Life insurance is a financial tool that provides a safety net for individuals and their families in the event of unexpected death. The concept of optimalis in this context refers to the idea of maximizing the benefits of life insurance to ensure financial security and peace of mind. Optimalis life insurance is designed to offer tailored coverage, taking into account individual needs, health, and financial goals. It aims to provide a comprehensive solution, ensuring that the policyholder's loved ones are protected and their financial future is secured, even in the face of unforeseen circumstances. This type of insurance is a strategic investment, allowing individuals to plan for the long term and create a legacy for their beneficiaries.

What You'll Learn

- Definition: Life insurance optimizes financial security by providing coverage tailored to individual needs

- Benefits: It offers financial protection, peace of mind, and support for loved ones

- Types: Term, whole life, and universal life are common types with unique features

- Cost Factors: Premiums depend on age, health, lifestyle, and desired coverage amount

- Policy Customization: Policies can be tailored to meet specific financial goals and circumstances

Definition: Life insurance optimizes financial security by providing coverage tailored to individual needs

Life insurance is a financial tool that plays a crucial role in ensuring the financial well-being of individuals and their loved ones. It is a contract between an individual and an insurance company, where the insurer promises to provide a financial benefit to the policyholder or their designated beneficiaries upon the occurrence of a specified event, typically the death of the insured. The primary purpose of life insurance is to optimize financial security by offering coverage that is tailored to meet the unique needs of each individual.

When it comes to optimizing financial security, life insurance provides a safety net and peace of mind. It ensures that the financial responsibilities and obligations of the insured individual are met, even in the event of their untimely passing. This coverage can help cover various expenses, such as mortgage payments, outstanding debts, funeral costs, and most importantly, the day-to-day living expenses of the family. By providing a financial cushion, life insurance allows beneficiaries to maintain their standard of living and achieve their financial goals, even when the primary breadwinner is no longer present.

The key to optimizing life insurance lies in its customization. Each person's financial situation, goals, and risks are unique, and a one-size-fits-all approach may not be sufficient. Life insurance policies can be tailored to individual needs, taking into account factors such as age, health, lifestyle, and financial obligations. For example, a young, healthy individual with no significant financial commitments may opt for a term life insurance policy, which provides coverage for a specific period, such as 10, 20, or 30 years. This ensures that the insurance is relevant and affordable during the years when the insured is most likely to benefit from it.

On the other hand, an older individual with a substantial estate and dependent family may choose a permanent life insurance policy, such as whole life or universal life insurance. These policies offer lifelong coverage and accumulate cash value over time, providing a financial asset that can be borrowed against or withdrawn. The customization extends to the type of coverage, the amount of the death benefit, and the policy's features, ensuring that the insurance aligns perfectly with the individual's financial objectives.

In summary, life insurance optimizes financial security by offering personalized coverage that adapts to an individual's circumstances. It provides a means to protect loved ones from financial hardship and ensures that the insured's financial goals and obligations are met, even in their absence. By understanding one's unique needs and choosing the right type of life insurance, individuals can gain valuable peace of mind and secure their family's future.

Life Insurance After Cancer: What's the Wait Time?

You may want to see also

Benefits: It offers financial protection, peace of mind, and support for loved ones

Life insurance is a crucial financial tool that provides a safety net for individuals and their families, offering a range of benefits that are often overlooked. One of its primary advantages is financial protection. When you purchase life insurance, you are essentially creating a financial safety net for your loved ones. This is especially important if you have a family or dependents who rely on your income. In the event of your untimely passing, the insurance policy will provide a lump sum payment, known as a death benefit, to your beneficiaries. This financial cushion can help cover essential expenses such as mortgage payments, education costs, or even daily living expenses, ensuring that your loved ones are financially secure during a difficult time.

The peace of mind that life insurance provides is another significant benefit. Knowing that your family is protected financially can alleviate stress and anxiety. It allows you to focus on living your life to the fullest, without constantly worrying about what might happen if something were to happen to you. With life insurance, you can rest assured that your loved ones will be taken care of, even if you are no longer around. This peace of mind is invaluable and can significantly improve the overall well-being of you and your family.

Furthermore, life insurance provides support for your loved ones by ensuring their long-term financial stability. It enables them to maintain their standard of living and pursue their goals, even after your passing. The death benefit can be used to pay for funeral expenses, outstanding debts, or even to start a new business or education fund for your children. By providing this financial support, life insurance helps ease the burden on your loved ones and allows them to grieve without the added stress of financial worries.

In addition to the financial benefits, life insurance also offers emotional support. It provides a sense of security and reassurance, knowing that your family will be cared for. This can be especially important for children, as it ensures they have the necessary resources to grow up in a stable environment. For older adults, life insurance can be a way to leave a legacy and ensure that their life's work and values are preserved for future generations.

In summary, life insurance is a powerful tool that offers financial protection, peace of mind, and support for your loved ones. It provides a safety net during difficult times, allowing your family to focus on healing and moving forward. With the right policy, you can ensure that your loved ones are taken care of, and your legacy will live on, even after your passing. It is a wise investment that demonstrates your commitment to the well-being of your family.

MetLife Insurance: Orthodontic Coverage and Braces Benefits

You may want to see also

Types: Term, whole life, and universal life are common types with unique features

Life insurance is a crucial financial tool that provides financial security and peace of mind to individuals and their loved ones. When considering life insurance, it's essential to understand the different types available, each with its own unique features and benefits. The three primary types of life insurance are term life, whole life, and universal life, each catering to various needs and preferences.

Term Life Insurance: This type of insurance offers coverage for a specified period, known as the 'term.' It is a pure insurance product, providing a death benefit if the insured individual passes away during the term. Term life insurance is often more affordable than other types, making it an attractive option for those seeking temporary coverage. It is ideal for individuals who want to protect their family during a specific period, such as when they have young children or a mortgage. The key advantage is its simplicity and cost-effectiveness, making it a popular choice for short-term financial planning.

Whole Life Insurance: In contrast, whole life insurance provides permanent coverage for the entire lifetime of the insured individual. It offers a death benefit and a cash value component that grows over time. The premiums for whole life insurance are typically higher than term life due to the long-term commitment. This type of policy builds cash value, which can be borrowed against or withdrawn, providing financial flexibility. Whole life insurance is suitable for those seeking long-term financial security and the potential for tax-advantaged savings. It is a comprehensive solution, ensuring that the insured's beneficiaries receive a payout regardless of when the policyholder passes away.

Universal Life Insurance: Universal life insurance offers flexibility and permanent coverage. It provides a death benefit and a cash value component, similar to whole life. However, universal life insurance allows policyholders to adjust their premiums and death benefits over time. This type of policy is suitable for individuals who want the security of permanent coverage but prefer the adaptability of adjusting their insurance plan as their financial situation changes. Universal life insurance can be an excellent choice for those who want to maximize their insurance coverage while also having the option to customize their policy.

Understanding the unique features of each type of life insurance is crucial in making an informed decision. Term life provides temporary coverage at a lower cost, whole life offers permanent protection with a growing cash value, and universal life provides flexibility and customization. The choice between these types depends on an individual's financial goals, risk tolerance, and long-term plans. It is always advisable to consult with a financial advisor to determine the most suitable life insurance type to meet your specific needs.

Finding Life Insurance: Locating Your Provider and Coverage

You may want to see also

Cost Factors: Premiums depend on age, health, lifestyle, and desired coverage amount

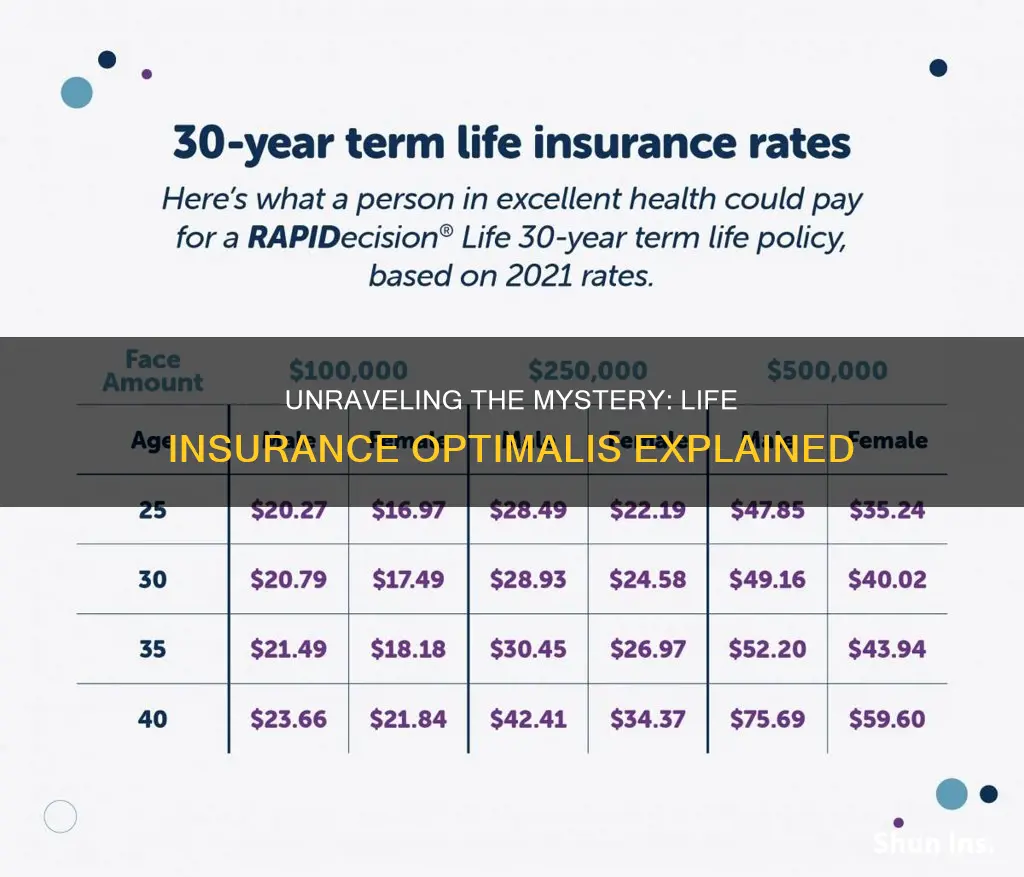

When considering life insurance, understanding the cost factors is crucial as they significantly impact the overall premium. One of the primary determinants of the premium is age. Younger individuals typically pay lower premiums compared to older adults because they are statistically less likely to require insurance payouts during the policy term. As you age, the risk of health issues and mortality increases, leading to higher premiums. For instance, a 25-year-old might pay a lower monthly premium compared to a 55-year-old for the same coverage amount.

Health status plays a pivotal role in determining life insurance premiums. Insurers often assess an individual's health through medical exams, health history, and lifestyle factors. People with pre-existing health conditions, such as heart disease, diabetes, or cancer, may face higher premiums due to the increased likelihood of requiring medical attention or early death. Conversely, individuals with a healthy lifestyle, including regular exercise, a balanced diet, and no significant health issues, are likely to receive more favorable rates.

Lifestyle choices also contribute to premium calculations. Smoking, excessive alcohol consumption, and engaging in high-risk activities can significantly impact the cost of life insurance. Insurers consider these factors as they directly influence an individual's life expectancy and overall health. For example, a non-smoker with a healthy diet and regular exercise routine may pay lower premiums compared to a smoker with a sedentary lifestyle.

The desired coverage amount is another critical factor affecting the premium. The higher the coverage amount, the more the premium will be. This is because a larger payout in the event of the insured's death means a higher risk for the insurer. For instance, a $500,000 life insurance policy will likely have a higher premium than a $100,000 policy, assuming all other factors are equal. It's essential to strike a balance between the desired coverage and the associated premium cost.

In summary, life insurance premiums are influenced by various factors, including age, health, lifestyle, and the desired coverage amount. Younger individuals with healthy lifestyles and no significant health issues often pay lower premiums. Conversely, older adults with health conditions and those engaging in risky behaviors may face higher costs. Additionally, the amount of coverage one chooses directly impacts the premium, with higher coverage amounts resulting in increased costs. Understanding these cost factors is essential for making informed decisions when selecting a life insurance policy.

Insuring Your Boss: Can You Get Life Insurance on Them?

You may want to see also

Policy Customization: Policies can be tailored to meet specific financial goals and circumstances

Life insurance is a powerful tool that can provide financial security and peace of mind, especially when it is customized to fit individual needs. The concept of 'Optimalis' in life insurance refers to the process of tailoring a policy to achieve specific financial objectives and address unique personal circumstances. This customization is a key advantage of life insurance, allowing individuals to create a safety net that aligns perfectly with their goals and situations.

When it comes to policy customization, there are several aspects to consider. Firstly, the amount of coverage can be adjusted based on the individual's financial obligations and goals. For instance, a young professional with a mortgage and a growing family might opt for a higher coverage amount to ensure their loved ones are financially protected in the event of their passing. On the other hand, an elderly individual with no dependents might choose a lower coverage to avoid unnecessary financial burden. This flexibility ensures that the policy is not one-size-fits-all but rather a personalized solution.

Secondly, the type of life insurance policy can be adapted to suit different life stages and priorities. Term life insurance, for instance, provides coverage for a specified period, making it ideal for individuals who want to secure their family's financial future during a particular phase of life. Conversely, permanent life insurance offers lifelong coverage and a cash value component, which can be beneficial for long-term financial planning and wealth accumulation. By choosing the right type of policy, individuals can ensure that their insurance aligns with their evolving needs.

Furthermore, policy customization allows for the inclusion of additional benefits and riders to enhance coverage. For example, an individual might opt for an accidental death benefit rider, which provides an additional payout if the insured person's death is a result of an accident. Other customizable features could include waiver of premium riders, which ensure that premiums are waived if the insured becomes unable to work due to illness or injury. These customizable options empower individuals to create a comprehensive insurance plan that goes beyond basic coverage.

In summary, life insurance optimization through policy customization is a strategic approach to financial planning. It enables individuals to create a tailored safety net that addresses their specific financial goals and circumstances. By adjusting coverage amounts, choosing appropriate policy types, and adding beneficial riders, individuals can ensure that their life insurance is a powerful tool for achieving long-term financial security and peace of mind. This level of customization is a key advantage of life insurance, making it an essential consideration for anyone seeking to protect their loved ones and secure their financial future.

Exam FX Life Insurance: How Many Questions?

You may want to see also

Frequently asked questions

Life Insurance Optimalis is a comprehensive life insurance plan designed to provide financial security and peace of mind to individuals and their families. It offers a range of benefits, including coverage for accidental death, critical illness, and disability, ensuring that policyholders and their loved ones are protected in various life circumstances.

This insurance plan operates by assessing the individual's risk profile and offering tailored coverage. It typically involves a medical examination to determine eligibility and set the premium rate. The policy then provides financial benefits to the beneficiary upon the occurrence of a covered event, such as death, critical illness, or disability.

Optimalis may include features like:

- Accidental Death Coverage: Provides a payout if the insured person dies as a result of an accident.

- Critical Illness Benefits: Offers financial assistance if the policyholder is diagnosed with a critical illness, helping with medical expenses and income replacement.

- Disability Income Protection: Ensures a regular income stream if the insured becomes disabled and cannot work.

- Flexible Payout Options: Allows policyholders to choose how and when the benefits are received.

Eligibility criteria may vary, but generally, it is available to individuals who meet the insurer's health and age requirements. Factors such as medical history, lifestyle, and occupation are considered to determine eligibility and set the premium. It is advisable to consult the insurance provider to understand the specific eligibility criteria and available options.