Life insurance policies can be confusing, with their many provisions and terminologies. One such term is unit of insurance, which refers to the minimum amount of coverage one can purchase. In most cases, one unit of life insurance is equivalent to $1000 worth of coverage, though it can also be $5000 or $10,000. The number of units of coverage you need depends on the amount of financial support you want to leave your family. For instance, if you want to pay off significant debts like mortgages or leave your spouse with a large payout, you will need more units of coverage. The cost of one unit of coverage may differ from provider to provider, and it is also influenced by factors such as age, gender, and health habits.

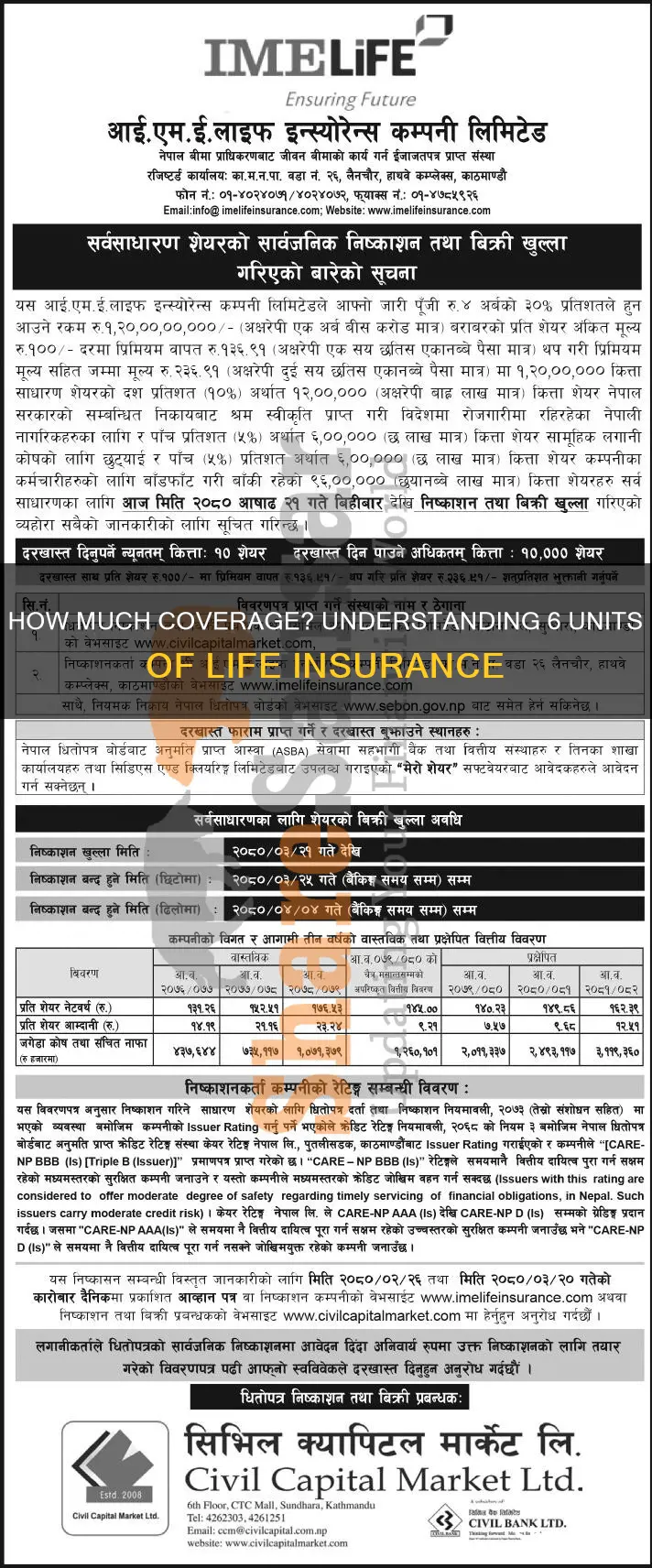

| Characteristics | Values |

|---|---|

| Unit of coverage | Base death benefit amount |

| Unit of coverage for 1 person | $1,000 |

| Unit of coverage for 6 people | $6,000 |

| Unit cost | $9.95 |

| Number of units | 12 units (in NY) |

What You'll Learn

- A unit of life insurance coverage is the base death benefit amount

- The unit cost of life insurance is typically $1000, but can vary

- The number of units of coverage depends on the amount of financial support you want to leave your family

- The cost of a unit of life insurance coverage is decided based on how risky the insurance company views you

- Guaranteed issue life insurance policies are described in units as opposed to total face amount

A unit of life insurance coverage is the base death benefit amount

Life insurance policies can be confusing, with their many provisions and terminologies. One such term is "unit of insurance" or "unit of coverage". This refers to the base death benefit amount of a life insurance policy. In other words, it is the minimum amount of coverage that you can purchase.

A unit of life insurance coverage is usually worth $1,000, though it can vary depending on the insurance provider and other factors like age and gender. For example, a 66-year-old male may only get $846 in coverage from a single unit, whereas a 65-year-old female may get $1,000. The death benefit for one unit may also change based on your age, gender, or other factors. So, it's important to check with each prospective insurer to understand how they value one unit of coverage.

The number of units you need depends on the amount of financial support you want to leave your family. For instance, consider your funeral and burial expenses, income replacement needs, and any significant debts you want to pay off. By purchasing additional units, you increase the total death benefit. So, if one unit provides $1,000 in coverage, buying five units would provide a total benefit of $5,000.

When insurance companies quote your policy, they determine the cost of providing you with $1,000 of coverage (or one unit) and set your premium per unit accordingly. The higher the risk you pose, the higher your premium may be. Risk factors can include smoking, poor health, or other factors. In some cases, the premium per unit is fixed, but the death benefit per unit of coverage changes, so the higher the risk, the lower the death benefit.

Mortgage Life Insurance: Worth the Cost?

You may want to see also

The unit cost of life insurance is typically $1000, but can vary

The unit cost of life insurance is the minimum amount of coverage you can purchase, and the final benefit will be a multiple of this base unit. The unit cost is typically $1,000, but this can vary between providers and depend on several factors. For example, Colonial Penn offers a unit of coverage for $9.95, which is significantly lower than the average.

The unit cost of life insurance is determined based on risk factors such as age, gender, and state requirements. The older you are, the less coverage you will get per unit. For example, a 50-year-old male may get $1,669 in coverage from one unit, while a 65-year-old female may get $1,000. Similarly, the cost of life insurance tends to be higher for males than females because males generally have shorter lifespans and are more likely to engage in dangerous jobs or lifestyles.

Other factors that can influence the unit cost of life insurance include your health, hobbies, criminal history, and occupation. Insurers typically offer lower rates to those who do not smoke, maintain a healthy weight, and avoid high-risk activities. Additionally, certain occupations, such as police officers or firefighters, may be subject to higher premiums due to the hazardous nature of their work.

It is important to note that the unit cost of life insurance may also vary depending on the type of policy you choose. Term life insurance, which lasts for a set number of years, is generally less expensive than permanent life insurance, which includes a cash value component.

Tech Credit Union: Life Insurance for Members?

You may want to see also

The number of units of coverage depends on the amount of financial support you want to leave your family

The number of units of life insurance coverage you need depends on the financial support you want to provide for your family after your death. A unit of coverage is the base death benefit amount. For example, if one unit of coverage is $1,000, then six units would provide $6,000 of coverage. The death benefit amount per unit may vary depending on factors such as age, gender, and other risk factors.

When considering how many units of coverage to purchase, it's important to think about the financial needs of your loved ones. For example, if you have dependents or a spouse who relies on your income, you may want to ensure that your life insurance payout is sufficient to replace your income for a certain number of years. This can help them maintain their current standard of living and cover essential expenses.

You may also want to consider any significant debts or expenses that your family may face after your death, such as mortgage payments, funeral expenses, or property taxes. If you want to ensure that your spouse has the financial flexibility to quit their job or take time off to grieve, a larger policy with more units of coverage may be appropriate.

Additionally, the number of units you need can depend on your current savings and investments. If you already have substantial savings or other sources of income, you may require fewer units of life insurance coverage. However, if you are the primary breadwinner and your family relies heavily on your income, you may want to consider a higher number of units to provide adequate financial protection.

In summary, the number of units of life insurance coverage you need is a personal decision that depends on your unique financial situation and the level of support you want to provide for your family. It's important to carefully consider your options and seek advice from a licensed insurance agent to ensure that you are choosing the right amount of coverage for your needs.

Life Insurance: Couples, Accidents, and Employer Benefits

You may want to see also

The cost of a unit of life insurance coverage is decided based on how risky the insurance company views you

The cost of life insurance is determined by a variety of factors that are assessed during the underwriting process. This is when the insurance company examines the risks, decides how much life insurance to offer an individual, and sets the price. The goal of this process is to determine how much risk the company will take on by insuring an individual. The cost of a unit of life insurance coverage is decided based on how risky the insurance company views you.

The younger and healthier you are, the less likely you are to have health problems, and the lower your premiums are likely to be. This is because age and health are two of the biggest factors in policy pricing. Generally, younger people pay less than older people, and women often pay less than men of a similar age and health, as women tend to live longer.

Your habits and hobbies can also affect the price of your insurance. If you smoke or use tobacco, you will pay more in premiums than non-smokers, as tobacco use increases the risk of heart disease, lung cancer, emphysema, and other medical conditions. Similarly, if you enjoy skydiving or racing cars, you may have higher premiums than someone who doesn't participate in these risky activities.

Your occupation can also influence the cost of your insurance. If you work in a high-risk job such as a police officer, firefighter, pilot, or construction worker, you may have higher premium payments than someone in a low-risk occupation.

The amount of coverage you choose will also impact the cost of your insurance. The more coverage you get, the higher the premiums are likely to be.

It's important to note that the cost of life insurance can vary between companies, even for the same amount of coverage. This is because companies weigh the different factors differently, but they all have the same goal of determining the level of risk associated with insuring an individual.

Employers' Life Insurance: Term or Whole?

You may want to see also

Guaranteed issue life insurance policies are described in units as opposed to total face amount

Guaranteed issue life insurance policies are described in units as opposed to the total face amount. This means that the policy's death benefit is calculated in units, typically of $1,000 each, though they can also be $5,000 or $10,000. The number of units purchased determines the total death benefit, so if one unit is $1,000, five units would provide $5,000 of coverage. The death benefit per unit may vary based on factors such as age, gender, and health.

For example, a guaranteed issue life insurance policy with a $250,000 death benefit would be equivalent to 250 units. The cost of each unit is determined by the insurance company based on the risk they perceive the individual to be. Factors such as smoking, poor health, age, and gender can increase the cost per unit. The unit price is not usually disclosed to the customer and is instead used by insurance companies when submitting premium calculations to governments for regulation.

Guaranteed issue life insurance, also known as "no questions life insurance", does not require the applicant to undergo a medical exam or disclose their medical history. This type of insurance is designed for individuals with serious health conditions that prevent them from obtaining traditional life insurance policies. As a result, guaranteed issue life insurance policies typically have higher premiums relative to their death benefits.

It's important to note that guaranteed issue life insurance policies always have a waiting period, typically of two to three years. If the insured person passes away during this waiting period, their beneficiaries will not receive the policy's death benefit. Instead, the insurance company will repay the premiums paid, plus interest. This waiting period is in place to protect insurance companies from individuals purchasing a policy while on their deathbed.

Life Insurance: Avoiding Capital Gains Tax?

You may want to see also

Frequently asked questions

A unit of life insurance is the minimum amount of coverage you can purchase. One unit of life insurance usually equals $1,000 worth of coverage. The cost of one unit of coverage may differ from one provider to another.

6 units of life insurance would provide $6,000 of coverage. The cost of 6 units depends on the provider and your personal factors, such as age, gender, lifestyle, and health.

The number of units of coverage you need depends on the amount of financial support you want to leave your family. You should consider factors such as funeral and burial expenses, income replacement, and any significant debts you want to pay off.