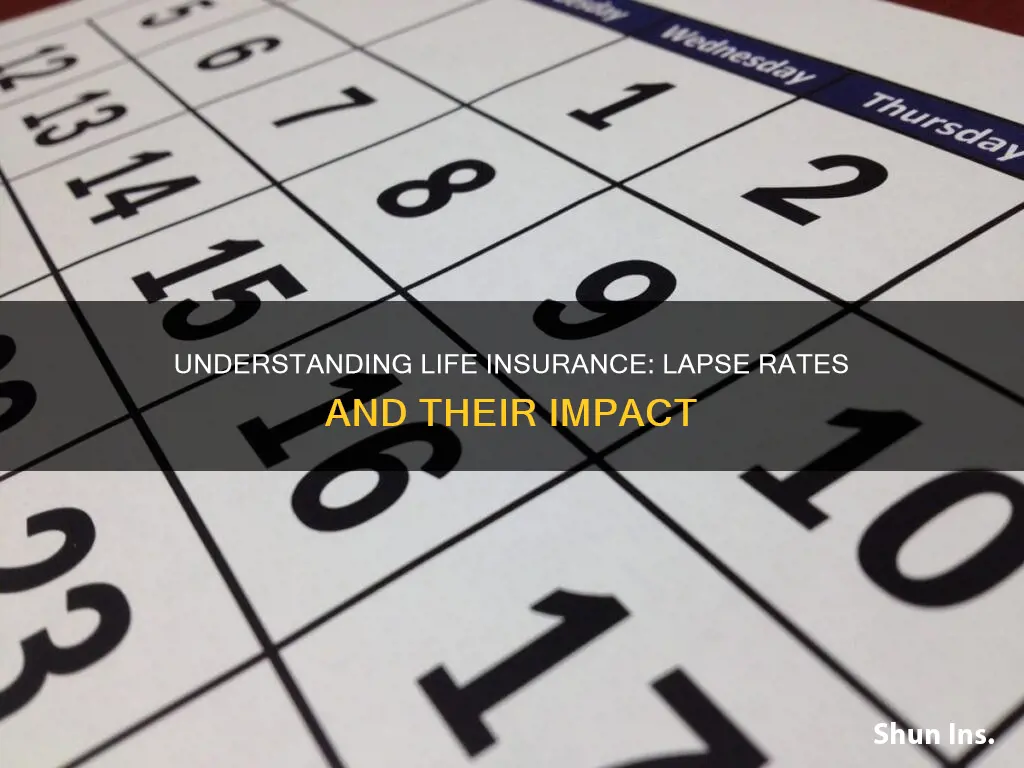

Life insurance lapse rates refer to the number of policies that are allowed to lapse before a death benefit is paid out. In other words, the coverage runs out and is not available if the policyholder dies. According to some studies, as many as 80% of policies will lapse before a payout is due. This can be due to a number of reasons, including the policyholder forgetting to pay their premium within the grace period. The insurance company wins when no death benefit is paid out, so lapse-based pricing is a common practice in the industry.

| Characteristics | Values |

|---|---|

| Definition | When the coverage runs out and is not available if the policyholder dies |

| Total lapse rate for term insurance between 2004 and 2005 | 6.6% |

| Estimated number of policies that lapse before paying a claim | 9 out of 10 |

What You'll Learn

The dangers of letting your life insurance lapse

Life insurance policies tend to lapse, meaning the coverage runs out and is not available if you die. According to the nonprofit Insurance Information Institute, term life insurance is the simplest and cheapest life insurance product available. It only pays out if death occurs during the term of the policy, which is usually one to 30 years. In 2008, about half of all U.S. life insurance policies were term life. A study by the Society of Actuaries found that the total lapse rate for term insurance between 2004 and 2005 was 6.6 per cent. However, many people don't realise that all term life policies lapse unless a death benefit is paid.

Some studies claim that as many as 80 per cent of policies will lapse before a payout is due. This is because life insurance policies have a 30-day grace period for paying your premium. If you forget to pay your premium within that time, your policy will be cancelled. This can be disastrous for an older person who has health problems that they didn't have when they initially bought the policy.

Lapse-based pricing means that the insurance company wins when no death benefit is paid. Therefore, those whose policies lapse get a raw deal from the insurance company, while the insurance company gets a great deal from those policies that lapse.

Life Insurance Payouts Without Beneficiaries: Who Gets the Money?

You may want to see also

Term life insurance

Lapse rates are beneficial to insurance companies. If a policy lapses, the insurance company does not have to pay out a death benefit. Therefore, those that keep a policy in force until death get a great deal from the insurance company.

Typically, life insurance policies have a 30-day grace period for paying your premium. If you forget to pay your premium within that time, your policy will be canceled. This can be disastrous for an older person who has health problems that they didn't have when they initially bought the policy.

Child Life Insurance: What Parents Need to Know

You may want to see also

Whole life insurance

One of the key features of whole life insurance is that it builds cash value over time. This means that a portion of the premiums paid by the policyholder is invested by the insurance company, and the policyholder can access this cash value while they are still alive. The cash value can be used for various purposes, such as paying for unexpected expenses, supplementing retirement income, or even borrowing against it to purchase a home.

However, it's important to note that whole life insurance policies can also lapse. A lapse occurs when the policyholder stops paying their premiums, and the coverage is no longer in force. This can happen for various reasons, such as financial difficulties or simply forgetting to pay the premiums. If a policy lapses, the insurance company may not pay the death benefit, and the policyholder may lose any cash value that has accumulated in the policy.

To avoid a lapse, it's important for policyholders to stay up to date with their premium payments. Most life insurance policies have a grace period, typically 30 days, during which the policyholder can pay their premium without losing coverage. However, if the premium is not paid within this grace period, the policy will be cancelled, and the coverage will no longer be available.

Chubb Life Insurance: Quality Coverage, Peace of Mind

You may want to see also

Lapse-based pricing

Life insurance is ruled by lapse-based pricing. This means that the insured person wins when a death benefit is paid out, and the insurance company wins when no death benefit is paid. Therefore, those that keep a policy in force until death get a great deal from the insurance company, while the insurance company gets a great deal from those policies that lapse.

The total lapse rate for term insurance between 2004 and 2005 was 6.6 per cent, according to a study by the Society of Actuaries. However, other studies claim that as many as 80 per cent of policies will lapse before a payout is due. This is because many people fail to realise that all term life policies lapse unless a death benefit is paid.

The reasons behind this phenomenon are complicated and avoidable. For example, life insurance policies typically have a 30-day grace period for paying your premium. If you forget to pay your premium within that time, your policy will be cancelled.

Life Insurance: When to Include Your Corporation as a Beneficiary

You may want to see also

Grace periods for paying your premium

Life insurance policies have a grace period for paying your premium. This is typically 30 days, and if you forget to pay your premium within that time, your policy will be cancelled. This can be disastrous for an older person who has health problems that they didn't have when they initially bought the policy.

The grace period is a crucial feature of life insurance policies, as it allows policyholders a second chance to make their premium payments and maintain their coverage. However, it's important to note that the grace period is not a free pass to skip payments. If you don't pay your premium within the grace period, your policy will lapse, and you will lose your coverage.

The lapse rate of a life insurance policy refers to the percentage of policies that lapse before a payout is due. In other words, it's the rate at which policies are cancelled due to non-payment of premiums. According to some studies, as many as 80% of policies will lapse before a payout is made. This means that a significant number of policyholders are at risk of losing their coverage if they don't keep up with their premium payments.

The grace period for paying your premium is a critical component of the life insurance policy. It provides policyholders with a window of opportunity to make their premium payments without penalty. However, it's important to be mindful of the deadline, as missing the grace period can result in the cancellation of your policy. By understanding the grace period and staying on top of premium payments, policyholders can ensure that their coverage remains intact and they don't become part of the lapse rate statistics.

Explore Old Military Life Insurance: Get Paid?

You may want to see also

Frequently asked questions

A life insurance lapse rate is the rate at which life insurance policies lapse, or run out, before a payout is due.

It is very common for life insurance policies to lapse. Some studies claim that as many as 80% of policies will lapse before a payout is due. A study by the Society of Actuaries found that the total lapse rate for term insurance between 2004 and 2005 was 6.6%.

If your life insurance policy lapses, your coverage will run out and will not be available if you die.

Life insurance policies typically have a 30-day grace period for paying your premium. If you forget to pay your premium within that time, your policy will be cancelled, and your coverage will lapse.