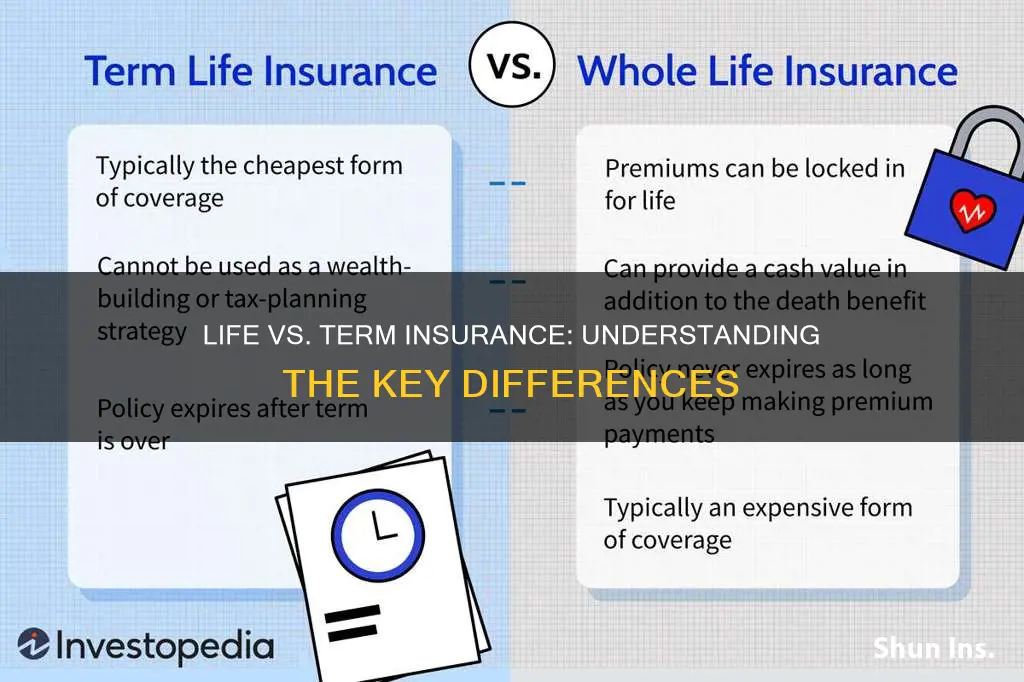

Life insurance and term insurance are two distinct types of coverage that provide financial protection for individuals and their families. While both offer financial benefits upon the insured's death, they differ in their coverage duration, cost, and flexibility. Life insurance provides coverage for the entire life of the insured, offering a death benefit to beneficiaries regardless of when the insured passes away. Term insurance, on the other hand, is designed for a specific period, typically 10, 15, or 20 years, and pays out only if the insured dies during that term. The key difference lies in the length of coverage and the associated costs, with term insurance generally being more affordable but only providing protection for a limited time.

What You'll Learn

- Coverage Duration: Life insurance provides lifelong coverage, while term insurance is for a specific period

- Cost: Term insurance is generally more affordable due to its shorter duration

- Flexibility: Life insurance offers more customization and options for riders and additional benefits

- Risk Assessment: Term insurance focuses on specific risks, while life insurance covers a broader range

- Long-Term Financial Planning: Life insurance is crucial for long-term financial security and legacy planning

Coverage Duration: Life insurance provides lifelong coverage, while term insurance is for a specific period

When it comes to insurance, understanding the coverage duration is crucial as it determines the length of time your policy will provide financial protection. One of the primary differences between life insurance and term insurance lies in the duration of their coverage.

Life insurance is designed to offer lifelong coverage, ensuring that your beneficiaries receive financial support even after your passing. This type of insurance is typically permanent and remains in effect for as long as you remain insured. The primary purpose is to provide financial security to your loved ones during their lifetime, covering various expenses such as mortgage payments, education costs, or daily living expenses. With life insurance, the coverage amount is guaranteed to be paid out upon your death, providing a sense of reassurance and financial stability for your family.

On the other hand, term insurance provides coverage for a specific period or 'term'. This type of insurance is often more affordable compared to permanent life insurance because it is designed to meet specific financial needs for a limited time. Term insurance is ideal for individuals who want coverage for a particular goal or event, such as covering a mortgage or providing financial support for children's education. The policy duration can vary, ranging from a few years to several decades, and once the term ends, the coverage expires unless you choose to renew it.

The key advantage of term insurance is its cost-effectiveness, making it an attractive option for those seeking temporary coverage. It allows individuals to secure financial protection during a specific period without the long-term commitment of permanent insurance. After the term ends, policyholders can decide whether to renew the policy or explore other insurance options.

In summary, the coverage duration is a fundamental distinction between life and term insurance. Life insurance offers lifelong protection, ensuring financial security for your loved ones indefinitely. In contrast, term insurance provides coverage for a specified period, catering to temporary financial needs and goals. Understanding this difference is essential when choosing the right insurance policy to meet your specific requirements and provide adequate protection for your family's future.

Life Insurance: Necessary Without Kids?

You may want to see also

Cost: Term insurance is generally more affordable due to its shorter duration

When comparing life insurance and term insurance, one of the most significant factors that set them apart is the cost. Term insurance is often the more cost-effective option, especially for those seeking temporary coverage. This is primarily because term insurance is designed to provide protection for a specific period, typically 10, 15, 20, or 30 years. During this time, the insurance company guarantees financial support to the policyholder's beneficiaries if the insured individual passes away.

The affordability of term insurance can be attributed to its structured and time-bound nature. Since the coverage is limited to a defined period, the insurance provider takes on a lower risk compared to permanent life insurance. With permanent policies, the insurance company is committed to providing coverage for the entire life of the insured individual, which involves a higher level of uncertainty and risk. In contrast, term insurance allows the insurer to set premiums based on the specific duration of coverage, making it more financially viable.

For individuals who want to secure their family's financial future without a long-term financial commitment, term insurance offers a practical solution. The lower premiums make it accessible to a broader range of people, allowing them to protect their loved ones without straining their budgets. This type of insurance is particularly beneficial for those who have a limited budget for insurance but still want to ensure their family's financial stability in the event of their untimely demise.

Moreover, the shorter duration of term insurance encourages policyholders to plan for the future. As the coverage is temporary, individuals are more inclined to review and potentially renew their policies periodically. This proactive approach to insurance management can lead to better financial planning and a more secure future.

In summary, term insurance is generally more affordable due to its shorter duration, making it an attractive option for those seeking cost-effective coverage. The structured nature of term insurance allows insurance providers to offer competitive premiums, ensuring that individuals can protect their loved ones without incurring excessive financial burdens. Understanding the cost difference between life and term insurance is essential for making informed decisions about one's insurance needs.

Life Insurance and Taxes: What You Need to Know

You may want to see also

Flexibility: Life insurance offers more customization and options for riders and additional benefits

Life insurance provides policyholders with a range of customization options and additional benefits that can be tailored to their specific needs and preferences. This flexibility is a key advantage over term insurance, which is a more straightforward and standardized product. With life insurance, individuals can choose from various policy types, coverage amounts, and payment options, ensuring that the insurance plan aligns perfectly with their financial goals and circumstances.

One of the primary benefits of this flexibility is the ability to add riders to the policy. Riders are optional add-ons that enhance the coverage and provide additional protection. For example, a critical illness rider can offer financial support if the insured person is diagnosed with a critical illness, ensuring that medical expenses and daily living costs are covered. Similarly, a disability rider can provide income replacement if the insured becomes unable to work due to an accident or illness. These riders allow individuals to customize their life insurance policy to address specific concerns and potential risks.

Furthermore, life insurance policies often offer a wide array of additional benefits. These may include accelerated death benefits, which allow policyholders to receive a portion of their death benefit while still alive if they are diagnosed with a terminal illness, providing financial security and peace of mind. Some policies also offer waiver of premium benefits, where the insurance company temporarily pays the premiums if the insured becomes disabled, ensuring that the policy remains in force even during challenging financial times. These additional benefits demonstrate the comprehensive nature of life insurance and its ability to adapt to various life events and changing circumstances.

The customization options in life insurance also extend to payment plans. Policyholders can choose from various payment frequencies, such as monthly, quarterly, or annual payments, and even opt for lump-sum payments if they prefer. This flexibility in payment options ensures that the insurance premium fits comfortably within the individual's budget and financial planning. Additionally, some life insurance companies offer the option to increase or decrease coverage amounts over time, allowing policyholders to adjust their insurance needs as their financial situation and family circumstances evolve.

In contrast, term insurance typically offers a more limited range of options. It is designed for a specific period, often 10, 20, or 30 years, and provides coverage during that time. While term insurance is generally more affordable, it lacks the customization and additional benefits that life insurance provides. This simplicity can be advantageous for those who prefer a straightforward product without the complexity of additional riders and benefits. However, for individuals seeking comprehensive coverage and the ability to adapt their insurance plan to their evolving needs, life insurance's flexibility is a significant advantage.

Incorporating Life Insurance in Your Net Worth Calculation

You may want to see also

Risk Assessment: Term insurance focuses on specific risks, while life insurance covers a broader range

Term insurance and life insurance are two distinct types of coverage, each with its own unique approach to risk assessment and coverage. Understanding these differences is crucial for individuals seeking insurance protection for themselves or their loved ones.

Term insurance, as the name suggests, is designed to provide coverage for a specific period or 'term'. This type of insurance focuses on addressing particular risks and financial obligations that may arise during that defined period. For example, a term life insurance policy might cover a 30-year-old individual for a period of 10 years. During this term, the insurance company promises to pay out a predetermined death benefit if the insured individual passes away. This coverage is particularly useful for individuals who want to secure their family's financial future during a specific life stage, such as when they have young children or a mortgage. The risk assessment here is more targeted, ensuring that the insurance provides a safety net for a particular set of circumstances.

In contrast, life insurance takes a broader approach to risk assessment. It is designed to provide coverage for the entire duration of the insured individual's life. This type of insurance aims to offer financial protection for the policyholder's beneficiaries in the event of their death, regardless of the specific timing. Life insurance policies often have a longer-term perspective, providing coverage for decades or even for the entire lifetime of the insured. The risk assessment in life insurance is more comprehensive, considering various factors that could impact the insured's longevity and the likelihood of a payout. This includes assessing health, lifestyle, and other demographic factors to determine the overall risk to the insurance company.

The key difference lies in the scope of coverage and the associated risks. Term insurance is tailored to address specific risks and financial needs for a defined period, making it a precise and targeted solution. On the other hand, life insurance provides a more comprehensive safety net, covering a broader range of potential risks and financial obligations throughout the insured's life. This broader coverage ensures that the insured's beneficiaries are protected even if the specific term-based risk (e.g., a mortgage) has passed.

When assessing the need for insurance, individuals should consider their unique circumstances and financial goals. Term insurance can be an excellent choice for those seeking focused coverage during a particular life stage, while life insurance offers a more permanent safety net. Understanding these differences enables individuals to make informed decisions about their insurance needs, ensuring they have the right protection in place.

LLC Life Insurance: Ownership and Benefits Explained

You may want to see also

Long-Term Financial Planning: Life insurance is crucial for long-term financial security and legacy planning

Life insurance is a powerful tool for long-term financial planning, offering both financial security and the ability to leave a lasting legacy. It provides a safety net for your loved ones in the event of your passing, ensuring their financial well-being and peace of mind. When considering long-term financial planning, life insurance is a critical component that should not be overlooked.

The primary purpose of life insurance is to provide financial protection for your family or beneficiaries. It offers a guaranteed payout, which can be used to cover various expenses, such as mortgage payments, education costs, or daily living expenses. This financial support can help your loved ones maintain their standard of living and achieve their financial goals, even if you are no longer around. For example, if you have a young family, life insurance can ensure that your children's education and future needs are financially secured, providing a sense of stability and security.

Long-term financial planning with life insurance goes beyond immediate financial needs. It is a strategic approach to building and preserving wealth over time. Permanent life insurance, such as whole life or universal life, offers a range of benefits that contribute to long-term financial security. These policies accumulate cash value over time, which can be borrowed against or withdrawn, providing a source of funds for various financial goals. Additionally, the death benefit of a permanent life insurance policy remains in force for the entire life of the insured, ensuring that your beneficiaries receive the intended financial support.

Legacy planning is another essential aspect of long-term financial planning with life insurance. By purchasing a life insurance policy, you can leave a financial legacy for your heirs. This legacy can help fund their future endeavors, such as starting a business, purchasing a home, or pursuing higher education. The death benefit can be structured to provide a lump sum or an income stream, allowing your beneficiaries to make significant financial decisions and achieve their long-term goals. Moreover, life insurance can be a valuable asset in estate planning, helping to minimize taxes and ensure a smooth transfer of wealth to the next generation.

In summary, life insurance plays a vital role in long-term financial planning by providing financial security and a means to create a lasting legacy. It offers a safety net for your loved ones, helps build and preserve wealth, and enables you to leave a financial gift for future generations. When considering your financial future, it is essential to evaluate your specific needs and consult with a financial advisor to determine the most suitable life insurance policy for your long-term financial security and legacy planning.

Life Insurance and Suicide: What's the Verdict?

You may want to see also

Frequently asked questions

The main distinction lies in the duration of coverage. Life insurance provides permanent coverage, meaning it remains in effect for the entire life of the insured individual. It offers a death benefit to the policyholder's beneficiaries if the insured person passes away during the policy term. On the other hand, term insurance is a temporary policy that provides coverage for a specific period, typically 10, 20, or 30 years. If the insured survives the term, the policy expires, and no death benefit is paid.

Generally, term insurance is more affordable than permanent life insurance. The lower cost is due to the shorter coverage period, as term policies do not accumulate cash value over time, unlike permanent policies. Term insurance is ideal for those seeking affordable coverage for a specific period, such as when they have a mortgage or dependants who need financial support for a certain duration.

Yes, many term insurance policies offer the option to convert them into permanent life insurance, typically at the end of the term. This conversion allows policyholders to continue their coverage without a medical examination, as the risk of insuring an individual increases with age. It provides a seamless transition from temporary to permanent coverage, ensuring long-term financial protection.

Term insurance is advantageous for several reasons. Firstly, it is a straightforward and cost-effective way to secure financial protection for a specific period. It is particularly useful for individuals who want to cover short-term financial obligations or provide for their family during a particular life stage. Additionally, term insurance can be a building block for a comprehensive financial plan, allowing individuals to explore other insurance options later.

While term insurance is an excellent choice for many, it may not be suitable for those seeking long-term financial planning. Unlike permanent life insurance, term policies do not accumulate cash value, which means there is no investment component. Additionally, if the insured individual outlives the policy term, the coverage ends, and no death benefit is paid. It's essential to assess your long-term financial goals and consult with an insurance advisor to determine the most appropriate type of coverage.