Insurance rates can vary significantly across different regions and locations, often influenced by factors such as local demographics, crime rates, natural disaster risks, and the overall cost of living. Some areas may experience higher insurance premiums due to increased risks, such as frequent natural disasters or higher crime rates, while other regions might offer more competitive rates due to lower risk profiles and fewer claims. Understanding these variations can help individuals and businesses make informed decisions when choosing insurance providers and coverage options.

What You'll Learn

- Geographical Factors: Insurance rates vary due to regional risks like natural disasters

- Demographics: Age, gender, and population density influence insurance costs

- Crime Rates: Higher crime areas often have increased insurance premiums

- Healthcare Access: Limited healthcare access can lead to higher insurance costs

- Economic Conditions: Economic stability and unemployment rates impact insurance pricing

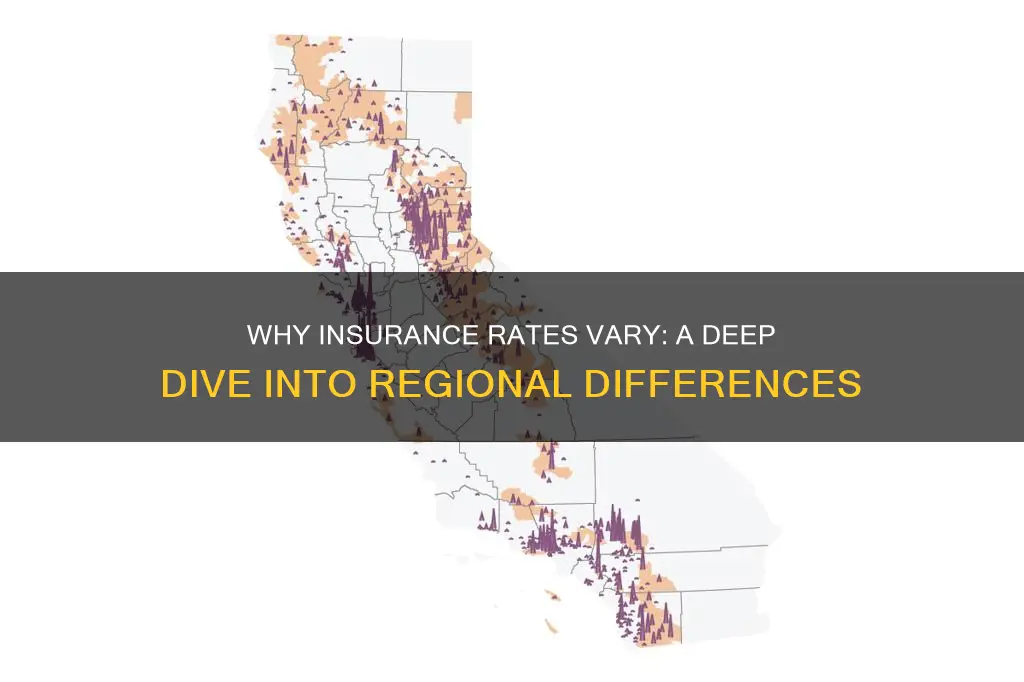

Geographical Factors: Insurance rates vary due to regional risks like natural disasters

The cost of insurance can indeed fluctuate significantly across different regions, and geographical factors play a crucial role in these variations. One of the primary reasons for these differences is the varying levels of risk associated with specific areas, particularly when it comes to natural disasters.

In regions prone to frequent and severe natural disasters such as hurricanes, earthquakes, floods, or wildfires, insurance rates tend to be higher. These events can cause extensive damage to property and infrastructure, leading to substantial financial losses for insurance companies. As a result, insurers often charge higher premiums to account for the increased risk and potential costs associated with these disasters. For instance, homeowners in coastal areas may face higher insurance rates due to the higher risk of hurricane damage, while residents in earthquake-prone regions can expect more expensive insurance coverage.

The frequency and intensity of natural disasters in a particular region are key considerations for insurance providers. Areas with a history of frequent natural disasters often experience higher insurance premiums as insurers need to factor in the potential for more frequent claims. Additionally, the severity of these events can also impact insurance rates. More catastrophic disasters can lead to higher insurance costs, as the potential for large-scale damage and subsequent claims is greater.

Geographical location also influences insurance rates due to the varying costs of living and doing business in different regions. In areas with a higher cost of living, insurance premiums may be elevated to reflect the increased expenses associated with repairing or replacing damaged property. Similarly, regions with a higher density of businesses or critical infrastructure may have elevated insurance rates due to the potential for more significant economic losses in the event of a disaster.

Understanding these geographical factors is essential for individuals and businesses when evaluating insurance options. By considering the regional risks and their impact on insurance rates, people can make more informed decisions about their coverage and potentially find more affordable insurance solutions in areas with lower disaster risks.

Family Members and Auto Insurance

You may want to see also

Demographics: Age, gender, and population density influence insurance costs

Age, gender, and population density are key demographic factors that significantly impact insurance costs. These elements are often considered by insurance providers when calculating premiums, as they can influence the likelihood and severity of potential risks.

Age is a critical factor in many insurance types. For instance, in health insurance, younger individuals typically pay lower premiums as they are less likely to require extensive medical care. As people age, their risk of developing health issues increases, leading to higher insurance costs. Similarly, in auto insurance, younger drivers often face higher premiums due to their lack of driving experience and higher accident rates. Conversely, older drivers may benefit from lower rates as they are generally considered less risky. This age-based pricing is a common practice in the insurance industry to manage risk and ensure sustainable operations.

Gender also plays a role in insurance pricing, although the reasons behind these differences are often debated. Historically, women have been associated with lower insurance premiums, particularly in auto and health insurance. This is partly due to statistical data showing that women generally have fewer accidents and are less likely to develop certain health conditions. However, it's important to note that gender-based pricing is increasingly being questioned and challenged due to potential discrimination. As a result, many regions are moving towards gender-neutral insurance rates.

Population density is another significant factor affecting insurance costs. In densely populated areas, the concentration of people and their assets increases the risk of various events, such as accidents, natural disasters, and theft. This higher risk is reflected in elevated insurance premiums. For example, in urban cities, homeowners' insurance rates are often higher due to the increased likelihood of property damage or theft. Similarly, in crowded neighborhoods, auto insurance costs may be more expensive due to the higher risk of accidents and the potential for more frequent vehicle repairs.

Additionally, population density can impact the availability and cost of insurance. In less populated or rural areas, insurance providers might have fewer customers, which can lead to higher premiums to ensure profitability. This is often referred to as the 'rural premium' effect. Conversely, in highly populated regions, insurance companies may have more competition, potentially driving down costs for consumers.

Understanding these demographic influences is essential for individuals and businesses to navigate the insurance market effectively. By considering age, gender, and population density, consumers can make informed decisions when selecting insurance policies, ensuring they receive appropriate coverage at competitive prices.

How Driving Monitors Affect Auto Insurance Rates

You may want to see also

Crime Rates: Higher crime areas often have increased insurance premiums

In regions with higher crime rates, insurance premiums tend to be elevated due to the increased risk of property damage and theft. Insurance companies often consider the local crime statistics when determining the cost of coverage. Areas with a higher incidence of burglaries, vandalism, and other criminal activities are typically associated with a greater likelihood of insurance claims, which can lead to higher premiums for residents. This is because the likelihood of a claim being made is directly related to the frequency of crimes in a given area.

The relationship between crime rates and insurance costs is a complex one. Insurance providers analyze various factors, including crime statistics, to assess the potential risks associated with insuring a particular location. When a neighborhood experiences a surge in criminal activities, it signals a higher potential for financial losses for the insurance company. As a result, they may increase the premiums to account for this additional risk. This is especially true for comprehensive insurance policies that cover a wide range of potential losses, such as home and auto insurance.

For instance, if a city has a reputation for being a hotspot for car theft, insurance companies might charge higher rates for auto insurance in that area. The reasoning is straightforward: the higher the crime rate, the more likely it is that a vehicle will be stolen or damaged, leading to increased costs for the insurance provider. Similarly, home insurance premiums can be affected by the frequency of burglaries and property crimes in a specific neighborhood.

Understanding the impact of crime rates on insurance premiums is essential for residents and businesses alike. It highlights the importance of considering local crime statistics when making insurance decisions. For individuals, this knowledge can encourage them to take additional security measures to protect their homes and belongings, potentially lowering their insurance costs. For businesses, it may prompt them to review their insurance coverage and explore options that provide adequate protection while managing their insurance expenses effectively.

In summary, higher crime rates often result in increased insurance premiums due to the elevated risk of claims. Insurance companies use crime statistics as a critical factor in their pricing models to ensure they can adequately cover potential losses. Being aware of this correlation can empower individuals and businesses to make informed choices regarding their insurance coverage, ultimately helping them manage their financial risks more effectively.

The Art of Waiting: Navigating the Timeline of Auto Insurance Adjusters

You may want to see also

Healthcare Access: Limited healthcare access can lead to higher insurance costs

Limited healthcare access is a significant issue in many regions, and it has a direct impact on insurance costs. When healthcare facilities and services are scarce or inaccessible, individuals and communities face higher financial burdens when they need medical care. This phenomenon is particularly evident in rural areas or regions with a shortage of healthcare professionals and specialized treatments.

In places with limited healthcare access, insurance companies often have to consider the increased risk and cost associated with providing coverage. Here's how this relationship works: Firstly, when there are fewer medical resources available, patients may require more frequent and specialized care, which can be expensive. For instance, in rural communities, residents might need to travel long distances to access essential medical services, including emergency care, specialized surgeries, or advanced diagnostic tests. These additional transportation costs and the need for out-of-town specialists can significantly impact insurance premiums.

Secondly, limited healthcare access often leads to a higher prevalence of chronic diseases and health complications. Without easy access to regular check-ups, preventive care, and timely treatment, individuals are more likely to develop untreated or poorly managed conditions. As a result, insurance providers may experience increased claims for chronic disease management, emergency room visits, and long-term care, all of which contribute to higher insurance rates in these areas.

Furthermore, the lack of healthcare infrastructure can lead to a higher incidence of preventable diseases and health issues. For example, regions with limited access to clean water and sanitation facilities may experience higher rates of infectious diseases, which can be costly to treat and manage. Insurance companies might need to account for these additional healthcare costs, especially in areas where the overall health of the population is at risk.

Addressing limited healthcare access is crucial for both improving public health and reducing insurance costs. Strategies such as investing in local healthcare facilities, increasing the number of medical professionals, and implementing telemedicine solutions can help bridge the gap. By ensuring better healthcare accessibility, regions can work towards lowering insurance premiums and providing more affordable coverage for their residents.

Mastering Root Insurance: Tips for Safe and Efficient Driving

You may want to see also

Economic Conditions: Economic stability and unemployment rates impact insurance pricing

Economic stability and unemployment rates are significant factors that influence insurance pricing across different regions. In areas with a stable economy, insurance companies often offer more competitive rates due to lower risk. This is because a stable economic environment typically indicates a lower likelihood of widespread financial losses, which are a primary concern for insurance providers. For instance, regions with a growing job market and low unemployment rates may witness more affordable insurance premiums, as individuals and businesses are generally more financially secure. Conversely, in economically volatile areas, insurance prices tend to be higher. This is because higher unemployment rates often lead to increased insurance claims, as more people may require financial support in the form of insurance payouts. As a result, insurance companies may charge higher premiums to account for the potential financial burden.

During economic downturns or recessions, insurance prices can skyrocket. This is a direct consequence of the higher risk associated with such periods. When unemployment rises, the number of people making insurance claims increases, putting more strain on insurance companies' resources. As a result, insurers may adjust their pricing strategies to ensure they can cover potential losses and maintain profitability. This dynamic is particularly evident in the health and life insurance sectors, where economic conditions can significantly impact the overall health and longevity of policyholders, thereby affecting insurance costs.

The relationship between economic conditions and insurance pricing is complex and often interrelated with other factors. For instance, in regions with a high cost of living, insurance premiums may be elevated to reflect the increased financial burden on individuals and businesses. Similarly, areas prone to natural disasters or specific health risks may experience higher insurance rates due to the anticipated higher claims. Understanding these economic influences is crucial for both insurance consumers and providers, as it helps in making informed decisions and managing expectations regarding insurance costs.

Insurance companies often employ sophisticated risk assessment models that consider various economic indicators to determine pricing. These models analyze historical data, current market trends, and regional economic factors to predict potential risks and set appropriate premiums. By incorporating economic stability and unemployment rates, insurers can better assess the likelihood of claims and adjust their pricing strategies accordingly. This approach ensures that insurance prices reflect the unique characteristics of each region, promoting fair and sustainable insurance practices.

In summary, economic conditions, particularly economic stability and unemployment rates, play a pivotal role in shaping insurance pricing across different places. Regions with stable economies and low unemployment tend to offer more affordable insurance, while economically volatile areas may result in higher premiums. Insurance providers' pricing strategies are intricately linked to these economic factors, allowing them to manage risks and ensure financial stability. Understanding these influences is essential for individuals and businesses seeking insurance coverage, as it enables them to make informed choices and navigate the complexities of insurance pricing in various geographical contexts.

Unleash Your Potential: A Guide to High-Performance Insurance Broker Success

You may want to see also

Frequently asked questions

Insurance rates can vary significantly due to several factors, including the cost of living, crime rates, population density, and the frequency of natural disasters in a specific area. For instance, regions with a higher risk of hurricanes or earthquakes may have elevated insurance premiums due to the potential for extensive damage.

The location of your home plays a crucial role in determining insurance premiums. Factors like the neighborhood's crime rate, the proximity to emergency services, and the local infrastructure can influence the likelihood of certain events, such as theft, vandalism, or damage from severe weather.

Yes, insurance rates often tend to be higher in urban areas. Urban centers typically have higher population densities, which can lead to increased competition for resources and potentially higher crime rates. Additionally, the concentration of buildings and infrastructure in cities may result in more significant damage during natural disasters, contributing to elevated insurance costs.

Absolutely. The local economy and employment rates can impact insurance rates. Areas with higher unemployment rates or economic instability might experience increased insurance claims due to financial hardship or a higher risk of theft or vandalism. Insurance companies may adjust premiums accordingly to account for these factors.

Insurance companies use various data sources and statistical models to assess risk and set rates. They consider historical data on claims, local demographics, environmental factors, and the likelihood of specific events occurring in a particular area. This comprehensive analysis helps them calculate the potential costs associated with insuring a property or individual in a specific location.