Life insurance and life assurance are both forms of protection designed to pay out after the policyholder passes away. However, there is a key difference between the two: life insurance covers the policyholder for a specific term, while life assurance covers the policyholder for their entire life.

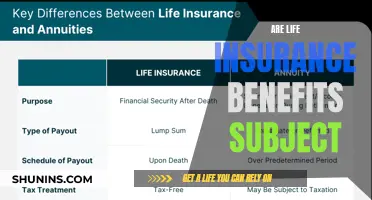

| Characteristics | Values |

|---|---|

| Term | Life insurance covers the policyholder for a specific term, while life assurance covers the policyholder for their entire life |

| Payout | Life insurance pays out a tax-free sum to beneficiaries if the policyholder dies during the term of the policy. Life assurance pays out after the policyholder dies |

What You'll Learn

- Life insurance covers the policyholder for a specific term

- Life assurance covers the policyholder for their entire life

- Life insurance pays out a tax-free sum to beneficiaries if the policyholder dies during the term of the policy

- Life assurance pays out after the policyholder dies

- Life insurance and life assurance are used almost interchangeably

Life insurance covers the policyholder for a specific term

Life insurance is designed to cover the policyholder for a specific term. This means that if you die during the term of the policy, the insurance company will pay a tax-free sum to your beneficiaries. However, if you outlive the term of the policy, your beneficiaries will not receive any payment.

The most common types of life insurance are level, increasing and decreasing cover. Life insurance covers you for a specific term, or amount of time. This is often the same amount of time as your mortgage, for example.

There are three different types of term life insurance products: pension term protection, convertible term life insurance and term life insurance.

Life insurance is not the same as life assurance, which is designed to cover the policyholder for their entire life. Life assurance is not based on the principle of protection for a fixed term. Instead, it means you are covered until you die. Therefore, with life assurance, typically a payment is made when the policyholder dies.

Life Insurance Credit Cards: Benefits and Drawbacks

You may want to see also

Life assurance covers the policyholder for their entire life

Although many people think that life assurance and life insurance are the same thing, there is a subtle but key difference between the two. Life insurance covers the policyholder for a specific term, while life assurance covers the policyholder for their entire life. In other words, life assurance is not based on the principle of protection for a fixed term and instead means you are covered until you die.

Life assurance, also known as 'whole of life' insurance, is designed to protect against events that will happen, whereas insurance covers you in case an event happens. This means that with life assurance, a payment is made when the policyholder dies. This is in contrast to life insurance, where a tax-free sum is paid to your beneficiaries if you die during the term of the policy, but nothing is paid out if you outlive the term.

Life assurance provides peace of mind in knowing that your 'whole of life' policy can protect your loved ones for the rest of your life. It is a guaranteed payout, as it will pay out in the event of a valid claim after you die, whenever that may be.

Corporate Resolution: Understanding Life Insurance Requirements

You may want to see also

Life insurance pays out a tax-free sum to beneficiaries if the policyholder dies during the term of the policy

Life insurance and life assurance are often used interchangeably, but there is a subtle but key difference between the two. Life insurance covers the policyholder for a specific term, while life assurance covers the policyholder for their entire life.

There are three different types of term life insurance products: pension term protection, convertible term life insurance and term life insurance. The most common types of life insurance are level, increasing and decreasing cover.

Life assurance, on the other hand, is not based on the principle of protection for a fixed term. Instead, it means you are covered until you die. Therefore, with life assurance, a payment is typically made when the policyholder dies.

Life Insurance and Taxes: What's the Government's Cut?

You may want to see also

Life assurance pays out after the policyholder dies

Life assurance is designed to protect against events that will happen, whereas insurance covers you in case an event happens. In the context of life cover, assurance is also known as 'whole of life' insurance, which covers you for your entire life. There is no end date attached to the policy.

Life assurance is not based on the principle of protection for a fixed term. Instead, it covers you until you die. Therefore, with life assurance, a payment is typically made when the policyholder dies. This is in contrast to life insurance, which only pays out if the policyholder dies during the term of the policy. If the policyholder outlives the term of the policy, their beneficiaries will not receive any payment.

Life assurance is designed to provide peace of mind, knowing that your loved ones will be protected for the rest of your life. It guarantees a payout after you die, whenever that may be. This is different from life insurance, which only pays out if a valid claim is made during the length of the policy.

Life assurance is a form of protection designed to pay out after the policyholder passes away. It is important to note that life assurance and life insurance are not the same things, despite what many people think. The key difference is that life insurance covers the policyholder for a specific term, whereas life assurance covers the policyholder for their entire life.

Listing Yourself as a Beneficiary: Is it Possible?

You may want to see also

Life insurance and life assurance are used almost interchangeably

Life insurance is designed to cover the policyholder for a specific term. If you die during the term of the policy, the insurance company will pay a tax-free sum to your beneficiaries. However, if you outlive the term of the policy, your beneficiaries will not receive any payment. The most common types of life insurance are level, increasing and decreasing cover. This cover is often the same amount of time as your mortgage, for example.

Life assurance, on the other hand, is not based on the principle of protection for a fixed term and instead means you are covered until you die. Therefore, with life assurance, typically a payment is made when the policyholder dies. This is also known as 'whole of life' insurance.

In summary, assurance is designed to protect against events that will happen, whereas insurance covers you in case an event happens.

Becoming a Life Insurance Agent: Malaysia's Guide

You may want to see also

Frequently asked questions

Life insurance covers the policyholder for a specific term, while life assurance covers the policyholder for their entire life.

The insurance company will pay a tax-free sum to your beneficiaries.

Your beneficiaries will not receive any payment.

Life assurance is an investment that pays out when you die.