When you retire, it's a significant life milestone, and it's a good time to review your financial and insurance plans. One important consideration is whether to keep your life insurance policy. Retirees often have different financial needs and priorities compared to those in the workforce. Some may choose to keep their life insurance to provide financial security for their loved ones, especially if they have dependents or specific financial obligations. Others might opt to review and potentially adjust their coverage, depending on their retirement income and changing circumstances. Understanding the options and benefits of keeping or adjusting your life insurance policy is essential to ensure you make the best decision for your retirement and the well-being of your loved ones.

What You'll Learn

- Policy Ownership: Retirees can choose to keep their life insurance policy, transferring ownership to a beneficiary

- Policy Conversion: Many policies allow conversion to a new plan, ensuring continued coverage

- Beneficiary Selection: Retirees can update beneficiaries, ensuring their loved ones are protected

- Policy Loans: Life insurance can be used as collateral for loans, providing financial flexibility

- Policy Termination: Retirees may choose to terminate the policy, receiving any remaining cash value

Policy Ownership: Retirees can choose to keep their life insurance policy, transferring ownership to a beneficiary

When individuals retire, they often reevaluate their financial assets and insurance policies to ensure they are adequately prepared for their new chapter in life. One important consideration is the status of their life insurance policies during retirement. Many retirees wonder if they can continue to benefit from their life insurance even after stepping away from the workforce. The answer lies in understanding the concept of policy ownership and the options available to retirees.

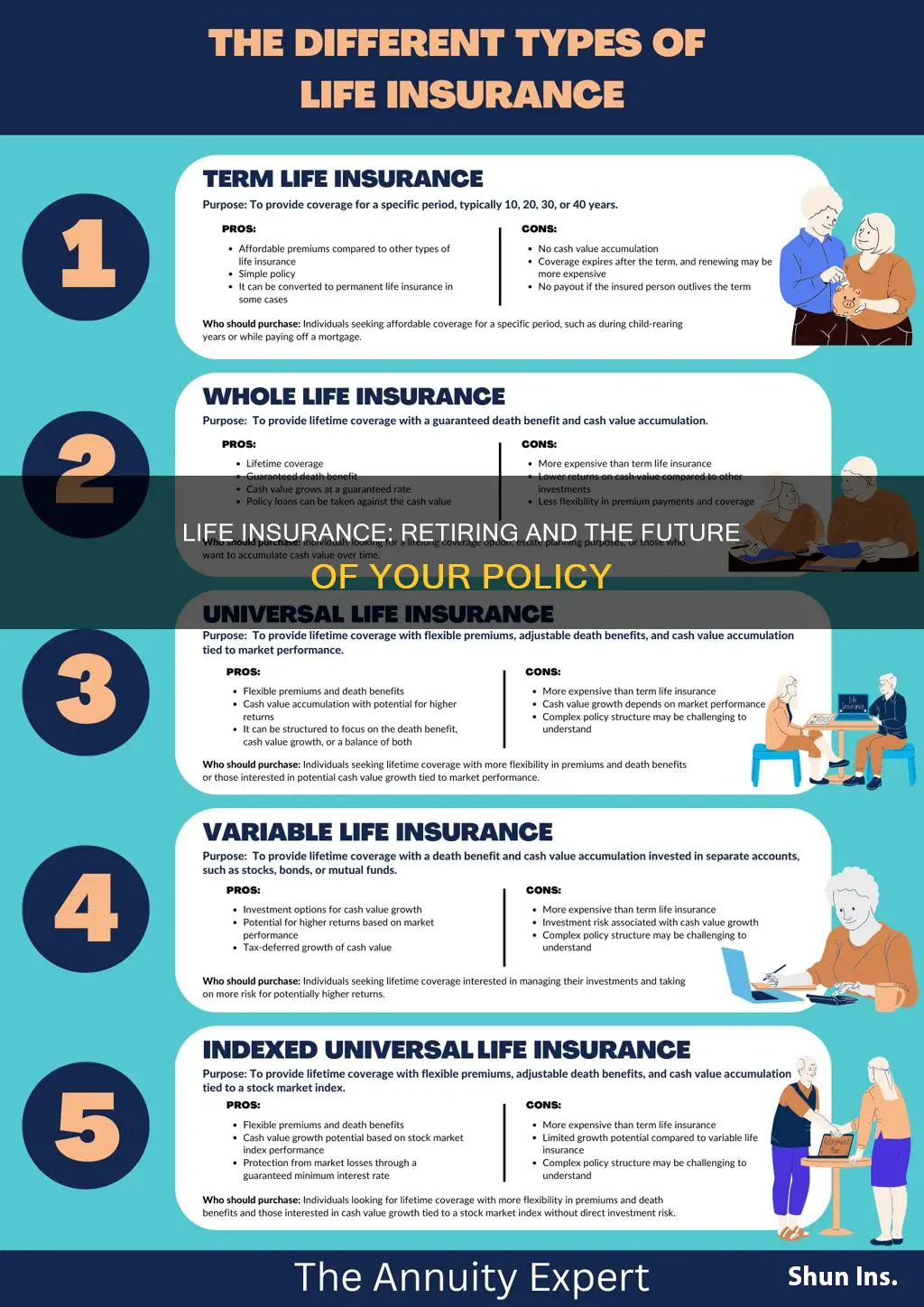

Life insurance policies, whether term or permanent, typically offer the policyholder (the person named as the insured) the right to own and control the policy. This ownership is crucial as it determines who will receive the death benefit upon the insured's passing. Retirees have the flexibility to choose how they want to handle their life insurance policies during this life stage.

One option is for retirees to keep their life insurance policy, ensuring its continued value. By retaining ownership, retirees can decide who will receive the death benefit as the beneficiary. This decision is significant as it allows retirees to provide financial security for their loved ones even in their absence. Retaining ownership also enables retirees to make changes to the policy, such as increasing or decreasing the coverage amount, as their financial needs evolve.

Transferring ownership of the policy is a straightforward process. Retirees can simply notify their insurance company of their decision to keep the policy and provide the necessary documentation. The insurance provider will then update the policy's ownership records to reflect the retiree's choice. It is essential to review the policy's terms and conditions to understand any specific requirements or restrictions regarding ownership changes.

In summary, retirees have the autonomy to decide the fate of their life insurance policies. Keeping the policy and transferring ownership to a beneficiary is a viable option, allowing retirees to maintain control over their financial legacy. This decision ensures that their loved ones remain protected, and the retiree can adapt the policy to their changing circumstances. Understanding the policy's ownership structure empowers retirees to make informed choices about their insurance coverage during retirement.

Deaf People's Access to Life Insurance Options

You may want to see also

Policy Conversion: Many policies allow conversion to a new plan, ensuring continued coverage

When it comes to life insurance, one of the most important considerations for retirees is understanding the options available to them. Many individuals assume that once they retire, their life insurance policy is no longer relevant or necessary. However, this is not always the case, and there are several strategies to ensure that your life insurance remains a valuable asset during retirement. One such strategy is policy conversion, a feature offered by many insurance providers.

Policy conversion is a powerful tool that allows policyholders to transform their existing life insurance policy into a new, tailored plan. This process is particularly beneficial for retirees as it provides an opportunity to adapt the insurance coverage to their changing needs and circumstances. By converting the policy, you can ensure that your life insurance remains relevant and continues to offer financial protection even after retirement. The conversion process typically involves reviewing and updating the policy's terms and conditions to reflect the new plan's requirements. This may include adjusting the coverage amount, policy type, or any other relevant factors to suit the retiree's preferences.

The primary advantage of policy conversion is the ability to maintain continuous coverage without the need for a new application process. Retirees often face unique health considerations, and the conversion allows them to bypass potential medical underwriting, which could be more stringent for older individuals. By converting the policy, you can keep the same level of coverage you had before retirement, ensuring financial security for your loved ones. This is especially crucial if you have dependents or specific financial obligations that require ongoing support.

During the conversion process, it is essential to carefully review the new policy's terms and conditions. This includes understanding the premium payments, policy duration, and any additional benefits or riders that may be included. Retirees should also consider consulting with a financial advisor or insurance specialist to ensure they make informed decisions. These professionals can provide valuable guidance on the best course of action, taking into account the retiree's overall financial plan and retirement goals.

In summary, policy conversion is a valuable strategy for retirees to keep their life insurance relevant and effective. It allows for customization and ensures continued coverage without the complexities of a new application. By exploring this option, retirees can maintain financial protection and peace of mind, knowing that their life insurance remains a reliable asset throughout their retirement journey. Remember, it is always advisable to seek professional advice to make the most of your insurance policy during this significant life transition.

Life Insurance Refund: What Happens When You Cancel?

You may want to see also

Beneficiary Selection: Retirees can update beneficiaries, ensuring their loved ones are protected

When individuals retire, it's a significant life transition, often marking a shift in priorities and responsibilities. One crucial aspect that retirees should not overlook is the management of their life insurance policies. Life insurance is a vital financial tool that provides financial security and peace of mind, especially for those who have dependents or loved ones relying on their income. As retirees, it is essential to review and update the beneficiaries on these policies to ensure that the intended recipients are protected.

Life insurance policies typically allow policyholders to name beneficiaries, who are the individuals or entities that will receive the death benefit upon the insured person's passing. Retirees should periodically review and update this information to reflect any changes in their personal lives. For instance, if a retiree gets married or divorced, or if their children leave home and start their own families, the list of beneficiaries may need to be adjusted. By keeping the beneficiaries up-to-date, retirees can ensure that their life insurance proceeds go to the people who need them the most.

The process of updating beneficiaries is often straightforward and can usually be done by contacting the insurance company. Retirees should provide the insurance provider with the new beneficiary's full name, relationship to the insured, and any other relevant details. It is advisable to keep multiple copies of these updates in a secure place, as they may be required in the event of the retiree's passing. Additionally, maintaining accurate contact information for the insurance company is essential to ensure prompt communication regarding any changes.

One important consideration for retirees is the potential impact of beneficiary selection on estate planning. Life insurance proceeds can be a significant asset in an estate, and proper beneficiary designation can help minimize estate taxes and ensure that the intended beneficiaries receive the funds. Retirees should consult with financial advisors or estate planning professionals to understand how life insurance fits into their overall financial strategy and to make informed decisions about beneficiary selection.

In summary, retirees should not overlook the importance of beneficiary selection and updates for their life insurance policies. By regularly reviewing and adjusting the beneficiaries, retirees can provide financial security for their loved ones and ensure that their life insurance proceeds are distributed according to their wishes. Taking this proactive step will help retirees maintain control over their financial affairs and provide peace of mind during this new phase of life.

Understanding Tax Implications: Cashing Out Universal Life Insurance

You may want to see also

Policy Loans: Life insurance can be used as collateral for loans, providing financial flexibility

Life insurance is a valuable financial tool that provides security and peace of mind for individuals and their loved ones. However, when it comes to retirement, many people wonder about the fate of their life insurance policies. The question of whether you keep your life insurance when you retire is an important consideration, as it can impact your financial plans and overall retirement strategy.

One aspect to explore is the concept of policy loans, which can offer financial flexibility during retirement. When you own a life insurance policy, it becomes an asset that can be utilized in various ways. One such method is taking out a loan against the policy's cash value. This process allows policyholders to access a portion of the policy's value as a loan, providing immediate funds without the need for a medical exam or extensive paperwork. Policy loans can be particularly beneficial for retirees who may require additional income to cover expenses or support their retirement lifestyle.

The loan amount is typically determined by the cash value accumulated in the policy, which grows over time through regular premium payments. This growth is a result of the policy's investment component, where a portion of the premiums is invested in various financial instruments. By accessing this cash value, retirees can tap into a source of funds that is already theirs, without the need to sell the policy or take on additional debt. This approach can be especially advantageous for those who want to maintain their life insurance coverage while also having access to financial resources for other retirement needs.

It's important to note that policy loans are not a replacement for life insurance but rather a way to utilize the policy's value. When you retire, you may choose to keep your life insurance policy if it still serves a purpose, such as providing coverage for your spouse or dependent children. Alternatively, you might decide to reduce the coverage or convert the policy into a different type of insurance product that better suits your retirement goals. The flexibility offered by policy loans allows you to make these decisions based on your evolving financial circumstances.

In summary, life insurance can remain a valuable asset during retirement, and policy loans provide a way to access the cash value of your policy for financial flexibility. This approach enables retirees to make informed choices about their life insurance coverage while also having access to immediate funds. Understanding the options available with life insurance policies can help individuals navigate their retirement finances effectively and ensure they have the necessary resources to support their desired lifestyle.

Seizure's Impact: Life Insurance and Your Health

You may want to see also

Policy Termination: Retirees may choose to terminate the policy, receiving any remaining cash value

When individuals retire, they often reevaluate their financial priorities and may consider the future of their life insurance policies. One important aspect to consider is the option to terminate the policy, especially if the retiree no longer needs the coverage or if the policy's costs become a burden. Terminating a life insurance policy can be a strategic decision, offering retirees the opportunity to access the policy's accumulated cash value.

Life insurance policies, particularly whole life or universal life policies, often accumulate cash value over time. This cash value grows through regular premium payments and investment returns. As retirees age, they may find that the initial reasons for purchasing life insurance, such as providing financial security for dependents or covering business expenses, are no longer relevant. In such cases, terminating the policy can be a wise financial move.

Upon termination, retirees can access the cash value they have built up in the policy. This amount can be withdrawn as a lump sum or used to purchase an annuity, providing a steady income stream during retirement. The cash value represents the policy's investment growth and any additional benefits or dividends earned over the policy's term. By terminating the policy, retirees can unlock this financial asset and potentially use it to supplement their retirement income.

It is essential for retirees to carefully consider the timing and reasons for terminating their life insurance policies. They should evaluate their financial needs, retirement goals, and the overall value of the policy. Consulting with a financial advisor can provide valuable insights into the potential benefits and risks associated with policy termination. Additionally, understanding the specific terms and conditions of the policy, including any surrender charges or penalties, is crucial before making a decision.

In summary, retirees have the flexibility to terminate their life insurance policies, allowing them to access the policy's cash value. This option can provide financial benefits and enable retirees to make informed decisions about their retirement planning. By carefully assessing their needs and seeking professional guidance, retirees can navigate the process of policy termination and make the most of their life insurance assets during this significant life transition.

Life Insurance Annuity Product: How Does It Work?

You may want to see also

Frequently asked questions

Yes, your life insurance policy will typically continue to be in force even after retirement. Life insurance is a long-term financial protection tool, and it is designed to provide coverage for your entire life, regardless of your employment status. Retiring does not automatically cancel your policy, and you can continue to enjoy the benefits it offers.

Absolutely! You can still modify your life insurance policy even after retirement. This may include adjusting the coverage amount, changing the beneficiary, or exploring additional riders or benefits. It's important to review your policy regularly and ensure it aligns with your current financial needs and goals.

If you have a term life insurance policy, which provides coverage for a specific period, and you outlive that term, the policy will generally expire. However, you can consider converting it to a permanent life insurance policy, such as whole life or universal life, which offers lifelong coverage. This conversion can ensure that you maintain the insurance protection you need even as you age.

Retiring and continuing your life insurance policy may have tax considerations. In many cases, the death benefit paid out upon your passing is generally not subject to income tax. However, there might be tax implications if you take out loans or make withdrawals from your policy's cash value. It's advisable to consult with a financial advisor or tax professional to understand the specific tax rules and how they apply to your situation.