Life insurance is a financial safety net that provides peace of mind and security for individuals and their loved ones. One of its primary advantages is the ability to ensure financial stability and security for your family in the event of your untimely death. It offers a way to protect your loved ones from the financial burden of unexpected expenses, such as funeral costs, mortgage payments, or daily living expenses, by providing a lump sum payment or regular income. This financial support can help your family maintain their standard of living, cover essential costs, and achieve their long-term goals, even when you're no longer around. Additionally, life insurance can be a valuable tool for estate planning, business continuity, and charitable giving, making it an essential consideration for anyone looking to safeguard their loved ones' future.

What You'll Learn

- Financial Security: Life insurance provides a safety net for loved ones in the event of your death

- Debt Relief: It can help pay off debts and mortgages, preventing financial strain

- Income Replacement: Policies offer a regular income stream to replace lost wages

- Medical Expenses: Coverage can cover unexpected medical costs, ensuring financial stability

- Peace of Mind: Knowing you're protected brings reassurance and reduces stress

Financial Security: Life insurance provides a safety net for loved ones in the event of your death

Life insurance is a powerful tool that offers a crucial advantage: financial security for your loved ones. When you purchase a life insurance policy, you are essentially creating a safety net for your family, ensuring they are protected financially in the event of your untimely death. This financial security is an invaluable benefit that can provide peace of mind and help your loved ones maintain their standard of living even if you are no longer there to support them.

The primary purpose of life insurance is to provide a financial cushion during difficult times. When a primary earner passes away, the surviving family members may face significant financial challenges. They might struggle to cover essential expenses, such as mortgage payments, utility bills, or even daily living costs. Life insurance steps in to bridge this gap, ensuring that your loved ones have the necessary financial resources to cope with the sudden loss of income. This financial security can be a lifeline, allowing your family to grieve without the added stress of financial worries.

The amount of coverage you choose should be sufficient to cover your family's potential short-term and long-term expenses. Short-term expenses might include funeral costs, outstanding debts, or immediate living expenses. Long-term considerations could involve children's education fees, mortgage payments, or even the cost of raising a family. By assessing these potential financial obligations, you can determine the appropriate life insurance coverage to ensure your family's financial stability.

Moreover, life insurance can provide a sense of reassurance and comfort to your loved ones. Knowing that they have a financial safety net in place can ease the emotional burden of your passing. It allows them to focus on healing and remembering you rather than worrying about their financial future. This aspect of life insurance is often overlooked but can significantly impact the well-being of your family during a challenging period.

In summary, life insurance is a vital tool for providing financial security and peace of mind. It ensures that your loved ones are protected financially when you are no longer around, allowing them to maintain their lifestyle and focus on honoring your memory. By carefully considering your family's needs and choosing the right coverage, you can offer a valuable gift that will benefit your loved ones for years to come.

Withholding Tax: Does It Affect Your Life Insurance?

You may want to see also

Debt Relief: It can help pay off debts and mortgages, preventing financial strain

Life insurance can be a powerful tool for managing and reducing debt, offering a safety net that can provide financial relief and peace of mind. One of the key advantages of life insurance is its ability to help individuals and families pay off debts and mortgages, which can be a significant source of financial strain. When someone passes away, the life insurance policy they have in place can provide a lump sum payment or regular income to their beneficiaries. This financial support can be used to settle outstanding debts, such as personal loans, credit card balances, or even larger financial obligations like mortgages. By utilizing the death benefit from a life insurance policy, individuals can ensure that their loved ones are protected from the burden of debt, especially during a time of grief and emotional stress.

For those with substantial debts, life insurance can be a strategic financial move. It allows policyholders to allocate a portion of their premium payments towards building a cash value, which can then be used to pay off debts. Over time, the cash value grows, providing a source of funds that can be borrowed against or withdrawn to cover expenses. This approach not only helps in debt relief but also ensures that the insurance policy remains in force, providing coverage for the insured individual's family.

In the event of a mortgage, life insurance can be particularly beneficial. A mortgage is often a significant financial commitment, and the death of the primary income earner can lead to financial hardship for the family. With life insurance, the policy's proceeds can be used to pay off the mortgage, ensuring that the family retains ownership of the home and avoids the additional financial burden of a mortgage payment during a difficult time. This can be especially important for families with children, as it provides a stable living environment and financial security.

The process of utilizing life insurance for debt relief is straightforward. Policyholders can review their insurance policies and identify the death benefit amount. They can then work with financial advisors or insurance professionals to develop a strategy that allocates a portion of the death benefit to debt repayment. This approach ensures that the insurance policy remains a valuable asset, providing both financial security and debt management solutions.

In summary, life insurance offers a practical and effective way to address debt relief and prevent financial strain. By leveraging the death benefit, individuals can settle debts, including mortgages, and provide a secure future for their families. It is a strategic financial decision that combines insurance coverage with debt management, ensuring a more stable and financially secure life for those who rely on the policy.

Term Life Insurance: Affordable Coverage for Specific Needs

You may want to see also

Income Replacement: Policies offer a regular income stream to replace lost wages

Life insurance is a financial tool that provides a safety net and offers numerous advantages, one of which is income replacement. When an individual purchases a life insurance policy, they essentially enter into a contract with an insurance company, agreeing to pay regular premiums in exchange for a financial benefit upon the occurrence of a specified event, typically the death of the insured. This policy is a powerful tool for those who want to ensure financial security for their loved ones in the event of their untimely demise.

The primary advantage of life insurance in terms of income replacement is its ability to provide a steady and predictable income stream to the beneficiaries. When a person dies, the insurance company pays out a lump sum amount, known as the death benefit, to the designated beneficiaries. This financial payout can be structured in various ways, but the most common and advantageous for income replacement is the term life insurance policy. Term life insurance is designed to provide coverage for a specific period, often 10, 20, or 30 years, and during this term, it offers a regular, fixed income to the beneficiaries.

For example, imagine a family where the primary breadwinner, let's call them John, has a family that relies on his income. John purchases a term life insurance policy with a death benefit equal to 10 times his annual salary. If John were to pass away during the policy term, the insurance company would pay out $100,000 (10 times his salary) to his spouse or designated beneficiaries. This lump sum can then be used to replace John's lost income, ensuring that his family can maintain their current standard of living and cover essential expenses such as mortgage payments, groceries, education, and other daily costs.

The beauty of this arrangement is that the income replacement provided by life insurance is guaranteed and secure. Unlike other sources of income, such as investments or business profits, which can fluctuate or be uncertain, the death benefit from a life insurance policy is a fixed amount that the beneficiaries can rely on. This predictability and reliability are crucial for providing financial stability and peace of mind to the family, especially during challenging times.

Furthermore, the income replacement aspect of life insurance is particularly beneficial for families with young children or those with long-term financial commitments. The regular income stream can help cover the costs associated with raising a family, such as education expenses, extracurricular activities, and healthcare. It can also provide a safety net for long-term financial goals, such as saving for a child's future education or ensuring that a mortgage is fully paid off.

In summary, life insurance, particularly term life insurance, offers a powerful advantage in the form of income replacement. By providing a regular and guaranteed income stream to beneficiaries, life insurance policies ensure that the financial needs of a family are met even in the absence of the primary earner. This financial security is an invaluable benefit that can provide peace of mind and help maintain a family's standard of living and long-term financial goals.

Whole Life Insurance: Dave Ramsey's Investment Advice

You may want to see also

Medical Expenses: Coverage can cover unexpected medical costs, ensuring financial stability

Life insurance is a financial tool that provides a safety net for individuals and their families, offering numerous advantages that contribute to overall financial stability and peace of mind. One of its most significant benefits is the coverage it provides for medical expenses, which can be a critical aspect of financial planning.

In today's healthcare landscape, medical costs can quickly escalate, especially in the event of unexpected illnesses or accidents. Without adequate insurance coverage, these expenses can become overwhelming and financially devastating. This is where life insurance steps in as a valuable asset. It offers a comprehensive solution to address the financial burden associated with medical emergencies. When an individual purchases a life insurance policy, they essentially create a financial reserve that can be utilized to cover various medical-related expenses. This coverage ensures that policyholders and their beneficiaries are protected against the financial impact of unforeseen medical situations.

The advantage of having medical coverage through life insurance is twofold. Firstly, it provides immediate financial support during critical times. When a policyholder falls ill or requires urgent medical attention, the insurance payout can be used to cover hospital bills, surgery costs, medication expenses, and other related medical fees. This ensures that the individual receives the necessary treatment without the added stress of financial constraints. Secondly, it offers long-term financial security. By having a life insurance policy with medical coverage, individuals can safeguard their finances from potential medical debt, which could otherwise lead to financial strain and even bankruptcy.

Moreover, life insurance with medical coverage can be particularly beneficial for families with children or dependents. In the event of a policyholder's untimely demise, the insurance payout can provide financial support to cover the costs of raising and educating the children, ensuring their well-being and future security. This aspect of life insurance is often overlooked but can significantly impact the overall financial health of a family.

In summary, life insurance with a focus on medical expenses coverage is an essential component of a comprehensive financial strategy. It empowers individuals to face unexpected medical costs head-on, providing financial stability and peace of mind. By understanding and utilizing this advantage, people can ensure that their loved ones are protected, and their financial future remains secure, even in the face of unforeseen medical challenges.

Life Insurance for Terminally Ill Parents: Is It Possible?

You may want to see also

Peace of Mind: Knowing you're protected brings reassurance and reduces stress

The primary advantage of life insurance is the peace of mind it provides, offering a sense of security and reassurance to individuals and their loved ones. When you have life insurance, you can rest easy knowing that your family is financially protected in the event of your untimely passing. This knowledge significantly reduces stress and anxiety, allowing you to focus on living a fulfilling life without constantly worrying about the future.

Life insurance provides a safety net, ensuring that your dependents are taken care of financially. It covers essential expenses such as mortgage payments, children's education, and daily living costs, providing a steady income stream to support your loved ones. This financial security is invaluable, as it enables your family to maintain their standard of living and make important life decisions without the burden of financial worry.

Moreover, life insurance offers a sense of control and preparedness. By having a policy, you actively take steps to protect your loved ones, demonstrating your commitment to their well-being. This proactive approach can provide a sense of empowerment, knowing that you've made provisions for the future, even if you're not around. It allows you to leave a lasting legacy, ensuring that your family's financial stability is not compromised.

The peace of mind that comes with life insurance is a powerful benefit. It enables individuals to make the most of their time, pursue their passions, and create lasting memories without the constant fear of the unknown. With insurance in place, you can focus on the present, knowing that your family's future is secure. This sense of security can lead to improved mental well-being and a more positive outlook on life.

In summary, life insurance provides an invaluable advantage by offering peace of mind and financial security. It empowers individuals to take control of their future, ensuring that their loved ones are protected and their financial obligations are met. This reassurance and reduced stress allow people to live life to the fullest, knowing that they've made a wise decision to safeguard their family's well-being.

Who Gets the Life Insurance Payout in Delaware?

You may want to see also

Frequently asked questions

The main benefit of life insurance is providing financial security and peace of mind for your loved ones in the event of your death. It ensures that your family can maintain their standard of living, cover essential expenses, and achieve their financial goals, even if you're no longer around.

Life insurance is a valuable tool for long-term financial planning. It allows individuals to secure their family's future by providing a financial safety net. The death benefit can be used to pay off debts, fund children's education, build an emergency fund, or even be invested to grow over time, providing a financial cushion for the policyholder's beneficiaries.

Yes, certain types of life insurance policies, such as whole life or universal life insurance, offer a unique advantage of tax-efficient savings. The premiums paid into these policies can be tax-deductible, and the cash value of the policy grows tax-free. This allows policyholders to build a substantial savings component within the insurance policy, providing both insurance coverage and a long-term savings opportunity.

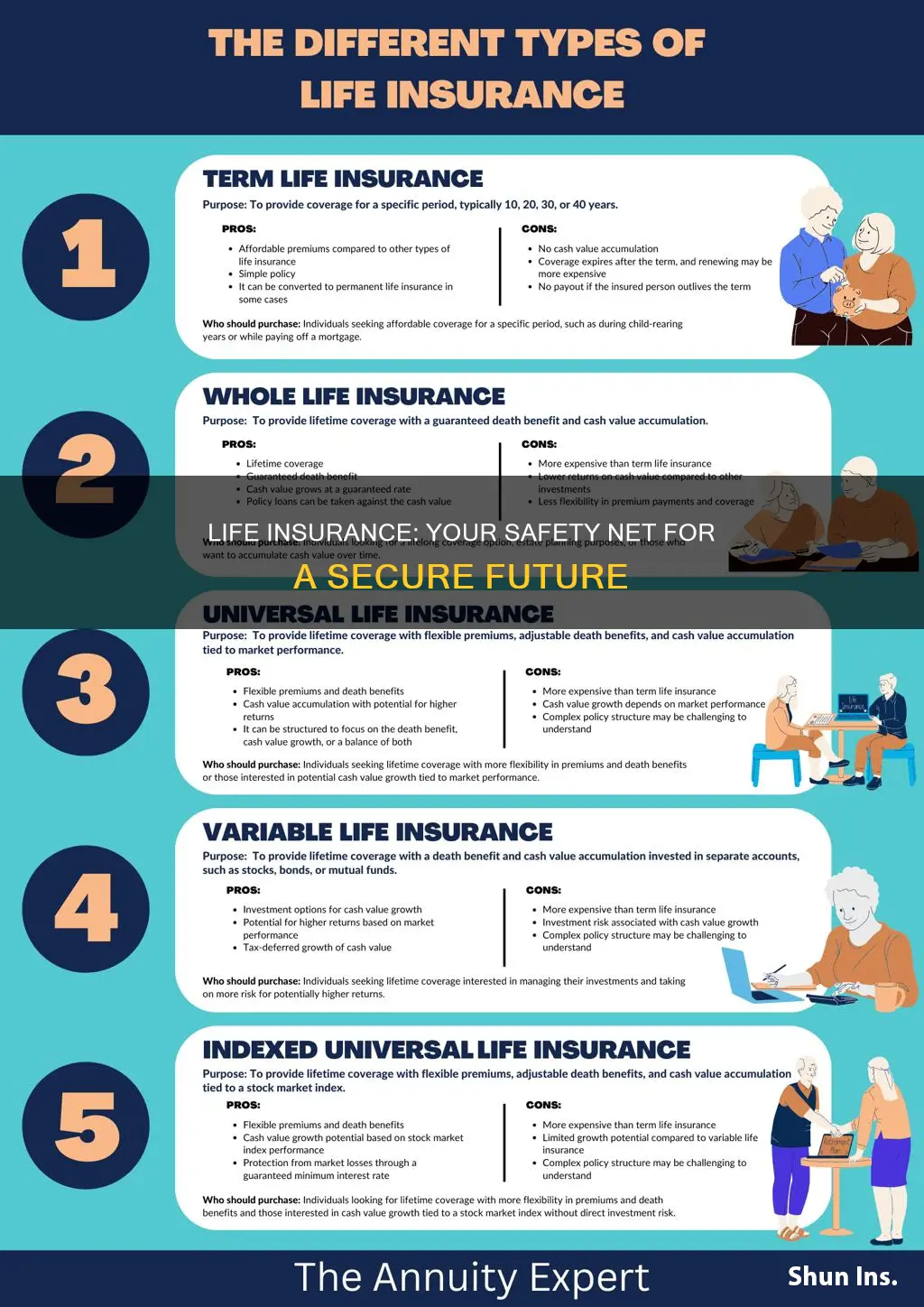

There are several types of life insurance, each with its own advantages:

- Term Life Insurance: Provides coverage for a specific period, offering affordable premiums and a guaranteed death benefit if you pass away during the term.

- Permanent Life Insurance (Whole Life, Universal Life): Offers lifelong coverage and includes an investment component, allowing cash value accumulation.

- Whole Life: Provides guaranteed death benefit, fixed premiums, and a fixed interest rate on the cash value.

- Universal Life: Offers flexibility in premium payments and death benefit, with the potential for higher returns on the cash value.