the purchase price. This gap can be a headache for buyers, as it may force them to spend more upfront for the home and even cause them to question the purchase altogether.

An appraisal contingency is a clause that allows home buyers to back out of an agreement if the appraisal value of the property is lower than the purchase price. This contingency helps protect the buyer's finances and ensures they are not buying a home with major problems or paying more for a home than a mortgage lender is willing to finance. It is a safety net that gives buyers a legal way out of the contract if the appraised value doesn't match the agreed-upon sales price.

When an appraisal comes in lower than the offer, buyers can ask the seller to lower the sale price, come up with the cash to cover the difference, or back out of the sale. With an appraisal contingency in place, buyers have leverage in negotiating a lower price. Without it, they may have to walk away from the sale if an agreement cannot be reached.

Waiving an appraisal contingency can make things difficult for the buyer if the home appraisal is low. It could put them at risk of breaking the contract and losing their earnest money deposit. The earnest money deposit is usually 1% to 3% of the sales price, and it can be lost if the buyer backs out of the contract without an appraisal contingency.

In a competitive seller's market, buyers may choose to waive the appraisal contingency to make their offer more attractive. However, this is a risky move, as they would be expected to complete the purchase even if the appraisal comes in lower than the purchase price.

Insuring a New Vehicle: What to Expect

You may want to see also

Appraisal gaps are common in a seller's market

An appraisal gap is the difference between the appraised value of a property and the seller's asking price. Appraisal gaps are common in a seller's market, where demand for homes outstrips the supply of available properties. In this scenario, home prices increase rapidly as buyers engage in bidding wars, often offering above the asking price.

Appraisers determine the fair market value of a property by evaluating its condition and comparing it to similar homes in the area, known as "comps". However, in a hot market, appraised values may struggle to keep up with the swift rise in home prices, leading to appraisal gaps.

For example, consider a home listed for $300,000. A buyer may submit an offer of $325,000 with a 5% down payment to make their offer more attractive. If the seller accepts, but the appraisal comes back at a lower value, an appraisal gap occurs. In this case, the buyer would need to come up with additional funds to cover the difference, renegotiate the terms, or walk away from the deal.

Appraisal gaps can cause disruptions and send both buyers and sellers back to the drawing board. However, they do not necessarily derail the sale. Buyers can include an appraisal gap clause in their offer to safeguard against a low appraisal. This clause states that the buyer will cover the difference between the appraised value and the purchase price, up to a certain amount. In a competitive market, such a clause can strengthen a buyer's offer and provide assurance to the seller that the deal is less likely to fall through due to a low appraisal.

Additionally, buyers can work with their agent to structure their offer in a way that protects against appraisal gaps and have a contingency plan in case one occurs. For instance, they can include an appraisal contingency clause, which allows them to back out of the contract and retain their earnest money if the appraised value doesn't match the agreed-upon sales price.

While appraisal gaps can cause challenges, they are not uncommon, and most real estate contracts include some form of appraisal gap coverage to address this scenario. By being proactive and including appropriate clauses in the sales contract, both buyers and sellers can protect themselves and increase the likelihood of a successful transaction.

Mutual of Omaha: Gap Insurance Explained

You may want to see also

Appraisal gaps can be addressed by renegotiating the purchase price

An appraisal gap is the difference between the appraised value of a property and the purchase price. This gap can cause issues when it comes to finalising the sale of a home, as it suggests that the actual value of the property is less than the agreed-upon sale price.

If you find yourself in a situation where the appraisal value is lower than the purchase price, you can address the appraisal gap by renegotiating the purchase price. Here are some ways to do this:

- Request the seller to lower the price to the appraised value: This would eliminate the appraisal gap and allow you to purchase the home without having to pay the difference out of pocket. However, this option may not be feasible in a seller's market, as the seller may have other offers to consider.

- Ask the seller to split the difference: If the seller is unwilling to lower the price to meet the appraised value, you could negotiate a compromise where both parties contribute to covering the appraisal gap. For example, if there is a $10,000 difference, you could ask the seller to lower the price by $5,000 while you contribute the remaining $5,000.

- Include an appraisal gap coverage clause in the contract: This clause states that you are willing to pay the difference between the appraised value and the contract price, up to a certain amount. This option allows you to make a competitive offer while protecting yourself from paying more than you can afford.

- Get a new appraisal: You can dispute the original appraisal and request a new one by providing evidence that the assessed value is incorrect. However, this process may be time-consuming and may not guarantee a higher appraisal value.

- Back out of the contract: If none of the above options are feasible, you may have the option to terminate the contract, especially if you have an appraisal contingency clause in place. This allows you to walk away from the deal without losing your earnest money.

Remember that the best approach to addressing an appraisal gap will depend on your specific situation, the real estate market conditions, and the willingness of both the buyer and seller to negotiate. It is always recommended to seek the guidance of a real estate professional or attorney when navigating these complex transactions.

Cashing Out: Gap Insurance Claims

You may want to see also

Frequently asked questions

An appraisal gap is the difference between the appraised value of a property and the purchase price. An independent appraiser analyses a home and compares it to similar homes in the area to determine its fair market value.

An appraisal gap coverage clause is custom wording in the purchase contract that says you will pay the difference between the appraised value and the contract price, up to a certain amount.

An appraisal contingency gives the buyer a legal way out of the contract if the appraised value doesn't match the agreed-upon sales price. The contingency allows the buyer to back out of the contract and keep their earnest money.