Life insurance is a financial safety net that ensures your family will be provided for in the event of your passing. But are there any tax implications?

In most cases, life insurance proceeds are not taxable. However, there are some exceptions. For example, if your beneficiaries choose to receive the life insurance payout in instalments, any interest accumulated on those payments will be taxed as regular income.

Another exception occurs when a policyholder leaves the death benefit to their estate instead of naming a person as the beneficiary. If the estate's total value is large enough, it may trigger estate taxes.

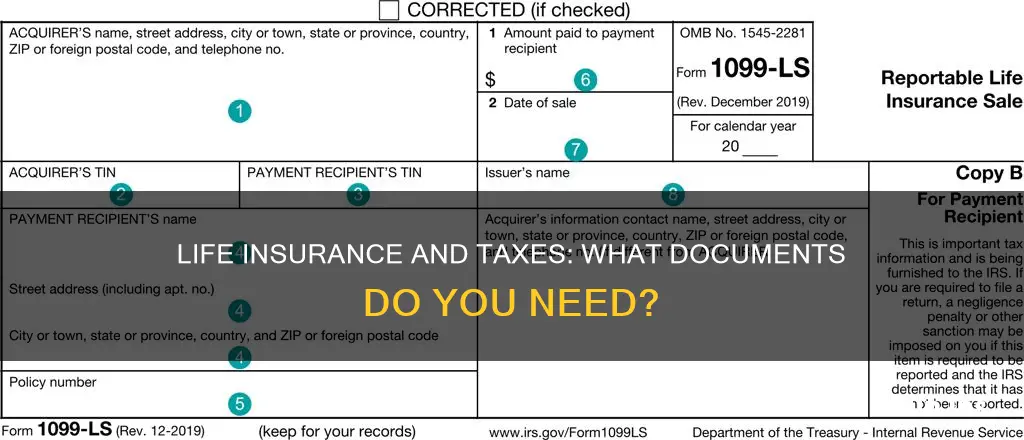

It's also important to note that if you sell your policy, you may be subject to income and capital gains taxes.

Overall, while life insurance offers many tax advantages, careful planning is necessary to avoid potential tax complications.

| Characteristics | Values |

|---|---|

| Are life insurance proceeds taxable? | No, but some exceptions exist. |

| Are there exceptions to not paying taxes on life insurance? | Yes, e.g. when the contract changes ownership for cash or other valuable consideration. |

| Are life insurance payouts included in your estate? | Yes, if the death benefit is paid to the estate of the insured or if the deceased person owns the policy on the date of death. |

| Does timing matter for transferring a policy in terms of taxability? | Yes, if you transfer a policy and die within three years, the policy will likely be included in your estate. |

| Are life insurance policy loans taxable? | No, as long as the loan is equal to or less than the sum of the insurance premiums you have paid on the policy. |

| Are there tax documents for having life insurance? | Yes, e.g. Form 712, Form 1099-INT, Form 1099-R, Form 1040, Form 1040-SR, Form W-4S, Form 1040-ES, Form 709, Form 706. |

What You'll Learn

Life insurance and taxation

Life insurance is often tax-free, but there are some exceptions.

In most cases, money paid out from a life insurance policy is not taxable and does not need to be reported as income. However, any interest received is taxable and must be reported.

If the contract changes ownership in exchange for cash or other valuable consideration, the policy may be subject to taxation. In this case, you can exclude what you paid (the purchase price) and any additional premiums you pay after the purchase. This is known as the transfer-for-value rule. Certain exceptions exist to this rule, and you should refer to forms such as Form 1099-INT or Form 1099-R to report the taxable amount.

Life insurance death benefits may be subject to taxation if the death benefit is paid to the estate of the insured or if the deceased person owns the policy on the date of their death. To avoid this, most people opt to name individuals (other than themselves) as beneficiaries.

If you transfer an insurance policy and die within three years, the policy will likely be included in your estate. Therefore, if you fear that poor health may shorten your lifespan, you may opt to transfer the policy sooner rather than later to avoid tax consequences.

Cash value life insurance, such as whole or universal life, has its own tax rules. Policyholders can generally borrow or withdraw money from the policy's cash value without immediate tax implications. However, if there are unpaid loans against the policy, they will be deducted from the death benefit, meaning your beneficiaries will receive less.

If the policy is a modified endowment contract (MEC), taxes are different. Withdrawals are treated as taxable income until they cumulatively equal all interest earnings in the contract.

Term life insurance taxation is generally straightforward, as there is no cash value component involved. However, if the death benefit is paid out in installments rather than a lump sum, any interest that accumulates on those payments will be taxed as regular income.

Permanent life insurance taxation is more complicated due to the cash value component. Withdrawals above your cost basis (the total amount of premiums you've paid) are considered taxable income. If you take out loans against your permanent life insurance policy and the policy lapses, any outstanding loan balance above your cost basis will be treated as taxable income.

To avoid paying life insurance taxes, you can choose a lump-sum payout, use an irrevocable life insurance trust (ILIT), keep policy loans in check, transfer ownership early, and regularly review and update beneficiaries.

Life Insurance: Does Age Affect Payout Value?

You may want to see also

Interest on life insurance payouts

The IRS considers the interest earned on life insurance payouts as taxable income. This means that beneficiaries will have to pay taxes on the interest they receive. The interest is usually reported as interest received on tax forms, such as Form 1099-INT or Form 1099-R.

It is important to note that the taxation of interest on life insurance payouts may vary depending on the specific circumstances and the tax laws in the applicable jurisdiction. It is always recommended to consult with a tax professional or financial advisor to get personalized advice regarding tax obligations.

Temporary Life Insurance: What You Need to Know

You may want to see also

Life insurance and estate tax

Life insurance death benefits are usually tax-free, but there are exceptions. For instance, if the payout is set up to be paid in multiple payments, the interest on those payments can be taxable.

If the policyholder has withdrawn money or taken out a loan, and the money withdrawn or loaned is more than the total amount of premiums paid, the excess may be taxable.

If the policyholder surrenders their policy, any funds over the policy's cash basis will be taxed as regular income.

In some cases, an employer-paid plan that pays out more than $50,000 may be taxable according to the Internal Revenue Service (IRS). Otherwise, the death benefit is usually paid to beneficiaries tax-free.

If the death benefit and the total value of the deceased's estate exceed the federal estate tax threshold, estate taxes must be paid on the proceeds over the allowed limit. This limit was $12.92 million in 2023 and $13.61 million in 2024.

To avoid estate tax on life insurance proceeds, the insured must avoid:

- Payment to the insured's estate

- "Incidents of ownership"

This can be achieved by:

- Having another person or entity apply for and purchase a new policy on an insured's life

- Transferring all "incidents of ownership" in an existing policy to another person or entity

If the insured surrenders their policy, the amount they get back is considered a tax-free return of their principal.

GSK Retirement Benefits: Life Insurance Coverage Explained

You may want to see also

Life insurance and gift tax

Life insurance death benefits are typically tax-free, but there are exceptions.

If the policyholder elects to delay the benefit payout and the money is held by the life insurance company for a given period, the beneficiary may have to pay taxes on the interest generated during that period. When a death benefit is paid to an estate, the person or persons inheriting the estate may have to pay estate taxes.

If the policy's current cash value exceeds the gift tax exclusion, gift taxes will be assessed and due at the time of the original policyholder's death.

If you give a permanent life insurance policy to another person, including a beneficiary, the IRS regards the transaction as a gift. That means that, depending on the policy's worth, the transfer could be taxed.

The IRS will also look for any incidents of ownership by the person who transfers the policy. In transferring the policy, the original owner must forfeit any legal rights to change beneficiaries, borrow against the policy, surrender or cancel the policy, or select beneficiary payment options.

Furthermore, the original owner must not pay the premiums to keep the policy in force. These actions are considered part of the ownership of the assets, and if any of them are carried out, they can negate the tax advantage of transferring them.

To avoid gift taxes, the insured and owner or the owner and beneficiary should be the same person.

Life Insurance Post-Stroke: Is It Possible?

You may want to see also

Life insurance and income tax

Life insurance is often tax-free, but there are some exceptions. The type of policy, the size of your estate, and how the benefit is paid out can determine whether or not life insurance proceeds are taxed.

Taxation on Death Benefits

If you receive a death benefit payout as a beneficiary, this is generally not considered taxable income and does not need to be reported. However, if you receive the payout in installments, any interest accumulated on those payments is taxed as regular income.

If the policyholder leaves the death benefit to their estate instead of naming a person as the beneficiary, the payout may be subject to estate taxes if the estate's value exceeds the federal estate tax exemption.

Taxation on Policy Changes

If the policy is sold or transferred for cash or other valuable consideration, the proceeds may be taxable. The taxable amount is based on the type of income document received, such as a Form 1099-INT or Form 1099-R.

If you withdraw more money from a universal life insurance policy than you have paid in premiums, the excess amount is considered taxable income. Similarly, if you borrow against the cash value of your policy and there are unpaid loans when the policy is terminated or surrendered, the loan amount exceeding your premium payments will be treated as taxable income.

Taxation on Dividends

If you have a participating whole life insurance policy that pays dividends, you do not need to pay taxes on the dividends. However, if you let the insurer keep your dividends in exchange for interest, you must pay income tax on the interest.

Canceling Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Life insurance proceeds are generally not taxable if you are the beneficiary. However, if you are the policyholder and you surrender the policy for cash, you may have to pay taxes if the amount you receive is more than the cost of the policy.

No, you do not need to report life insurance proceeds as they are typically not considered gross income.

If you are filing an estate tax return, you will need to submit IRS Federal Form 712 for each life insurance policy in effect at the time of death. This form reports the value of a life insurance policy's proceeds for estate tax purposes.