Life insurance and mortgage insurance are two distinct financial products designed to protect individuals and their loved ones. While life insurance provides financial security by paying out a death benefit to beneficiaries in the event of the insured's passing, mortgage insurance focuses on safeguarding homeowners from financial loss if they default on their mortgage payments. Understanding the differences between these two types of insurance is crucial for individuals to make informed decisions about their financial well-being and the protection of their assets.

Life Insurance vs. Mortgage Insurance: Key Differences

| Characteristics | Values |

|---|---|

| Purpose | Life insurance provides financial protection for beneficiaries in the event of the insured's death. Mortgage insurance, on the other hand, protects the lender from financial loss if the borrower defaults on the mortgage loan. |

| Coverage | Covers death, illness, or injury. Mortgage insurance covers the mortgage loan balance if the borrower cannot make payments. |

| Benefits | Provides financial security to dependents, covers funeral expenses, and may offer tax advantages. Helps borrowers qualify for a mortgage with a smaller down payment. |

| Premiums | Paid regularly (monthly, annually) by the insured. Typically calculated as a percentage of the mortgage amount and paid by the borrower. |

| Eligibility | Requires a medical examination and may have health restrictions. Generally, available to borrowers with a credit score and income meeting the lender's criteria. |

| Term | Can be permanent or term-based (e.g., 10, 20 years). Mortgage insurance is typically required until the loan is paid off. |

| Cost | Varies depending on factors like age, health, coverage amount. Mortgage insurance premiums are usually lower but can vary based on loan amount and down payment. |

| Lender Requirement | Lenders often require mortgage insurance for loans with a high loan-to-value ratio (LTV) to mitigate risk. |

| Refundability | Some life insurance policies offer return of premium (ROP) if the insured survives the term. Mortgage insurance premiums are generally non-refundable. |

| Tax Implications | May offer tax benefits, but details vary by jurisdiction. Mortgage insurance premiums are typically tax-deductible for certain income levels. |

What You'll Learn

- Coverage: Life insurance provides financial support to beneficiaries, while mortgage insurance protects lenders from borrower default

- Purpose: Life insurance offers financial security for loved ones, whereas mortgage insurance safeguards the lender's investment

- Risk: Life insurance mitigates the risk of premature death, while mortgage insurance addresses the risk of borrower default on a loan

- Term: Life insurance is typically permanent, whereas mortgage insurance may be temporary, ending when the loan is paid off

- Cost: Life insurance premiums are generally higher than mortgage insurance premiums, reflecting the different risks involved

Coverage: Life insurance provides financial support to beneficiaries, while mortgage insurance protects lenders from borrower default

Life insurance and mortgage insurance are two distinct financial products that serve different purposes and offer unique coverage. Understanding the difference between these two types of insurance is essential for anyone looking to protect their loved ones or secure their financial future.

Life Insurance Coverage:

Life insurance is a contract between an individual (the insured) and an insurance company. The primary purpose of life insurance is to provide financial security to the beneficiaries (usually family members or designated recipients) in the event of the insured's death. When an individual purchases life insurance, they agree to pay regular premiums in exchange for a death benefit, which is a lump sum amount paid out upon their passing. This coverage ensures that the beneficiaries have financial support to cover various expenses, such as funeral costs, outstanding debts, mortgage payments, or daily living expenses. The death benefit can be a significant financial cushion, allowing the beneficiaries to maintain their standard of living and achieve their financial goals.

Mortgage Insurance Coverage:

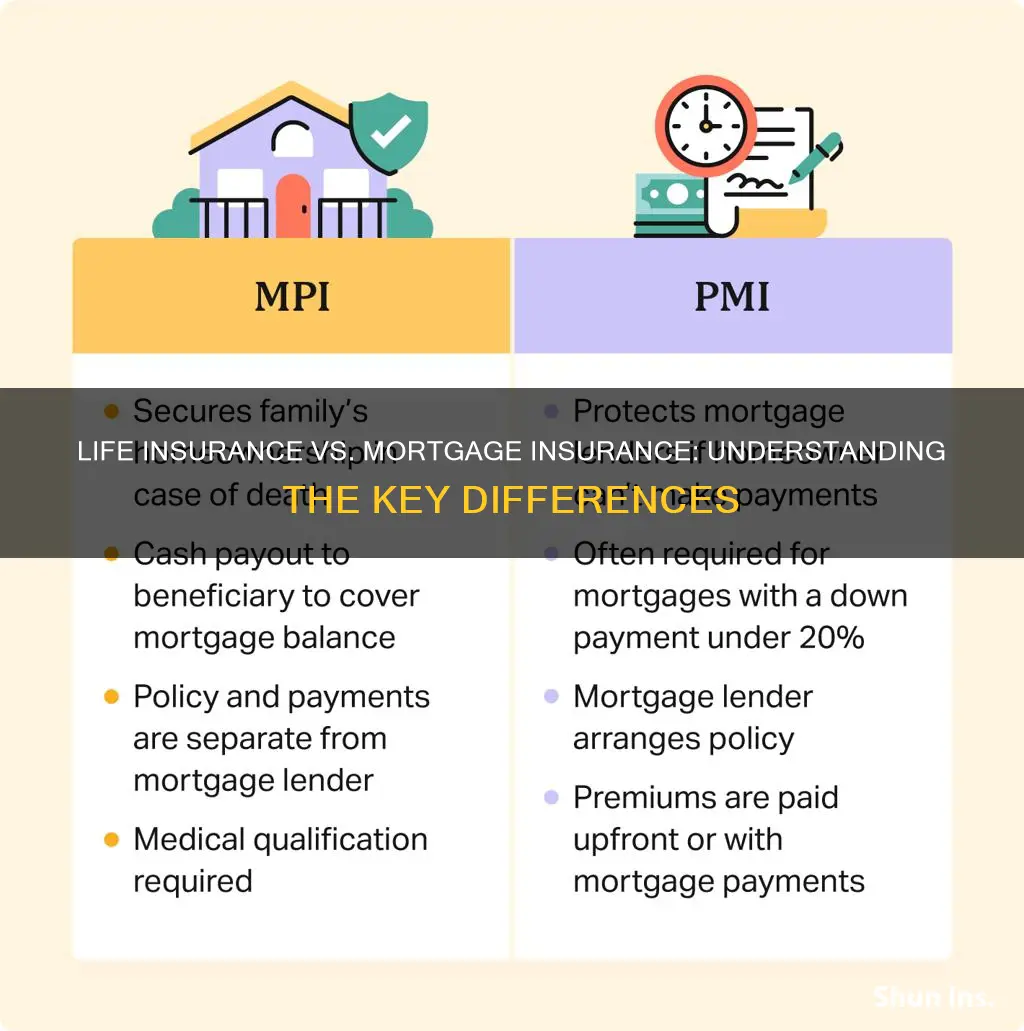

Mortgage insurance, on the other hand, is designed to protect lenders from the financial risk associated with mortgage loans. When a borrower takes out a mortgage to purchase a property, the lender provides the funds, and the borrower agrees to repay the loan over a specified period. Mortgage insurance comes into play when the borrower's down payment is less than 20% of the property's value. In this scenario, the lender requires mortgage insurance to safeguard their investment. This insurance protects the lender if the borrower defaults on the mortgage payments. It ensures that the lender can recover their losses and provides peace of mind, knowing that their financial investment is protected.

The key difference lies in the beneficiaries and the focus of the coverage. Life insurance is centered around providing financial support to the beneficiaries, ensuring their well-being and helping them cope with the financial impact of the insured's death. In contrast, mortgage insurance is a safeguard for lenders, protecting their interests and reducing the risk associated with mortgage lending. While life insurance offers a safety net for loved ones, mortgage insurance ensures the stability of the lending institution.

Understanding Taxable Gains on Life Insurance Policies

You may want to see also

Purpose: Life insurance offers financial security for loved ones, whereas mortgage insurance safeguards the lender's investment

Life insurance and mortgage insurance serve distinct purposes and are designed to protect different stakeholders in the financial landscape. Life insurance is a financial tool that provides a safety net for the beneficiaries, typically the family or loved ones of the insured individual. Its primary purpose is to offer financial security and peace of mind during challenging times. When an individual purchases life insurance, they agree to pay regular premiums in exchange for a death benefit that is paid out upon their passing. This benefit can be a substantial financial cushion for the family, ensuring that their financial obligations, such as mortgage payments, education expenses, or daily living costs, are covered. The loved ones can rely on this financial support to maintain their standard of living and achieve their long-term goals, even in the absence of the primary breadwinner.

On the other hand, mortgage insurance is a safeguard for the lender's investment. It is typically required by lenders when an individual takes out a mortgage to purchase a property. The purpose of mortgage insurance is to protect the lender from potential financial losses if the borrower defaults on the loan. When a borrower secures a mortgage, the lender provides the funds to facilitate the property purchase. To mitigate the risk associated with lending, the lender may require mortgage insurance, especially for loans with a high loan-to-value ratio. This insurance ensures that if the borrower were to default, the lender would be protected, and the lender's investment would be safeguarded.

The key difference lies in the beneficiaries of these insurance policies. Life insurance is designed to benefit the loved ones and ensure their financial well-being, providing a sense of security and stability during emotionally challenging times. In contrast, mortgage insurance is a safety net for the lender, protecting their financial interests and reducing the risk associated with lending large sums of money. While life insurance offers long-term financial security, mortgage insurance is a short-term measure to protect the lender's investment in the property. Understanding these distinctions is essential for individuals to make informed decisions when choosing the right insurance coverage for their specific needs.

Voluntary Life Insurance: Pre-Tax Benefits for Employees

You may want to see also

Risk: Life insurance mitigates the risk of premature death, while mortgage insurance addresses the risk of borrower default on a loan

Life insurance and mortgage insurance are two distinct financial products that serve different purposes and address specific risks. Understanding these differences is crucial for individuals to make informed decisions about their financial well-being.

Life insurance is a financial tool designed to provide financial security and peace of mind to individuals and their loved ones. It primarily focuses on mitigating the risk of premature death. When an individual purchases life insurance, they essentially enter into a contract with an insurance company, agreeing to pay regular premiums in exchange for a death benefit. This death benefit is a lump sum payment that is paid out to the policyholder's beneficiaries upon their passing. The primary purpose is to ensure that the financial obligations and commitments of the deceased are met, providing financial support to their family or dependents. For example, if a breadwinner in a family dies, life insurance can cover funeral expenses, outstanding debts, mortgage payments, or any other financial responsibilities, ensuring the family's financial stability.

On the other hand, mortgage insurance is tailored to address the risk of borrower default on a loan, specifically a mortgage. When an individual takes out a mortgage to purchase a home, the lender requires protection against the possibility of the borrower failing to make payments. This is where mortgage insurance comes into play. There are two main types: private mortgage insurance (PMI) and mortgage insurance premium (MIP). PMI is typically required for borrowers who make a down payment of less than 20% of the home's purchase price. It protects the lender by covering the risk of default. If the borrower defaults, the insurance pays off the remaining mortgage balance. MIP, often associated with government-backed loans like FHA loans, serves a similar purpose but is paid to the government agency rather than a private insurance company.

The key difference lies in the risks they cover. Life insurance is a safety net for the family's financial future, ensuring that loved ones are protected in the event of the insured's untimely death. It provides financial support to cover various expenses and ensures the continuation of a stable lifestyle for the family. On the other hand, mortgage insurance safeguards the lender's interests by mitigating the risk of the borrower defaulting on their loan payments. This is particularly important for lenders, as it allows them to offer mortgages to borrowers with lower credit scores or smaller down payments, who might otherwise be considered high-risk.

In summary, while life insurance provides financial security and peace of mind to individuals and their families, mortgage insurance is a critical component of the lending process, ensuring that lenders are protected against the risk of borrower default. Both forms of insurance play vital roles in different aspects of personal finance, and understanding their unique purposes is essential for making the right choices to protect oneself and one's financial interests.

Term Life Insurance: Multiple Payments or One-Time Premium?

You may want to see also

Term: Life insurance is typically permanent, whereas mortgage insurance may be temporary, ending when the loan is paid off

Life insurance and mortgage insurance are two distinct financial products with different purposes and characteristics. One key difference lies in their duration and permanence. Life insurance is designed to provide financial protection for a policyholder's beneficiaries in the event of their death. It is typically a long-term commitment, often lasting for the policyholder's entire lifetime. This means that once a life insurance policy is in place, it remains active until the insured individual passes away, at which point the death benefit is paid out to the designated recipients. The permanence of life insurance ensures that the policyholder's family or beneficiaries are financially secure during challenging times.

On the other hand, mortgage insurance is a safeguard for lenders and borrowers in the context of home loans. It protects the lender in case the borrower defaults on the mortgage payments. This type of insurance is often required by lenders for borrowers who make a down payment of less than 20% of the home's purchase price. Mortgage insurance can be either private mortgage insurance (PMI) or mortgage insurance premium (MIP), depending on the type of loan and the lender's policies. Importantly, mortgage insurance is typically temporary. It usually ends when the borrower has paid off a substantial portion of the loan, typically when the loan-to-value ratio drops below a certain threshold, often 78% or 80%. At that point, the borrower may choose to remove the mortgage insurance, or it may be automatically canceled, depending on the loan terms.

The key distinction here is that life insurance is a long-term financial commitment, providing lifelong coverage and peace of mind, while mortgage insurance is designed to protect the lender's interests during the initial years of a mortgage. Once the borrower has built up sufficient equity in the home, the need for mortgage insurance diminishes, and it can be terminated. This temporary nature of mortgage insurance ensures that borrowers are not burdened with insurance costs indefinitely, making it a more flexible and cost-effective solution for lenders and borrowers alike. Understanding these differences is essential for individuals to make informed decisions when choosing the right type of insurance coverage for their specific needs.

Who Can Be a Life Insurance Beneficiary?

You may want to see also

Cost: Life insurance premiums are generally higher than mortgage insurance premiums, reflecting the different risks involved

When comparing life insurance and mortgage insurance, one of the most significant differences lies in the cost of premiums. Life insurance premiums tend to be higher compared to mortgage insurance premiums, and this disparity is primarily due to the distinct risks associated with each type of insurance.

Life insurance is a financial safety net designed to provide financial security to beneficiaries in the event of the insured individual's death. The primary risk in life insurance is the uncertainty of the insured person's lifespan. Since the insurance company is guaranteeing a payout upon the insured's death, the longer the policy term, the higher the risk and, consequently, the premium. The insurance provider must account for the possibility of paying out the policy amount within the term, which can be several decades or more.

On the other hand, mortgage insurance is typically required when an individual borrows money to purchase a property. This insurance protects the lender in the event that the borrower defaults on their mortgage payments. The risk here is more immediate and often tied to the borrower's ability to make regular payments. Since mortgage insurance is designed to protect the lender's financial interest, the premiums are generally lower compared to life insurance. The risk is more localized and can be managed more effectively through regular mortgage payments.

The difference in cost can be attributed to the varying levels of risk and the nature of the coverage. Life insurance policies often have longer terms, and the insurance company must consider the entire lifespan of the insured individual. In contrast, mortgage insurance usually covers a specific period, typically the duration of the mortgage, and the risk is more directly tied to the borrower's financial stability during that time. As a result, life insurance premiums are structured to account for the extended period of potential risk, while mortgage insurance premiums are more focused on the immediate financial obligations of the borrower.

Understanding these cost differences is essential for individuals to make informed decisions when choosing between life and mortgage insurance. It highlights the importance of evaluating one's specific needs and circumstances to determine the most suitable insurance coverage.

Life Insurance: Child Coverage and Your Options

You may want to see also

Frequently asked questions

Life insurance is a financial protection tool that provides a monetary benefit to the policyholder's beneficiaries upon their death. It ensures that the loved ones of the insured individual are financially secure during their time of grief and loss. On the other hand, mortgage insurance is designed to protect the lender in the event of the borrower's default on a mortgage loan. It typically covers the remaining balance of the mortgage if the borrower passes away, ensuring the lender gets their money back.

Life insurance can indirectly impact mortgage payments. If an individual has a mortgage and also has a life insurance policy, the death benefit from the life insurance can be used to pay off the outstanding mortgage balance. This means the mortgage lender is protected, and the mortgage loan is not left with a large unpaid sum, which could lead to foreclosure.

Yes, there can be tax considerations for both life and mortgage insurance. Life insurance death benefits are generally tax-free and paid out to the designated beneficiaries. However, the premiums paid for life insurance may be tax-deductible, depending on the jurisdiction and the type of policy. Mortgage insurance, especially private mortgage insurance (PMI), may have tax implications, and the premiums paid can sometimes be tax-deductible, but this varies by country and region. It's essential to consult with a tax professional to understand the specific tax rules applicable to your situation.