Life insurance is a financial product that provides coverage and peace of mind to individuals and their families. When considering life insurance, one important factor is the insurable age, which refers to the age range during which an individual can be eligible for life insurance coverage. This age limit is crucial as it determines the insurability and the terms of the policy. Understanding the insurable age is essential for anyone looking to secure their loved ones' financial future and ensure that they have the necessary coverage in place.

What You'll Learn

- Life Expectancy: Age limits are based on statistical life expectancy

- Health Factors: Underwriting considers health, lifestyle, and family history

- Risk Assessment: Insurers evaluate risk based on age-related health trends

- Product Suitability: Different insurance products cater to various age groups

- Legal Considerations: Age restrictions may vary by jurisdiction and insurance type

Life Expectancy: Age limits are based on statistical life expectancy

The concept of life expectancy is a crucial factor in determining the insurable age for life insurance policies. Insurers use statistical data to assess the likelihood of an individual's death within a specific period, which directly influences the premium rates and eligibility for coverage. Life expectancy is a measure of the average number of years a person is expected to live, and it varies based on various demographic and health factors. When it comes to life insurance, understanding these age-related expectations is essential for both the insurer and the policyholder.

Statistical life expectancy is calculated by analyzing large datasets of mortality rates and survival patterns over time. This data is used to predict the probability of death at different ages, allowing insurers to set appropriate age limits for their policies. For instance, younger individuals generally have a higher life expectancy, making them more attractive candidates for long-term life insurance plans. As age increases, the statistical likelihood of death also rises, which may result in higher premiums or even eligibility restrictions.

Age limits for life insurance policies are often set to ensure that the premiums remain affordable and the risk profile of the insurer is managed. Younger individuals, typically those in their 20s or 30s, are considered prime candidates for life insurance due to their longer life expectancy and lower mortality rates. This demographic is more likely to benefit from long-term coverage, such as whole life or term life insurance, which provides financial security for their families or beneficiaries.

However, as individuals age, the statistical life expectancy decreases, and so do the chances of qualifying for certain types of life insurance. For instance, individuals in their 60s or 70s may face challenges in obtaining comprehensive life insurance coverage, as the risk of death increases with age. In such cases, insurers might offer limited coverage or specialized policies tailored to older adults, often at higher premiums.

It is important to note that life expectancy is just one of the many factors considered by insurers when determining insurable age. Other factors include health status, lifestyle choices, family medical history, and the overall financial health of the applicant. A comprehensive assessment by the insurer ensures that the policy is suitable for the individual and provides the necessary protection. Understanding these age-related expectations can help individuals make informed decisions about their life insurance coverage and plan accordingly for their future needs.

Life Insurance and Child Support: New York's Complex Reality

You may want to see also

Health Factors: Underwriting considers health, lifestyle, and family history

When it comes to life insurance, age is a critical factor, but it's not the only one. Underwriters also consider an individual's health, lifestyle choices, and family medical history to determine eligibility and set premiums. This comprehensive approach ensures that the insurance company can accurately assess the risk associated with insuring a particular individual.

Health is a significant determinant of insurable age. Underwriters often review medical records, including any existing or past health conditions, to gauge the likelihood of future health issues. Chronic diseases, such as diabetes, heart disease, or cancer, can impact life expectancy and may result in higher insurance premiums or even denial of coverage. Additionally, underwriters may consider factors like blood pressure, cholesterol levels, and body mass index (BMI) to assess overall health and potential risks.

Lifestyle choices play a crucial role in underwriting decisions. Smoking, excessive alcohol consumption, and drug use are often scrutinized as they can significantly affect health and longevity. Underwriters may request detailed information about an individual's smoking history, including the duration and frequency, as smoking is a leading cause of preventable deaths. Similarly, excessive drinking or drug abuse can lead to health complications and may impact the underwriting process.

Family history is another essential aspect that underwriters consider. Certain medical conditions or diseases that run in a family can increase the likelihood of an individual developing similar health issues. For example, a family history of heart disease or early-onset cancer may prompt underwriters to request genetic testing or additional medical information. This information helps them make more informed decisions about the risk profile of the applicant.

By evaluating health, lifestyle, and family history, insurance companies can better understand the potential risks associated with insuring a particular individual. This comprehensive underwriting process allows them to set appropriate premiums and determine the most suitable coverage options, ensuring that life insurance policies are fair and beneficial for both the insurer and the policyholder.

Life Term Insurance: Gaining Cash Value?

You may want to see also

Risk Assessment: Insurers evaluate risk based on age-related health trends

The concept of 'insurable age' is a critical factor in the life insurance industry, as it directly influences risk assessment and premium calculations. Insurers use age as a primary metric to determine an individual's life expectancy and overall health, which are essential considerations when evaluating the risk associated with providing life insurance coverage. This assessment is based on extensive research and statistical analysis of age-related health trends, allowing insurers to make informed decisions about policy eligibility and pricing.

Age-related health trends provide valuable insights into the likelihood of certain health issues or conditions developing over time. For instance, older individuals generally face a higher risk of chronic diseases such as heart disease, diabetes, and cancer. These trends are well-documented and can be used to predict the potential health risks associated with different age groups. Insurers leverage this knowledge to assess the likelihood of policyholders requiring medical interventions or developing critical illnesses, which directly impacts the cost of providing insurance.

When evaluating risk, insurers consider various age-related health factors. These include the prevalence of specific diseases, the rate of age-related cognitive decline, and the overall health and lifestyle choices of individuals at different age milestones. For example, younger individuals might be considered lower-risk due to their generally better health and longer life expectancy, while older individuals may face higher premiums due to the increased likelihood of health complications.

The assessment process involves analyzing statistical data, medical research, and demographic trends. Insurers often use sophisticated algorithms and models to predict health outcomes and calculate risk profiles. These tools help them understand the potential financial impact of providing insurance to individuals at different ages. By considering age-related health trends, insurers can offer tailored coverage options and ensure that their risk management strategies are effective.

In summary, insurers use age-related health trends as a powerful tool to assess risk and determine the insurable age of individuals. This approach allows them to provide appropriate coverage while managing potential financial risks. Understanding these trends is essential for both insurers and prospective policyholders, as it influences the accessibility and cost of life insurance.

Child Term Life Insurance: What Parents Need to Know

You may want to see also

Product Suitability: Different insurance products cater to various age groups

When it comes to life insurance, age is a critical factor that determines product suitability and pricing. The insurable age range varies depending on the insurance company and the specific product. Generally, life insurance is available to individuals from their late teens to their late 80s or even 90s, but the eligibility criteria and terms can differ significantly.

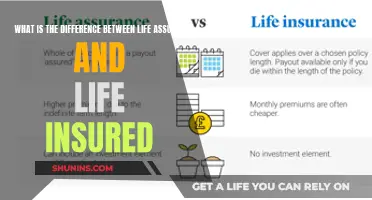

For young adults, term life insurance is often the most suitable product. This type of policy provides coverage for a specific period, typically 10, 20, or 30 years, and is designed to protect against financial loss in the event of the insured's death during that term. Young, healthy individuals often qualify for lower premiums due to the reduced risk associated with their age and lifestyle. Term life insurance is an excellent way for young families to ensure financial security and cover expenses like mortgage payments, education costs, or other long-term commitments.

As individuals age, the insurance market offers various options, including whole life insurance, universal life insurance, and final expense insurance. Whole life insurance provides lifelong coverage and accumulates cash value over time, making it a popular choice for long-term financial planning. Universal life insurance offers flexibility in premium payments and death benefit amounts, allowing policyholders to adjust their coverage as their needs change. Final expense insurance, also known as burial insurance, is designed to cover the costs associated with funeral and burial arrangements, providing peace of mind for the insured and their loved ones.

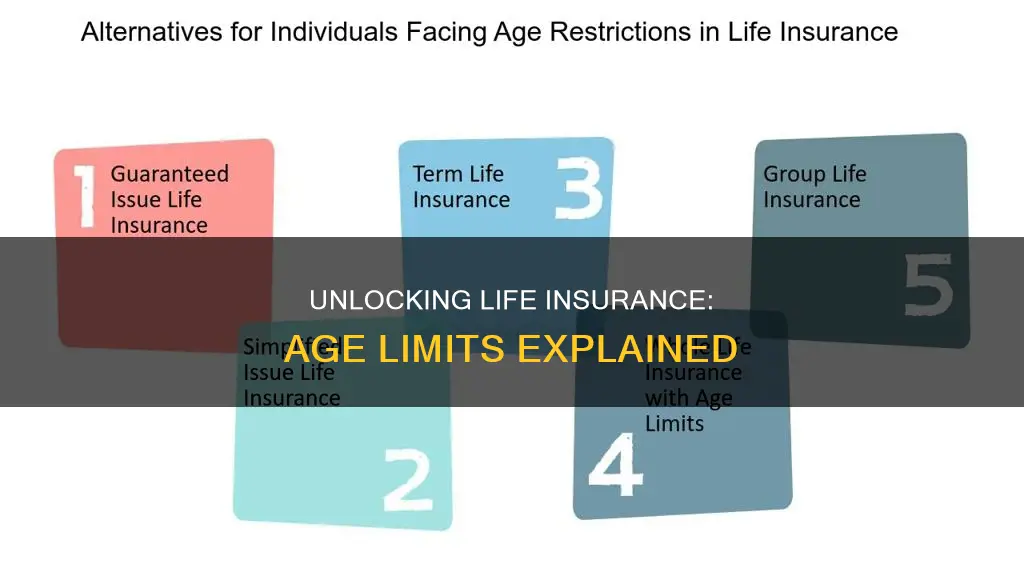

Senior citizens, who may face higher health risks, can still find suitable insurance products. However, they might need to consider specialized policies or work with an insurance agent to find the best options. Some insurance companies offer guaranteed acceptance life insurance, which provides coverage without the need for a medical examination, making it accessible to those with pre-existing health conditions.

In summary, different age groups require specific insurance products to meet their unique needs. Young adults often benefit from term life insurance, while older individuals may explore whole life, universal life, or final expense insurance. Understanding the insurable age range and product suitability is essential for making informed decisions and ensuring adequate financial protection.

Life Insurance Options for Pancreatic Cancer Patients

You may want to see also

Legal Considerations: Age restrictions may vary by jurisdiction and insurance type

When it comes to life insurance, age is a critical factor that can significantly impact an individual's eligibility and the terms of the policy. The concept of the "insurable age" refers to the age at which an individual can legally purchase life insurance and is considered a suitable candidate for coverage. These age restrictions are not arbitrary but are carefully determined by insurance companies and legal frameworks to ensure fair and responsible underwriting practices.

Age-based restrictions in life insurance are primarily driven by the principle of risk assessment. Insurance providers analyze various risk factors, including age, to determine the likelihood of an insured individual's death or the occurrence of a policy-covered event. Younger individuals generally present lower risks, as they have a longer life expectancy and a reduced probability of developing health conditions that could impact insurance claims. As a result, many insurance companies offer more competitive rates and better coverage options for younger applicants.

Legal considerations play a vital role in defining the insurable age. Different jurisdictions have their own regulations and guidelines regarding life insurance eligibility. For instance, in some countries, the minimum age for purchasing life insurance is set at 18 years, while in others, it may be 21 or even older. These age restrictions are often based on the legal capacity of an individual to enter into binding contracts and make financial decisions. Minors, who are typically under the age of 18, may require a legal guardian's consent to purchase life insurance.

Furthermore, the type of life insurance policy can also influence age restrictions. Term life insurance, which provides coverage for a specified period, often has more flexible age requirements compared to permanent life insurance policies. Permanent life insurance, including whole life and universal life, may offer lifelong coverage and accumulate cash value, making them more suitable for individuals who want long-term financial security. The age limits for these policies can vary, with some insurers accepting applications from individuals as young as 10 years old for certain types of permanent life insurance.

It is essential for individuals to understand that age is just one of many factors considered during the underwriting process. Insurance companies also assess an individual's health, lifestyle, occupation, and financial situation to determine the most appropriate coverage and premiums. Therefore, while age restrictions are a significant consideration, they should not be the sole determining factor in an individual's decision to purchase life insurance.

Voluntary Life Insurance: Pre-Tax Benefits for Employees

You may want to see also

Frequently asked questions

Life insurance companies typically consider individuals between the ages of 18 and 85 to be eligible for coverage. However, the specific age range can vary depending on the insurance provider and the type of policy. Some insurers may offer coverage to individuals as young as 16 or as old as 90, while others may have different criteria.

Yes, life insurance is often more affordable and easier to obtain at a younger age. Insurers generally consider younger individuals to be lower-risk policyholders due to their longer life expectancy. Young adults can typically qualify for term life insurance, which provides coverage for a specified period, often with the option to convert it to a permanent policy later.

Older individuals can still qualify for life insurance, but the terms and conditions may differ. As people age, their health and medical history become more relevant to insurance assessments. Older applicants might be offered limited coverage or be required to undergo a more thorough medical examination. Some insurers provide guaranteed acceptance policies, ensuring coverage without medical questions, but these options may come with higher premiums.

Term life insurance is generally available to individuals from the age of 18 to 80, but this can vary. Some insurers offer term policies to individuals as young as 16 or 17, while others may have a maximum age of 75 or 85. The specific age range can also depend on the policy's duration and the insurer's underwriting guidelines.