Term life insurance is a type of insurance policy that provides coverage for a specific period, typically 10, 20, or 30 years. It is a popular choice for individuals seeking affordable and straightforward coverage to protect their loved ones during a particular time frame. Dave Ramsey, a well-known financial advisor and author, often emphasizes the importance of term life insurance as a fundamental component of a solid financial plan. This insurance offers a death benefit if the insured person passes away during the term, ensuring financial security for beneficiaries. Understanding the basics of term life insurance is essential for anyone looking to build a comprehensive financial strategy, as it can provide peace of mind and financial protection for one's family.

What You'll Learn

- Definition: Dave Ramsey defines term life insurance as a temporary policy covering a specific period

- Cost: It's generally more affordable than permanent life insurance

- Coverage: Provides financial protection for a set duration, typically 10-30 years

- Benefits: Covers debts, mortgage, and depends, ensuring family financial security

- Alternatives: Consider term life before permanent policies for short-term needs

Definition: Dave Ramsey defines term life insurance as a temporary policy covering a specific period

Term life insurance, as defined by Dave Ramsey, is a type of life insurance policy that provides coverage for a specific period. This means that the insurance is designed to protect your loved ones for a predetermined duration, such as 10, 20, or 30 years. Unlike permanent life insurance, which offers lifelong coverage, term life insurance is a more affordable and straightforward option for those seeking temporary protection.

Ramsey emphasizes that term life insurance is ideal for individuals who want to ensure their family's financial security during a particular phase of life. For example, it can be a valuable tool for young families with mortgages, children's education expenses, or other long-term financial commitments. By choosing a term life insurance policy, you can provide a financial safety net for your loved ones without the long-term financial burden associated with permanent insurance.

The key aspect of term life insurance is its temporary nature. This type of policy is structured to align with the duration of specific life events or responsibilities. For instance, you might opt for a 10-year term policy to cover the period when your children are young and require financial support, or a 20-year term to coincide with the repayment period of a mortgage. Once the term ends, the policy expires, and you can decide whether to renew it or explore other insurance options.

Dave Ramsey's approach to term life insurance is practical and focused on financial planning. He encourages individuals to assess their financial needs and choose a term length that aligns with their goals. This ensures that the insurance coverage is relevant and beneficial during the specific period when it is needed most. By understanding the temporary nature of term life insurance, individuals can make informed decisions about their insurance needs and manage their finances effectively.

In summary, Dave Ramsey's definition of term life insurance highlights its temporary and period-specific nature. This type of insurance is a practical solution for individuals seeking affordable coverage during particular life stages. By choosing a term life insurance policy, you can provide essential financial protection without the long-term commitment of permanent insurance, allowing for better financial planning and management.

Term Life Insurance: Permanent or Temporary Solution?

You may want to see also

Cost: It's generally more affordable than permanent life insurance

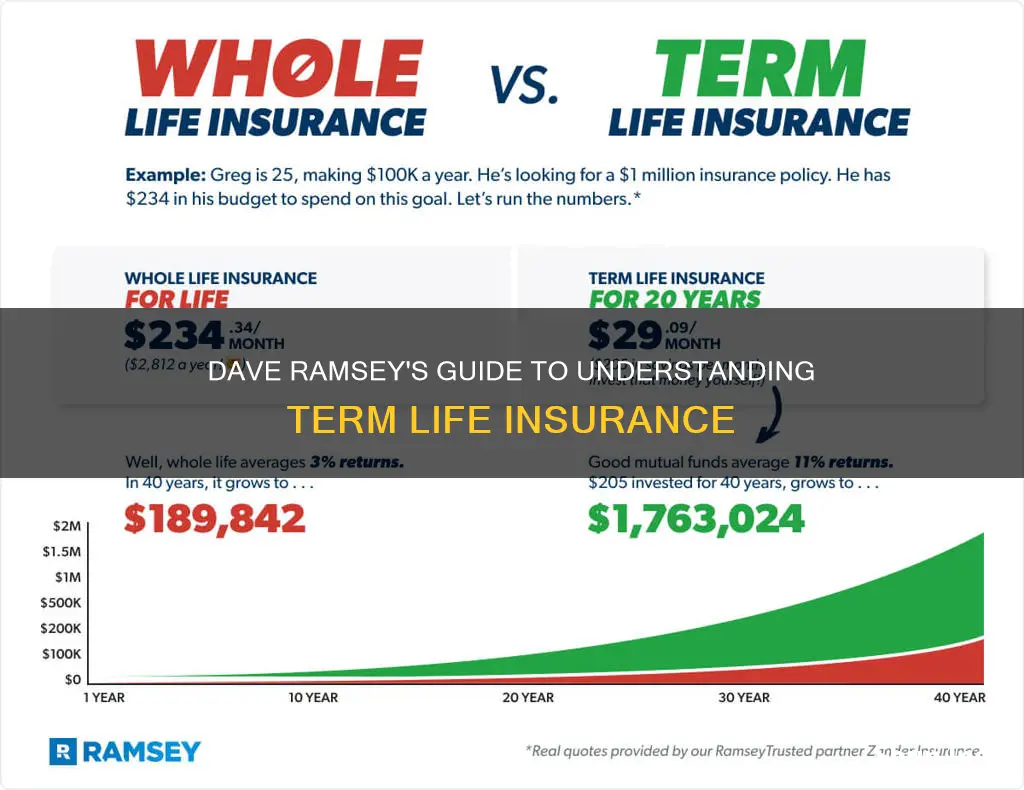

Term life insurance, as popularized by Dave Ramsey, is a cost-effective solution for those seeking affordable life coverage. This type of insurance is designed to provide a specific period of coverage, typically 10, 20, or 30 years, making it a temporary but highly efficient choice. The primary advantage of term life insurance is its lower cost compared to permanent life insurance. This affordability is a result of the insurance company's assessment that the risk of death during the term period is lower, allowing them to offer policies at more competitive rates.

When considering the cost, it's essential to understand that term life insurance is a pure risk transfer mechanism. It doesn't accumulate cash value or investment components, which are common features in permanent life insurance policies. By eliminating these additional benefits, the insurance provider can offer term life insurance at a significantly lower price. This makes it an attractive option for individuals who prioritize affordability without compromising on the essential aspect of life coverage.

The lower cost of term life insurance is particularly beneficial for those who need coverage for a specific period, such as covering mortgage payments, providing for children's education, or ensuring financial security during a particular phase of life. For instance, a young professional taking out a 20-year term life insurance policy might pay lower premiums compared to someone with a permanent policy, as the risk of death during this period is statistically lower.

Furthermore, the flexibility of term life insurance allows individuals to adjust their coverage as their needs change. If someone's financial obligations or family circumstances evolve, they can opt for a different term length or even convert their term policy into a permanent one. This adaptability ensures that the insurance remains relevant and cost-effective throughout one's life.

In summary, term life insurance, as advocated by Dave Ramsey, offers a more affordable alternative to permanent life insurance. Its temporary nature, lack of investment components, and lower risk assessment during the specified term period contribute to its cost-effectiveness. This makes it an ideal choice for those seeking comprehensive life coverage without the higher costs associated with permanent policies.

Understanding Islamic Life Insurance: A Comprehensive Guide

You may want to see also

Coverage: Provides financial protection for a set duration, typically 10-30 years

Term life insurance is a type of coverage that offers financial protection for a specific period, often ranging from 10 to 30 years. It is a straightforward and cost-effective way to secure your family's financial future during a critical time. This insurance product is particularly popular among individuals seeking temporary coverage, especially those with short-term financial goals or a limited budget.

The primary purpose of term life insurance is to provide a financial safety net for your loved ones in the event of your untimely passing. During the specified term, the policy guarantees a death benefit payout to your designated beneficiaries if you were to pass away. This financial support can help cover various expenses, such as mortgage payments, children's education, or daily living costs, ensuring your family's financial stability.

One of the key advantages of term life insurance is its affordability. Since the coverage is limited to a specific period, the premiums are typically lower compared to permanent life insurance policies. This makes it an attractive option for those who want to maximize their coverage without breaking the bank, especially when they have a limited time frame during which they need financial protection.

When choosing a term life insurance policy, it's essential to consider the length of the term. A 10-year term is suitable for short-term goals, while a 20 or 30-year term provides longer-lasting protection. Dave Ramsey, a renowned personal finance expert, often emphasizes the importance of term life insurance for young families, as it offers peace of mind and financial security during the years when your loved ones may need it the most.

In summary, term life insurance provides a focused and temporary solution to financial protection. It is an excellent choice for individuals who want to secure their family's future without the long-term commitment and higher costs associated with permanent insurance. By understanding the duration and benefits of term life insurance, you can make an informed decision to safeguard your loved ones' financial well-being.

Life Insurance and Divorce: Who Gets the Payout?

You may want to see also

Benefits: Covers debts, mortgage, and depends, ensuring family financial security

Term life insurance is a powerful financial tool that can provide a sense of security and peace of mind, especially for those with financial responsibilities like debts, mortgages, and dependents. It is a type of life insurance that offers coverage for a specific period, often 10, 20, or 30 years, and it is designed to protect your loved ones and financial commitments during this time. This insurance product is particularly relevant to Dave Ramsey's financial advice, as it aligns with his emphasis on financial security and the importance of having a plan for the future.

One of the primary benefits of term life insurance is its ability to cover debts and financial obligations. When you have a mortgage, car loans, or any other debts, a sudden financial loss due to death can lead to significant difficulties for your family. By taking out a term life insurance policy, you ensure that your loved ones are protected in the event of your passing. The insurance payout can be used to pay off these debts, ensuring that your family doesn't have to face the burden of financial liabilities while also providing for their immediate needs. This is especially crucial if you are the primary breadwinner, as it guarantees that your family's standard of living is maintained even in your absence.

Mortgage payments are another critical aspect of financial planning. A term life insurance policy can provide the necessary funds to cover these payments if you were to pass away. This ensures that your family doesn't lose their home, which is often the most significant asset a family owns. With the insurance proceeds, your family can continue to make mortgage payments, keeping the home in their name and providing a stable living environment for your dependents. This aspect of term life insurance is particularly valuable, as it addresses a common concern among families with a mortgage.

Additionally, term life insurance is essential for families with dependents, such as children or elderly parents who rely on your income. The financial support provided by the insurance policy ensures that your dependents' needs are met, including education, healthcare, and daily living expenses. This financial security allows your family to focus on adjusting to life changes without the added stress of financial instability. Knowing that your loved ones are protected financially can provide immense comfort and peace of mind.

In summary, term life insurance is a practical and essential component of financial planning, especially for those with debts, mortgages, and dependents. It offers a safety net that ensures your family's financial security and stability, allowing them to navigate life's challenges with confidence. By covering these critical financial obligations, term life insurance empowers individuals to take control of their financial future and provide for their loved ones.

Understanding Florida's Life Insurance Replacement Rules

You may want to see also

Alternatives: Consider term life before permanent policies for short-term needs

When it comes to life insurance, Dave Ramsey often emphasizes the importance of term life insurance for short-term needs. This type of coverage is a more affordable and straightforward option compared to permanent life insurance policies. Here's why considering term life insurance can be a wise financial decision:

Affordability: Term life insurance is generally more budget-friendly, especially for those with short-term financial goals. It provides coverage for a specific period, typically 10, 20, or 30 years. During this term, the policy offers a death benefit if the insured individual passes away. The lower cost is due to the limited duration of the policy, making it an excellent choice for individuals who want insurance coverage without a long-term financial commitment.

Simplicity: Term life insurance policies are straightforward and easy to understand. They have no cash value accumulation, meaning the policyholder doesn't have to worry about building a savings component within the policy. This simplicity makes it a more accessible option for those who prefer a clear and transparent insurance product.

Flexibility: One of the key advantages of term life insurance is its flexibility. If your financial needs change, you can typically adjust your coverage accordingly. For instance, if you start a new business and require additional coverage, you can explore other insurance options or increase your term life policy. This flexibility ensures that your insurance strategy remains adaptable to your evolving circumstances.

Short-Term Coverage: For individuals facing specific short-term financial obligations, term life insurance can be a perfect fit. It is ideal for covering debts like mortgages, student loans, or business loans. If something happens to the policyholder, the death benefit can be used to pay off these debts, providing financial security for the family. This short-term focus ensures that the insurance is tailored to address immediate concerns.

Cost-Effective for Young Families: Young families often have significant financial responsibilities, such as raising children, paying for education, and covering daily expenses. Term life insurance can provide a safety net during these years, ensuring that the family's financial obligations are met if something unexpected happens. The lower premiums make it an affordable way to protect your loved ones.

In summary, term life insurance, as advocated by Dave Ramsey, is a practical and cost-effective solution for short-term needs. It offers simplicity, flexibility, and affordability, making it an excellent choice for individuals seeking insurance coverage without the complexities of permanent policies. By considering term life insurance, you can ensure that your financial strategy is aligned with your short-term goals and provide valuable protection for your loved ones.

Beneficiaries of Life Insurance: How Many Can You Name?

You may want to see also

Frequently asked questions

Term life insurance is a type of coverage that provides a death benefit for a specified period, known as the "term." It is a pure insurance product, meaning it only pays out if the insured person dies during the term. Dave Ramsey, a well-known financial advisor, often recommends term life insurance as a cost-effective way to protect your loved ones financially. He emphasizes the importance of having enough coverage to cover essential expenses, such as mortgage payments, living expenses, and children's education, for a specific period.

Dave Ramsey's approach to insurance is centered around the idea of "protecting the protectable." He suggests that term life insurance is a tool to safeguard your family's financial future during the years when they are most dependent on your income. The policy pays out a lump sum or regular payments to your beneficiaries if you pass away during the term. This financial safety net allows your family to maintain their standard of living and cover any outstanding debts or expenses.

Dave Ramsey's philosophy on term life insurance highlights several advantages. Firstly, it is typically more affordable than permanent life insurance, making it accessible to a broader range of individuals. Secondly, term life insurance provides a clear end date, which can help individuals focus on building other financial assets during the term. Additionally, the coverage can be tailored to specific needs, ensuring that the policy aligns with an individual's financial goals and priorities.