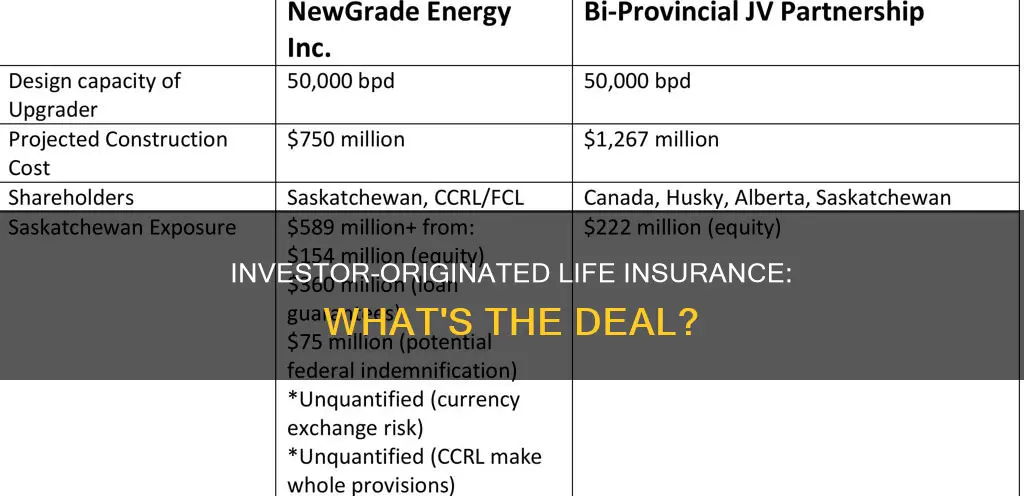

Investor-originated life insurance (IOLO), also known as IOLI, is a type of life insurance that is primarily aimed at generating long-term investment returns for the policyholder. It is not just another insurance policy; it's an investment strategy. IOLO is a low-risk investment strategy that is backed by established insurance companies. The main benefit is continuous growth and security for your investment, with personalised solutions and expert advice.

| Characteristics | Values |

|---|---|

| Type of insurance | Life insurance |

| Aim | Generating long-term investment returns for the policyholder |

| Who benefits | The policy owner (investor) |

| Who receives the death benefit | The investor |

| How it works | Investors buy whole or universal life policies from insurance companies |

| How it works | Investors leverage the policy's cash value to secure loans, which are used to fund other investment ventures |

| How it works | The growth of the initial investment often outpaces the loan interest, leading to increased returns over time |

| How it works | These investments are backed by established insurance companies, making them low-risk and easy to manage |

| Other names | IOLI, IOLO, Stranger-Owned Life Insurance (STOLI) |

What You'll Learn

IOLO is an investment strategy

Investor-originated life insurance (IOLO), also known as IOLI, is a distinctive type of life insurance that is primarily aimed at generating long-term investment returns for the policyholder. IOLO is not just another insurance policy; it’s an investment strategy.

Here's how it works: investors buy whole or universal life policies from insurance companies. They then leverage the policy’s cash value to secure loans, which are used to fund other investment ventures. Often, the growth of the initial investment outpaces the loan interest, leading to increased returns over time. These investments are backed by established insurance companies, making them low-risk and easy to manage.

The main benefit of IOLO is continuous growth and security for your investment. It also offers personalised solutions, with tailored policies to meet your financial goals.

If you are interested in IOLO, the first step is to consult a seasoned life insurance agent. They can clarify the nuances of IOLO and help you determine whether it aligns with your financial goals.

Transamerica's E-App for Life Insurance: A Digital Revolution

You may want to see also

IOLO is a distinctive type of life insurance

IOLO, also known as IOLI, is a distinctive type of life insurance. It is primarily aimed at generating long-term investment returns for the policyholder.

IOLO is not just another insurance policy; it’s an investment strategy. Investors buy whole or universal life policies from insurance companies. They then leverage the policy’s cash value to secure loans, which are used to fund other investment ventures. The growth of the initial investment often outpaces the loan interest, leading to increased returns over time. These investments are backed by established insurance companies, making them low-risk and easy to manage.

IOLO offers continuous growth and security for your investment, as well as tailored policies to meet your financial goals. It is a complex strategy, so it is recommended that you consult a seasoned life insurance agent to clarify the nuances of IOLO and help you determine whether it aligns with your financial goals.

Finding Unclaimed Life Insurance: A Free, Easy Guide

You may want to see also

IOLO is low-risk

Investor-Originated Life Insurance (IOLO), also known as IOLI, is a distinctive type of life insurance that is primarily aimed at generating long-term investment returns for the policyholder.

IOLO is not just another insurance policy; it's an investment strategy. It offers continuous growth and security for your investment, as well as tailored policies to meet your financial goals.

Upon the insured's death, the death benefit is paid directly to the investor, who can then utilise it as they see fit. This means that the investor benefits from the continuous growth and security of their investment, even after the insured's death.

If you are considering IOLO, it is important to consult a seasoned life insurance agent. They can help you to understand the nuances of IOLO and determine whether it aligns with your financial goals.

Life Status Changes: Cancelling Health Insurance

You may want to see also

IOLO is a long-term investment

IOLO, also known as IOLI, is a distinctive type of life insurance that is primarily aimed at generating long-term investment returns for the policyholder. It is not just another insurance policy; it's an investment strategy.

Investors buy whole or universal life policies from insurance companies. They then leverage the policy's cash value to secure loans, which are used to fund other investment ventures. The growth of the initial investment often outpaces the loan interest, leading to increased returns over time. These investments are backed by established insurance companies, making them low-risk and easy to manage.

Finding Life Insurance Buyers: Strategies for Agents

You may want to see also

IOLO is a personalised solution

IOLO, also known as IOLI, is a distinctive life insurance type that is primarily aimed at generating long-term investment returns for the policyholder. It is not just another insurance policy; it's an investment strategy.

Here's how it works: investors buy whole or universal life policies from insurance companies. They then leverage the policy's cash value to secure loans, which are used to fund other investment ventures. Often, the growth of the initial investment outpaces the loan interest, leading to increased returns over time.

Upon the insured's death, the death benefit is directly paid to the investor, who can then utilise it as deemed fit.

Life Insurance Sales: A Lucrative Career Choice?

You may want to see also

Frequently asked questions

Investor-originated life insurance (IOLO) is a type of life insurance aimed at generating long-term investment returns for the policyholder.

Investors buy whole or universal life policies from insurance companies. They then leverage the policy's cash value to secure loans, which are used to fund other investment ventures.

IOLO offers continuous growth and security for your investment, as well as personalised solutions and expert advice.

While the insured's beneficiaries remain unaffected, the real winner in an IOLO arrangement is the policy owner (investor). Upon the insured's death, the death benefit is paid directly to the investor.

Stranger-owned life insurance (STOLI) tries to bypass the insurable-interest requirement of purchasing life insurance. With IOLO, you need to prove that you have an insurable interest in the lives of those you buy life insurance for.