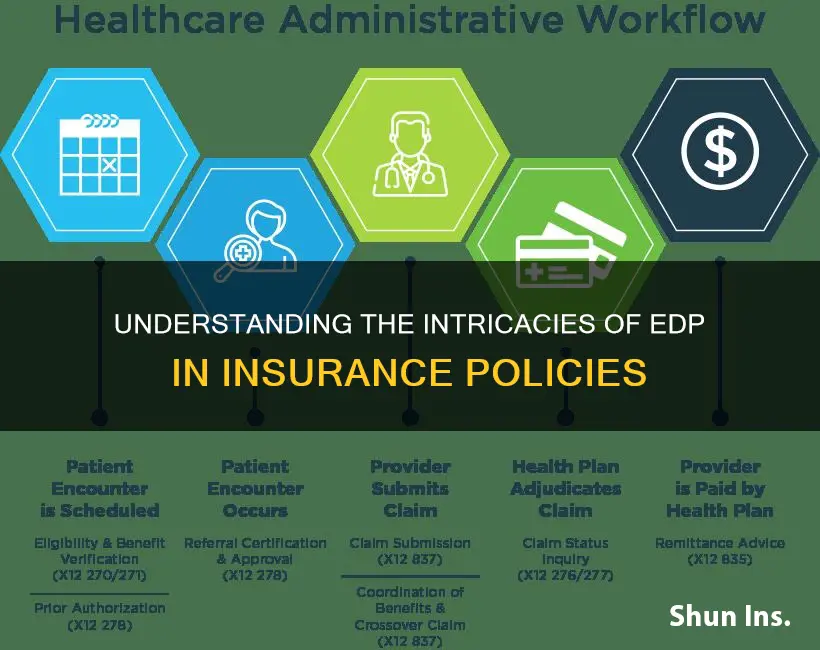

Electronic Data Processing (EDP) insurance is an add-on to a commercial property insurance policy that covers electronic data processing equipment and software from damage. This includes computers, servers, disks, storage devices, and the data they contain. EDP insurance can help protect a business's income in the event of data loss during a power surge, fire, natural disaster, or similar incident. It typically covers a wider range of events than standard commercial property insurance, including electrical disturbances, mechanical breakdowns, changes in humidity and temperature, and damage from computer viruses, hacking, and cyberattacks.

| Characteristics | Values |

|---|---|

| Type of insurance | Add-on to a commercial property insurance policy |

| What it covers | Electronic data processing equipment (computers, servers, disks, laptops, storage devices, etc.) and the data they contain |

| Type of coverage | All risks property insurance |

| Perils covered | Electrical disturbances (power surges), mechanical breakdowns, changes in humidity and temperature, damage from computer viruses, hacking, cyberattacks, offsite data storage |

| Exclusions | Third-party property damage, data losses caused by a third party (utility interruption), human error, stolen or damaged business property |

| Valuation options | Actual cash value (ACV), replacement value |

| Additional coverages | Newly acquired EDP equipment, EDP equipment at newly acquired premises, EDP equipment in transit, utility interruption, EDP equipment offsite |

What You'll Learn

- EDP insurance covers electronic devices such as computers, storage devices, and the data they contain

- It is an add-on to a commercial property insurance policy

- EDP insurance covers three main categories: data, media, and hardware

- It protects against a wide range of events, including power surges, mechanical breakdowns, and changes in humidity and temperature

- EDP policies have many defined terms because technology is dynamic

EDP insurance covers electronic devices such as computers, storage devices, and the data they contain

Electronic Data Processing (EDP) insurance is an add-on to a commercial property insurance policy that covers electronic data processing equipment from accidental damage. This includes computers, storage devices, and the data they contain.

EDP insurance is essential for small businesses that rely on electronic devices for their day-to-day operations. It fills the gaps in standard commercial property policies, which often exclude coverage for electronic equipment.

The EDP policy covers three main categories: data, media, and hardware. Data includes software, computer programs, and other forms of data valuable to a company, such as proprietary software and operating systems. Media refers to any devices that store data, like external hard drives, USB drives, magnetic tapes, and network storage servers. Hardware includes electronic equipment such as laptops, workstations, and computers. It can also cover printers, copiers, scanners, telecommunications systems, and cooling systems.

EDP insurance typically covers a wide range of events, including power surges, mechanical breakdowns, changes in humidity and temperature, and damage from computer viruses, hacking, and cyberattacks. It can also cover off-site data storage and equipment.

When determining the value of damaged goods, EDP insurance providers consider factors such as replacement cost, functional replacement cost, and the item's cash value. It's important to note that EDP insurance usually has specific exclusions, such as financial losses or damages caused by a utility service interruption.

The Mystery of Discontinuance: Unraveling the Insurance Terminology

You may want to see also

It is an add-on to a commercial property insurance policy

Electronic Data Processing (EDP) insurance is an optional add-on to a commercial property insurance policy. It covers electronic data processing equipment and software from damage.

EDP insurance is an important add-on for businesses that rely on computers and electronic data to carry out their daily operations. It fills in the gaps in standard commercial property insurance policies, which often do not cover electronic equipment and data.

EDP insurance covers three main categories: data, media, and hardware. Data includes software, computer programs, and other forms of data valuable to a company, such as proprietary software and operating systems. Media refers to any devices that store data, such as drums, discs, and tapes. Hardware includes electronic equipment such as laptops, workstations, and computers. Some policies may also cover copiers, scanners, telecommunications equipment, cooling systems, smartphones, and tablets.

EDP insurance typically covers a wide range of events, including electrical disturbances, mechanical breakdowns, changes in humidity and temperature, and damage from computer viruses, hacking, and cyberattacks. It is important to note that EDP insurance usually does not cover data losses or damage caused by a third party, such as a utility interruption or power surge from a power company.

When determining the value of damaged goods, EDP insurance providers will consider factors such as the replacement cost, functional replacement cost, and the item's cash value.

Businesses can benefit from EDP insurance to protect their electronic data processing equipment and ensure coverage for events not typically included in standard commercial property insurance policies.

The Hidden Dangers of Critical Illness: Uncovering the Critical Illnesses Covered by Term Insurance

You may want to see also

EDP insurance covers three main categories: data, media, and hardware

Electronic Data Processing (EDP) insurance is an add-on to a commercial property insurance policy that covers electronic data processing equipment and protects business income. EDP insurance covers electronic equipment belonging to three main categories: data, media, and hardware.

Data includes software, computer programs, and other forms of data that are valuable to a company, including proprietary software and operating systems. This also includes any data stored on devices, such as customer information and accounting data.

Media refers to devices that store data, like drums, discs, tapes, memory cards, and network storage servers.

Hardware includes any electronic equipment, including laptops, workstations, and computers. Depending on the policy, hardware can also include printers, copiers, scanners, telecommunications systems, cooling systems, and air conditioning equipment used solely for hardware.

Understanding the Criteria: Unlocking Short-Term Insurance Eligibility

You may want to see also

It protects against a wide range of events, including power surges, mechanical breakdowns, and changes in humidity and temperature

EDP insurance, or Electronic Data Processing insurance, is an add-on to a commercial property insurance policy that covers electronic data processing equipment and software from damage. This includes computers, servers, disks, storage devices, and the data they contain.

EDP insurance is designed to protect against a wide range of events, including power surges, mechanical breakdowns, and changes in humidity and temperature. These events can cause significant damage to electronic equipment and data, leading to costly repairs or replacements.

Power surges, for example, can occur due to lightning strikes, power company issues, or outdated wiring. They can damage or destroy appliances, electronics, and even electrical wiring, potentially leading to fires. EDP insurance can provide coverage for the replacement or repair costs of damaged equipment.

Mechanical breakdowns can also be covered under EDP insurance. This includes electrical or mechanical failures of equipment, such as motor burnouts or ruptures caused by centrifugal force. Coverage may also extend to air conditioning and heating equipment, electric doors, locks, and emergency generators.

Changes in humidity and temperature can also be insured against with EDP insurance. Electronic equipment is sensitive to these environmental factors, and fluctuations can cause damage. EDP insurance can provide financial protection to replace or repair equipment affected by these changes.

Overall, EDP insurance offers comprehensive protection for businesses that rely on electronic data processing equipment. By safeguarding against power surges, mechanical breakdowns, and changes in humidity and temperature, businesses can minimize the financial impact of potential damage to their critical electronic assets.

Understanding Insurance Events: Unraveling the Meaning and Its Impact

You may want to see also

EDP policies have many defined terms because technology is dynamic

Electronic Data Processing (EDP) insurance is an add-on to a commercial property insurance policy that covers electronic data processing equipment and data from damage. EDP policies are important for businesses that rely on computers and electronic data to carry out their operations, as they fill in the gaps in standard commercial property policies regarding electronic equipment.

The dynamic nature of technology means that EDP policies have many defined terms. The coverage provided by EDP policies depends on the specific definitions of key terms in the policy, such as "computer hacking," "computer virus," "data records," "media," and "telecommunications equipment." Liberal use of specific policy language helps preserve the intended coverage of an EDP policy.

EDP policies typically cover a wide range of events, including risks not usually included in standard commercial property insurance. This includes electrical disturbances (except from power companies), mechanical breakdowns, changes in humidity and temperature, damage from computer viruses, hacking, and cyberattacks, and off-site data storage.

The devices covered by EDP insurance include desktop computers, laptops, mainframe computers, workstations, copiers, scanners, telecommunications equipment, networking devices, and cooling systems. It also covers data storage devices and the information they contain, such as customer data and accounting data. Additionally, EDP insurance covers software, including computer programs, operating systems, and proprietary programs.

The value of damaged EDP property is typically calculated based on its replacement cost or functional replacement cost. The functional replacement cost takes into account the frequent technological changes, where an identical replacement may not be available, and a functionally equivalent property is used instead.

Frequently asked questions

EDP stands for Electronic Data Processing.

EDP insurance covers electronic data processing equipment and software from damage. This includes computers, servers, disks, storage devices, and the data they contain.

EDP insurance typically covers damage caused by electrical disturbances, power surges, mechanical breakdowns, changes in humidity and temperature, computer viruses, hacking, and cyberattacks. It also covers data loss during a natural disaster or fire.