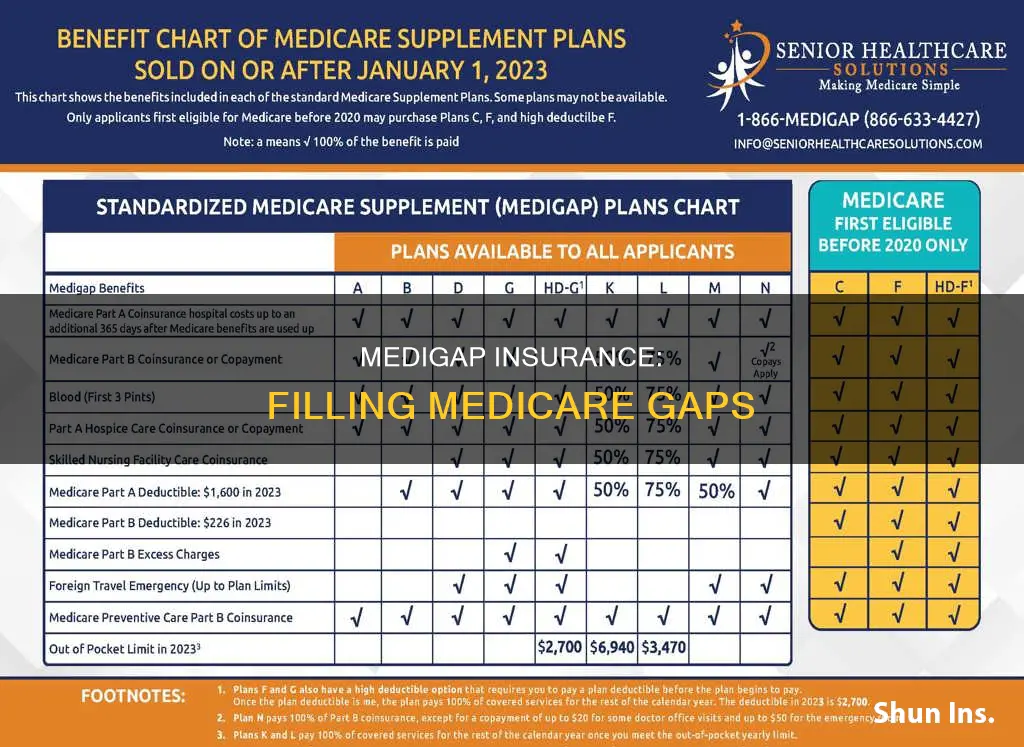

Medigap insurance, also known as Medicare Supplement Insurance, is an optional extra insurance coverage that fills in the gaps in Original Medicare Parts A and B that aren't covered. Medigap policies are sold by private insurance companies and help pay for deductibles, copayments, coinsurance, and other expenses that Original Medicare doesn't cover. Medigap plans are standardised and named by letters, like Plan G or Plan K, with each lettered plan offering the same benefits regardless of the insurance company. While Medigap insurance is not mandatory, it can provide peace of mind and protect finances against costly healthcare expenses, especially for seniors or individuals with extensive treatment needs.

| Characteristics | Values |

|---|---|

| What is it? | Extra insurance coverage to fill in the gaps that Original Medicare doesn't cover |

| Who is it for? | Seniors over 65 |

| Who provides it? | Private insurance companies |

| What does it cover? | Deductibles, copayments, coinsurance and other expenses |

| What are the plan names? | A, B, C, D, F, G, K, L, M, and N |

| What is the best time to buy it? | Within 6 months of getting Part B coverage at 65 or older |

| What is the average cost? | $100-$150 per month or more for the most popular Medigap plan, Plan G |

What You'll Learn

Medigap covers some or all of the costs Medicare doesn't

Medigap, or Medicare Supplement Insurance, is an extra insurance policy that can be purchased from a private health insurance company to cover some or all of the costs that Original Medicare doesn't. Original Medicare consists of Part A (Hospital Insurance) and Part B (Medical Insurance). Medigap policies help to pay for out-of-pocket costs associated with Original Medicare, such as copayments, coinsurance, and deductibles.

Medigap can also cover some services that Original Medicare doesn't, like emergency medical care when travelling outside of the US. This is known as foreign travel emergency care, and it is included in most Medigap plans with a lifetime limit of $50,000.

Medigap policies can also extend certain qualifying medical services that are received as part of long-term care, such as hospital stays or skilled nursing facility stays. However, it's important to note that Medigap doesn't cover everything, and long-term care, vision or dental care, and private-duty nursing are generally not included.

The benefits offered by Medigap plans differ, and you can choose to buy the plan that best meets your needs. Medigap policies are guaranteed renewable as long as you pay the premium, and they are available to those with Original Medicare coverage and Medicare Parts A and B.

Florida's Shift Away from No-Fault Insurance: A New Era for Motorists

You may want to see also

Medigap can be purchased from private insurance companies

Medigap, also known as Medicare Supplement Insurance, is an optional form of extra insurance coverage that can be purchased from private insurance companies. It fills in the gaps in Original Medicare Parts A and B, which don't always cover all healthcare costs. Medigap helps to pay for deductibles, copayments, coinsurance and other expenses.

Medigap plans are identified by capital letters, with each lettered plan offering the same standardised features, regardless of the insurance company. The price of these plans, however, can vary depending on the insurance company, the plan and where you live.

Medigap is especially useful for seniors who want to protect their finances against costly healthcare expenses. It can also be beneficial for those who want to choose their own doctors, as Medigap doesn't require a referral to see any doctor.

The best time to buy a Medigap policy is when you turn 65 and enroll in Medicare Part A and B. During the first six months of your enrollment, you can buy any Medigap policy sold in your state, even if you have pre-existing health conditions. After this initial enrollment period, it may be more difficult and expensive to purchase a Medigap policy.

To purchase a Medigap plan, you can compare the benefits of each lettered plan and find insurance companies that sell the standardised plan you want. It is recommended to contact multiple companies to get an estimate, as costs can vary widely between them.

Birthing Costs: Unraveling the Insurance Billing Process for New Mothers

You may want to see also

Medigap is different from Medicare Advantage plans

Medigap and Medicare Advantage are both coverage options for people with Medicare, but there are some key differences between the two.

Medigap is Supplemental Coverage

Medigap, also known as Medicare Supplement Insurance, is sold by private companies and helps pay some of the health care costs that Original Medicare doesn't cover, like copayments, coinsurance and deductibles. Some Medigap plans also offer coverage for services that Original Medicare doesn't cover, like medical care when travelling outside the U.S.

Medicare Advantage is an Alternative to Original Medicare

Medicare Advantage, also known as Medicare Part C, is an alternative to Original Medicare. It is provided by private insurers and replaces Original Medicare as your primary insurance. Medicare Advantage plans cover all Medicare-covered benefits and may also provide additional benefits like some dental, hearing, vision and fitness coverage. Most of them also include Medicare Part D, which covers prescription drugs.

Medigap Offers More Freedom of Choice

Medigap gives you more freedom of choice than Medicare Advantage, provided your physician or facility accepts Medicare. As long as you pay your premiums, your Medigap policy is renewable for life and will only be dropped if you stop paying premiums, you falsify your application, or the insurance company files for bankruptcy.

Medicare Advantage Offers More Comprehensive Coverage

Medicare Advantage plans provide all the same benefits provided by Original Medicare, plus coverage for items and services not covered by Original Medicare, including some vision, dental, hearing and wellness programs like gym memberships. Most Medicare Advantage plans include prescription drugs, too, and many help pay for services Original Medicare doesn’t cover, such as routine dental, hearing and vision care.

Medigap and Medicare Advantage Cannot Be Combined

Medigap and Medicare Advantage are very different, and their unique types of coverage cannot be combined. If you have a Medicare Advantage Plan, you cannot buy a Medigap policy. It is illegal for anyone to sell you a Medigap policy unless you're switching back to Original Medicare.

Food Delivery: Rideshare Insurance?

You may want to see also

Medigap policies are designed to provide additional coverage for routine services

Medigap insurance, also known as a Medicare Supplement, is an additional insurance policy that can be purchased from a private health insurance company. It is designed to provide extra coverage for costs not covered by Original Medicare, such as copayments, coinsurance, and deductibles. Medigap policies are standardised and identified by capital letters, with each letter denoting a specific set of features.

Medigap plans help to eliminate out-of-pocket costs for Medicare recipients. For example, if an individual has Original Medicare and buys a Medigap plan, Medicare will pay its share of the approved amount for covered health care costs, and then the Medigap plan will pay its share. This can include extending coverage for hospital stays or skilled nursing facility care, which may be particularly beneficial for those requiring long-term care.

Medigap plans can also provide coverage for emergency healthcare when travelling abroad, offering peace of mind for frequent travellers. The lifetime limit for coverage when travelling abroad is $50,000, and some plans may offer additional coverage for foreign travel emergency care.

It is important to note that Medigap plans are designed to supplement Original Medicare benefits and are not a replacement. Individuals must have Original Medicare Part A (Hospital Insurance) and Part B (Medical Insurance) to be eligible for a Medigap policy. Medigap policies are also tailored to individual needs, and the cost will vary depending on factors such as age, gender, and location.

Spectra S1: Hospital Grade for Insurance?

You may want to see also

Medigap plans are standardised and named by letters

The benefits in each lettered plan are the same across insurance companies, with price being the only difference between policies with the same letter sold by different companies. Costs can vary widely between companies, so it is recommended to contact more than one company to get an estimate.

Medigap plans cover "gaps" in Medicare Part A and Part B, which include deductibles, copayments, and coinsurance. For example, Medicare Part A has a deductible of $1,632 in 2024, which you owe before Medicare starts to pay for inpatient hospital care. Most Medigap plans cover the Part A deductible, and plans with premiums below $136 per month could put you ahead based on that benefit alone.

Medigap plans may also help with long-term care. While Medigap does not provide long-term care (LTC) insurance, its policies can extend certain qualifying medical services that are received as part of LTC, such as stays in a hospital or skilled nursing facility.

Medigap also covers some emergency healthcare needs when travelling abroad. The Medigap lifetime limit for coverage when travelling abroad is $50,000.

It is important to note that Medigap plans only cover one person. If you and your spouse both want Medigap coverage, you will each have to buy separate policies.

Understanding the Fundamentals: Is Insurance Term or Permanent?

You may want to see also

Frequently asked questions

What is Medigap insurance?

What does Medigap insurance cover?

Who needs Medigap insurance?

When should I enroll in Medigap insurance?

How much does Medigap insurance cost?