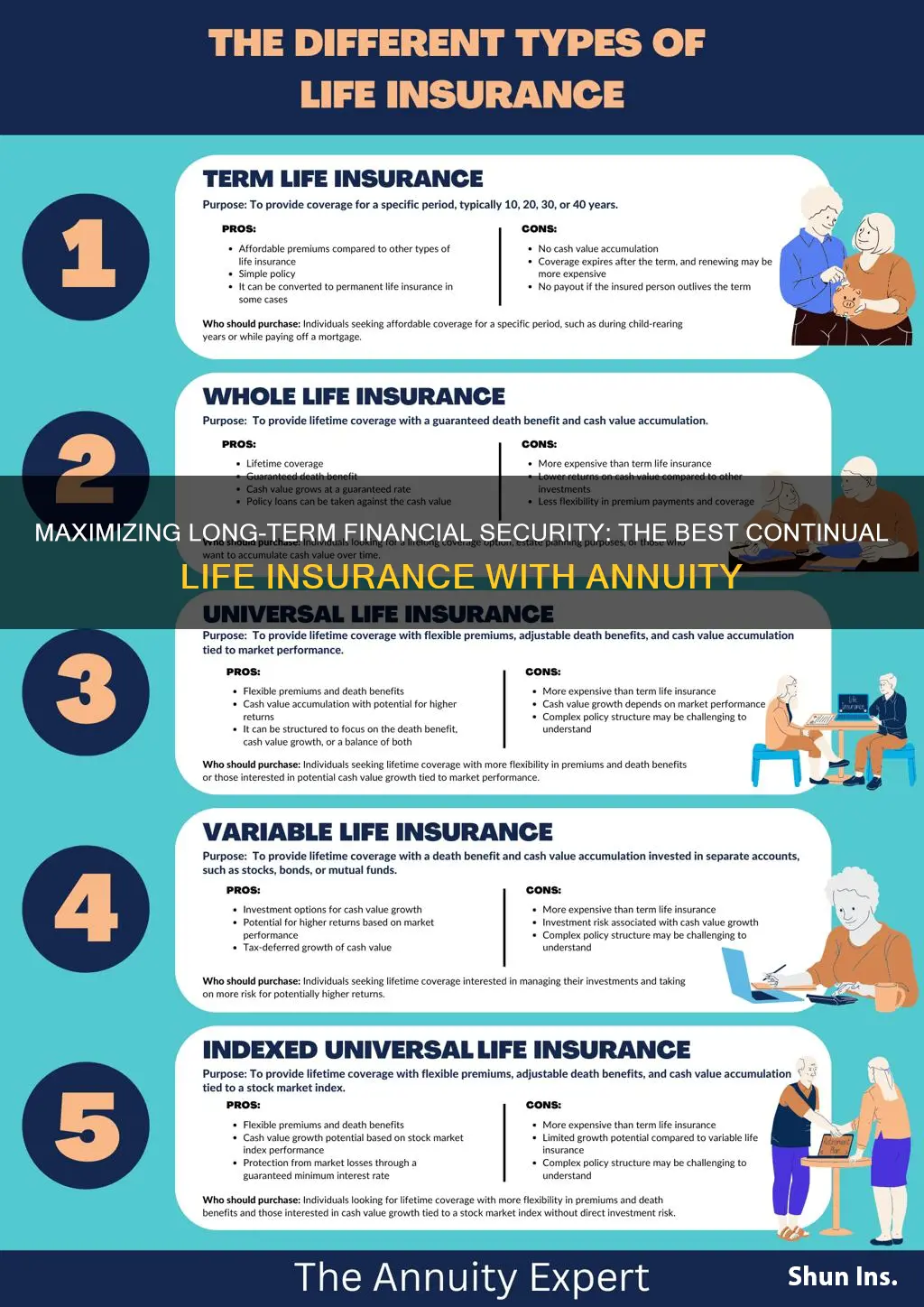

When it comes to choosing the best continuous life insurance policy with an annuity, it's important to consider several factors. These include the financial strength and stability of the insurance company, the policy's coverage and benefits, and the overall cost. Additionally, understanding the different types of annuities and how they work in conjunction with life insurance is crucial. This comprehensive guide will explore the key aspects to consider, helping you make an informed decision about the best continuous life insurance policy with an annuity that suits your needs and financial goals.

What You'll Learn

- Cost-Effectiveness: Compare premiums and benefits to find the most affordable option

- Longevity Guarantees: Look for policies with guaranteed income for life

- Investment Options: Choose a course with flexible investment strategies

- Tax Advantages: Understand tax benefits to maximize savings

- Customer Service: Prioritize companies with excellent support and transparency

Cost-Effectiveness: Compare premiums and benefits to find the most affordable option

When evaluating the cost-effectiveness of different life insurance policies with annuity features, it's crucial to compare the premiums and benefits offered by various providers. Here's a detailed approach to help you make an informed decision:

- Understand Your Needs: Begin by assessing your specific requirements for life insurance and annuity. Consider factors such as your age, health, desired coverage amount, and the length of time you need the policy. Different providers may offer tailored plans to cater to various demographics and needs. For instance, some companies might provide more competitive rates for non-smokers or individuals with a history of healthy lifestyles.

- Compare Premiums: The premium is the amount you pay regularly (monthly, annually, etc.) to maintain your life insurance policy. Lower premiums are generally more affordable, but it's essential to ensure that the policy still provides adequate coverage. When comparing premiums, look for policies that offer a good balance between cost and the benefits provided. Remember that the cheapest option might not always be the best value in the long run.

- Analyze Benefits and Payouts: Life insurance with an annuity component typically offers a combination of death benefits and annuity payments. Evaluate the payout options and ensure they align with your financial goals. Some policies might provide a lump sum payment upon death, while others offer regular income streams through the annuity feature. Consider the potential tax implications of different payout structures as well.

- Review Policy Terms and Conditions: Pay close attention to the terms and conditions of each policy. Understand the conversion options, if any, which allow you to convert the annuity component into a different type of annuity or investment product. Also, check for any surrender charges or fees associated with canceling the policy early. These charges can vary between providers, so it's essential to be aware of them to make a cost-effective choice.

- Seek Professional Advice: Insurance professionals or financial advisors can provide valuable insights and help you navigate the complex world of life insurance and annuities. They can assist in comparing policies, understanding the fine print, and ensuring that the chosen plan meets your long-term financial objectives.

By following these steps, you can make a well-informed decision when selecting a life insurance policy with an annuity component, ensuring that you find the most cost-effective option that suits your needs and provides the necessary financial security. Remember, the best policy is one that offers a good balance between premiums, benefits, and long-term value.

Understanding Life Insurance: Cash Surrender Value Explained

You may want to see also

Longevity Guarantees: Look for policies with guaranteed income for life

When considering long-term financial planning, especially in the context of life insurance and annuities, longevity guarantees are a crucial aspect to explore. These guarantees provide a sense of security and stability, ensuring that you and your beneficiaries will receive a steady income stream regardless of how long you live. Here's why this feature is essential and how to find policies that offer it:

Understanding Longevity Guarantees: Longevity guarantees, in the context of life insurance and annuities, refer to the insurance company's commitment to provide a guaranteed income for life. This means that once you start receiving payments, you can be assured that these payments will continue as long as you are alive. It's a safety net that provides financial security, especially for those concerned about outliving their retirement savings.

Why Look for Guaranteed Income? The primary benefit of longevity guarantees is the peace of mind they offer. Here are a few reasons why this feature is valuable:

- Financial Security: With a guaranteed income, you can plan for a stable future, knowing that your financial needs will be met, even in your later years. This is particularly important for those who want to ensure their long-term financial well-being.

- Long-Term Planning: Annuities with longevity guarantees allow you to make long-term financial decisions with confidence. You can calculate your expected income and plan accordingly, whether it's for retirement, education funds, or other financial goals.

- Risk Mitigation: By locking in a guaranteed income, you reduce the risk of outliving your savings. This is especially relevant for those who want to avoid the uncertainty of relying solely on investment returns, which can fluctuate over time.

Finding Policies with Longevity Guarantees: When shopping for life insurance or annuity products, here's how you can identify policies that offer longevity guarantees:

- Review Policy Documents: Carefully read the terms and conditions of any insurance or annuity policy you are considering. Look for sections that discuss guaranteed income riders or lifetime income benefits. These are often optional add-ons that provide the desired guarantee.

- Consult Financial Advisors: Experienced financial advisors can provide valuable insights and help you navigate the various options available. They can explain the different types of guarantees and recommend policies that align with your financial goals and risk tolerance.

- Compare Policies: Different insurance companies may offer varying levels of guarantees. Compare policies from multiple providers to find the best combination of coverage, fees, and guaranteed income options that suit your needs.

In summary, longevity guarantees are a powerful tool for anyone seeking long-term financial security. By incorporating guaranteed income into your life insurance or annuity policy, you can ensure a steady financial future, even as life expectancy continues to increase. This aspect of financial planning is essential for those who want to make informed decisions and protect their financial well-being.

Calculating Age for Life Insurance: What You Need to Know

You may want to see also

Investment Options: Choose a course with flexible investment strategies

When considering a life insurance course with annuity options, it's crucial to prioritize flexibility in investment strategies. This flexibility allows policyholders to adapt their investments to changing market conditions and personal financial goals. Here's why this feature is essential and how to identify courses that offer it:

Understanding Investment Flexibility: Investment flexibility in life insurance courses refers to the ability to customize and adjust investment choices. This is particularly important because financial markets are dynamic, and what works today might not be optimal in the future. A flexible course should allow policyholders to make changes to their investment allocations, ensuring that their money is managed according to their evolving needs and preferences. For instance, a policyholder might want to increase their equity investments during a bull market or shift towards more conservative options when market volatility is high.

Benefits of Flexible Investment Strategies: Courses with flexible investment options offer several advantages. Firstly, they provide policyholders with control over their financial decisions, allowing them to actively manage their investments. This is especially beneficial for those who prefer a more hands-on approach to their finances. Secondly, flexibility enables policyholders to take advantage of market opportunities. For example, if a particular investment fund is performing exceptionally well, a flexible course would allow the policyholder to reallocate funds to maximize returns. Lastly, flexibility can help in risk management. Policyholders can adjust their investments to align with their risk tolerance, ensuring that their financial strategy remains suitable for their comfort level.

Identifying Flexible Courses: When choosing a life insurance course with annuity, look for the following indicators of flexibility:

- Customizable Portfolios: Opt for courses that offer a range of investment portfolios, each with different asset allocations. This way, you can select a portfolio that matches your risk tolerance and financial objectives.

- Regular Rebalancing: Ensure the course provides the ability to rebalance investments periodically. Rebalancing helps maintain the desired asset allocation and can be especially useful when market conditions change.

- Diverse Investment Options: A flexible course should offer a variety of investment choices, including stocks, bonds, mutual funds, and real estate investment trusts (REITs). Diversification is key to managing risk and maximizing returns.

- Access to Professional Guidance: Consider courses that provide access to financial advisors or investment managers who can offer personalized advice and help adjust investment strategies as needed.

Understanding Tax Implications on Life Insurance Payouts

You may want to see also

Tax Advantages: Understand tax benefits to maximize savings

When it comes to life insurance and annuities, understanding the tax advantages can significantly impact your financial planning and savings. These financial products offer a range of benefits, and being aware of the tax implications is crucial to making informed decisions. Here's a detailed breakdown of how to maximize your savings through tax-efficient strategies:

Tax benefits associated with life insurance and annuities can be substantial, providing an incentive for individuals to utilize these financial tools effectively. One of the primary advantages is the ability to defer taxation on the growth of the policy's value. Life insurance policies, especially those with a cash value component, allow for tax-deferred accumulation. This means that the money invested in the policy can grow tax-free until it's needed. For instance, if you have a whole life insurance policy, the cash value can accumulate over time, and any earnings or interest generated are not taxed until the policyholder withdraws or surrenders the policy. This tax-deferred growth can be particularly beneficial for long-term savings goals.

Additionally, certain types of life insurance policies offer tax-free withdrawals. For instance, with a universal life insurance policy, you can typically take loans or make withdrawals from the policy's cash value without incurring taxes on the earnings. This feature allows policyholders to access their savings without paying taxes on the growth, providing flexibility and control over their finances. It's important to note that these tax advantages are often available to both the policyholder and their beneficiaries, making it a valuable tool for estate planning and wealth transfer.

Maximizing these tax benefits requires a strategic approach. One strategy is to contribute to a life insurance policy through premium payments that are deductible on your tax return. This is particularly advantageous for those in higher tax brackets, as the deduction can significantly reduce your taxable income. Another tactic is to utilize the policy's loan feature, which allows you to borrow against the cash value without triggering a tax event. By carefully managing these tax advantages, you can optimize your savings and potentially reduce your overall tax liability.

Furthermore, understanding the tax treatment of annuity payments is essential. Annuities provide a steady stream of income, and the tax implications can vary depending on the type of annuity. Fixed annuities, for example, offer tax-deferred growth, similar to life insurance policies. Variable annuities, on the other hand, may allow for tax-free withdrawals, but the tax treatment can be more complex. It's crucial to consult with a financial advisor or tax professional to ensure you're taking full advantage of the tax benefits associated with your annuity.

In summary, life insurance and annuities offer significant tax advantages that can contribute to substantial savings. By deferring taxation on growth, providing tax-free withdrawals, and offering deductible premium payments, these financial instruments can be powerful tools for wealth accumulation. Maximizing these benefits requires a strategic approach, and consulting with financial experts can ensure you make the most of these tax-efficient opportunities. Understanding and utilizing these tax advantages can be a key factor in achieving your long-term financial goals.

Unveiling the Mystery: What is Involuntary Life Insurance?

You may want to see also

Customer Service: Prioritize companies with excellent support and transparency

When considering the best options for a continual life insurance course with an annuity, it's crucial to prioritize companies that excel in customer service and maintain high levels of transparency. This is because the process of purchasing and managing life insurance can be complex, and having a reliable support system is essential for a positive experience. Here's why focusing on customer service and transparency is key:

Comprehensive Support: The best companies in this field offer comprehensive support throughout the entire journey. This includes pre-sales assistance, where advisors provide detailed explanations of different policies and help customers understand their needs. Post-sales, they should offer ongoing support, addressing any questions or concerns that may arise. A dedicated customer service team can guide policyholders through the intricacies of their policies, ensuring they feel supported and informed.

Transparency in Communication: Transparency is vital to building trust with customers. Companies should provide clear and concise information about their products, fees, and policy details. This includes explaining the value of the annuity component and how it works in conjunction with the life insurance policy. Transparent communication ensures that customers can make informed decisions and understand the long-term benefits and potential risks associated with their chosen plan.

Efficient Issue Resolution: Excellent customer service also involves prompt and efficient issue resolution. When customers encounter problems or have inquiries, they should be able to reach out to a responsive support team. Whether it's a claim process, policy changes, or general questions, quick response times and effective problem-solving demonstrate a company's commitment to customer satisfaction.

Regular Policy Reviews: Prioritizing companies that offer regular policy reviews is essential. Life insurance needs can change over time, and a good provider will conduct periodic assessments to ensure the policy remains suitable. These reviews allow for adjustments to be made, ensuring the policyholder's best interests are served. Regular communication and policy updates are signs of a company's dedication to customer service.

Educational Resources: Additionally, companies should provide educational resources to empower customers. This can include online tutorials, webinars, or guides that explain various aspects of life insurance and annuities. Educating customers enables them to make more informed choices and understand the long-term implications of their decisions.

By prioritizing companies with excellent customer service and transparency, individuals can ensure they receive the necessary support and guidance when navigating the complexities of life insurance and annuity products. This approach helps in making well-informed decisions and fosters a positive and reliable relationship with the insurance provider.

Life Insurance After a Suicide Attempt: What's the Wait Time?

You may want to see also

Frequently asked questions

A life insurance policy provides a death benefit to beneficiaries upon the insured's passing, offering financial security to loved ones. An annuity, on the other hand, is a long-term financial product that provides regular income payments to the annuitant during their lifetime. It can be used to supplement retirement income and offer tax advantages.

A life insurance policy can be enhanced with an annuity rider, which allows the policyholder to convert a portion of their death benefit into an annuity. This rider provides an additional layer of financial security, ensuring that the policyholder's beneficiaries receive the death benefit, and the annuitant can access a steady income stream.

Combining life insurance and an annuity can offer several advantages. It provides comprehensive financial protection, ensuring that your loved ones are taken care of with a death benefit, while also offering you a steady income stream during your retirement years. This combination can be particularly beneficial for those seeking both long-term financial security and retirement planning.

Yes, there can be tax benefits associated with this type of policy. Life insurance death benefits are generally tax-free, and annuity payments can be tax-deferred, allowing the money to grow tax-free until they are withdrawn. Consult with a financial advisor to understand the specific tax implications based on your jurisdiction.

Selecting the right policy involves considering several factors, including your age, health, financial goals, and the level of coverage you require. It's essential to work with a reputable insurance agent or financial advisor who can guide you through the process, explain different options, and help you choose a policy that aligns with your specific needs and preferences.