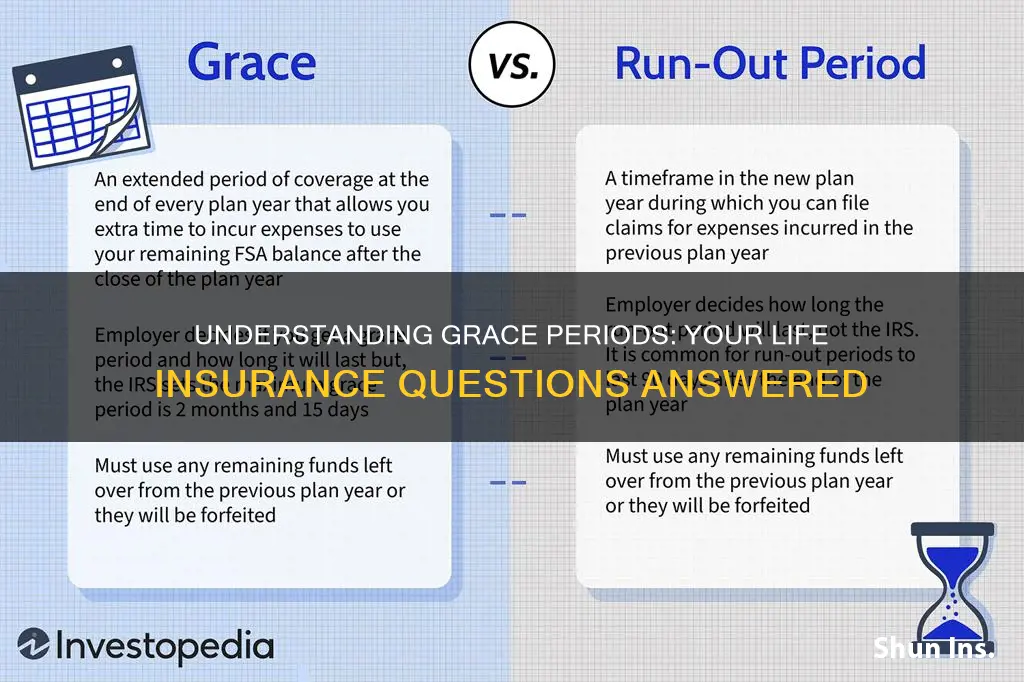

The grace period for life insurance is a crucial aspect of understanding the coverage provided by a policy. This period, typically lasting 30 to 60 days, offers a safety net for policyholders after their initial payment. During this time, if the insured individual passes away, the insurance company will still honor the death benefit, ensuring financial security for beneficiaries. This grace period is an essential feature of life insurance, providing a period of protection and peace of mind for those relying on the policy's financial support.

What You'll Learn

- Definition of Grace Period: Time after policy start when premiums are waived if paid on time

- Grace Period Duration: Typically 30 days, varies by policy

- Grace Period Benefits: Coverage continues without lapse during grace period

- Grace Period Conditions: Premiums must be paid within grace period to avoid lapse

- Grace Period Renewal: Policy may renew automatically after grace period with new premium terms

Definition of Grace Period: Time after policy start when premiums are waived if paid on time

The grace period is a crucial aspect of life insurance policies, offering a temporary reprieve for policyholders. It is a defined period, typically ranging from 30 to 60 days, during which the insurance company waives the premium payment requirement if the policyholder fails to make the payment on time. This provision is designed to provide a safety net for policyholders, ensuring they don't lose their coverage due to a missed payment.

During this grace period, the policy remains in force, and the insurance company continues to provide the promised coverage. This is particularly important as it allows policyholders to address any financial challenges they might face without immediately losing their life insurance benefit. It's a period of leniency that gives individuals time to manage their finances and ensure they can meet their premium obligations.

The grace period is a standard feature in most life insurance policies, offering peace of mind to policyholders. It is a critical component of the policy's terms and conditions, ensuring that the coverage remains active even if the premiums are not paid promptly. This grace period is especially beneficial for those who may experience temporary financial difficulties, providing them with a window to resolve their issues without the risk of policy lapse.

It's essential to understand that the grace period is not an indefinite extension. Once it expires, the policyholder must pay the outstanding premium to keep the policy in force. If the premium is not paid within this grace period, the policy may lapse, and the coverage could be terminated. Therefore, policyholders should be aware of the grace period's duration and take necessary steps to ensure timely premium payments.

In summary, the grace period in life insurance is a vital aspect of policy management, offering a temporary waiver of premium payments. It provides policyholders with a safety net, allowing them to address financial challenges without losing their insurance coverage. Understanding the grace period's terms and conditions is essential for effective policy management and ensuring the continuity of life insurance benefits.

Life Insurance: Money Laundering's Unlikely Friend

You may want to see also

Grace Period Duration: Typically 30 days, varies by policy

The grace period for life insurance is a crucial aspect of understanding your policy and its benefits. This period is a temporary reprieve that provides policyholders with a window of time to take action if they encounter certain challenges. During this grace period, typically lasting 30 days, the insurance company allows policyholders to address issues that might otherwise lead to the policy being terminated or canceled.

This grace period is a standard feature in most life insurance policies and is designed to offer financial protection and peace of mind to policyholders. It provides a safety net, ensuring that individuals and their families are not left without coverage in the event of unforeseen circumstances. For instance, if a policyholder misses a premium payment, the grace period allows them to make up for it without immediately losing their insurance coverage.

The duration of the grace period can vary depending on the insurance provider and the specific policy terms. While 30 days is the most common duration, some policies may offer a longer grace period, providing more time to resolve issues. It is essential to review your policy documents to understand the exact grace period applicable to your situation.

During this grace period, policyholders can take the necessary steps to ensure their policy remains active. This might include making the missed payment, providing required documentation, or taking any other actions specified by the insurance company. It is advisable to contact your insurance provider as soon as possible to discuss any concerns and ensure your policy remains in force.

Understanding the grace period duration and its implications is vital for effective financial planning and ensuring continuous coverage. By knowing the specific terms of your policy, you can make informed decisions and take appropriate actions when needed. Remember, the grace period is a valuable tool that provides a temporary solution, allowing you to manage your insurance policy effectively.

Colonial Penn Life Insurance: Understanding the Wait Period

You may want to see also

Grace Period Benefits: Coverage continues without lapse during grace period

The grace period for life insurance is a crucial aspect of the policy that provides a safety net for policyholders. When you purchase a life insurance policy, it typically comes with a grace period, which is a temporary period during which the insurance company continues to cover the policyholder even if they miss a premium payment. This grace period offers several benefits and is an essential feature to understand when considering life insurance.

During the grace period, which usually lasts for a specific number of days (often 30 days), the insurance company maintains the policy in force, ensuring that the coverage remains active. This is particularly important as it prevents the policy from lapsing, which could result in the loss of coverage and potential financial risks for the policyholder. The primary purpose of this grace period is to provide a buffer for policyholders, allowing them to address any financial challenges or delays without immediately losing their insurance protection.

One of the key advantages of the grace period is the peace of mind it offers. Policyholders can rest assured that their life insurance coverage will not be interrupted due to missed payments. This is especially beneficial for those who may experience temporary financial difficulties or unexpected events that could impact their ability to make premium payments on time. By providing a grace period, insurance companies demonstrate their commitment to maintaining coverage and supporting policyholders during challenging times.

Furthermore, the grace period allows policyholders to review their financial situation and make necessary adjustments without the immediate concern of policy lapse. It provides an opportunity to catch up on missed payments and ensure the policy remains in force. This is particularly useful for individuals who may have irregular income streams or those who are new to managing insurance policies. The grace period serves as a valuable tool for policyholders to manage their insurance coverage effectively.

In summary, the grace period for life insurance is a valuable feature that ensures coverage continuity without lapse during a specified period. It provides policyholders with a safety net, allowing them to address financial challenges and maintain their insurance protection. Understanding the grace period benefits is essential for making informed decisions about life insurance, ensuring that individuals can safeguard their loved ones and themselves even during temporary financial setbacks.

Withholding Tax: Does It Affect Your Life Insurance?

You may want to see also

Grace Period Conditions: Premiums must be paid within grace period to avoid lapse

The grace period for life insurance is a crucial aspect of understanding the policy's terms and conditions. It is a period of time, typically ranging from 30 to 60 days, during which the policyholder can pay their premiums without facing a lapse in coverage. This grace period is an essential safety net for policyholders, providing them with a window to address any financial challenges they may encounter.

During this grace period, the insurance company does not terminate the policy, and the coverage remains in force. However, it is essential to note that the grace period is not an extension of the policy's initial term. If the premium is not paid within this grace period, the policy may lapse, and the coverage could be at risk.

The primary condition associated with the grace period is that the premiums must be paid within this specified timeframe. This means that policyholders should be aware of the due date of their premiums and make the necessary arrangements to ensure timely payment. Paying the premium within the grace period is crucial to maintaining the policy's continuity and avoiding any potential gaps in coverage.

If the premium is not paid during the grace period, the policyholder may receive a notice from the insurance company regarding the overdue payment. This notice typically outlines the amount due and the consequences of non-payment. It is the policyholder's responsibility to review and respond to such communications promptly. Failure to pay the premium within the grace period could result in the policy being terminated, and the insurance company may offer a new policy with potentially higher premiums or different terms.

In summary, the grace period for life insurance provides a valuable opportunity for policyholders to manage their finances and ensure the continued protection of their loved ones. By understanding the conditions, including the requirement to pay premiums within the grace period, individuals can take control of their insurance coverage and avoid any unexpected lapses in protection. It is a critical aspect of maintaining a comprehensive and reliable life insurance policy.

Funeral Expenses: Life Insurance Payouts Explained

You may want to see also

Grace Period Renewal: Policy may renew automatically after grace period with new premium terms

The grace period for life insurance is a crucial aspect of understanding your policy's renewal process. When you purchase a life insurance policy, it typically comes with a grace period, which is a temporary window of time during which you can avoid the policy lapsing. This grace period usually lasts for a specific number of days, often 30 days, after the due date of the premium payment. During this time, the insurance company will not cancel your policy, allowing you to catch up on any missed payments.

After the grace period, the policy may enter a renewal phase. This is where the 'Grace Period Renewal' comes into play. If you have not made the required premium payment by the end of the grace period, the insurance company may automatically renew your policy with new premium terms. This automatic renewal is a convenient feature, ensuring that your coverage remains in place even if you temporarily forget to pay. However, it's essential to understand the implications of this process.

When your policy renews automatically, the insurance company will typically review your coverage and adjust the premium terms accordingly. This could mean an increase in the premium amount, especially if there have been changes in your age, health, or other factors that influence the risk associated with the policy. The new premium terms will be based on the current market rates and the insurance company's assessment of your risk profile. It is important to review these new terms carefully to ensure you understand the cost and coverage you are agreeing to.

During the grace period renewal, you may also have the option to update your personal details or make changes to your policy. This could include adjusting the coverage amount, adding or removing beneficiaries, or making changes to the policy's riders or endorsements. It is advisable to review your policy documents and communicate with your insurance provider to ensure that any changes you make are reflected accurately in the renewal process.

In summary, the grace period for life insurance provides a safety net, allowing you to address payment issues without immediately losing coverage. The grace period renewal process, when your policy automatically renews with new premium terms, offers a convenient way to maintain your insurance coverage. However, it is essential to be aware of the potential changes in premium amounts and policy terms to make informed decisions regarding your life insurance policy.

Life Insurance Klang: Protecting Your Family's Future

You may want to see also

Frequently asked questions

A grace period is a specific time frame, typically 30 days, during which a life insurance policy remains in force even if a premium payment is missed. This period allows the policyholder to pay the overdue premium and maintain coverage without losing the insurance benefit.

If a policyholder fails to pay the required premium by the due date, the insurance company will usually send a notice and a payment reminder. The grace period starts from the due date and ends 30 days later. During this time, the policy remains active, and the insured individual remains covered.

If you don't pay the premium within the grace period, the policy may enter a 'lapse' status. This means the coverage will be suspended, and you'll no longer have the insurance benefit. However, the policy can often be revived by paying the overdue premium plus any applicable fees within a specified time frame after the lapse.

The grace period is a standard provision in most life insurance policies and is not typically customizable. It is a fixed period designed to provide a safety net for policyholders. If you miss a payment, you should act promptly to ensure your coverage remains in force.

Some life insurance policies, especially those with a higher value or specific terms, may have different grace period rules. For instance, some policies might offer a longer grace period or provide options to pay the premium in installments. It's essential to review your policy documents or consult your insurance provider to understand the specific terms and conditions regarding the grace period.