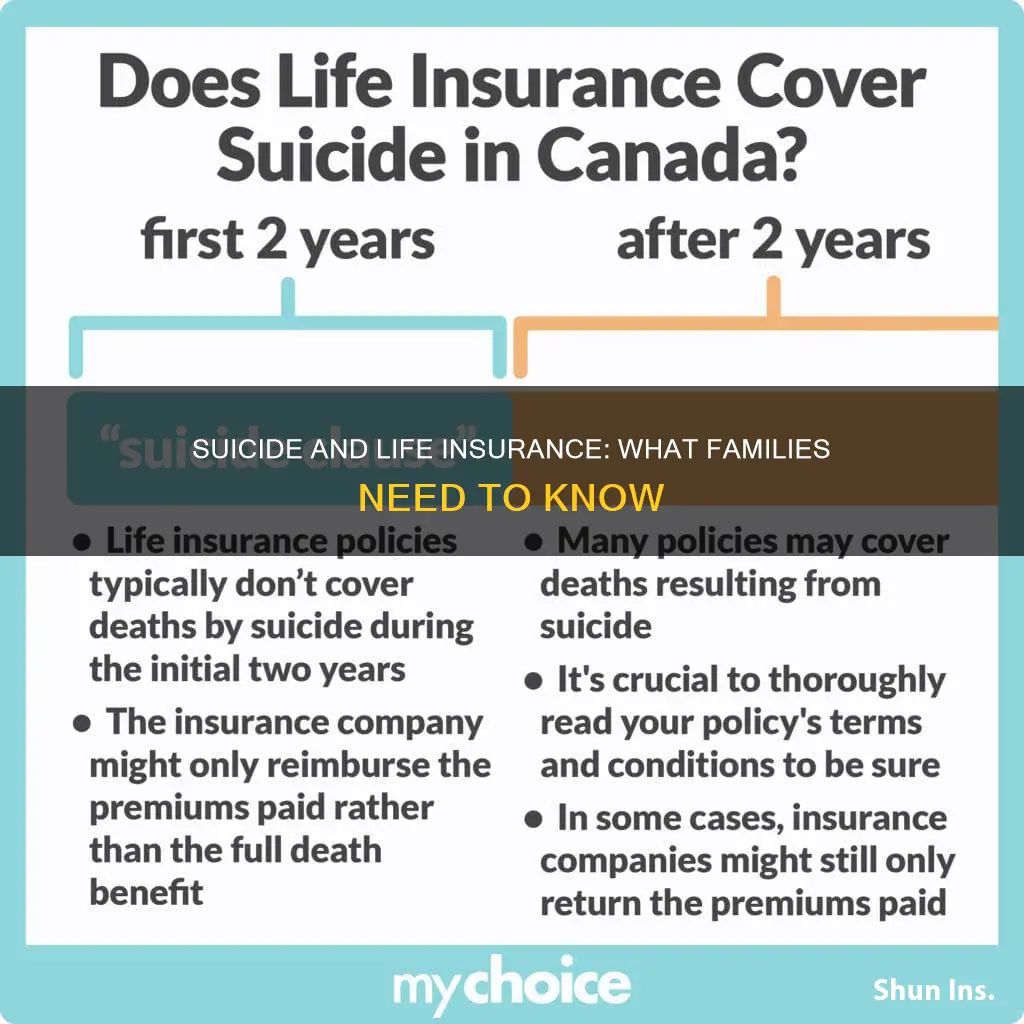

The death of a loved one is a harrowing experience, and when it is a result of suicide, it can be even more challenging for families to cope. One of the many questions that may arise during this difficult time is whether the deceased's life insurance policy is still valid. The answer depends on the type of policy and its specific terms. Many life insurance policies include a suicide clause, which prevents the insurer from paying out a claim if the insured's death was due to self-inflicted injury within a certain period, typically the first two years of the policy. However, after this exclusion period, most life insurance policies do cover suicide, and beneficiaries are entitled to receive the full death benefit.

| Characteristics | Values |

|---|---|

| Do families of suicide victims get life insurance? | It depends on the type of policy and how long the policy has been in place. |

| How long is the suicide exclusion period? | Typically, 1-2 years after the policy is issued. |

| What happens if the suicide occurs during the exclusion period? | The insurer may deny the death benefit or refund the premiums paid. |

| What happens if the suicide occurs after the exclusion period? | The beneficiaries are entitled to the full death benefit. |

| What if the policy is changed or replaced? | The exclusion period may restart. |

| What if the claim is denied? | Review the policy, gather relevant documentation, and understand your rights under state laws. |

What You'll Learn

Suicide clauses

The suicide clause typically applies during the first one to two years after a policy is issued, depending on the insurer and state regulations. During this exclusion period, if the policyholder dies by suicide, the insurer may limit or deny the death benefit payout. Instead, they might refund the premiums paid up to that point.

After the exclusion period ends, most life insurance policies cover suicide, and beneficiaries are entitled to receive the full death benefit. However, changing a policy, such as adding coverage or converting a term policy to a whole life policy, can reset the exclusion period.

The suicide clause is separate from the incontestability clause, which allows the insurer to deny a claim during the contestability period (usually the first two years) due to errors or omissions in the application, except in cases of fraud.

It's important to note that different types of life insurance policies may have specific variations of the suicide clause. For example, group life insurance policies, often provided by employers, typically do not include a suicide clause, and beneficiaries will receive the death benefit regardless of the cause of death. On the other hand, traditional life insurance policies, including term and permanent life insurance, usually contain a suicide clause with an exclusion period.

Cancer and Life Insurance: Blood Test Checks?

You may want to see also

Incontestability clauses

An incontestability clause is a provision in a life insurance policy that allows the insurance company to deny a claim during the contestability period, which is usually the first two years after the policy comes into effect. Once this period has passed, the claim becomes incontestable, and the insurance company cannot deny the claim except in cases of fraud or misrepresentation. This clause is designed to protect insurance companies from individuals who take out a policy with the intention of ending their lives soon after.

The incontestability clause is separate from the suicide clause, which specifically addresses the circumstances of the policyholder's death. If the policyholder dies by suicide during the contestability period, the insurance company may deny the death benefit or only return the premiums paid. However, after the contestability period ends, the policy generally covers suicide, and the beneficiaries will receive the full death benefit.

It is important to note that the incontestability clause covers more than just suicide. It allows the insurance company to void the policy or deny a claim if there is fraud or misrepresentation in the application. Misrepresentation occurs when the policyholder fails to disclose information, while fraud involves lying on the application. If fraud is discovered, the insurance company can deny the claim. In cases of misrepresentation, the insurance company may still pay a claim based on the coverage amount the policyholder would have qualified for if they had provided accurate information.

The incontestability clause provides added security for policyholders and their beneficiaries, knowing that their coverage cannot be easily contested after the initial period. It is important for policyholders to carefully review all the documents and seek help from a licensed expert if they have any questions about the incontestability clause or any other provisions in the policy.

Lupus and Life Insurance: What Coverage Is Available?

You may want to see also

Group life insurance

After the exclusion period, group life insurance generally does cover suicide, and beneficiaries will be entitled to receive the full death benefit.

It's important to note that group life insurance provided by an employer or organisation may treat suicide differently. Military life insurance, for example, typically pays out the death benefit to beneficiaries regardless of the cause of death. Similarly, Servicemembers' Group Life Insurance (SGLI) and Veterans' Group Life Insurance (VGLI) policies usually pay out the death benefit to beneficiaries even in the case of suicide.

Supplemental life insurance purchased through an employer usually has a standard suicide clause and contestability period.

Who Gets the Payout? Contesting Life Insurance Beneficiaries in Canada

You may want to see also

Whole life insurance

- Lifetime Coverage: Whole life insurance provides coverage for the insured person's entire life, unlike term life insurance, which only covers a specific number of years.

- Fixed Premiums: The premiums for whole life insurance tend to be higher than those of term life insurance, but they remain consistent throughout the policy. Your age, medical history, and coverage goals will determine the cost.

- Death Benefit: Whole life insurance guarantees a death benefit payout to your beneficiaries when you pass away. The amount is established when you purchase the policy and remains the same.

- Cash Value: Whole life insurance has a savings component called the "cash value," which accumulates over time. This cash value can be accessed by the policyholder during their lifetime through withdrawals or loans. The cash value grows tax-deferred, and withdrawals up to the total premiums paid are typically tax-free.

- Investment Opportunities: The cash value of a whole life insurance policy can be used to make investments or supplement retirement income. The cash value may also be used to pay monthly premiums.

- Limited Adjustments: Unlike some other types of insurance, whole life insurance policies offer limited flexibility to adjust the premium or death benefit. However, dividends may be used to purchase additional coverage.

In the context of suicide, whole life insurance policies typically include a "suicide clause" that prevents the insurer from paying out the claim if the insured's death is due to self-inflicted injury within a certain period, usually the first one to two years of the policy. If the suicide occurs after this exclusion period, the beneficiaries will generally receive the full death benefit and any accumulated cash value.

Term Life Insurance: Renewal, Revision, or Release?

You may want to see also

Contestability periods

The contestability period is the first few years a life insurance policy is in effect. During this period, the insurer can deny a claim if it discovers discrepancies with the policy application, such as undisclosed health problems. Failing to disclose health problems or other relevant information could be considered insurance fraud.

The contestability period is typically a maximum of two years from a policy becoming active, though in some states, such as Missouri, it is just one year. It only applies to policyholders who intentionally lied on their life insurance application. While the contestability period is when insurers are the most likely to investigate a death claim, they can investigate any claim at any time if there are signs of fraud.

If the insured passes away within the contestability period and the insurer discovers discrepancies, they may investigate the claim and, in some cases, refuse to pay the death benefit. If the missing information would have caused the application to be denied originally, no death benefit will be paid to the family. If the missing information would have just made the premiums higher, the difference will be taken from the death benefit amount and the family will receive the remaining balance.

Not all claims filed within the contestability period are investigated. While the insurance company has the legal right to investigate during this period, they usually only do so when there is a reason to suspect misrepresentation. For example, if someone had claimed to be a non-smoker during their application process, but passed away from COPD within the first two years of their policy, an investigation process would include viewing lab results to indicate tobacco use.

If the policyholder dies by suicide during the contestability period, the insurer may deny the death benefit. This is known as the suicide exclusion. The suicide exclusion is typically in effect for the first one to two years after a policy is issued, depending on the insurer and state regulations. During this period, if the policyholder dies by suicide, the insurer may limit or deny the death benefit payout. Instead of paying out the full death benefit, the insurer might only return the premiums paid up to that point.

The contestability period and suicide exclusion are not the same. While both are in effect for a limited time period, typically two years, they operate differently. During the contestability period, the insurer could contest a claim based on suicide or due to undisclosed information during the application period. Under the suicide exclusion, the insurer can deny a claim only in the event of a suicidal death that occurs while the exclusion is in effect.

Borrowing Against Globe Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

It depends on the type of policy and how long the policy has been in place. Many life insurance policies include a "suicide clause" that prevents the insurer from paying out the claim if the insured's death was due to self-inflicted injury within a certain period, typically two years. After this exclusion period, most life insurance policies do cover suicide, and beneficiaries are entitled to receive the full death benefit.

A suicide clause, also known as a suicide provision, typically states that if the policyholder dies by suicide within a certain period after the policy is issued, usually within the first two years, the insurer may deny the death benefit or only return the premiums paid.

Insurance companies want to prevent people from having a financial incentive to take their own lives. The clause is intended to protect the insurance company from financial risk.

If the suicide happens more than two years after the policy is issued, the life insurance policy will pay out the death benefit to the policy's beneficiaries.

If the suicide occurs during the exclusion period, the death benefit may not be paid. However, beneficiaries may receive a refund of the premiums that were paid into the policy before the death.