Life insurance is a good idea if you have a partner or children who rely on your income for daily expenses, mortgage payments, student loans or other debts. There's no set amount of life insurance everyone needs, but a common rule of thumb is to have a policy with coverage equal to at least 10 times your annual income. Some financial advice pundits recommend buying insurance equal to 20 times your salary before taxes. This is because, if the benefit is invested in bonds that pay 5% interest, it would produce an amount equal to your salary at death, so the survivors could live off the interest.

| Characteristics | Values |

|---|---|

| Rule of thumb | Coverage equal to at least 10 times your annual income |

| DIME method | A popular strategy |

| Final expense insurance | A basic whole life policy that pays out enough to cover funeral expenses, outstanding medical or legal bills and other costs associated with settling your estate |

| Permanent coverage | Higher premiums than term coverage |

| Term life policy | Generally has the lowest premiums |

| Premium cost factors | Age, gender, health |

What You'll Learn

How much life insurance do you need?

There is no set amount of life insurance that everyone needs. The best coverage amount is the one that gives you the most reassurance that your family will be taken care of. A common rule of thumb is to have a policy with coverage equal to at least 10 times your annual income. Many pundits recommend buying life insurance equal to a multiple of your salary. For example, one financial advice columnist recommends buying insurance equal to 20 times your salary before taxes. This is because, if the benefit is invested in bonds that pay 5% interest, it would produce an amount equal to your salary at death, so the survivors could live off the interest without having to touch the principal.

The DIME method is another popular strategy. This stands for Debt, Income, Mortgage and Education. Final expense insurance, also known as burial insurance, is a basic whole life policy that pays out enough to cover funeral expenses, outstanding medical or legal bills and other costs associated with settling your estate.

The cost of life insurance premiums depends on several factors, including age and health. For example, a 30-year-old female in good health will pay an average of about $23 per month for a $500,000, 20-year term policy, while a 30-year-old male would pay about $30 per month for the same policy. For a $500,000 whole life policy, a 30-year-old female would pay about $408 per month, while a male would pay about $472 per month.

It's important to consider your own financial situation and goals when deciding how much life insurance to purchase. You may want to consult with a financial professional to get personalized advice and explore different types of life insurance policies to find the coverage amount that's right for you.

Life Insurance After Military Service: What's Covered?

You may want to see also

How much does life insurance cost?

There is no set amount of life insurance that everyone needs. However, there are a few rules of thumb that can be used to determine how much life insurance to buy. One common rule is to have a policy with coverage equal to at least 10 times your annual income. Another rule of thumb is to buy life insurance equal to a multiple of your salary. For example, one financial advice columnist recommends buying insurance equal to 20 times your salary before taxes. This is because, if the benefit is invested in bonds that pay 5% interest, it would produce an amount equal to your salary at death, so the survivors could live off the interest without having to touch the principal.

The cost of life insurance premiums depends on several factors, including age and health. For example, a 30-year-old female in good health will pay an average of about $23 per month for a $500,000, 20-year term policy, while a 30-year-old male would pay about $30 per month for the same policy. For a $500,000 whole life policy, a 30-year-old female would pay about $408 per month, while a male would pay about $472 per month.

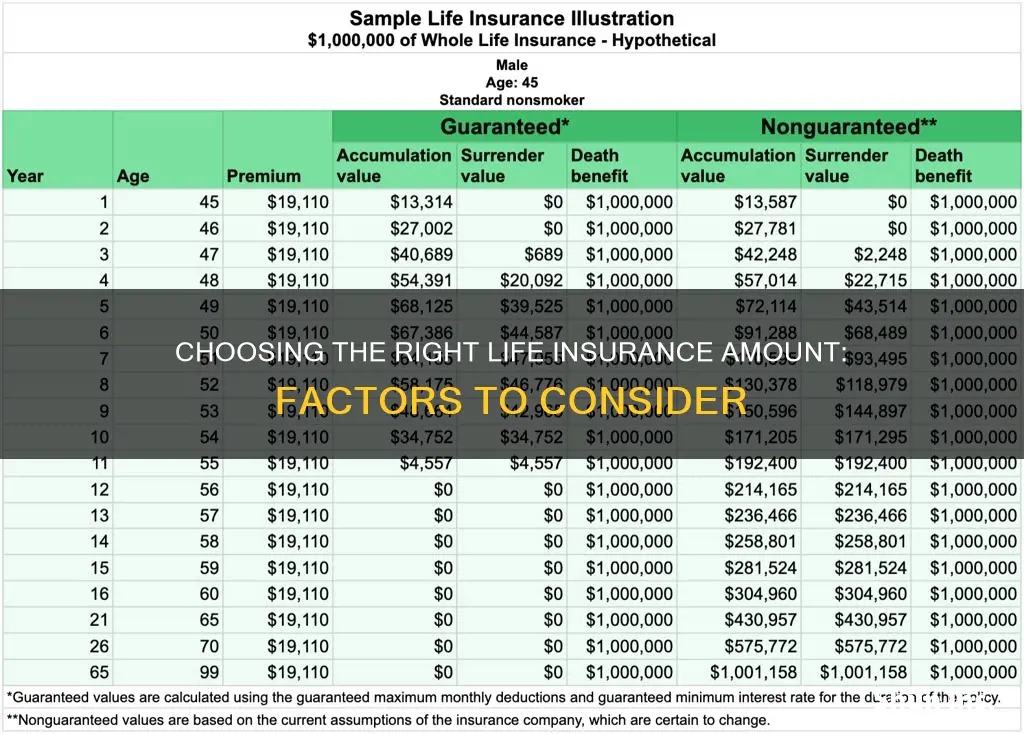

Life insurance premiums are generally higher with permanent coverage than with term coverage because permanent life insurance policies provide more and longer-lasting benefits. However, it is not necessary to choose one over the other; it is possible to combine policy types to get the coverage amount needed. Ultimately, the best coverage amount is the one that gives the most reassurance that your family will be taken care of, even if you're not around to provide that care.

Life Insurance Cash Fund: A Smart Financial Move?

You may want to see also

How much life insurance do you need to cover funeral expenses?

There is no set amount of life insurance that everyone needs. However, a common rule of thumb is to have a policy with coverage equal to at least 10 times your annual income. Another rule of thumb is to buy life insurance equal to a multiple of your salary. One financial advice columnist recommends buying insurance equal to 20 times your salary before taxes. This is because, if the benefit is invested in bonds that pay 5% interest, it would produce an amount equal to your salary at death, so the survivors could live off the interest without having to "invade" the principal.

Final expense insurance, also known as burial insurance, is a basic whole life policy that pays out enough to cover funeral expenses, outstanding medical or legal bills and other costs associated with settling your estate. Adding $15,000 for funeral and other final expenses brings the minimum life insurance needed to $375,000.

The cost of life insurance depends on several factors, including age. As we get older, more health issues may emerge, so premiums cost more the older you are. For example, a 30-year-old female in good health will pay an average of about $23 per month for a $500,000, 20-year term policy, while a 30-year-old male would pay about $30 per month for the same policy.

Cancer and Term Life Insurance: Does Level Death Benefit?

You may want to see also

How much life insurance do you need to cover your family?

There is no set amount of life insurance that everyone needs, but there are a few rules of thumb that can help you decide how much to get. One common rule is to have a policy with coverage equal to at least 10 times your annual income. Another rule of thumb is to buy life insurance equal to a multiple of your salary. For example, one financial advice columnist recommends buying insurance equal to 20 times your salary before taxes. This is because, if the benefit is invested in bonds that pay 5% interest, it would produce an amount equal to your salary at death, so the survivors could live off the interest without having to touch the principal. However, this assumes no inflation and that one could assemble a bond portfolio that, after expenses, would provide a 5% interest stream every year.

The DIME method is another popular strategy. This involves taking out final expense insurance, also known as burial insurance, which is a basic whole life policy that pays out enough to cover funeral expenses, outstanding medical or legal bills and other costs associated with settling your estate.

The best coverage amount is the one that gives you the most reassurance that your family will be taken care of, even if you're not around to provide that care. For example, the life insurance amount needed today to provide between $1,700 and $2,100 monthly is roughly $360,000. Adding $15,000 for funeral and other final expenses brings the minimum life insurance needed for the example to $375,000.

Several factors play into the cost of premiums, including age. As we get older, more health issues may emerge, so premiums cost more the older you are.

Streamlining Life Insurance: Automation Strategies for Efficiency

You may want to see also

How much life insurance do you need to cover your mortgage?

There is no set amount of life insurance that everyone needs. However, there are a few rules of thumb that can help you determine how much life insurance you need to cover your mortgage. One common rule is to have a policy with coverage equal to at least 10 times your annual income. Another rule of thumb is to buy life insurance equal to a multiple of your salary. For example, one financial advice columnist recommends buying insurance equal to 20 times your salary before taxes. This is because, if the benefit is invested in bonds that pay 5% interest, it would produce an amount equal to your salary at death, so the survivors could live off the interest without having to touch the principal.

The amount of life insurance you need will also depend on your personal circumstances and financial goals. If you have a partner or children who rely on your income for daily expenses, mortgage payments, student loans, or other debts, you may want to consider a higher amount of coverage. Additionally, you may want to consider the cost of funeral expenses and other final expenses, which can add up to $15,000 or more.

Ultimately, the best coverage amount is the one that gives you the most reassurance that your family will be taken care of, even if you're not around to provide that care. You can also combine policy types to get the coverage amount you need. For example, you can choose a term life policy, which generally has the lowest premiums, or a whole life policy, which provides more comprehensive coverage but at a higher cost.

Americo Life Insurance: Is It a Good Choice?

You may want to see also

Frequently asked questions

There's no set amount of life insurance that everyone needs. A common rule of thumb is to have a policy with coverage equal to at least 10 times your annual income.

The DIME method is a popular strategy for calculating how much life insurance you need. It stands for Debt, Income, Mortgage and Education.

A term life policy generally has the lowest premiums. A 30-year-old female in good health will pay an average of about $23 per month for a $500,000, 20-year term policy, while a 30-year-old male would pay about $30 per month for the same policy.

A whole life policy provides more and longer-lasting benefits than a term life policy, so the premiums are higher. For a $500,000 whole life policy, a 30-year-old female would pay about $408 per month, while a male would pay about $472 per month.

Final expense insurance, also known as burial insurance, is a basic whole life policy that pays out enough to cover funeral expenses, outstanding medical or legal bills and other costs associated with settling your estate.