Target life insurance is a financial product designed to provide financial security and peace of mind to individuals and their loved ones. It is a type of life insurance policy that offers coverage for a specific period, often aligned with a particular goal or target, such as paying off a mortgage, funding a child's education, or covering business expenses. This insurance policy ensures that a predetermined amount is paid out upon the insured's death during the policy term, providing financial protection and support to beneficiaries. By setting clear targets and goals, target life insurance helps individuals and families manage risks and plan for the future, ensuring that their financial objectives are met even in the face of unforeseen circumstances.

What You'll Learn

- Definition: Target life insurance is a financial product designed to meet specific financial goals

- Benefits: It provides coverage tailored to individual needs, offering financial security

- Policy Types: Term, whole life, and universal life are common policy types

- Cost: Premiums are calculated based on age, health, and desired coverage amount

- Claims Process: Claims are typically processed efficiently, ensuring financial support for beneficiaries

Definition: Target life insurance is a financial product designed to meet specific financial goals

Target life insurance is a specialized financial tool that plays a crucial role in achieving defined financial objectives. It is a structured approach to life insurance, where the policy is tailored to fulfill particular goals, often related to financial security and planning. This type of insurance is designed to address specific needs, such as providing financial support to a family, funding a child's education, or ensuring the financial stability of a business. By customizing the policy to these goals, target life insurance offers a more precise and effective way to manage financial risks and uncertainties.

The primary objective of target life insurance is to provide a clear and defined outcome, ensuring that the financial goals are met. This is achieved through a carefully constructed policy that aligns with the specific requirements of the individual or entity seeking coverage. For instance, a parent might choose target life insurance to secure their child's future education, ensuring that a lump sum or regular payments are available for this purpose. Similarly, a business owner could utilize this insurance to protect their enterprise, guaranteeing financial support for key employees or specific business ventures.

In the context of personal finance, target life insurance can be a powerful tool for families. It allows parents to plan for their children's future, ensuring that funds are available for education, marriage, or other significant life events. This type of insurance provides a sense of security, knowing that specific financial milestones will be achieved, even in the event of the policyholder's untimely demise. For businesses, target life insurance can be a strategic asset, safeguarding against potential losses and ensuring the continuity of operations.

The key advantage of target life insurance lies in its customization. Policies can be tailored to various financial objectives, making it a versatile tool for different situations. Whether it's providing for a family's long-term financial needs, funding a business venture, or ensuring personal financial security, this insurance offers a targeted approach to risk management. By working closely with insurance professionals, individuals and businesses can design policies that align perfectly with their unique goals.

In summary, target life insurance is a financial strategy that empowers individuals and businesses to achieve specific goals through a carefully designed insurance policy. It provides a structured and customized solution, ensuring that financial risks are managed effectively while meeting defined objectives. With its ability to cater to diverse needs, target life insurance offers a powerful means of financial planning and security.

Understanding Standard Risk: Life Insurance Basics Explained

You may want to see also

Benefits: It provides coverage tailored to individual needs, offering financial security

Target life insurance is a type of life insurance that is designed to meet specific financial goals and provide tailored coverage to individuals. It is a flexible and customizable policy that allows policyholders to define their unique needs and objectives. This type of insurance offers a personalized approach to financial security, ensuring that individuals can protect their loved ones and achieve their long-term financial aspirations.

One of the key benefits of target life insurance is its ability to provide coverage that is specifically tailored to an individual's circumstances. Unlike standard life insurance policies, which may offer a one-size-fits-all approach, target insurance allows policyholders to customize the policy to match their personal requirements. This customization includes adjusting the coverage amount, choosing the appropriate term length, and selecting the desired death benefit. By doing so, individuals can ensure that the policy aligns perfectly with their financial objectives, whether it's providing for a family's long-term needs, funding a child's education, or securing a comfortable retirement.

Financial security is a primary advantage of this insurance. It offers a safety net for individuals and their families during challenging times. In the event of the insured's passing, the death benefit is paid out to the designated beneficiaries, providing them with a financial cushion. This coverage can help cover essential expenses, such as mortgage payments, outstanding debts, or daily living costs, ensuring that the family's financial stability is maintained even in the absence of the primary income earner. The peace of mind that comes with knowing one's loved ones are protected is invaluable.

Furthermore, target life insurance provides flexibility, allowing policyholders to adapt the policy as their life circumstances change. As individuals progress through different life stages, their financial needs may evolve. This insurance policy can be adjusted to accommodate these changes, ensuring that the coverage remains relevant and effective over time. For example, a policyholder may opt for a higher coverage amount during their peak earning years and then reduce it as they approach retirement, thus optimizing the financial benefits.

In summary, target life insurance offers a unique and personalized approach to financial security. By tailoring the coverage to individual needs, it provides a sense of control and peace of mind. This type of insurance is an essential tool for anyone seeking to protect their loved ones and secure their financial future, allowing them to focus on what matters most without worrying about unforeseen circumstances.

Child Rider: A Life Insurance Add-on for Parents

You may want to see also

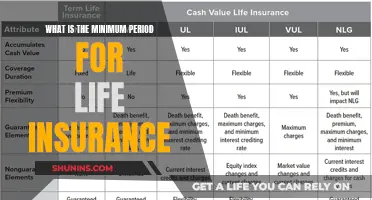

Policy Types: Term, whole life, and universal life are common policy types

When it comes to life insurance, understanding the different policy types is crucial to making an informed decision. Here's an overview of three common policy types: Term, Whole Life, and Universal Life.

Term Life Insurance: This is a straightforward and affordable type of life insurance that provides coverage for a specified period, typically 10, 20, or 30 years. It offers a death benefit if the insured individual passes away during the term. Term life insurance is ideal for those seeking temporary coverage, often used to protect against financial burdens like mortgage payments or children's education. One of its key advantages is its simplicity; it has no cash value accumulation, making it a pure insurance product. This type of policy is generally less expensive than permanent life insurance options, making it a popular choice for those on a budget.

Whole Life Insurance: In contrast to term life, whole life insurance provides permanent coverage for the entire lifetime of the insured individual. It offers a death benefit and also includes a cash value component that grows over time. The cash value can be borrowed against or withdrawn, providing financial flexibility. Whole life insurance is a long-term commitment, and premiums are typically higher than term life. However, it offers guaranteed coverage and a fixed premium, providing peace of mind for the policyholder and their beneficiaries. This policy type is well-suited for those seeking long-term financial security and a consistent premium payment structure.

Universal Life Insurance: This policy offers permanent coverage with a flexible premium and death benefit. Universal life insurance provides a death benefit and a cash value account, similar to whole life. However, the policyholder has more control over the death benefit and premium payments. They can adjust the death benefit and make additional payments to the cash value account, allowing for potential investment growth. Universal life insurance is suitable for those who want the flexibility to customize their policy and potentially build a substantial cash value over time. It is a more complex product compared to term and whole life, requiring careful consideration of the policyholder's financial goals and risk tolerance.

Each of these policy types has its unique features and benefits, catering to different financial needs and preferences. Understanding the differences between term, whole life, and universal life insurance is essential for individuals to choose the right coverage for their specific circumstances.

Finding Lost Life Insurance: A Comprehensive Guide to Uncover Policies

You may want to see also

Cost: Premiums are calculated based on age, health, and desired coverage amount

When considering life insurance, understanding the factors that influence its cost is crucial. One of the primary determinants of the premium you pay for life insurance is your age. Younger individuals typically pay lower premiums because they have a longer life expectancy, reducing the insurance company's risk. As you age, the premiums tend to increase due to the higher likelihood of health issues and potential mortality. This is a standard practice in the insurance industry, ensuring that the coverage remains financially viable for both the insurer and the policyholder.

Health plays a significant role in calculating life insurance premiums. Insurance companies assess your overall health, including any pre-existing medical conditions, to determine the risk associated with providing coverage. A person with a history of chronic illnesses or those who smoke or have unhealthy lifestyles may be considered higher-risk, resulting in higher premiums. Conversely, individuals with a healthy lifestyle, regular exercise, and a balanced diet may qualify for more favorable rates.

The desired coverage amount is another critical factor in premium calculation. The coverage amount refers to the financial benefit paid out upon the insured's death. A higher coverage amount means a larger financial burden for the insurance company, which is reflected in the premium. Therefore, individuals seeking higher coverage amounts can expect to pay more in premiums. This is because the insurance company needs to ensure that the financial commitment is adequately covered in the event of the insured's passing.

It's important to note that these factors are not the only considerations. Insurance companies also take into account your gender, occupation, hobbies, and lifestyle choices. For instance, certain high-risk occupations or extreme sports may impact premium rates. Additionally, the type of life insurance policy you choose, such as term life or permanent life, can also affect the cost. Understanding these various elements can help you make informed decisions when selecting a life insurance policy that suits your needs and budget.

Getting a Life Insurance License: Is It Challenging?

You may want to see also

Claims Process: Claims are typically processed efficiently, ensuring financial support for beneficiaries

The claims process for Target Life Insurance is designed to be straightforward and efficient, ensuring that beneficiaries receive the financial support they are entitled to. When a policyholder's death is confirmed, the process begins with the submission of a claim form, which can be done by the designated beneficiary or their legal representative. This form typically requires detailed information about the policyholder, including personal details, policy number, and the cause of death (if applicable). It is crucial to provide accurate and complete information to avoid any delays in processing.

Once the claim is received, the insurance company's claims department will review the documentation. They will verify the policy's existence, confirm the policyholder's death, and assess the validity of the claim. This step ensures that all necessary paperwork is in order and that the claim complies with the terms and conditions of the policy. The efficiency of this process is vital to providing quick financial assistance to the beneficiaries.

After the initial review, the claims adjuster will investigate further, which may involve gathering additional documentation, such as death certificates, medical records, or witness statements. This step is essential to ensure the accuracy of the claim and to protect both the insurance company and the beneficiaries. The adjuster will then communicate with the beneficiaries to gather any required information and answer any questions they may have.

Upon completion of the investigation, the claims adjuster will make a decision regarding the claim. If the claim is approved, the insurance company will provide the financial support as per the policy's terms. This financial assistance can be a lump sum or in regular installments, depending on the policy's structure. The company aims to ensure that the beneficiaries have the necessary resources to cover any immediate expenses and provide for their future needs.

In the event of a dispute or if further clarification is required, the claims department will work closely with the beneficiaries to resolve any issues promptly. Efficient communication and transparency throughout the process are key to maintaining trust and ensuring a smooth claims experience. Target Life Insurance's commitment to a streamlined claims process is a testament to their dedication to providing financial security and peace of mind to their policyholders and their loved ones.

Life Insurance for Roommates: Is It Possible?

You may want to see also

Frequently asked questions

Target Life Insurance is a type of insurance policy that provides financial protection to the policyholder's beneficiaries in the event of the insured's death. It is designed to help individuals and families achieve specific financial goals, such as covering mortgage payments, funding children's education, or providing income replacement.

This insurance policy involves setting a target amount that the insurer aims to pay out upon the insured's death. The policyholder chooses this target amount, which can be customized to fit their financial needs. The insurance company then calculates the premium based on the target amount, age, health, and other factors. If the insured passes away, the insurer pays out the specified target amount to the designated beneficiaries.

This type of insurance offers several advantages:

- Flexibility: Policyholders can set a target amount that aligns with their unique financial objectives.

- Customization: The policy can be tailored to individual needs, allowing for various coverage options and beneficiaries.

- Financial Security: It provides a guaranteed payout, ensuring that loved ones receive the intended financial support.

- Peace of Mind: Knowing that a financial safety net is in place can offer reassurance and help individuals focus on their goals.

Target Life Insurance is suitable for individuals who want to secure their family's financial future and achieve specific milestones. It is often considered for those with financial responsibilities, such as homeowners with mortgages, parents saving for children's education, or professionals seeking income replacement. However, the decision should be based on personal financial goals and the advice of a qualified insurance advisor.