Joint whole life insurance is a type of life insurance that covers two people, usually a married couple or business partners. It provides coverage for the entire lifetime of the policyholders, with the added benefit of building cash value. The death benefit is paid after the first person dies or after both people die. Joint life insurance is more expensive than term joint life insurance but can be a good option for couples or partners who want to leave a financial legacy for their children or other loved ones.

What You'll Learn

Joint life insurance covers two people

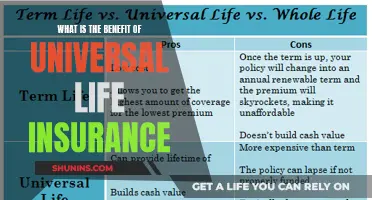

Joint life insurance provides coverage for the entire lifetime of the policyholders, with the added benefit of building cash value. It is more expensive than term joint life insurance, but long-term policies, such as whole life insurance, universal life insurance, and variable universal life insurance, can be a good option for couples or partners who want to leave a financial legacy for their children or other loved ones.

The death benefit is paid after the first person dies or after both people die. Joint life insurance can be a good option for couples who want to ensure their loved ones are provided for after their or their partner's death. It is also a good option for an older, less healthy spouse who may not be able to obtain coverage on their own.

Group life insurance costs are calculated based on the average health status and life expectancy of the group as a whole. If one person is significantly less healthy than the other, premium costs will be higher. Similarly, if there is a significant age disparity, or one person has a family history of a serious medical condition, policy costs will be higher.

Finding VCU Life Insurance: A Comprehensive Guide

You may want to see also

It is most commonly issued to married couples

Joint whole life insurance is a type of life insurance that covers two people, usually a married couple. It provides coverage for the entire lifetime of the policyholders, with the added benefit of building cash value. The death benefit is paid after the first person dies or after both people die. Joint life insurance is a good option for couples who want to leave a financial legacy for their children or other loved ones.

Joint life insurance is a relatively rare type of policy, but it can be a good option for couples who want to ensure that their loved ones will be provided for after their death. It is also a more affordable option than two separate permanent policies. The cost of joint life insurance is calculated based on the average health status and life expectancy of the group as a whole. If one person is significantly less healthy than the other, premium costs will be higher. Similarly, if there is a significant age disparity or one person has a family history of a serious medical condition, policy costs will be higher.

When considering joint whole life insurance, it is important to take the time to thoroughly research the options available, taking into account financial objectives, coverage needs, family, any health issues, and personal preferences.

Life Insurance with Atrial Fibrillation: What You Need to Know

You may want to see also

It is also issued to business partners

Joint whole life insurance is a type of life insurance that covers two people, usually business partners or married couples. It provides coverage for the entire lifetime of the policyholders, with the added benefit of building cash value. While it is more expensive than term joint life insurance, it can be a good option for couples or partners who want to leave a financial legacy for their children or other loved ones.

Joint life insurance is a relatively rare type of life insurance policy. It is issued as a permanent life insurance policy, though some carriers offer term policies. In some cases, obtaining a joint policy can help an older, less healthy spouse obtain coverage they couldn’t qualify for on their own.

Joint life insurance is also issued to business partners. This type of insurance can be beneficial for business partners who want to ensure that their business is protected in the event of one partner's death. It can also help provide financial stability for the surviving partner and the business.

The cost of joint life insurance for business partners will depend on various factors, including the health status and life expectancy of the partners. If one partner is significantly less healthy than the other, the premium costs will be higher. Similarly, if there is a significant age disparity or a family history of serious medical conditions, the policy costs will be higher.

Overall, joint whole life insurance can be a valuable option for business partners who want to protect their business and provide financial security for their loved ones in the event of their death. It offers a lifetime of protection while building tax-deferred cash value.

Life Insurance: Me Bank's Guide to Peace of Mind

You may want to see also

It is a permanent life insurance policy

Joint whole life insurance is a permanent life insurance policy that covers two people. It is a type of group insurance policy issued for the smallest possible group of people – two individuals. It provides coverage for the entire lifetime of the policyholders, with the added benefit of building cash value.

Joint life insurance is most commonly issued to business partners or married couples. It is available to eligible individuals aged 18 to 85. While it is more expensive than term joint life insurance, long-term policies can be a good option for couples or partners who want to leave a financial legacy for their children or other loved ones.

The death benefit is paid after the first person dies or after both people die. Joint life insurance can be a good option for couples who want to make sure their loved ones will be provided for after their death or the death of their partner. It can also help an older, less healthy spouse obtain coverage they couldn't qualify for on their own.

Group life insurance costs are calculated based on the average health status and life expectancy of the group as a whole. If one person is significantly less healthy than the other, premium costs will be higher. Similarly, if there is a significant age disparity, or one person has a family history of a serious medical condition, policy costs will be higher.

Life Insurance Payouts: Are There Limits to Benefits?

You may want to see also

It is more expensive than term joint life insurance

Joint life insurance is a type of insurance that covers two people, usually business partners or married couples. It is a permanent life insurance policy that provides coverage for the entire lifetime of the policyholders, with the added benefit of building cash value. While it is more expensive than term joint life insurance, it can be a good option for couples or partners who want to leave a financial legacy for their children or other loved ones. The policy offers coverage for two individuals, often at a lower cost than two separate permanent policies, and an income-tax-free death benefit is paid to beneficiaries upon the death of the first insured.

The cost of joint life insurance is influenced by the health status and life expectancy of the group as a whole. If one person is significantly less healthy than the other, premium costs will be higher. Similarly, if there is a significant age disparity or one person has a family history of a serious medical condition, policy costs will increase.

When considering joint life insurance, it is important to thoroughly research all available options and take into account financial objectives, coverage needs, family dynamics, health issues, and personal preferences.

Check Your Texas Life Insurance License Status

You may want to see also

Frequently asked questions

Joint whole life insurance is a type of life insurance that covers two people, usually a couple or business partners, for their entire lifetime.

Joint whole life insurance offers the benefit of building cash value over time, which can be a good option for couples or partners who want to leave a financial legacy for their loved ones. It also provides an income-tax-free death benefit to beneficiaries upon the death of the first insured.

The cost of joint life insurance is calculated based on the average health status and life expectancy of the group as a whole. If one person is significantly less healthy than the other, has a family history of serious medical conditions, or is a smoker, the policy costs will be higher.

Joint life insurance is available to eligible individuals ages 18 to 85.

Joint life insurance covers two people instead of one, and it is a relatively rare type of policy. Most life insurance policies are purchased by individuals for themselves, but joint policies can be beneficial for couples or business partners who want to ensure coverage for both parties.