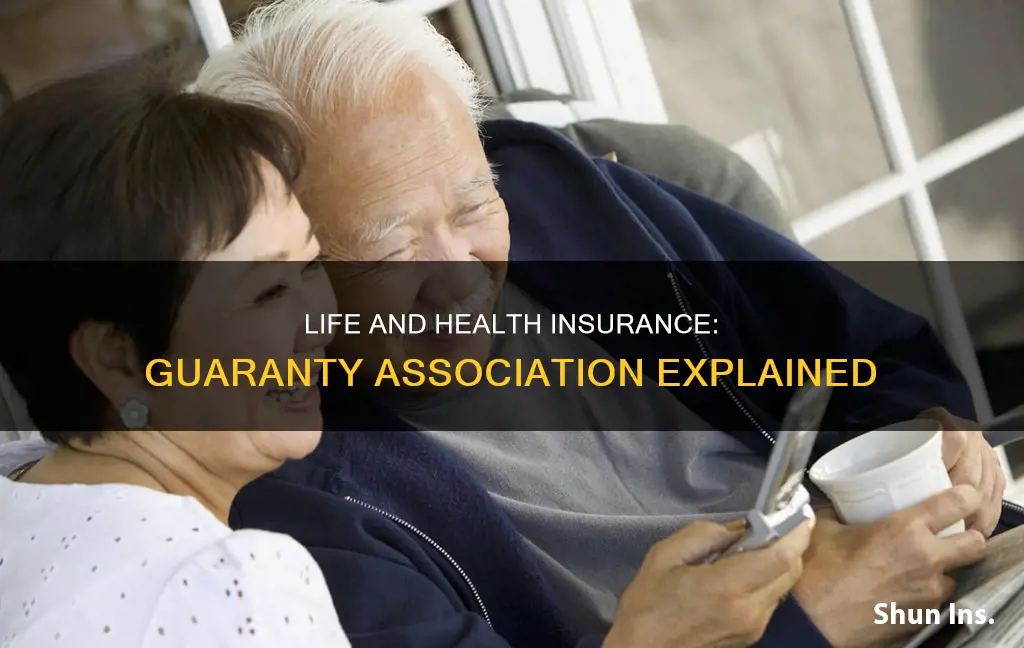

Guaranty associations are generally governed by a board of directors and the state's insurance regulator. All state guaranty associations are members of the National Organization of Life and Health Insurance Guaranty Associations (NOLHGA). In the case of an insolvent life insurer with policyholders in multiple states, the activities of the various guaranty associations are coordinated by NOLHGA. Insurance companies are required by law to be members of the guaranty association in states in which they are licensed to do business. Most states have two types of guaranty associations: a life and health guaranty association and a property and casualty insurance guaranty association. The amount of coverage provided by the guaranty association is set by state statute and differs from state to state.

| Characteristics | Values |

|---|---|

| What is it? | A guaranty association is generally governed by a board of directors and the state’s insurance regulator. |

| Who is it for? | Individual and group life insurance policies as well as annuities, long-term care and disability income insurance policies are covered by life and health guaranty associations. |

| Who is a member? | Insurance companies are required by law to be members of the guaranty association in states in which they are licensed to do business. All state guaranty associations are members of the National Organization of Life and Health Insurance Guaranty Associations (NOLHGA). |

| How much coverage is provided? | The amount of coverage provided by the guaranty association is set by state statute and differs from state to state. Most states provide the following amounts of coverage (or more): $250,000 in present value of annuity benefits, including cash surrender and withdrawal values. In most states, there is an overall cap of $300,000 in total benefits for any one individual with one or multiple policies with the insolvent insurer. |

| Who pays? | If an insurance company has insufficient assets to pay policyholder claims, a guaranty association will obtain funds by assessing member insurers that write the same kind of business as the insolvent insurer. |

What You'll Learn

The National Organization of Life and Health Insurance Guaranty Associations (NOLHGA)

The NOLHGA provides resources and technical expertise to the state guaranty associations, as well as a national forum for discussion of state guaranty association issues. It also coordinates the activities of the various guaranty associations in the case of an insolvent life insurer that has policyholders in multiple states.

Most states have two types of guaranty associations: a life and health guaranty association and a property and casualty insurance guaranty association. Life and health guaranty associations cover individual and group life insurance policies, annuities, long-term care, and disability income insurance policies. The amount of coverage provided by guaranty associations differs from state to state and is set by state statute. For example, most states provide $250,000 in present value of annuity benefits and there is an overall cap of $300,000 in total benefits for any one individual with one or multiple policies with an insolvent insurer.

In the case of an insurance company being unable to pay policyholder claims, a guaranty association will obtain funds by assessing member insurers that write the same kind of business as the insolvent insurer. The Illinois Life & Health Insurance Guaranty Association, for example, has been responsible for the payment of all claims since March 1, 2017.

Life Insurance: A Benefit to Attract and Retain Employees

You may want to see also

Individual and group life insurance policies

Guaranty associations are generally governed by a board of directors and the state's insurance regulator. All state guaranty associations are members of the National Organization of Life and Health Insurance Guaranty Associations (NOLHGA).

For example, the Illinois Life and Health Insurance Guaranty Association has been responsible for the payment of all claims since March 1, 2017.

In the case of an insolvent life insurer that has policyholders in multiple states, the activities of the various guaranty associations are coordinated by NOLHGA. NOLHGA provides resources and technical expertise to the state guaranty associations, as well as a national forum for discussion of state guaranty association issues.

Primerica Life Insurance: Canceling Your Policy, Simplified

You may want to see also

Annuities, long-term care and disability income insurance policies

Guaranty associations are generally governed by a board of directors and the state's insurance regulator. All state guaranty associations are members of the National Organization of Life and Health Insurance Guaranty Associations (NOLHGA). In the case of an insolvent life insurer that has policyholders in multiple states, the activities of the various guaranty associations are coordinated by NOLHGA.

The guaranty association responsible for an individual's claim is generally determined by the state in which the individual lives at the time the insurance company is unable to pay. In certain circumstances, other factors, such as where the insurance company is licensed to do business, determine which guaranty association may be responsible. For example, the Illinois Life and Health Insurance Guaranty Association has been responsible for payment of all claims since March 1, 2017.

Independent Agents: NY Life Insurance's Secret Weapon?

You may want to see also

State guaranty associations

NOLHGA provides resources and technical expertise to the state guaranty associations, as well as a national forum for discussion of state guaranty association issues. Most states have two types of guaranty associations: a life and health guaranty association and a property and casualty insurance guaranty association.

Individual and group life insurance policies, as well as annuities, long-term care, and disability income insurance policies are covered by life and health guaranty associations. The amount of coverage provided by the guaranty association is set by state statute and differs from state to state. Most states provide the following amounts of coverage (or more): $250,000 in present value of annuity benefits, including cash surrender and withdrawal values. In most states, there is an overall cap of $300,000 in total benefits for any one individual with one or multiple policies with the insolvent insurer.

In the case of an insurance company being unable to pay, the guaranty association responsible is generally determined by the individual's place of residence at that time. In certain circumstances, other factors, such as where the insurance company is licensed to do business, determine which guaranty association may be responsible. For example, the Illinois Life and Health Insurance Guaranty Association has been responsible for the payment of all claims since March 1, 2017.

Verify a Life Insurance Agent's License: Quick Guide

You may want to see also

Illinois Life and Health Insurance Guaranty Association

The Illinois Life and Health Insurance Guaranty Association has been responsible for the payment of all claims since March 1, 2017.

A guaranty association is generally governed by a board of directors and the state's insurance regulator. All state guaranty associations are members of the National Organization of Life and Health Insurance Guaranty Associations (NOLHGA). In the case of an insolvent life insurer that has policyholders in multiple states, the activities of the various guaranty associations are coordinated by NOLHGA.

Most states have two types of guaranty associations: a life and health guaranty association and a property and casualty insurance guaranty association. Individual and group life insurance policies, as well as annuities, long-term care and disability income insurance policies, are covered by life and health guaranty associations.

The amount of coverage provided by the guaranty association is set by state statute and differs from state to state. Most states provide the following amounts of coverage (or more), which are specified in the National Association of Insurance Commissioners' (NAIC) Life and Health Insurance Guaranty Association Model Law: $250,000 in present value of annuity benefits, including cash surrender and withdrawal values. In most states, there is an overall cap of $300,000 in total benefits for any one individual with one or multiple policies with the insolvent insurer.

Life Insurance and Experimental Vaccines: What's Covered?

You may want to see also

Frequently asked questions

The NOLHGA is a national organisation that coordinates the activities of various guaranty associations. It provides resources and technical expertise to state guaranty associations, as well as a national forum for discussion.

A guaranty association is responsible for paying policyholder claims if an insurance company has insufficient assets. The amount of coverage provided differs from state to state.

Individual and group life insurance policies, annuities, long-term care and disability income insurance policies are covered by life and health guaranty associations.

A guaranty association is generally governed by a board of directors and the state's insurance regulator.