State Farm is one of the largest insurance companies in the country, offering a wide range of coverage options, including auto, home, renters, and life insurance. It has a strong reputation in the industry and is known for its reliability, with high ratings in multiple J.D. Power consumer satisfaction studies. State Farm has also received high financial strength ratings from A.M. Best and S&P Global Ratings, indicating its ability to pay claims.

State Farm offers standard auto insurance coverage, including liability, collision, comprehensive, medical payments, and uninsured/underinsured motorist coverage. It also provides add-ons such as roadside assistance and discount programs like Drive Safe & Save™. While State Farm's costs are generally average, it offers various discount options, such as multi-policy, multi-car, good student, and safe driving discounts.

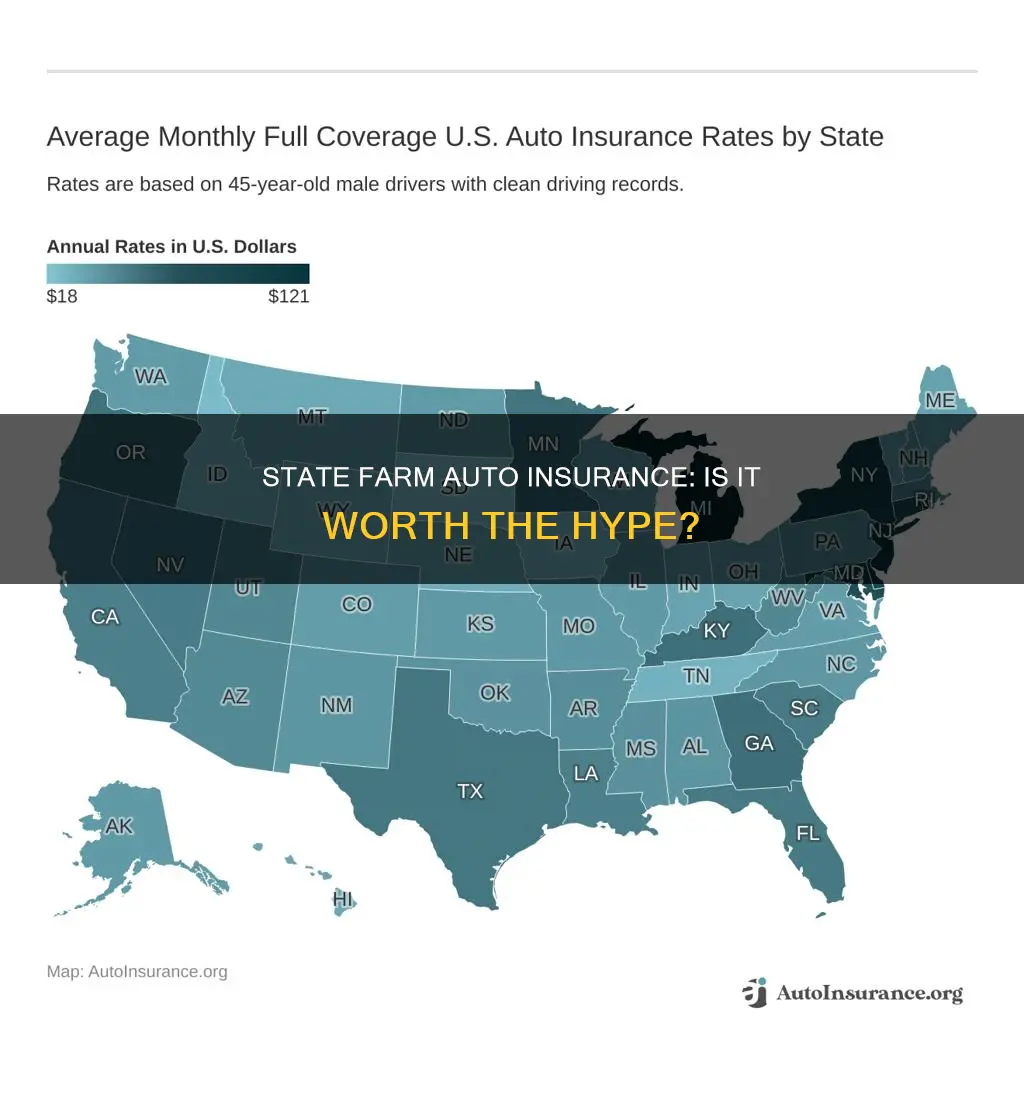

State Farm is available in all 50 states and Washington, D.C., and has a vast network of local agents to assist customers. Overall, State Farm is a good choice for auto insurance, providing reliable coverage, a user-friendly digital experience, and competitive rates for certain driver profiles.

| Characteristics | Values |

|---|---|

| Industry standing | State Farm has a great reputation in the insurance industry and is known for its reliability. |

| Availability | State Farm is available in all 50 states and Washington, D.C., but not all coverage features are available in all locations. |

| Cost and discounts | State Farm's costs are average, with some competitors offering more affordable coverage. |

| Customer experience | State Farm has a strong representation of local insurance agents throughout the U.S., adding the advantage of personalized service for those who value it. |

| BBB rating | C- |

| NAIC complaint index | 1.09 |

| Trustpilot rating | 2.2 out of 5 |

| BBB customer rating | 1.2 out of 5 |

| J.D. Power rating | State Farm has high ratings across multiple J.D. Power studies. |

| AM Best rating | B |

| S&P Global Rating | A |

What You'll Learn

State Farm's customer service

State Farm has a large network of local agents to assist with policy management. Its online portal and mobile app are also intuitive and easy to use. State Farm's customer service has received high ratings across multiple J.D. Power studies. The company's customer service number is 1-800-440-0998.

However, some customers have complained about State Farm's customer service. One customer said that they were treated "like a criminal rather than a valued customer". Another said that State Farm was "refusing to pay for original parts" for their car.

Report Auto Accidents: Claiming on Another's Insurance

You may want to see also

State Farm's insurance coverage

State Farm is one of the largest insurance companies in the United States, offering a wide range of coverage options, including auto, home, renters, and life insurance. The company has a strong network of over 19,000 local agents across the country, providing personalised service to its customers. State Farm's auto insurance coverage includes standard options such as liability insurance, collision insurance, comprehensive insurance, medical payments coverage, and uninsured/underinsured motorist coverage. They also offer add-ons like roadside assistance, rental car reimbursement, and travel expense coverage.

State Farm's home insurance covers the physical structure of your home, other structures on your property, personal property, loss of use/additional living expenses, personal liability, and medical payments. They also offer add-ons like personal liability umbrella policies, flood insurance, and earthquake insurance.

State Farm's renters insurance provides coverage for personal property, loss of use, and personal liability. They also offer add-ons for identity restoration, additional business property coverage, and incidental business liability.

State Farm life insurance offers term life insurance, whole life insurance, and universal life insurance, providing death protection, guaranteed death benefits, and tax-deferred cash value accumulation.

State Farm also provides health insurance, disability coverage, farm and ranch insurance, Medicare supplement, motorcycle insurance, and supplemental health insurance.

Removing Yourself from Your Parents' USAA Auto Insurance

You may want to see also

State Farm's insurance rates

State Farm is one of the largest auto insurance companies in the United States, serving a wide range of drivers. It offers a variety of coverage options, including standard auto insurance, home insurance, renters insurance, life insurance, and health insurance. State Farm's rates tend to be around the national average, but they can vary greatly depending on the driver's profile, with some groups finding cheaper rates elsewhere.

State Farm's average rate is $2,025 per year, which is close to the national average. However, its rates can be significantly higher or lower depending on factors such as age, driving record, and credit score. Here's a breakdown of State Farm's insurance rates for different driver profiles:

- Good drivers: State Farm's rates for good drivers without tickets, accidents, or DUIs are slightly higher than the national average.

- Drivers with a speeding ticket: State Farm offers competitive rates for drivers with a speeding ticket, with an average rate that is 10% lower than the national average.

- Drivers who caused an accident with injury: State Farm's rates for this group are about $600 per year below the national average.

- Drivers with a DUI: State Farm has relatively cheap rates for drivers with a DUI, which are about $650 per year lower than the national average.

- Drivers with poor credit: State Farm has the highest average rates for drivers with poor credit among the companies analyzed. Their rates are over $4,000 per year above the national average.

- Senior drivers: State Farm's rates for senior drivers are slightly higher than the national average.

- Parents adding a teen driver: State Farm is the third most expensive company for parents adding a 16-year-old driver to their policy.

State Farm also offers various discounts that can lower your insurance rates. These include multi-policy discounts, good student discounts, defensive driving course discounts, and safe driving discounts through their Drive Safe & Save program.

Auto Insurance Discounts: Farmers' Best Offers and Deals

You may want to see also

State Farm's insurance discounts

State Farm offers a wide range of insurance discounts, which can be divided into three main groups: safe driver discounts, vehicle safety discounts, and customer loyalty discounts.

Safe Driver Discounts

State Farm offers discounts to customers who maintain accident-free driving records or who educate themselves on how to become better drivers.

- Accident-Free Discount: Customers with an auto insurance policy for at least three consecutive years without a chargeable accident could qualify for a discount of up to 25%.

- Defensive Driving Course Discount: Completing a driver safety course could result in a discount, depending on the state and course.

- Student Away at School Discount: Students under 25 who are listed on a State Farm auto insurance policy and only use a covered vehicle while visiting home may be eligible for a discount.

- Good Driving Discount: New customers without an at-fault accident or traffic ticket in the past three years can get this discount.

- Driver Training Discount: Customers under 21 who complete a driver education course approved by State Farm may qualify for a discount.

- Good Student Discount: Students listed on a policy who achieve good grades (3.0+ GPA, top 20% of the class, or qualifying test scores) can save up to 25% until they turn 25.

- Drive Safe & Save Discount: Customers can save up to 30% by participating in the Drive Safe & Save program, which calculates discounts based on driving behaviour.

- Steer Clear Discount: Drivers under 25 with no at-fault accidents or traffic tickets in the past three years can save up to 15%.

Vehicle Safety Discounts

State Farm offers discounts for vehicles with modern safety features, including newer models and older cars equipped with safety technology.

- Vehicle Safety Discount: Customers with vehicles made in 1994 or later may save up to 40% on medical-related coverage, depending on the repair record of their vehicle's make and model.

- Passive Restraint Discount: Customers with older vehicles (older than a 1993 model) equipped with a factory-installed airbag or other passive restraint system can get a discount of up to 40% on medical-related coverage.

- Anti-Theft Discount: Vehicles with alarms or other anti-theft devices approved by State Farm may be eligible for a discount.

Customer Loyalty Discounts

State Farm provides discounts for customers with multiple policies or vehicles insured with the company.

- Multiple Auto Discount: Customers with two or more vehicles insured by State Farm can save up to 20% on their policy. The vehicles must be owned by related or married individuals.

- Multiple Line Discount: Customers with State Farm auto insurance and a homeowners, renters, condo, or life insurance policy can save up to 17%.

Understanding Auto Insurance Requirements in Texas

You may want to see also

State Farm's insurance claims

State Farm is a well-known insurance company that offers a range of insurance products, including auto insurance. The company has received positive reviews and ratings for its auto insurance, including a #4 ranking in the Best Car Insurance Companies category by US News. State Farm is also known for its customer service and claims handling, with high marks from policyholders surveyed.

When it comes to State Farm insurance claims, the company offers a straightforward process for its customers. Here are the steps involved in filing a claim with State Farm:

- Notify State Farm: Contact your State Farm agent or file a claim through the company's website or mobile app. You can also call their customer service number at 1-800-440-0998.

- Provide Information: State Farm will ask you to provide details about the incident, such as when and where it occurred, the extent of the damage, and any relevant information from other parties involved or witnesses. Take photos or videos of the incident if possible.

- Claim Review: State Farm will review your claim and policy to determine the next steps. They may send an adjuster to assess the damage or request additional information from you.

- Estimate and Repairs: State Farm will provide an estimate for the repairs or replacement needed. They have Select Service shops that offer a guaranteed completion date and a limited lifetime warranty. You can also choose your preferred repair shop.

- Payment Arrangement: State Farm will arrange the payment for the covered losses, minus any deductible that may apply. They may also offer rental car coverage if your policy includes it.

State Farm also offers a mobile app that allows customers to access claim information, upload documents, communicate with their Claims team, and receive electronic notifications. The app provides convenience and ease of access to customers throughout the claims process.

State Farm's financial strength and ability to pay claims have been recognized by organizations such as A.M. Best and S&P Global Ratings. The company has a long history of paying claims promptly and reliably, giving customers peace of mind that they are backed by a financially stable insurer.

Commercial Auto Insurance: Protecting Your Business on the Road

You may want to see also

Frequently asked questions

The average cost of State Farm auto insurance is $2,025 a year, based on a 2024 Forbes Advisor analysis. However, according to a 2024 MarketWatch analysis, the average cost is $2,544 per year for full-coverage insurance.

State Farm has a good rating for customer service. In a 2024 U.S. News review, 55% of surveyed customers said they were "completely satisfied" with State Farm's customer service.

State Farm has a good rating for claims handling. In a 2024 U.S. News review, 55% of surveyed customers said they were "completely satisfied" with the resolution of their claim.

State Farm has a good rating for customer loyalty. In a 2024 U.S. News review, 54% of surveyed customers said they were "very likely" to renew with State Farm, while 29% said they were "likely" to continue.