Life insurance is considered an asset class, and it can be a valuable financial asset for the policyholder during their life. The cash value of a life insurance policy can be considered an asset when applying for a bank loan and when calculating net worth. The death benefit of a life insurance policy can also be considered an asset, as seen in the life settlement industry.

The type of life insurance policy determines whether it is an asset or a liability. Whole life insurance, for example, can be considered an asset to the policyholder as it allows for the early access of cash value and is mostly protected under bankruptcy proceedings in many states. On the other hand, term life insurance is not usually considered an asset due to the lack of cash value, unless converted into a permanent life insurance policy.

Life insurance companies, especially life and annuity insurers, have extensive assets under management to support liability needs. As of year-end 2023, the US insurance industry had $8.5 trillion of reported total assets. The rapid influx of new entrants and the evolution of asset allocation and investment strategies of life insurance companies have caught the attention of regulatory bodies, prompting proposals for several new rules on the management and reporting of assets held by insurance companies.

| Characteristics | Values |

|---|---|

| Purpose | To meet future financial obligations and obtain a profit |

| Scope | Life insurance and annuities |

| Importance | The amount of resources committed to, and the extent of the controls applied to, a model should relate to the combination of the degree of reliance on model results and the financial importance of the results |

| Asset and liability inventories | The actuary should consider grouping asset or liability inventory data or other model inputs to produce reasonable results |

| Model structure | The actuary should consider the need for stochastic results, company and management practices in projecting future non-guaranteed elements, and policyholder behaviour in projecting future cash flows |

| Assumptions | The actuary should establish assumptions that are appropriate in light of the model's intended purpose |

| Validation and analysis | The nature and degree of model validation and analysis may be specified by the principal, by existing law or regulation, or by the actuary |

| Presentation of results | The actuary should present results of a realisation of the model in an understandable fashion, explaining methodology, key assumptions and any changes since a prior realisation |

| Governance and controls | The actuary should use appropriate model governance and controls to avoid the introduction or use of unintentional or untested changes and to maintain the integrity of the model |

What You'll Learn

Life Insurance as an Asset Class

Life insurance policies have a cash value, which can be viewed as part of a fixed-income portfolio. Insurers invest over 85% of policyholder premiums in investment-grade fixed income, offering high levels of capital protection and steady income from interest payments. This gives insurers liquidity, allowing them to turn their investments into cash on demand.

Life insurance companies guarantee policyholder returns, often at a rate of 1-2% per year. This guaranteed return supports the policy's cash value growth. Life insurance has lower risk and lowers volatility compared to a fixed-income portfolio.

Life insurance policies can also be used as collateral for loans, and the death benefit is paid out as a guaranteed fixed cash payout. This is in contrast to an investment portfolio, which can fluctuate due to stock market crashes and bond market corrections.

Types of cash-value life insurance

- Universal life insurance (ULI): Part of the premium gets invested, and policy owners can choose how. A popular type is indexed universal life insurance, where the insurer credits the policy based on the underlying performance of the investment.

- Whole life insurance (WOL): Part of the policy premium is invested by the insurer to grow the guaranteed cash value. Whole life insurance is the most secure type of life insurance policy.

- Variable universal life insurance (VUIL): The policy premium gets invested into shares, bonds, property and commodities. Values fluctuate with market returns, and policyholder cash values can fall as well as rise.

How to leverage life insurance as an asset

- Borrow against your policy: Take a loan from the life insurer, using the policy's cash value as collateral.

- Use your policy as collateral: Use your life insurance policy as collateral for a traditional bank loan.

- Withdraw from the policy's cash value: Make direct withdrawals from your policy's cash value. Unlike a loan, these funds do not need to be repaid, but any withdrawals may reduce the death benefit available to your beneficiaries.

- Surrender the policy (cash out): Surrender your policy if you no longer need life insurance coverage. This can be useful if your financial needs have changed, but it will end your life insurance coverage entirely.

Safety of life insurance as an asset

The guarantees that insurers provide are only as good as the company giving them, so it is important to choose an insurer with a very high financial strength rating.

Life insurance as part of your portfolio

Life insurance can be a powerful tool in any investor's portfolio, providing a death benefit that can increase your portfolio value for your family or the next generation. Adding life insurance to your portfolio can increase returns and reduce risk.

Life insurance is like an asset class in that it is an investment with an expected future cash value. However, unlike other assets, it also provides a safety net for loved ones.

Life Insurance: Benefiting From Your Own Policy?

You may want to see also

Whole Life Insurance as an Asset

Life insurance is a financial asset that can be used to benefit loved ones after death, but it can also be used as an asset during one's life. Whole life insurance is a type of permanent life insurance that can be used as an asset. It has a guaranteed death benefit that will never decrease as long as the premiums are paid and offers policyholders the ability to accumulate cash value. A portion of the premium paid every month goes into a cash value account, which accumulates over time at a minimum guaranteed rate indicated by the policy. The cash value of a whole life insurance policy can be used in a variety of ways, such as providing a source of funds during retirement or helping with estate planning.

Whole life insurance policies can also be used as collateral for loans, and the cash value can be accessed tax-free if the policy is designed properly. The cash value of a whole life insurance policy is considered a liquid asset because it can be accessed, although there may be fees or taxes involved. The ability to borrow against the cash value of a whole life insurance policy makes it a valuable financial tool for individuals and businesses.

In addition to the death benefit, whole life insurance policies offer living benefits such as cash value accumulation, which can be used to supplement retirement income, pay for unexpected expenses, or be borrowed against to purchase a home or invest in a business. The cash value of a whole life insurance policy can also be used to pay for long-term care expenses or fund a child's education.

Whole life insurance policies also provide policyholders with the ability to access the death benefit early if needed. This is known as an "accelerated death benefit" and can be used to cover medical expenses or other financial needs. Policyholders can typically withdraw a portion of the death benefit, and the remaining benefit will be paid out to their beneficiaries upon their death.

Whole life insurance policies also offer tax advantages. The cash value growth of a policy is tax-deferred, and if the policy is structured properly, the policyholder can access the cash value tax-free. Additionally, the death benefit paid out to beneficiaries is generally income tax-free.

Whole life insurance policies also provide policyholders with the ability to access the death benefit early if needed. This is known as an "accelerated death benefit" and can be used to cover medical expenses or other financial needs, such as long-term care costs. Policyholders can typically withdraw a portion of the death benefit, and the remaining benefit will be paid out to their beneficiaries upon their death.

When considering a whole life insurance policy as an asset, it is important to weigh the benefits against the costs. Whole life insurance policies tend to have higher premiums than other types of life insurance, such as term life insurance. Additionally, the cash value of a policy may not grow as quickly as other investments, and there may be penalties for surrendering the policy early. It is also important to consider the opportunity cost of investing in a whole life insurance policy, as the money used to pay the premiums could potentially be invested elsewhere.

Overall, whole life insurance can be a valuable asset for individuals and businesses, providing financial protection, flexibility, and tax advantages. It is important to carefully consider one's financial goals and needs when deciding whether to purchase a whole life insurance policy and to work with a qualified financial advisor to determine if it is the right choice.

Life Insurance and Taxes: What Documents Do You Need?

You may want to see also

Universal Life Insurance as an Asset

Universal life insurance is a type of permanent life insurance that offers lifetime coverage as long as you pay your premiums. It is an asset because it has a cash value element, which can be used as a financial asset during your life. This cash value grows over time and earns interest, and you can borrow against it without tax implications.

Universal life insurance is one of the two main types of permanent life insurance, the other being whole life insurance. Universal life insurance is more flexible than whole life insurance because it allows you to raise or lower your premiums within certain limits, and it can be cheaper. However, universal life insurance offers fewer guarantees than whole life insurance because if you make minimal premium payments for too long, it can impact cash value growth and the size of your death benefit.

Universal life insurance policies function similarly to whole life insurance policies in that they allow policyholders to grow an asset by accruing interest over time that can be borrowed against. However, with universal life insurance policies, the premiums aren't set and are subject to change, and there are no guarantees on the rate your money will earn over time.

Universal life insurance can be a valuable financial asset and can be used to borrow against or cash in your savings portion, which grows tax-deferred over your lifetime. It can also be used as collateral for a loan, making it easier to get approved or get a better rate.

- Take a loan from your policy: You can borrow against the cash value of your universal life insurance policy, but be sure to read the fine print as the interest rate can be fixed or variable, and it is set by the insurer.

- Use your policy as collateral for a loan: You can use your universal life insurance policy as collateral for a loan, which can make it easier to get approved or get a better rate.

- Withdraw funds: You can make withdrawals from your policy that are yours to keep, but note that if your withdrawal dips into your investment gains, you'll need to pay taxes.

- "Accelerated" benefits: Some policies enable you to receive your benefits during your lifetime if an unexpected or extreme medical emergency arises.

- Surrender the policy (cash out): Surrendering your policy means cancelling your coverage and getting back the cash value you put in, less any fees charged by the insurance company.

Universal life insurance is a powerful financial tool that can help protect your family's financial well-being and can give you the flexibility to build assets, deal with uncertainties, and even pass on wealth to the next generation.

Regulation's Impact: Life Insurance Industry's Future

You may want to see also

Life Insurance as a Financial Asset

Life insurance is increasingly being recognised as an asset class, with applications for investors and policyholders. Life insurance companies have a large number of assets under management to support liability needs. As of the end of 2023, the US insurance industry had $8.5 trillion of total assets, equivalent to approximately 40% of assets held by all US commercial banks. This heavy capitalisation has attracted investors such as private equity firms to invest in the life insurance sector.

Life insurance can be a financial asset for policyholders to use during their lifetime, similar to an IRA or mutual fund. Policyholders can build cash value over time and access it in several ways. The two main types of permanent life insurance that can be used as an asset are whole life insurance and universal life insurance.

Whole life insurance is the most common type of permanent life insurance, offering a death benefit and the ability to accumulate cash value. A portion of the premium is put into a cash value account, which accumulates over time at a minimum guaranteed rate. Premiums on these policies typically don't increase over the life of the policy. Universal life insurance functions similarly, allowing policyholders to accrue interest over time that can be borrowed against. However, premiums are not set and may change, and there is no guaranteed rate of return. Variable universal life insurance, a subset of universal life insurance, enables policyholders to invest their earnings in the accounts of their choosing, such as mutual funds, with the potential to earn more over time.

Policyholders can borrow against the cash value of their permanent life insurance policy, use it as collateral for a loan, or make withdrawals. These options provide liquidity and can enhance a policyholder's wealth-building strategy. Additionally, life insurance can be a valuable addition to an investment portfolio, providing diversification and reducing risk. It is often compared to cash or fixed income, offering guaranteed returns and lower volatility than a fixed-income portfolio.

Life insurance as an asset class is a powerful tool for investors and policyholders, providing financial benefits during the policyholder's lifetime and a death benefit for their beneficiaries.

Obesity and Life Insurance: What's the Connection?

You may want to see also

Life Insurance Models and Regulations

Life insurance companies have a large number of assets under management to support their liability needs. In the US, the insurance industry had a reported total of $8.5 trillion in assets as of the end of 2023, equivalent to approximately 40% of assets held by all commercial banks in the country. This has attracted seasoned investors such as private equity firms to invest their capital in the life insurance sector.

The rapid influx of new entrants and the evolution of asset allocation and investment strategies in the life insurance industry have caught the attention of regulatory bodies, leading to proposals for new rules on the management and reporting of assets held by insurance companies. These regulations aim to enhance the clarity and understanding of complex assets and their risk profiles.

Types of Life Insurance Models

There are two main types of permanent life insurance that can be used as an asset:

#### Whole Life Insurance

Whole life insurance is the most common type of permanent life insurance. It offers a death benefit and allows the policyholder to accumulate cash value over time. A portion of the premium paid every month is put into a cash value account, which accumulates at a minimum guaranteed rate. The premiums on these policies typically remain fixed throughout the life of the policy.

#### Universal Life Insurance

Universal life insurance functions similarly to whole life insurance, allowing policyholders to grow an asset by accruing interest over time that can be borrowed against. However, the premiums for universal life insurance are not set and are subject to change. Under the universal life insurance umbrella is variable universal life insurance, which enables policyholders to invest their earnings into accounts of their choosing, such as mutual funds, potentially earning higher returns.

Life Insurance Regulations

Regulations for the life insurance industry are set by bodies such as the National Association of Insurance Commissioners (NAIC) in the US. These regulations cover various aspects of the industry, including asset reporting and risk monitoring, with the aim of ensuring that insurance companies maintain sufficient reserves to meet future obligations to policyholders.

One example of a regulatory proposal is the requirement for a more detailed bond definition. Special Purpose Vehicles (SPVs) have often been used to convert underlying equity-like investments into debt instruments. The NAIC will enforce a principle-based bond definition driven by the substance of the investment design rather than its legal form, which will take effect in January 2025.

Another example is the formation of the Risk-Based Capital Investment Risk and Evaluation (E) Working Group by the NAIC. This group updated the C-1 charge of the residual tranche from 30% to 45% for the 2024 year-end reporting to address the underlying risk of structured products and maintain consistency between capital charges across assets with the same risk level.

It is important to note that regulations may vary depending on the region and specific circumstances, and life insurance companies must ensure they comply with the applicable laws and guidelines set by the relevant regulatory bodies.

Life Insurance and Home Equity: What's the Connection?

You may want to see also

Frequently asked questions

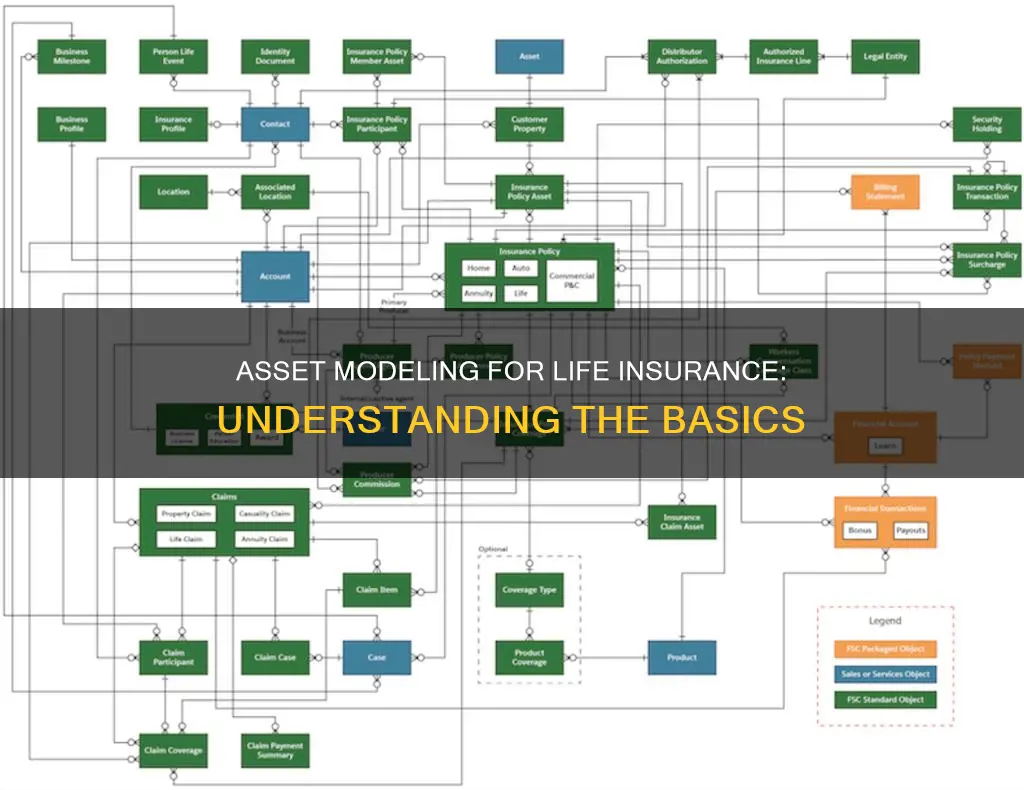

Asset modelling for life insurance is the process of using models to represent the complex assets and liabilities of life insurance companies. This involves structuring a model to meet its intended purpose, selecting or building a model to meet that purpose, and validating and analysing the model.

The key steps in the process of asset modelling for life insurance include:

- Selecting or building a model to meet the intended purpose.

- Operating the model to meet the intended purpose.

- Structuring the model to meet its intended purpose.

- Validating and analysing the model.

- Presenting the results.

Asset modelling for life insurance can provide a number of benefits, including:

- Improved decision-making: By using models to represent the complex assets and liabilities of life insurance companies, asset modelling can help actuaries and other stakeholders make more informed decisions.

- Risk management: Asset modelling can help identify and manage risks associated with life insurance policies, such as mortality, longevity, and investment risks.

- Regulatory compliance: Asset modelling can help life insurance companies comply with regulatory requirements and enhance the clarity and understanding of their complex assets and risk profiles.

- Enhanced investment strategies: Asset modelling can inform and improve investment strategies by providing a more detailed understanding of the assets and liabilities involved.

While asset modelling for life insurance can provide valuable insights and benefits, it also has some limitations. These include:

- Data limitations: The quality and availability of data can impact the accuracy and reliability of asset models.

- Model complexity: Developing and maintaining complex models can be resource-intensive and time-consuming.

- Assumptions and simplifications: Models often rely on assumptions and simplifications that may not fully capture the complexity and dynamics of real-world situations.

- Validation and uncertainty: Validating models and managing uncertainty can be challenging, particularly when dealing with stochastic models and future projections.