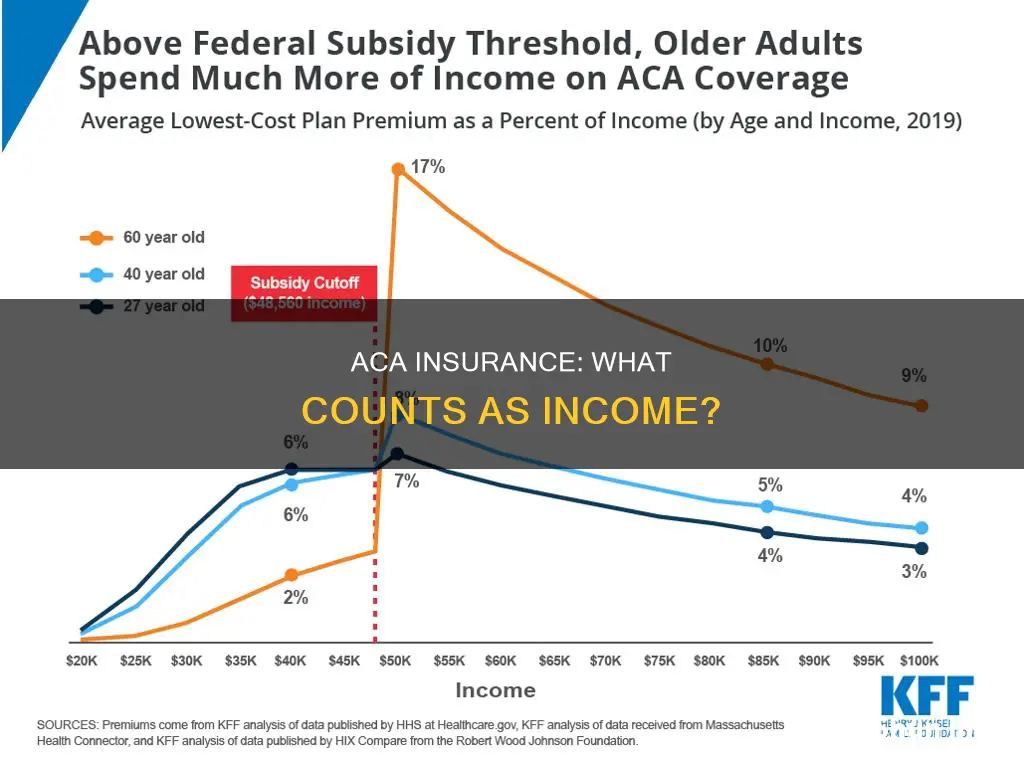

When applying for health insurance under the Affordable Care Act (ACA), eligibility for Medicaid, premium tax credits, premium subsidies, and cost-sharing reductions is based on an individual's or household's Modified Adjusted Gross Income (MAGI). MAGI is calculated using an individual's or household's total income for the tax year, minus certain adjustments, plus non-taxable social security benefits, tax-exempt interest, and foreign-earned income. This includes income from wages, salaries, self-employment, unemployment compensation, and more. It's important to note that MAGI calculations for ACA differ from those used for other purposes.

Characteristics of Income for ACA Insurance

| Characteristics | Values |

|---|---|

| Modified Adjusted Gross Income (MAGI) | Adjusted Gross Income (AGI) plus tax-exempt interest, non-taxable Social Security benefits, and excluded foreign income |

| Adjusted Gross Income (AGI) | Total income for the tax year minus certain adjustments (deductions for IRA contributions, student loan interest, etc.) |

| Types of income included in MAGI | Federal taxable wages, self-employment income, unemployment compensation, Social Security Disability Income (SSDI), retirement or pension income, interest and dividends, rental and royalty income, etc. |

| Types of income excluded from MAGI | Supplemental Security Income (SSI), proceeds from loans, child tax credits, veterans' disability payments, workers' compensation |

| Household income | MAGI of the tax filer, spouse, and any dependent required to file a tax return |

What You'll Learn

Modified Adjusted Gross Income (MAGI)

MAGI is based on your Adjusted Gross Income (AGI), which is your total income for the tax year, minus certain adjustments. These adjustments include deductions for conventional IRA contributions, student loan interest, and more. Your AGI can be found on IRS Form 1040, line 11.

To calculate your MAGI, you take your AGI and add back certain deductions, which may include:

- IRA contributions

- Student loan interest

- One-half of self-employment tax

- Qualified tuition expenses

- Tuition and fees deduction

- Passive loss or passive income

- Non-taxable social security payments

- Exclusion for income from U.S. savings bonds

- Foreign earned income exclusion

- Foreign housing exclusion or deduction

- Exclusion for adoption expenses

- Overall loss from a publicly traded partnership

MAGI is used by the Internal Revenue Service (IRS) to determine eligibility for certain tax benefits, such as:

- Whether your income qualifies you to contribute to a Roth individual retirement account (IRA)

- Whether you can deduct your traditional IRA contributions if you or your spouse have a retirement plan at work

- Whether you're eligible for the premium tax credit, which lowers your health insurance costs if you buy a plan through a state or federal Health Insurance Marketplace

MAGI is also used to determine eligibility for healthcare waivers and incentives under the Affordable Care Act (ACA) and for state Medicaid programs.

Maximizing Insurance Reimbursement: Navigating Transportation Billing for Healthcare Providers

You may want to see also

Adjusted Gross Income (AGI)

Adjustments to income are deductions that reduce total income to arrive at AGI. Examples of adjustments include half of the self-employment taxes paid, self-employed health insurance premiums, contributions to certain retirement accounts (such as a traditional IRA), student loan interest paid, and educator expenses.

AGI is used by the IRS as a basis for calculating how much an individual owes in taxes. It is also used by government agencies, banks, and private companies to determine if someone meets the criteria for a certain program, benefit, or application. For example, certain income-driven student loan repayment programs may use AGI to help determine eligibility.

AGI can be found on line 11 of Form 1040, U.S. Individual Income Tax Return. It is important to know one's AGI as it plays a role in calculating taxable income and can help determine eligibility for certain tax credits and benefits.

The formula for calculating AGI starts with determining one's gross income, which includes money earned from most sources. From one's gross income, the following can be subtracted:

- Educator expenses (books, supplies, equipment)

- Certain business expenses

- Deductible HSA contributions

- Moving expenses for military members

- Deductible self-employment taxes

- Contributions to retirement plans or health insurance for self-employed people

- Penalties on early withdrawals of savings

- Deductible IRA contributions

- Student loan interest

- Deductible tuition and fees

Insurtech Revolution: Redefining the Insurance Landscape

You may want to see also

Taxable wages

When filling out a Marketplace application, you will need to estimate your household income for the year you want coverage. This is based on your Modified Adjusted Gross Income (MAGI). MAGI is the total of the following for each member of your household who is required to file a tax return:

- Adjusted Gross Income (AGI): Your total or "gross" income for the tax year, minus certain adjustments you are allowed to take. Adjustments include deductions for conventional IRA contributions, student loan interest, and more.

- Excluded foreign income

- Nontaxable Social Security benefits (including tier 1 railroad retirement benefits)

- Tax-exempt interest

MAGI does not include Supplemental Security Income (SSI).

If your pay stub lists "federal taxable wages", use that number to calculate your MAGI. If not, use "gross income" and subtract the amounts your employer takes out of your pay for child care, health coverage, and retirement plans.

Unraveling the Myth: Exploring the True Nature of Term Insurance as an Investment Strategy

You may want to see also

Self-employment income

It can be challenging to estimate self-employment income, especially if your income fluctuates or is unpredictable. In this case, it is recommended to base your estimate on past experiences, realistic expectations, industry standards, and other relevant information. It is important to update your Marketplace application if you expect your yearly net income to be higher or lower than initially estimated.

When reporting self-employment income, you will be asked to describe the type of work you do. You may also be asked to provide additional information or documentation, such as a self-employment ledger, which can be in the form of a spreadsheet, a document from accounting software, or a handwritten ledger book.

The ACA offers tax credits and deductions that can help make health insurance more affordable for self-employed individuals. For example, self-employed individuals can deduct the amount they pay in health insurance premiums from their adjusted gross income. Additionally, health savings accounts (HSAs) allow self-employed individuals to pay for medical expenses with pre-tax dollars.

Prior to the ACA, self-employed individuals had to pay the full premium for an individual policy. However, the ACA's premium tax credits have made it more affordable for many self-employed Americans to purchase health insurance. These tax credits are now larger and more widely available due to the American Rescue Plan and the Inflation Reduction Act.

Incident-to Billing: Unraveling the Insurance Allowance Mystery

You may want to see also

Social Security benefits

The Marketplace uses a figure called Modified Adjusted Gross Income (MAGI) to determine eligibility for savings. MAGI is your Adjusted Gross Income (AGI) plus any non-taxable Social Security income, foreign-earned income, and tax-exempt interest income. If you have income from Social Security Disability Insurance (SSDI), this must be included in your MAGI, but Supplemental Security Income (SSI) should not be.

MAGI is used to determine eligibility for premium tax credits, most categories of Medicaid, and the Children's Health Insurance Program (CHIP). It is important to note that the guidelines and thresholds for these programs may change each enrollment year.

When filling out a Marketplace application, you will need to estimate your expected household income for the year you want coverage. This includes income from you, your spouse, and anyone you claim as a tax dependent. You will be asked about your current monthly income and then your yearly income. It is important to report any income changes as soon as possible to ensure you receive the correct amount of savings.

Switching Physicians with Medi-Cal Insurance: A Step-by-Step Guide

You may want to see also

Frequently asked questions

MAGI stands for Modified Adjusted Gross Income. It is the income number used to determine eligibility for savings. It includes the adjusted gross income (AGI) of each member of your household who is required to file a tax return, plus tax-exempt interest, non-taxable Social Security benefits, and excluded foreign income.

Income types included in MAGI are: Federal Taxable Wages, Self-employment income, Unemployment compensation, Retirement or pension income, Social Security Disability Income (SSDI), Rental and royalty income, and Veteran's disability payments, among others.

Income types excluded from MAGI are: Supplemental Security Income (SSI), Proceeds from loans (e.g. student loans), Child Tax Credit checks or deposits, Worker's Compensation, and Insurance proceeds (accident, casualty, health, life), among others.

To calculate your yearly income, you should consider including your income, your spouse's income, and that of any tax dependents. You can then provide information about expenses that may be deducted. You can use an online calculator to estimate your household's yearly income.