While life insurance is a financial product designed to provide financial protection and peace of mind for individuals and their loved ones. It is a type of insurance that offers coverage in the event of the insured person's death, ensuring that beneficiaries receive a lump sum payment or regular income. This coverage can help cover various expenses, such as mortgage payments, children's education, or daily living costs, providing financial security during challenging times. The policyholder pays a premium to the insurance company, and in return, the insurer promises to pay out a death benefit to the designated beneficiaries when the insured individual passes away.

What You'll Learn

- Definition: A contract that pays a death benefit if the insured dies during the policy term

- Benefits: Provides financial security for beneficiaries in the event of the insured's death

- Types: Term, whole life, universal, and variable are common types

- Cost: Premiums are based on age, health, and coverage amount

- Features: Offers guaranteed death benefit, investment options, and potential cash value accumulation

Definition: A contract that pays a death benefit if the insured dies during the policy term

While life insurance is a financial product designed to provide financial security and peace of mind to individuals and their loved ones. It is a contract between an insurance company and an individual, known as the insured, where the insurance company agrees to pay a predetermined amount of money, known as the death benefit, to the designated beneficiaries if the insured person passes away during the specified policy term. This type of insurance is a crucial tool for managing risks and ensuring financial stability, especially for those who have financial dependents or significant financial obligations.

The key feature of while life insurance is the promise of a death benefit, which is a lump sum payment made to the beneficiaries upon the insured's death. This benefit can be used to cover various expenses and financial responsibilities, such as funeral costs, outstanding debts, mortgage payments, or even provide financial support to family members who rely on the insured's income. The amount of the death benefit is typically determined by the insured and can be customized to fit individual needs and financial goals.

When purchasing while life insurance, the insured individual typically pays a premium to the insurance company. The premium is calculated based on various factors, including the insured's age, health, lifestyle, and the desired death benefit amount. Younger individuals often pay lower premiums as they are considered less risky to insure. The policy term refers to the duration for which the insurance coverage is active, and it can vary from a few years to several decades or even the insured's lifetime.

Upon the insured's death, the beneficiaries must notify the insurance company and provide the necessary documentation to claim the death benefit. The insurance company then verifies the insured's passing and processes the payment of the death benefit to the designated recipients. While life insurance provides a safety net and financial protection, it is essential to carefully consider the different types of life insurance policies available, such as term life, whole life, or universal life, each offering unique features and benefits to suit various financial planning needs.

Unilateral Life Insurance: Assignment System Explained

You may want to see also

Benefits: Provides financial security for beneficiaries in the event of the insured's death

While life insurance is a financial product designed to provide a safety net for loved ones in the event of the insured's passing. It offers a range of benefits that can be invaluable during challenging times. One of its primary advantages is the provision of financial security for beneficiaries when the insured individual dies. This financial security can be a lifeline for those left behind, ensuring that their basic needs and long-term goals are met.

The death benefit, a key feature of while life insurance, is typically a lump sum payment made to the designated beneficiaries upon the insured's death. This amount can be used to cover various expenses, such as funeral costs, outstanding debts, mortgage payments, or even the day-to-day living expenses of the family. By providing a financial cushion, the insurance company helps ease the financial burden on the beneficiaries, allowing them to focus on grieving and adjusting to life without the insured individual.

Moreover, while life insurance offers peace of mind, knowing that your loved ones will be taken care of financially can be incredibly reassuring. It provides a sense of security and stability, especially for those with dependents, such as children or a spouse, who may rely on the insured's income. The policy ensures that the family can maintain their standard of living and continue to meet their financial obligations, even in the absence of the primary breadwinner.

The financial security provided by while life insurance can also be crucial for long-term goals and future planning. Beneficiaries can use the death benefit to invest in education funds for children, start a business, or even plan for retirement. This aspect of the policy enables beneficiaries to build a secure future, even in the face of tragedy.

In summary, while life insurance is a powerful tool for providing financial security and peace of mind. It ensures that beneficiaries are protected and supported during difficult times, allowing them to honor the memory of the insured and build a brighter future. Understanding the benefits of this insurance type is essential for anyone seeking to safeguard their loved ones' financial well-being.

Should Employees Decline Life Insurance Over $50k?

You may want to see also

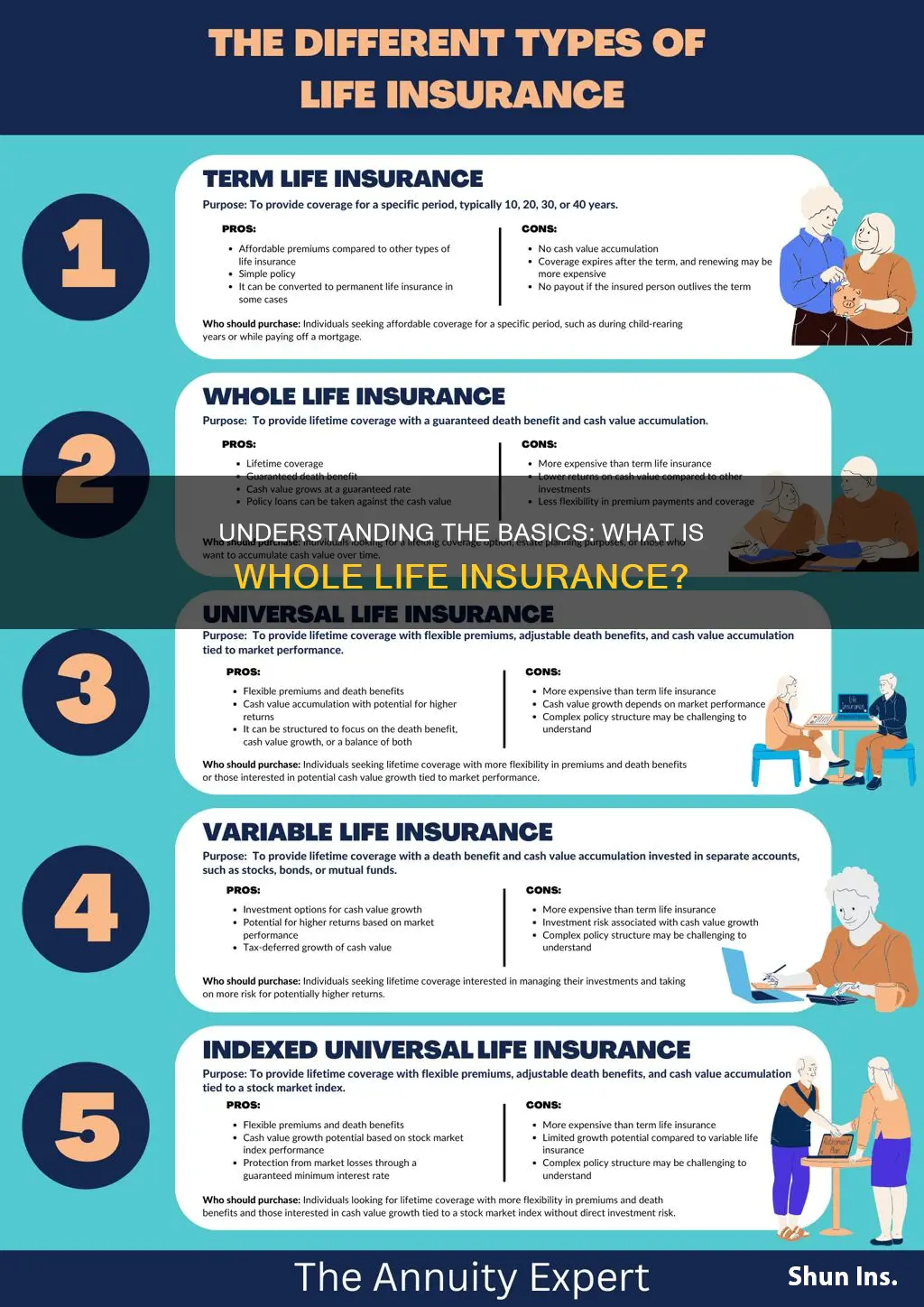

Types: Term, whole life, universal, and variable are common types

When it comes to life insurance, understanding the different types is crucial as it ensures you choose the right coverage for your needs. Here's an overview of the common types of life insurance:

Term Life Insurance: This is a straightforward and affordable type of coverage. It provides protection for a specified period, often 10, 20, or 30 years. During this term, the insurance company guarantees a death benefit if the insured individual passes away. Term life is ideal for those seeking temporary coverage, especially for those with financial obligations like mortgages or children's education. It offers a simple and cost-effective solution, allowing you to secure your loved ones' financial future for a defined period.

Whole Life Insurance: In contrast to term life, whole life insurance offers permanent coverage for the entire lifetime of the insured individual. It provides a death benefit and also includes a cash value component that grows over time. The premiums for whole life are typically higher than term life, but they remain constant throughout the policy's duration. This type of insurance is suitable for those seeking long-term financial security and a guaranteed payout to their beneficiaries. The cash value can be borrowed against or withdrawn, providing additional financial flexibility.

Universal Life Insurance: This type of policy offers flexibility in premium payments and death benefit amounts. It combines permanent coverage with an investment component. Policyholders can adjust their premiums and death benefit over time, allowing for customization based on changing financial circumstances. Universal life insurance provides a flexible approach, enabling individuals to adapt their coverage as their needs evolve. It offers a unique blend of insurance protection and investment opportunities.

Variable Life Insurance: Variable life insurance is a more complex and customizable option. It combines permanent coverage with an investment component, similar to universal life. However, the investment aspect of variable life insurance is more flexible, allowing policyholders to choose from various investment options. This type of policy provides a death benefit and also allows for potential investment growth. Variable life insurance is suitable for those who want both insurance protection and the opportunity to potentially grow their money through investments.

Each of these types of life insurance serves different purposes and caters to various financial goals. Whether you're looking for temporary coverage, long-term financial security, flexibility, or a combination of insurance and investment, understanding these types will help you make an informed decision when selecting the right life insurance policy.

Understanding Life and Long-Term Disability Insurance: Your Comprehensive Guide

You may want to see also

Cost: Premiums are based on age, health, and coverage amount

When considering life insurance, understanding the cost structure is crucial. The premium, or the amount you pay for your policy, is a significant factor in your decision-making process. The cost of life insurance is primarily determined by three key elements: age, health, and the coverage amount you choose.

Age is a critical factor in insurance pricing. Younger individuals typically pay lower premiums compared to older adults. This is because younger people are generally considered to have a longer life expectancy, reducing the risk for the insurance company. As you age, your risk profile changes, and insurance providers may adjust the premium accordingly. For instance, a 25-year-old might pay less for a substantial coverage amount than a 55-year-old with the same coverage needs.

Health status plays a pivotal role in determining the cost of life insurance. Insurance companies assess your health through medical exams, health questionnaires, and even blood tests. A person with a history of chronic illnesses, smoking, or obesity may be considered a higher risk and could face higher premiums. Conversely, maintaining a healthy lifestyle, including regular exercise, a balanced diet, and avoiding harmful habits, can lead to more favorable rates.

The coverage amount you select directly impacts the premium. A higher coverage amount means the insurance company needs to pay out a larger sum in the event of your passing. As a result, the premium will be more expensive to compensate for this increased risk. For example, a $500,000 coverage policy will likely cost more than a $100,000 policy for the same individual.

In summary, the cost of life insurance is tailored to individual circumstances. Age and health are significant determinants of the premium, while the chosen coverage amount also plays a crucial role. Understanding these factors can help you make an informed decision when selecting a life insurance policy that fits your needs and budget.

Variable Life Insurance: Understanding the Policy Flexibility

You may want to see also

Features: Offers guaranteed death benefit, investment options, and potential cash value accumulation

While life insurance is a financial product designed to provide financial security and peace of mind to individuals and their loved ones. It offers a range of features and benefits that can be tailored to meet specific needs and goals. One of the key features of while life insurance is the guaranteed death benefit, which is a fixed amount of money paid out to the policyholder's beneficiaries upon the insured individual's death. This guaranteed benefit ensures that the policyholder's family is financially protected even in the event of the worst-case scenario.

In addition to the guaranteed death benefit, while life insurance often provides investment options, allowing policyholders to grow their money over time. These investment components can be structured in various ways, such as whole life insurance, which includes an investment component that can accumulate cash value over the policy's lifetime. The cash value can be used to pay premiums, take loans, or even withdraw funds (though withdrawals may reduce the death benefit). This flexibility enables individuals to make the most of their insurance policy while also building a valuable asset.

The investment options within while life insurance policies offer a way to potentially increase the overall value of the policy. Policyholders can choose from different investment strategies, such as fixed interest rates, variable investment accounts, or a combination of both. These investment choices provide an opportunity to grow the policy's value, which can be particularly beneficial for long-term financial planning. Over time, the cash value accumulation can be significant, providing a substantial financial resource for the policyholder or their beneficiaries.

Another advantage of while life insurance is the potential for long-term financial security. As the policyholder survives, the cash value can continue to grow, providing a valuable asset that can be used for various purposes. This could include funding education expenses, starting a business, or simply building a financial safety net. The flexibility and potential for growth make while life insurance a versatile tool for individuals seeking comprehensive financial protection and planning.

In summary, while life insurance offers a range of features that provide financial security and flexibility. The guaranteed death benefit ensures peace of mind, while the investment options and potential cash value accumulation allow policyholders to grow their money and build valuable assets. By understanding these features, individuals can make informed decisions about their insurance needs and create a financial plan that aligns with their long-term goals.

Fidelity's Ladder Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Whole life insurance, also known as permanent life insurance, is a type of long-term insurance policy that provides coverage for the entire lifetime of the insured individual. It offers a guaranteed death benefit and a fixed premium that remains the same for the policyholder's entire life. This type of insurance builds up a cash value over time, which can be borrowed against or withdrawn, providing financial security and a potential investment component.

When you purchase a whole life insurance policy, you agree to pay a premium (a fixed amount of money) to the insurance company regularly. The insurance company then promises to pay out a death benefit to your beneficiaries when you pass away. The premiums are typically higher than term life insurance but offer more comprehensive coverage. The policy also has a cash value component, which grows tax-free and can be used for various purposes, such as taking out loans, paying for college, or supplementing retirement income.

There are several advantages to choosing whole life insurance:

- Lifetime Coverage: As the name suggests, it provides coverage for your entire life, ensuring financial security for your loved ones.

- Fixed Premiums: The premium remains constant throughout the policy term, offering stability and predictability in insurance costs.

- Accumulation of Cash Value: The policy's cash value grows over time, allowing policyholders to build a substantial fund that can be utilized for various financial goals.

- Dividend Potential: Some whole life insurance policies offer the opportunity to earn dividends, which can increase the death benefit or be used to pay premiums.

- Flexibility: Policyholders can customize the policy to fit their needs, such as choosing the death benefit amount and the premium payment schedule.

Whole life insurance is suitable for individuals who want long-term financial security and are looking for a comprehensive insurance solution. It is often chosen by those who want to ensure their family's financial well-being in the long run, especially for major expenses like education, mortgage payments, or retirement planning. Additionally, individuals with a desire to build a substantial cash reserve or those who prefer the stability of fixed premiums may find whole life insurance appealing.