Life insurance settlements can be complex, and understanding the default options is crucial for policyholders. The default life insurance settlement option refers to the standard payout structure provided by insurance companies when a policyholder passes away. This option typically involves a lump sum payment to the beneficiary, but it can also include various other forms of settlement, such as periodic payments or a combination of both. Knowing the default settings is essential as it can significantly impact the financial security of the policyholder's loved ones. This paragraph aims to shed light on the intricacies of these default options and their implications.

What You'll Learn

- Legal Requirements: Understanding the legal obligations and rights of the insured and beneficiaries

- Policy Terms: Exploring the specific terms and conditions of the life insurance policy

- Payout Options: Learning about the various ways the insurance company can settle the policy

- Tax Implications: Analyzing the tax consequences of different settlement options

- Beneficiary Preferences: Discussing how beneficiaries' preferences influence the default settlement choice

Legal Requirements: Understanding the legal obligations and rights of the insured and beneficiaries

When it comes to life insurance, understanding the legal requirements and rights of both the insured individual and the beneficiaries is crucial. The default life insurance settlement option, often referred to as the 'default benefit' or 'default distribution', is a legal process that determines how the proceeds of a life insurance policy are distributed upon the insured's death. This default option is typically outlined in the policy contract and is designed to ensure a fair and structured distribution of the insurance benefits.

The legal obligations and rights are primarily governed by the terms of the insurance policy and the applicable laws in the jurisdiction where the policy was issued. Here are some key points to consider:

Insured's Rights and Obligations: The insured individual has the right to choose their preferred settlement option, which may include a lump sum payment, periodic income, or an annuity. However, the insured's decision is subject to the policy's terms. For instance, some policies may require the insured to notify the insurer of any changes in personal or financial circumstances that could affect the settlement. Additionally, the insured is obligated to provide accurate and up-to-date personal information to the insurer to ensure proper administration of the policy.

Beneficiaries' Rights: Beneficiaries, who are typically named in the policy, have the right to receive the proceeds as specified in the policy. This could be a direct payment, an interest in the insured's estate, or a specific share of the policy's value. The legal rights of beneficiaries are protected by the terms of the policy and the law. It is essential for beneficiaries to be aware of their designated status and to understand the distribution process, especially if the policy includes complex settlement options.

Legal Obligations of the Insurer: Insurance companies have a legal obligation to honor the terms of the policy and provide the settlement option as agreed. They must ensure that the distribution process is transparent and follows the specified procedures. In some cases, the insurer may need to obtain legal advice or court approval if the policy's terms are unclear or if there are disputes regarding the settlement.

Understanding these legal requirements is vital for both the insured and beneficiaries to ensure that the life insurance policy is administered correctly and that the intended beneficiaries receive their rightful benefits. It is recommended to review the policy documents thoroughly and seek professional advice if needed to navigate any complexities in the legal obligations and rights associated with life insurance settlements.

Whole Life Insurance: A Smart Tax Shelter Strategy?

You may want to see also

Policy Terms: Exploring the specific terms and conditions of the life insurance policy

When it comes to life insurance, understanding the policy terms and conditions is crucial for making informed decisions. The default life insurance settlement option is a key aspect of these terms, as it determines how the policy's value is paid out upon the insured individual's death. This settlement option is often a standard feature of many life insurance policies and can significantly impact the beneficiary's financial security.

The specific terms related to the settlement option can vary depending on the insurance company and the type of policy. Typically, the default option is a lump-sum payment, where the full death benefit is paid out as a single amount to the designated beneficiary. This provides immediate financial relief and allows the beneficiary to make decisions regarding the funds, such as investing, paying off debts, or providing for loved ones. However, it's important to note that some policies may offer alternative settlement options, such as an income stream or an annuity, which provide a regular payment over time.

Exploring the policy terms will reveal the conditions under which the default settlement option applies. For instance, some policies may have a clause stating that the lump-sum payment is the standard, but it can be waived or modified under certain circumstances. These circumstances could include the insured individual's desire to opt for a different settlement method or the presence of specific conditions that the insurance company deems necessary. Understanding these conditions is vital to ensure that the policyholder's intentions are met and that the beneficiaries receive the intended financial support.

Additionally, the policy terms might include provisions related to the policy's conversion rights. These rights allow the policyholder to convert the life insurance policy into a different type of insurance, such as an annuity, at a later date. This flexibility can be advantageous, especially if the policyholder's financial needs or goals change over time. By exploring these terms, individuals can make informed decisions about their insurance coverage and ensure that the policy aligns with their long-term financial objectives.

In summary, the default life insurance settlement option is a critical component of the policy terms, offering financial security to beneficiaries. Understanding the specific conditions, settlement methods, and conversion rights outlined in the policy is essential for policyholders to make the most of their insurance coverage. It empowers individuals to take control of their financial future and provides peace of mind, knowing that their loved ones will be taken care of according to their wishes.

Life Insurance for Girlfriends: Is It Possible?

You may want to see also

Payout Options: Learning about the various ways the insurance company can settle the policy

When it comes to life insurance, understanding the payout options is crucial, especially if you're considering the default settlement option. The insurance company has several ways to settle a life insurance policy, and each method can significantly impact the beneficiary's financial future. Here's a detailed look at these payout options:

Lump Sum Payout: This is the most common and straightforward settlement option. When you choose a lump sum, the insurance company pays out the entire death benefit amount as a single, large payment to the beneficiary. This option provides immediate access to a substantial sum, allowing the beneficiary to use the funds for various purposes, such as covering funeral expenses, paying off debts, or investing for the future. It offers flexibility and can be a suitable choice for those who prefer a one-time payment.

Periodical Payments: In this option, the insurance company pays out the death benefit in regular intervals, typically monthly, quarterly, or annually. This method provides a steady income stream for the beneficiary over an extended period. Periodical payments can be advantageous for those who prefer a consistent financial flow and may need a long-term financial plan. However, it's essential to consider the potential tax implications and the impact on the overall value of the settlement over time.

Income With Periodicals: This payout option combines the benefits of both lump sum and periodical payments. The insurance company pays a portion of the death benefit as a lump sum and the remaining amount in regular installments. This approach provides a mix of immediate financial support and a steady income stream. It can be particularly useful for beneficiaries who want a combination of both options, ensuring they have immediate access to funds while also receiving a consistent payment over time.

Return of Premium: Some life insurance policies offer a unique payout option called "Return of Premium." In this case, the insurance company returns the premiums paid by the policyholder over the years, plus a small interest, as the death benefit. This option is less common but can be attractive to those who want to ensure that their premiums are utilized in a way that benefits the beneficiary. It's essential to review the policy details to understand the specific terms and conditions associated with this payout option.

Understanding these payout options is vital for making informed decisions about your life insurance policy. The default settlement option may vary depending on the insurance company and the policy type, so it's crucial to review the policy documents and consult with a financial advisor to determine the best course of action for your specific circumstances.

Usaa Life Insurance: Understanding Exclusions and Their Impact

You may want to see also

Tax Implications: Analyzing the tax consequences of different settlement options

When it comes to life insurance settlements, understanding the tax implications is crucial for making informed decisions. The default life insurance settlement option, often referred to as the "cash value" or "proceeds" of the policy, can have significant tax consequences depending on the jurisdiction and the specific circumstances. Here's an analysis of the tax considerations:

Tax Treatment of Proceeds: In many countries, the proceeds from a life insurance policy are generally not subject to income tax. This means that if you receive a lump-sum payment or regular installments as a beneficiary, you typically won't owe taxes on that amount. However, there are exceptions and nuances to consider. For instance, if the policy was owned by an individual, and the proceeds are received by a beneficiary, the tax treatment might differ from if the policy was owned by a trust or an entity.

Capital Gains Tax: If the life insurance policy has a significant cash value accumulation over time, and the proceeds are substantial, capital gains tax may apply. When the policy matures or is surrendered, the cash value accumulation could be considered a taxable event. The tax rate for capital gains varies depending on the jurisdiction and the beneficiary's income level. It's essential to understand the tax laws in your region to determine if and how capital gains tax applies.

Income Tax on Regular Payments: In some cases, if the life insurance policy pays out regular installments, these payments may be subject to income tax. The tax treatment can vary depending on the frequency and amount of the payments. For example, if the policy pays out monthly, the beneficiary might need to report these payments as income in the year they are received, potentially pushing the beneficiary into a higher tax bracket.

Tax-Deferred Growth: One of the advantages of life insurance is the potential for tax-deferred growth. If the policy is owned by an entity or a trust, the cash value accumulation can grow tax-free until it is withdrawn or the policy is surrendered. This is particularly beneficial for long-term financial planning, as the tax-deferred growth can result in substantial savings over time. However, when the policy is surrendered or matures, taxes may apply on the accumulated value, depending on the jurisdiction's tax laws.

Tax Planning Strategies: To optimize the tax implications of life insurance settlements, consider working with a tax professional or financial advisor. They can provide tailored advice based on your specific situation. Strategies may include structuring the policy ownership appropriately, considering the timing of policy surrender or maturity, and exploring tax-efficient investment options within the policy. Proper tax planning can help minimize tax liabilities and ensure a more efficient use of the life insurance proceeds.

Best Life Insurance Options for 50-Somethings: Secure Your Future

You may want to see also

Beneficiary Preferences: Discussing how beneficiaries' preferences influence the default settlement choice

When it comes to life insurance settlements, the concept of a "default" option is an important consideration for both insurance companies and policyholders. In many jurisdictions, insurance providers are required to offer a default settlement option to beneficiaries in the event of the insured's death. This default choice is designed to ensure that beneficiaries receive a fair and appropriate distribution of the insurance proceeds, especially when the policyholder has not explicitly stated their preferences.

Beneficiary preferences play a crucial role in determining the most suitable default settlement option. These preferences often reflect the intended use of the insurance money and the beneficiary's relationship with the insured. For instance, a policyholder might have a primary beneficiary, such as a spouse or a child, who is expected to rely on the insurance payout for their immediate financial needs. In such cases, a lump-sum payment might be the default choice, allowing the primary beneficiary to have full control over the funds. This option ensures that the beneficiary can make decisions regarding their own financial future, whether it's investing, saving, or spending the money.

On the other hand, if the policyholder has multiple beneficiaries with varying financial situations and goals, the default settlement option might lean towards a more structured distribution. For example, if the policyholder has a surviving spouse and several children, the default could be an annuity, providing a regular income stream for the spouse and ensuring a consistent financial contribution towards the children's education or future needs. This approach considers the long-term financial stability of all beneficiaries involved.

Additionally, some beneficiaries may prefer a more flexible default option, especially if they have specific financial goals or plans. For instance, a beneficiary might opt for a combination of a lump sum and a periodic payment, allowing them to cover immediate expenses and also have some control over the remaining funds. This flexibility can be particularly appealing to beneficiaries who want to make informed decisions about their financial future.

In summary, beneficiary preferences are integral to the default life insurance settlement option, as they guide the insurance company in providing a fair and suitable distribution of proceeds. By considering the unique circumstances and goals of each beneficiary, insurance providers can ensure that the default choice aligns with the policyholder's intentions and the beneficiaries' best interests. This approach promotes a more personalized and effective settlement process, ultimately benefiting all parties involved.

Stranger-Owned Life Insurance: A Unique Financial Strategy Explained

You may want to see also

Frequently asked questions

The default life insurance settlement option refers to the standard payout structure offered by insurance companies when a policyholder passes away. Typically, the beneficiary receives a lump sum payment, which is the total death benefit amount specified in the policy. This is the most common and straightforward settlement option, ensuring a clear and immediate financial benefit to the designated recipient upon the insured individual's death.

Yes, many life insurance policies offer flexibility in settlement options. You can often choose between a lump sum payment, an annuity (where the death benefit is paid out over a period of time), or a combination of both. Customizing your settlement option allows you to align the payout with your financial goals and the needs of your beneficiaries.

The default lump sum payment has several advantages. Firstly, it provides immediate financial relief to the beneficiaries, allowing them to make quick decisions regarding the funds. This option also offers beneficiaries the freedom to use the money as they see fit, whether for immediate needs, investments, or other financial goals. Additionally, a lump sum can potentially provide a higher overall value due to its tax-free nature, as opposed to annuity payments which may be subject to income tax over time.

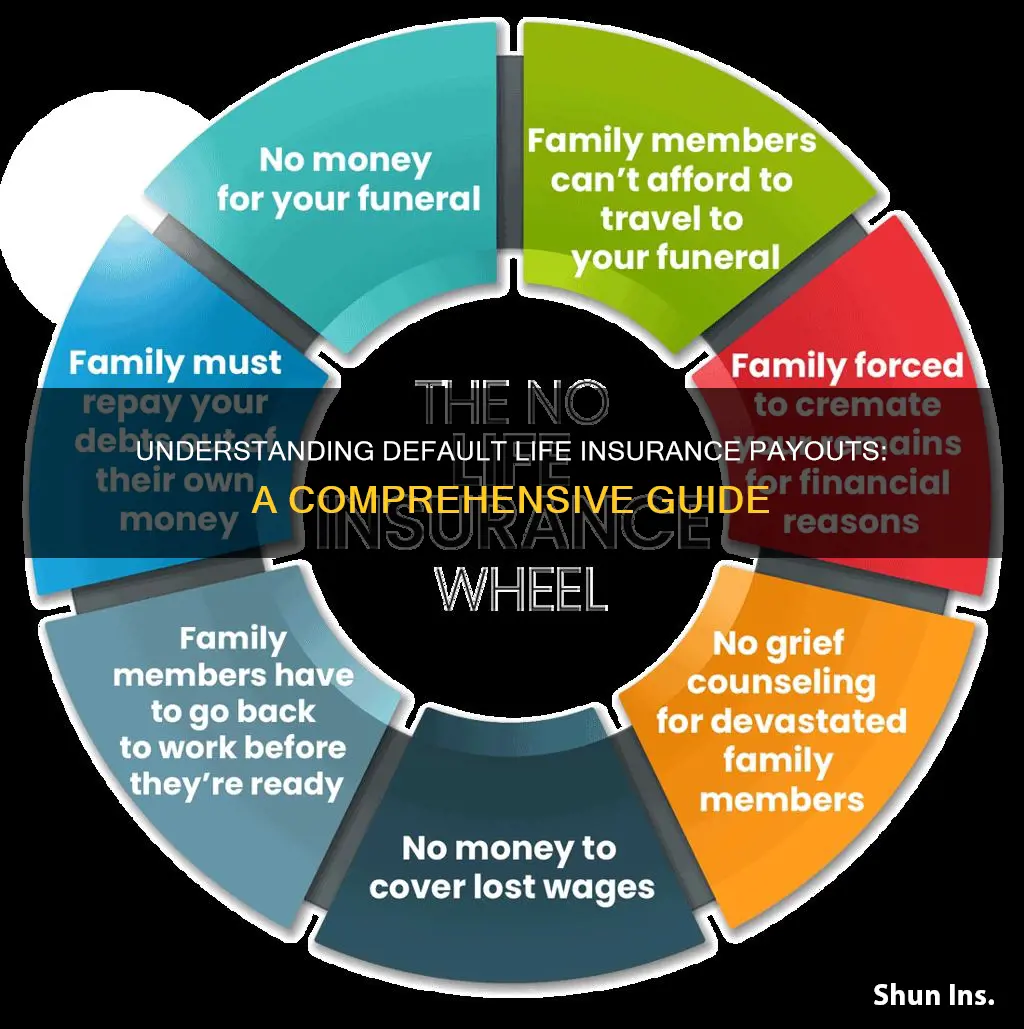

While the lump sum payment is a popular choice, it may not suit everyone's financial situation or goals. One potential disadvantage is the immediate large sum of money, which can be challenging for beneficiaries to manage effectively. It may also lead to impulsive financial decisions. Furthermore, if the policyholder dies shortly after purchasing the insurance, the lump sum might not cover all intended expenses, especially if the death benefit is not adequately calculated for the individual's needs.