Elite Life Insurance is a specialized form of life insurance designed to provide comprehensive coverage and tailored benefits to high-net-worth individuals and families. It offers a range of features that cater to the unique needs of elite clients, including higher coverage amounts, flexible premium options, and access to exclusive services. This type of insurance is often characterized by its ability to provide financial security and peace of mind, ensuring that beneficiaries receive substantial financial support in the event of the insured's passing. With its focus on personalized service and advanced risk management, Elite Life Insurance is a valuable tool for those seeking to protect their assets and loved ones.

What You'll Learn

- Definition: Elite life insurance is a high-end policy offering comprehensive coverage and exclusive benefits

- Benefits: It provides enhanced financial security, including higher death benefits and additional riders

- Features: Customizable options, such as increased coverage, premium financing, and investment components

- Eligibility: Typically, it requires a higher income, excellent health, and a favorable risk assessment

- Advantages: Offers peace of mind, tax advantages, and potential wealth accumulation for the elite

Definition: Elite life insurance is a high-end policy offering comprehensive coverage and exclusive benefits

Elite life insurance is a specialized and premium type of life insurance designed for individuals seeking comprehensive protection and exclusive advantages. This high-end policy is tailored to meet the needs of those who desire a robust safety net for themselves and their loved ones, often with a focus on providing financial security and peace of mind.

The term 'elite' in this context refers to the exceptional level of coverage and the exclusive benefits associated with the policy. It is a comprehensive solution that goes beyond standard life insurance, offering a range of features that cater to the needs of high-net-worth individuals or those with specific requirements. This type of insurance is typically characterized by its ability to provide extensive financial protection, often with higher coverage amounts, and may include additional benefits such as accelerated death benefits, which can provide financial support to beneficiaries if the insured individual is diagnosed with a critical illness or condition.

In terms of coverage, elite life insurance policies can offer a substantial death benefit, ensuring that the financial needs of the family or beneficiaries are met in the event of the insured's passing. This coverage can be particularly valuable for individuals with large families, significant financial obligations, or those who wish to leave a substantial inheritance. The policy may also include various riders and options to customize the coverage, allowing the insured to choose the level of protection that aligns with their specific circumstances.

One of the key advantages of elite life insurance is the access to exclusive benefits. These may include premium customer service, priority access to financial advisors, and personalized financial planning services. Policyholders might also enjoy additional perks such as concierge services, travel assistance, or even luxury experiences as part of the policy's benefits. These exclusive offerings set elite life insurance apart, providing a sense of exclusivity and added value to the policyholder.

For those considering elite life insurance, it is essential to understand the specific features and benefits offered by different providers. This includes comparing coverage amounts, policy terms, and the range of additional benefits available. By carefully evaluating these aspects, individuals can ensure they select a policy that aligns with their financial goals and provides the comprehensive protection they seek. Elite life insurance is a powerful tool for those who wish to secure their financial future and leave a lasting legacy, offering both financial security and a unique set of advantages.

Life and Burial Insurance: Key Differences Explained

You may want to see also

Benefits: It provides enhanced financial security, including higher death benefits and additional riders

Term Elite Life Insurance is a specialized form of life insurance designed to offer comprehensive financial protection during a specific period, often referred to as the 'term'. This type of insurance is particularly attractive to those seeking enhanced financial security for their loved ones. One of its key advantages is the provision of higher death benefits, which are the financial payouts made to beneficiaries upon the insured individual's passing. These death benefits can be significantly larger compared to standard term life insurance, ensuring that the financial needs of the family or dependents are adequately met.

The 'term' aspect of this insurance refers to the duration for which the policy is in effect. During this period, the insurance company guarantees the payment of the death benefit if the insured individual passes away. This term can vary, typically ranging from 10 to 30 years, and the longer the term, the more secure the financial protection for the beneficiaries. For instance, a 30-year term ensures that the family is covered for an extended period, providing a safety net for long-term financial commitments.

In addition to the higher death benefits, Term Elite Life Insurance often comes with additional riders or optional riders that offer further customization and enhanced coverage. These riders can include provisions for accelerated death benefits, which allow the insured to access a portion of the death benefit if they are diagnosed with a critical illness or are terminally ill. Other riders might offer waiver of premium benefits, ensuring that the policyholder does not have to pay premiums if they become unable to work due to illness or injury. These additional features provide flexibility and tailored protection to meet individual needs.

The benefits of Term Elite Life Insurance are particularly appealing to those with substantial financial obligations, such as mortgage payments, children's education expenses, or business ventures. By providing higher death benefits and customizable riders, this insurance ensures that the financial security of the insured's family is not compromised, even in the event of their untimely demise. It offers a sense of peace of mind, knowing that the financial future of loved ones is protected.

When considering Term Elite Life Insurance, it is essential to evaluate the specific needs and circumstances of the individual. Consulting with a financial advisor or insurance specialist can help in understanding the various options available and selecting the most suitable policy. This ensures that the insurance chosen aligns perfectly with the desired level of financial security and provides the necessary protection for the insured and their beneficiaries.

Finsnails: Can They Secure Life Insurance for Better Coverage?

You may want to see also

Features: Customizable options, such as increased coverage, premium financing, and investment components

Term Elite Life Insurance offers a range of customizable features to cater to individual needs and preferences, ensuring that policyholders can tailor their coverage to their unique circumstances. One of the key advantages is the ability to increase coverage, allowing individuals to enhance their protection over time as their financial responsibilities and goals evolve. This flexibility ensures that the insurance policy remains relevant and adequate throughout the policyholder's life.

Premium financing is another valuable option available with Term Elite Life Insurance. This feature enables policyholders to pay for their insurance premiums over a specified period, often with interest, providing financial flexibility. By offering premium financing, the insurance company ensures that the policy remains in force even if the insured individual faces temporary financial constraints, thus maintaining continuous coverage.

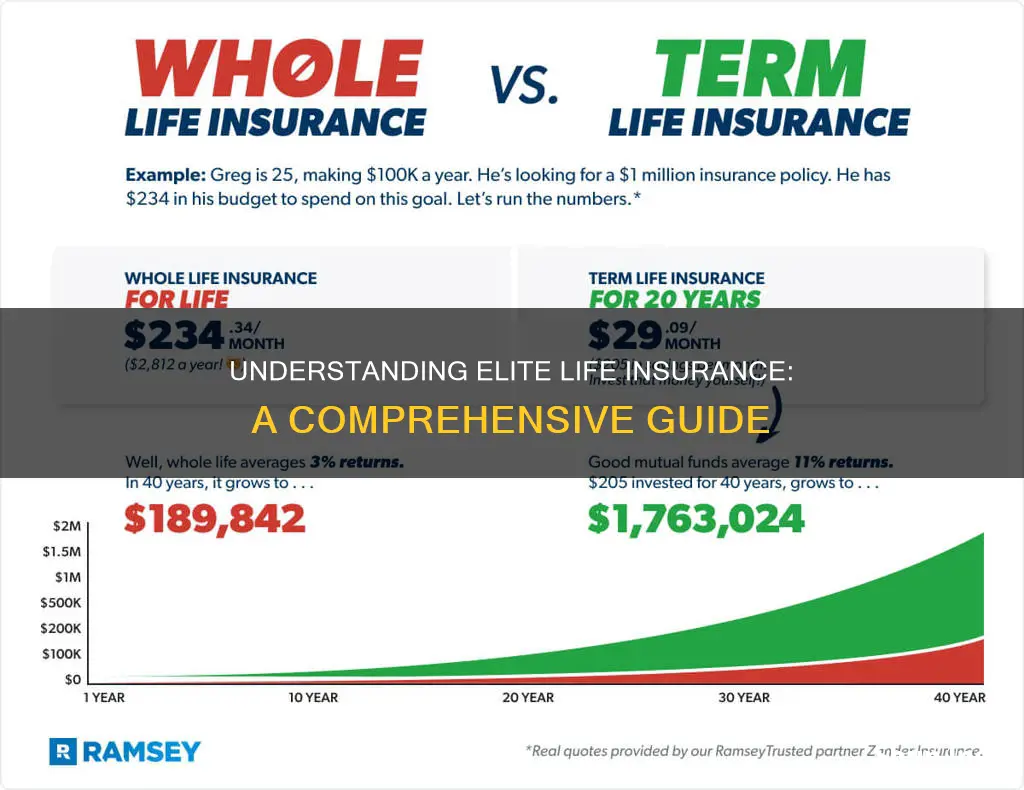

Additionally, Term Elite Life Insurance often incorporates investment components, allowing policyholders to grow their policy's cash value. This investment aspect can be particularly beneficial for those seeking to build long-term wealth while also protecting their loved ones. The investment options available may vary, and policyholders can choose the investment strategy that aligns with their financial goals and risk tolerance. This feature provides an opportunity to potentially increase the overall value of the policy over time.

With these customizable options, Term Elite Life Insurance provides a comprehensive and adaptable solution for individuals seeking life insurance. The ability to increase coverage, utilize premium financing, and incorporate investment components ensures that the policy can be tailored to meet specific financial needs and objectives. This level of customization empowers individuals to make informed decisions about their insurance coverage, providing peace of mind and financial security for themselves and their families.

Life Insurance and Medicare: Retirement's Dynamic Duo

You may want to see also

Eligibility: Typically, it requires a higher income, excellent health, and a favorable risk assessment

Term Elite Life Insurance is a specialized type of life insurance designed for individuals who meet specific criteria of excellence and high-risk tolerance. This insurance product is tailored for those who can afford a premium lifestyle and are willing to pay for the added security it provides. The term "elite" here refers to the stringent eligibility requirements and the potential for higher coverage amounts.

Eligibility for Term Elite Life Insurance is typically very strict and selective. Insurers look for individuals who possess certain desirable traits and characteristics. Firstly, a higher income is a significant factor. This insurance is often aimed at high-net-worth individuals or those in high-income professions, as the premiums can be substantial. The more income one has, the more they can afford to pay for insurance, and the higher the potential coverage amount.

Excellent health is another critical aspect of eligibility. Insurers will thoroughly assess an applicant's medical history and current health status. A favorable risk assessment is required, meaning individuals with no significant health issues, such as chronic diseases, heart conditions, or a history of smoking, are more likely to be approved. A clean bill of health increases the chances of securing this elite insurance.

In addition to income and health, insurers also consider other factors like age and lifestyle. Younger individuals typically have lower premiums due to the statistical advantage of longer life expectancy. A healthy lifestyle, including regular exercise and a balanced diet, can also improve eligibility. These factors combined give insurers the confidence to offer higher coverage amounts at competitive rates.

Meeting these eligibility criteria can be challenging, but it ensures that the insurance company provides a product that is both valuable and secure for the insured individual. Term Elite Life Insurance is an exclusive offering, catering to those who can meet the high standards set by the insurance industry. It is a testament to the insured's success and a way to ensure financial security for their loved ones.

Primerica Whole Life Insurance: Is It Worth the Investment?

You may want to see also

Advantages: Offers peace of mind, tax advantages, and potential wealth accumulation for the elite

Term elite life insurance is a specialized form of life insurance designed for high-net-worth individuals, offering a range of benefits that cater to their unique financial needs. This type of insurance provides a comprehensive solution for those seeking both financial security and an enhanced quality of life. Here's an exploration of its advantages:

Peace of Mind: One of the primary benefits of term elite life insurance is the peace of mind it offers. For the elite, this can be invaluable. Knowing that their loved ones are financially protected in the event of their passing provides a sense of security. This insurance ensures that their family can maintain their standard of living, cover essential expenses, and potentially even achieve financial goals, even if the primary breadwinner is no longer around. It's a powerful tool to safeguard against the unexpected, allowing individuals to focus on their passions and pursuits without constant worry.

Tax Advantages: Term elite life insurance policies often come with tax benefits. In many jurisdictions, the death benefit paid out upon the insured individual's passing is generally tax-free. This means that the proceeds can be used to cover various expenses, such as estate taxes, funeral costs, and outstanding debts, without triggering a significant tax liability. Additionally, the premiums paid for this insurance may be tax-deductible, providing further financial advantages. These tax efficiencies can be particularly appealing to high-income earners and business owners, enabling them to manage their wealth more efficiently.

Wealth Accumulation: This type of insurance can also serve as a powerful wealth-building tool. Many term elite life insurance policies offer investment components, allowing policyholders to grow their money over time. This feature enables individuals to potentially accumulate a substantial amount of wealth, which can be used for various purposes, such as funding education, starting businesses, or investing in other ventures. The investment aspect of these policies can provide an opportunity for the elite to diversify their portfolios and potentially earn higher returns compared to traditional savings accounts or investments.

For those in the elite category, term elite life insurance is a strategic financial decision. It provides a safety net for their loved ones while also offering the potential for wealth growth. The combination of peace of mind, tax benefits, and wealth-building opportunities makes it an attractive choice for those seeking to secure their financial future and that of their family. It is a testament to the power of specialized insurance solutions in catering to the unique needs of high-net-worth individuals.

Group Life Insurance: Portability and Your Options

You may want to see also

Frequently asked questions

Elite life insurance is a type of term life insurance that offers a higher level of coverage and benefits compared to standard term plans. It is designed to provide individuals with a comprehensive financial safety net, ensuring their loved ones are protected in the event of their passing. This insurance product typically features longer coverage periods, higher death benefits, and additional riders or options to customize the policy according to the insured's needs.

The key differences lie in the coverage duration, benefits, and flexibility. Standard term life insurance usually offers coverage for a specific period, often 10, 20, or 30 years. In contrast, elite life insurance provides coverage for an extended period, sometimes up to 40 years or even lifelong. It also includes additional features like accelerated death benefits, which allow policyholders to access a portion of their death benefit if they are diagnosed with a critical illness or face a terminal condition.

Elite life insurance is ideal for individuals who want comprehensive coverage and are willing to invest in a more expensive policy. It is suitable for those with a long-term financial planning goal, such as providing for a family's long-term needs or ensuring financial security for children's education. Individuals with a higher risk profile, such as those with pre-existing health conditions, may also benefit from the additional benefits and flexibility offered by elite life insurance.

While elite life insurance offers enhanced features, it can be more expensive than standard term plans. The higher coverage amounts and extended periods of coverage contribute to the increased cost. Additionally, some elite life insurance policies may have stricter underwriting requirements, and individuals with certain health conditions might find it challenging to qualify for the most competitive rates. It is essential to carefully review the policy details and consider one's financial situation and long-term goals before making a decision.