The consumer protection cycle in life insurance is a comprehensive framework designed to safeguard the interests of policyholders throughout the entire lifecycle of their insurance products. This cycle encompasses various stages, starting with the initial selection and purchase of a policy, followed by ongoing management and review, and ultimately concluding with claims processing and settlement. It ensures that insurance companies adhere to strict regulations, provide transparent communication, and offer fair treatment to policyholders, fostering trust and long-term relationships. Understanding this cycle empowers individuals to make informed decisions, manage their policies effectively, and ensure they receive the protection they need when it matters most.

What You'll Learn

- Pre-Purchase Awareness: Understanding consumer rights and insurance basics before buying a policy

- Policy Review: Regularly assessing the policy to ensure it meets changing needs

- Claim Process: Knowing how to file and manage claims for a smooth experience

- Regulatory Oversight: Understanding the role of regulators in protecting consumers

- Complaint Resolution: Effective mechanisms for addressing consumer concerns and disputes

Pre-Purchase Awareness: Understanding consumer rights and insurance basics before buying a policy

The process of purchasing life insurance is a significant financial decision, and being well-informed before committing to a policy is crucial for consumer protection. Pre-purchase awareness is the initial phase of the consumer protection cycle, where individuals educate themselves about their rights and the fundamentals of insurance. This step empowers consumers to make informed choices and ensures they are not caught off guard by unexpected terms or conditions.

When considering life insurance, it is essential to understand that consumers have specific rights that should be respected by insurance providers. These rights include the right to accurate and transparent information, fair pricing, and prompt claim settlements. Before making a purchase, potential policyholders should familiarize themselves with their legal rights as outlined by relevant insurance regulations. This knowledge ensures that they are aware of any protections or guarantees they are entitled to.

A key aspect of pre-purchase awareness is grasping the basics of life insurance. This involves comprehending the different types of policies available, such as term life, whole life, and universal life insurance. Each type has its own advantages and disadvantages, and understanding these differences is vital. For instance, term life insurance provides coverage for a specified period, while whole life offers lifelong protection. By educating themselves, consumers can identify the policy that best suits their needs and financial goals.

Additionally, consumers should learn about the various factors that influence insurance premiums. These factors may include age, health status, lifestyle choices, and the amount of coverage required. By assessing these elements, individuals can make informed decisions about the level of coverage they can afford and still meet their financial obligations. This awareness helps in avoiding surprises when reviewing quotes and ensures that the chosen policy aligns with their expectations.

In the pre-purchase stage, it is also beneficial to research and compare different insurance providers. Consumers can look for companies with a strong reputation for customer satisfaction and financial stability. Reading reviews and checking ratings can provide valuable insights into the experiences of other policyholders. This due diligence ensures that individuals select a reputable insurer who is likely to honor their commitments and provide excellent customer service.

By taking the time to educate themselves during the pre-purchase phase, consumers can make more confident and secure decisions when buying life insurance. This awareness empowers them to ask the right questions, understand policy details, and negotiate terms that are favorable and in line with their expectations. Ultimately, pre-purchase awareness is a critical step in the consumer protection cycle, enabling individuals to protect themselves and their loved ones effectively.

Whole Life Insurance: Ponzi Scheme or Smart Investment?

You may want to see also

Policy Review: Regularly assessing the policy to ensure it meets changing needs

The consumer protection cycle in life insurance is a comprehensive process designed to safeguard the interests of policyholders throughout their insurance journey. This cycle emphasizes the importance of regular policy reviews, which are essential for maintaining the relevance and effectiveness of life insurance policies. By conducting periodic assessments, individuals can ensure that their insurance coverage remains aligned with their evolving circumstances and objectives.

A policy review is a critical step in the consumer protection cycle as it allows for a comprehensive evaluation of the insurance policy. This process involves examining various aspects of the policy, including coverage amounts, beneficiaries, policy terms, and any additional benefits or riders. During a review, policyholders can assess whether the policy adequately addresses their current financial obligations, family responsibilities, and long-term goals. It provides an opportunity to identify any gaps in coverage and make necessary adjustments to ensure comprehensive protection.

Regular policy reviews are particularly important due to the dynamic nature of life events and financial situations. Over time, individuals may experience significant changes such as marriage, the birth of children, career advancements, or the acquisition of substantial assets. These life events can impact the level of insurance coverage required. For instance, a young couple starting a family might need to increase their life insurance coverage to secure their children's future, while a retiree may consider reducing coverage as their financial obligations diminish. By reviewing the policy periodically, individuals can proactively adjust their insurance plans to reflect these changes.

During a policy review, individuals should also consider the performance and fees associated with their insurance products. This includes evaluating investment-linked policies, where a portion of the premium is invested in various funds. Policyholders should assess the investment performance, fees, and potential risks associated with these investment options. Regular reviews enable individuals to make informed decisions about their insurance investments and ensure that they align with their risk tolerance and financial objectives.

In summary, the consumer protection cycle in life insurance emphasizes the significance of regular policy reviews. These reviews empower individuals to take control of their insurance coverage, ensuring it adapts to their changing needs. By conducting periodic assessments, policyholders can make informed decisions, address coverage gaps, and optimize their insurance plans, ultimately providing a robust level of protection for themselves and their loved ones. It is a proactive approach that contributes to a more secure and resilient financial future.

Critical Life Insurance: What Does It Cover?

You may want to see also

Claim Process: Knowing how to file and manage claims for a smooth experience

The claim process is a critical aspect of life insurance, ensuring that policyholders receive the benefits they are entitled to when a covered event occurs. Understanding how to file and manage claims efficiently can significantly impact the overall experience, making it smoother and less stressful. Here's a comprehensive guide to navigating the claim process effectively:

Initiating the Claim: When a policyholder or their designated beneficiary needs to file a claim, the first step is to contact the insurance company. This can typically be done through various channels, such as a dedicated phone line, online portal, or email. It is essential to have all the necessary documentation ready to initiate the process. This includes the policy document, proof of the insured's death or illness (if applicable), medical records, and any other relevant supporting documents. Promptly contacting the insurance company ensures that the claim process begins without unnecessary delays.

Documentation and Evidence: The insurance company will require comprehensive documentation to assess the claim. Policyholders should gather and organize all the necessary papers, including the death certificate (in case of the insured's passing), medical reports, hospital records, and any other evidence supporting the claim. For instance, in the case of a critical illness claim, medical professionals' notes and test results are crucial. Ensuring that the information is accurate and complete is vital to avoid any complications during the evaluation process.

Claim Submission and Follow-up: After gathering the required documents, the next step is to submit the claim to the insurance company. This may involve filling out claim forms, providing detailed descriptions of the event, and submitting supporting evidence. It is advisable to keep a record of the submission, including dates and reference numbers. Following up with the insurance company at regular intervals is essential to ensure the claim is being processed. This proactive approach helps identify any potential issues early on and allows for prompt resolution.

Claim Review and Payout: Upon receiving the claim, the insurance company will conduct a thorough review. This process involves verifying the information, assessing the validity of the claim, and determining the payout amount. The time taken for this review can vary depending on the complexity of the case and the insurance provider's procedures. During this period, it is beneficial to maintain open communication with the insurance representative to address any queries or concerns. Once the claim is approved, the payout process begins, and the benefits will be disbursed according to the policy terms.

Managing Delays and Disputes: Despite the insurance company's efforts, delays can occur due to various reasons, such as missing documentation or complex claim scenarios. In such cases, policyholders should remain patient and actively engage with the insurance provider to resolve any issues promptly. If a dispute arises, it is advisable to seek clarification and, if necessary, involve a legal advisor to protect one's rights. Effective communication and a thorough understanding of the policy terms can help navigate these challenges successfully.

Suicide and Life Insurance: What Families Need to Know

You may want to see also

Regulatory Oversight: Understanding the role of regulators in protecting consumers

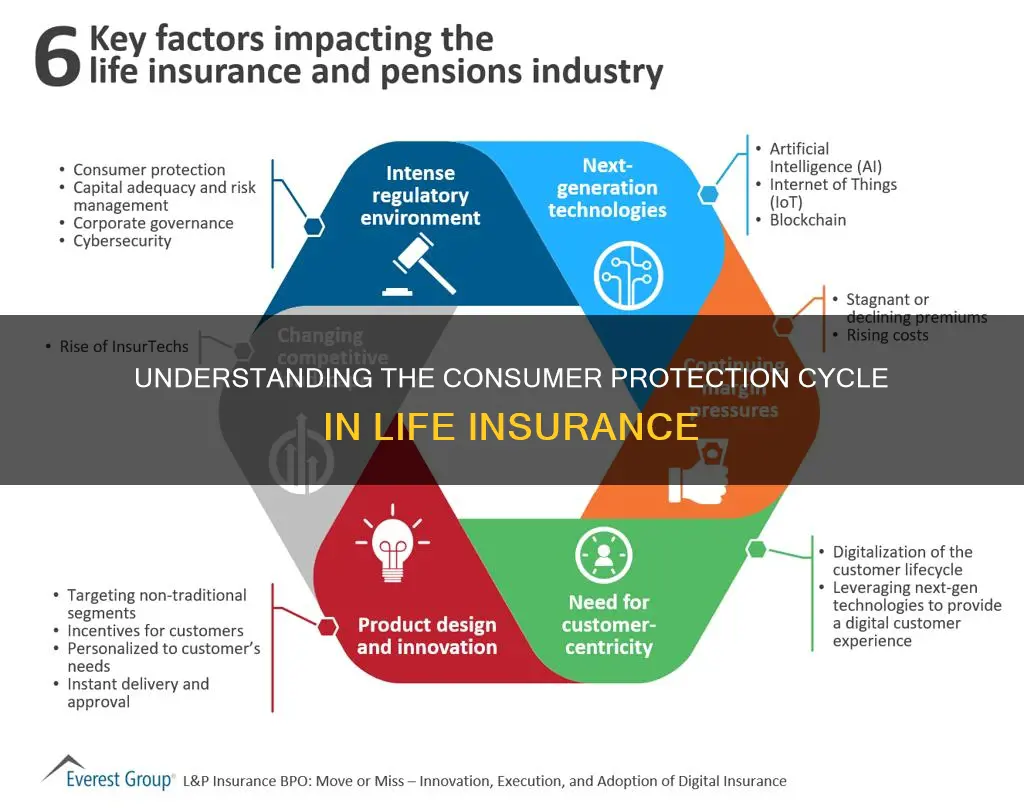

The consumer protection cycle in life insurance is a comprehensive framework designed to safeguard the interests of policyholders and ensure fair practices within the insurance industry. This cycle encompasses various stages, from the initial sale of a policy to ongoing monitoring and enforcement. At its core, the cycle aims to provide a structured approach to consumer protection, allowing regulators to identify and address potential issues while promoting transparency and accountability.

Regulatory oversight plays a pivotal role in this cycle, as it involves the active involvement of government bodies and financial authorities in monitoring and regulating the life insurance sector. These regulators are tasked with establishing and enforcing rules and standards that protect consumers' rights and interests. Their primary objective is to create a level playing field, ensuring that insurance companies operate with integrity and provide fair treatment to policyholders.

The role of regulators is multifaceted. Firstly, they set and enforce guidelines for insurance companies, including requirements for policy documentation, disclosure of terms and conditions, and the handling of customer complaints. These guidelines aim to prevent misleading or deceptive practices, ensuring that consumers receive clear and transparent information about their insurance products. Regulators also mandate regular reporting and financial disclosures, enabling them to assess the stability and solvency of insurance providers.

In addition to setting standards, regulators actively monitor the market for any violations or misconduct. They investigate complaints and conduct inquiries to identify potential issues, such as unauthorized fees, delays in claim settlements, or inappropriate sales practices. By taking prompt action, regulators can impose penalties, revoke licenses, or require corrective measures to protect consumers from harm. This proactive approach ensures that insurance companies remain accountable and adhere to the established consumer protection standards.

Furthermore, regulatory bodies often provide a mechanism for consumers to seek redress. They establish complaint resolution processes, allowing policyholders to voice their concerns and seek assistance. Through these channels, regulators facilitate communication between consumers and insurance companies, promoting timely resolutions to disputes. This aspect of regulatory oversight is crucial in maintaining trust and ensuring that consumers' rights are respected throughout the insurance lifecycle.

Prudential Life Insurance: Is It a Good Choice?

You may want to see also

Complaint Resolution: Effective mechanisms for addressing consumer concerns and disputes

The consumer protection cycle in life insurance is a comprehensive process designed to safeguard the interests of policyholders and ensure fair treatment throughout the insurance journey. This cycle typically involves several stages, each playing a crucial role in maintaining transparency, accountability, and consumer satisfaction. Understanding this cycle is essential for both insurance providers and policyholders to navigate the complexities of life insurance effectively.

Complaint Resolution: A Critical Component

Complaint resolution is a vital aspect of the consumer protection cycle, as it directly addresses consumer concerns and disputes. When a policyholder encounters an issue or disagreement with their insurance provider, an efficient and fair resolution process is essential to maintain trust and ensure compliance with regulatory standards. Effective complaint resolution mechanisms can significantly impact the overall consumer experience and the reputation of the insurance company.

Mechanisms for Efficient Dispute Resolution:

- Clear Communication Channels: Insurance companies should establish multiple communication channels for policyholders to voice their concerns. This may include dedicated customer service hotlines, email addresses, online chat support, or physical offices. By providing various contact options, insurers ensure accessibility and convenience for policyholders, encouraging them to reach out when needed.

- Internal Complaint Handling: Upon receiving a complaint, the insurance company's internal processes should be prompt and efficient. This involves assigning a dedicated team or individual to review and investigate the issue. The resolver should gather all relevant information, document the complaint, and provide regular updates to the policyholder. Timely responses and proactive issue resolution are key to maintaining customer satisfaction.

- Mediation and Arbitration: In cases where internal resolution is challenging, insurance providers can offer mediation or arbitration services. Mediation involves a neutral third party facilitating a discussion between the policyholder and the insurer to reach a mutually agreeable solution. Arbitration, on the other hand, is a more formal process where a neutral arbitrator makes a binding decision. These methods provide an alternative dispute resolution, ensuring a fair and unbiased outcome.

- Regulatory Oversight: Insurance regulators play a crucial role in complaint resolution. They establish guidelines and standards for insurers to follow, ensuring fair treatment of policyholders. Regulators may also provide external complaint resolution services, offering an independent review process. Policyholders can often file complaints directly with the regulatory body if they are dissatisfied with the insurer's response, ensuring an additional layer of protection.

- Continuous Improvement: Insurance companies should continuously monitor and evaluate their complaint resolution processes. Regularly analyzing complaint data can identify areas for improvement, allowing insurers to enhance their services and policies. This iterative approach demonstrates a commitment to consumer protection and fosters a positive relationship with policyholders.

By implementing these effective mechanisms, insurance providers can ensure that consumer concerns are addressed promptly and fairly, contributing to a robust consumer protection cycle in life insurance.

Understanding Term to 90 Life Insurance: A Comprehensive Guide

You may want to see also

Frequently asked questions

The consumer protection cycle is a process designed to safeguard the interests of life insurance policyholders throughout the entire lifecycle of their insurance policies. It involves several stages, including pre-purchase, post-purchase, policy administration, claims handling, and ongoing support.

During the pre-purchase stage, consumers are provided with clear and comprehensive information about different life insurance products. This includes understanding the policy terms, coverage options, premiums, and any associated fees. Regulators and insurance companies ensure that consumers make informed decisions by disclosing all relevant details.

After purchasing a life insurance policy, the post-purchase phase focuses on policy administration. This includes verifying the accuracy of personal and financial information, setting up policy accounts, and ensuring timely premium payments. Insurance companies also provide policyholders with access to their policy details and offer support for any policy-related inquiries.

When a policyholder makes a claim, the claims handling process comes into play. This involves verifying the claim, assessing the validity, and providing financial compensation as per the policy terms. Insurance companies are required to handle claims efficiently, fairly, and transparently, ensuring that policyholders receive their rightful benefits.

Throughout the policy's lifecycle, insurance companies offer ongoing support to policyholders. This includes providing regular policy updates, assisting with policy changes or modifications, and offering guidance on policy-related matters. Policyholders can also access customer service for any questions or concerns they may have.