Mortgage life insurance is a crucial financial tool for homeowners, providing a safety net in the event of death. When it comes to choosing the best mortgage life insurance, several factors come into play. The ideal policy should offer comprehensive coverage tailored to the borrower's needs, ensuring that their loved ones are financially protected. It's essential to consider the term length, coverage amount, and any additional benefits like waiver of premium or accelerated death benefits. Additionally, understanding the different types of mortgage life insurance, such as level term and decreasing term, can help borrowers make an informed decision. This introduction sets the stage for a detailed exploration of the key considerations and options available when selecting the most suitable mortgage life insurance policy.

What You'll Learn

- Cost-Effectiveness: Compare premiums and coverage to find the most affordable plan

- Coverage Options: Choose from term life, whole life, or universal life policies

- Mortgage Lender Approval: Ensure the insurance provider is approved by your mortgage lender

- Term Length: Select a term length that aligns with your mortgage repayment period

- Customer Reviews: Research and read reviews to gauge customer satisfaction and claims processing

Cost-Effectiveness: Compare premiums and coverage to find the most affordable plan

When considering mortgage life insurance, cost-effectiveness is a crucial factor to evaluate. It's essential to compare different policies and their associated premiums to ensure you're getting the best value for your money. Here's a guide to help you navigate this aspect:

Research and Compare Premiums: Start by gathering information from various insurance providers. Obtain quotes for mortgage life insurance policies, ensuring that the coverage amount aligns with your mortgage value. Pay attention to the monthly or annual premium rates. Lower premiums might indicate more affordable coverage, but it's important to consider the policy's overall value.

Understand Coverage Options: Mortgage life insurance typically offers two main types of coverage: level term and decreasing term. Level term insurance provides a fixed amount of coverage throughout the policy term, while decreasing term insurance reduces over time to match the decreasing mortgage balance. Evaluate your needs and the potential risks associated with your mortgage to determine the most suitable coverage type.

Review Policy Details: When comparing policies, scrutinize the fine print. Look for any additional fees, policy exclusions, and waiting periods. Some policies might offer lower premiums but have higher fees or shorter waiting periods, which could impact the overall cost. Ensure you understand the terms and conditions to make an informed decision.

Consider Your Health and Lifestyle: Insurance providers often factor in personal health and lifestyle factors when determining premiums. Provide accurate information about your medical history, smoking status, and any other relevant details. Quitting smoking, for instance, can significantly reduce premiums. Being proactive in managing your health can lead to more affordable insurance options.

Long-Term Savings: Think about the long-term financial implications. While a cheaper policy might be tempting, consider the potential savings over time. Some policies may have lower initial premiums but could result in higher costs later due to policy changes or increased risk assessments. Choose a plan that offers a balance between affordability and long-term financial stability.

By comparing premiums, understanding coverage options, and considering personal factors, you can make an informed decision when selecting the most cost-effective mortgage life insurance policy. It's a careful process that ensures you receive adequate coverage without compromising your financial well-being.

Term Life Insurance: Affordable Coverage for Specific Needs

You may want to see also

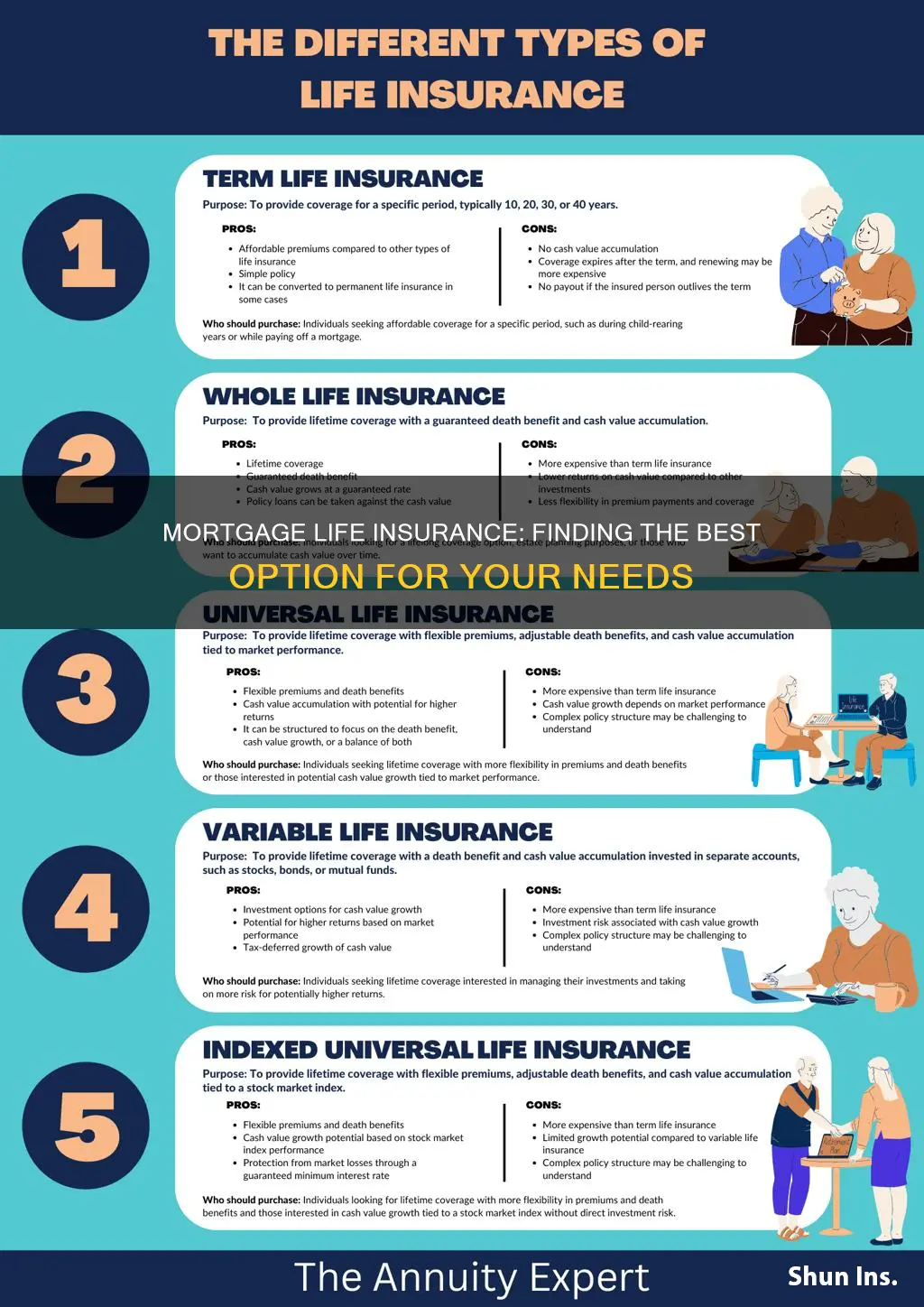

Coverage Options: Choose from term life, whole life, or universal life policies

When considering mortgage life insurance, one of the key decisions you'll need to make is choosing the right type of coverage. This decision will significantly impact the financial security of your loved ones and the protection you receive. Here's a breakdown of the coverage options available:

Term Life Insurance: This is a straightforward and cost-effective choice. Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years. During this term, the policy offers a death benefit if the insured individual passes away. The beauty of term life is its simplicity and affordability. It's ideal for individuals who want a temporary safety net to cover mortgage payments if something happens. For example, if you have a 30-year mortgage, a 20-year term life policy can ensure that your family is protected during the most critical years of the loan. Once the term ends, you can choose to renew the policy or opt for a different type of coverage.

Whole Life Insurance: In contrast to term life, whole life insurance offers permanent coverage for the entire lifetime of the insured individual. This means that as long as premiums are paid, the death benefit will be paid out upon the insured's death. One of the significant advantages of whole life is its guaranteed payout, which can provide long-term financial security. Additionally, whole life policies accumulate cash value over time, which can be borrowed against or withdrawn. This feature can be beneficial if you want to build a personal savings or have additional financial needs. However, whole life insurance is generally more expensive than term life due to its permanent nature and the accumulation of cash value.

Universal Life Insurance: Universal life insurance offers flexibility and potential long-term benefits. It provides permanent coverage, similar to whole life, but with adjustable premiums and a variable death benefit. The premiums are typically higher than term life but lower than whole life during the initial years. One of the key advantages of universal life is the flexibility it offers. You can choose to pay higher premiums to increase the death benefit or lower premiums to manage costs. Over time, the policy can accumulate cash value, which can be used to pay for future premiums or taken out as a loan. This option is suitable for those who want both coverage and the potential for long-term financial growth.

When deciding on the best mortgage life insurance, consider your financial goals, the length of your mortgage, and your family's long-term needs. Term life is excellent for short-term protection, while whole life provides permanent coverage and potential savings. Universal life offers a balance between coverage and flexibility. It's essential to evaluate your options and choose a policy that aligns with your specific circumstances and preferences.

Alabama Teachers' Life Insurance: What's Covered?

You may want to see also

Mortgage Lender Approval: Ensure the insurance provider is approved by your mortgage lender

When considering the best mortgage life insurance, it's crucial to ensure that the insurance provider is approved by your mortgage lender. This step is often overlooked, but it is a critical aspect of the process that can impact your mortgage application's success. Here's why it matters and how to navigate this requirement:

Understanding Mortgage Lender Approval:

Mortgage lenders have specific guidelines and criteria for approving insurance providers. They want to ensure that the insurance company can honor its commitments and provide the necessary coverage in the event of the borrower's death. Approval by the lender means that the insurance provider meets their standards and is willing to work within their framework. This approval process typically involves the insurance company providing detailed information about their financial stability, claims history, and ability to fulfill policy obligations.

Why It's Important:

Obtaining approval from your mortgage lender is essential because it demonstrates the insurance provider's reliability and commitment to the lender's interests. Lenders want to minimize risks, and by approving the insurance company, they ensure that the policyholder's family will receive the intended financial benefit in the event of a tragedy. This approval process also allows the lender to verify the insurance company's reputation and financial strength, which can provide peace of mind for both parties involved.

Steps to Ensure Approval:

- Research and Compare: Start by researching various mortgage life insurance providers and compare their offerings. Look for companies with a strong financial rating and a history of prompt claims processing.

- Check Lender Guidelines: Review your mortgage lender's guidelines or guidelines provided by the lender's association. These documents often list approved insurance providers or provide criteria for approval. Ensure that the insurance company you choose meets these standards.

- Contact the Lender: If the desired insurance provider is not explicitly listed as approved, contact your mortgage lender directly. Inquire about their approval process and any specific requirements they have for insurance companies. They may provide a list of approved providers or guide you through the necessary steps to obtain approval.

- Provide Necessary Documentation: When applying for mortgage life insurance, ensure that you provide all the required documentation to the lender. This may include financial statements, market analysis, and any other information the lender requests to assess the insurance company's credibility.

By following these steps, you can ensure that your chosen mortgage life insurance provider is approved by your lender, making the mortgage application process smoother and increasing the chances of a successful outcome. Remember, this approval process is a standard practice to protect both the borrower and the lender's interests.

Schizophrenia and Life Insurance: Insuring Your Sister

You may want to see also

Term Length: Select a term length that aligns with your mortgage repayment period

When considering mortgage life insurance, one of the most critical decisions you'll make is selecting the appropriate term length. This decision is crucial as it determines the duration for which you'll have coverage, ensuring financial protection for your loved ones during the term of your mortgage. Here's a guide to help you choose the right term length:

Assess Your Mortgage Duration: Start by understanding the length of your mortgage. Most mortgages are typically 15 to 30 years in duration. For instance, if you have a 25-year mortgage, you'll want a term of insurance that covers this entire period. The goal is to ensure that your beneficiaries receive financial support if something happens to you during the time you're making those mortgage payments.

Consider Future Plans: Your life circumstances can change over time. If you plan to pay off your mortgage early, consider a term length that allows for flexibility. For example, a 10-year term might be suitable if you anticipate selling your home or refinancing in the near future. On the other hand, if you're likely to keep the mortgage for the long term, a longer term length, such as 20 or 30 years, would provide comprehensive coverage.

Evaluate Affordability: Mortgage life insurance premiums can vary based on the term length. Longer terms generally result in lower monthly premiums but higher overall costs. Conversely, shorter terms offer higher monthly payments but lower cumulative costs. It's essential to balance the coverage you need with your budget to ensure you can afford the premiums over the selected term.

Review and Adjust: Life insurance needs can change over time, so it's a good practice to review your policy periodically. If you take on additional debt or have a significant life event, such as getting married or having a child, you may want to adjust your term length to ensure continued adequate coverage. Regularly assessing your situation will help you make informed decisions about your mortgage life insurance.

Remember, the term length should complement your mortgage repayment schedule and provide the necessary financial security for your loved ones. It's a personalized choice, and consulting with a financial advisor can help you make an informed decision based on your unique circumstances.

ADHD and Life Insurance: What You Need to Know

You may want to see also

Customer Reviews: Research and read reviews to gauge customer satisfaction and claims processing

When considering the best mortgage life insurance, customer reviews and feedback are invaluable resources to help you make an informed decision. Researching and reading reviews can provide insights into the experiences of other policyholders, allowing you to understand the strengths and weaknesses of different insurance providers. Here's how you can effectively utilize customer reviews to your advantage:

Online Reviews and Ratings: Start by searching online platforms and review websites dedicated to insurance products. Websites like Trustpilot, Google Reviews, or dedicated insurance review sites often host customer testimonials and ratings. These reviews can offer a snapshot of the overall customer satisfaction level with a particular mortgage life insurance company. Look for patterns in the feedback; positive reviews might highlight efficient claims processing, helpful customer service, and competitive pricing, while negative reviews could indicate delays in claims, complicated processes, or unexpected policy exclusions.

Focus on Claims Processing: One of the critical aspects of mortgage life insurance is the claims process. When reading reviews, pay close attention to how other customers describe their experiences with filing and settling claims. Did the insurance company respond promptly to their claims? Were the claims settled fairly and efficiently? Positive reviews often mention quick and straightforward claims processing, indicating a reliable and responsive insurance provider. On the other hand, negative reviews might highlight delays, denied claims, or a lack of transparency, which could be red flags.

Customer Service and Support: Excellent customer service can significantly impact your overall experience with mortgage life insurance. Reviews often provide insights into the responsiveness and helpfulness of the insurance company's customer support team. Look for reviews that mention friendly and knowledgeable representatives, quick response times, and effective resolution of issues. Positive customer service experiences can make a significant difference, especially during challenging times when policyholders need support.

Long-Term Satisfaction and Policy Features: Customer reviews can also give you an idea of how satisfied policyholders are with the long-term features of the insurance policy. This includes understanding the coverage provided, the flexibility of the policy, and any additional benefits or drawbacks mentioned by customers. For instance, some reviews might highlight the ease of policy customization or the availability of additional riders, while others might point out unexpected policy limitations.

Comparing Reviews Across Providers: When researching multiple mortgage life insurance companies, compare their reviews to identify trends and common themes. If several reviews consistently mention excellent customer service and efficient claims processing for one provider, it could be a strong indicator of their reliability. Conversely, if multiple reviews highlight the same issues with a particular company, it might be best to steer clear of that provider.

By thoroughly researching and analyzing customer reviews, you can gain a comprehensive understanding of the best mortgage life insurance options available. This research empowers you to make a well-informed decision, ensuring that you choose a provider that aligns with your needs and expectations in terms of customer satisfaction and claims processing.

Life Insurance: Who Has It and Who Doesn't?

You may want to see also

Frequently asked questions

Mortgage life insurance is a type of term life insurance designed to help protect your loved ones and ensure your mortgage is paid off in the event of your death. It provides a lump sum payment to your beneficiaries, which can be used to cover any remaining mortgage balance and other final expenses.

When you take out a mortgage, the lender often requires mortgage life insurance to protect their investment. The insurance policy pays out a predetermined amount if you pass away during the term of the policy, ensuring that your family is financially protected and the mortgage is settled.

The primary benefit is providing financial security to your family. If you die, the insurance payout can help cover living expenses, education costs, and other debts, ensuring your loved ones are taken care of. It also guarantees that your mortgage will be paid off, preventing your family from inheriting a financial burden.

When selecting a policy, consider the following: the term length should cover the duration of your mortgage, the coverage amount should be sufficient to pay off the mortgage and provide for your family's needs, and choose a reputable insurance company with good customer service. It's also essential to review the policy details, including premiums, exclusions, and any waiting periods before coverage begins.