Many people underestimate the importance of life insurance, often viewing it as an unnecessary expense or a topic to avoid. Despite its critical role in providing financial security and peace of mind, life insurance remains a misunderstood concept. This article aims to shed light on the common misconceptions surrounding life insurance, exploring why it is essential for individuals and families to consider as a vital component of their financial planning. By understanding the benefits and addressing the myths, readers can make informed decisions about their future and the well-being of their loved ones.

What You'll Learn

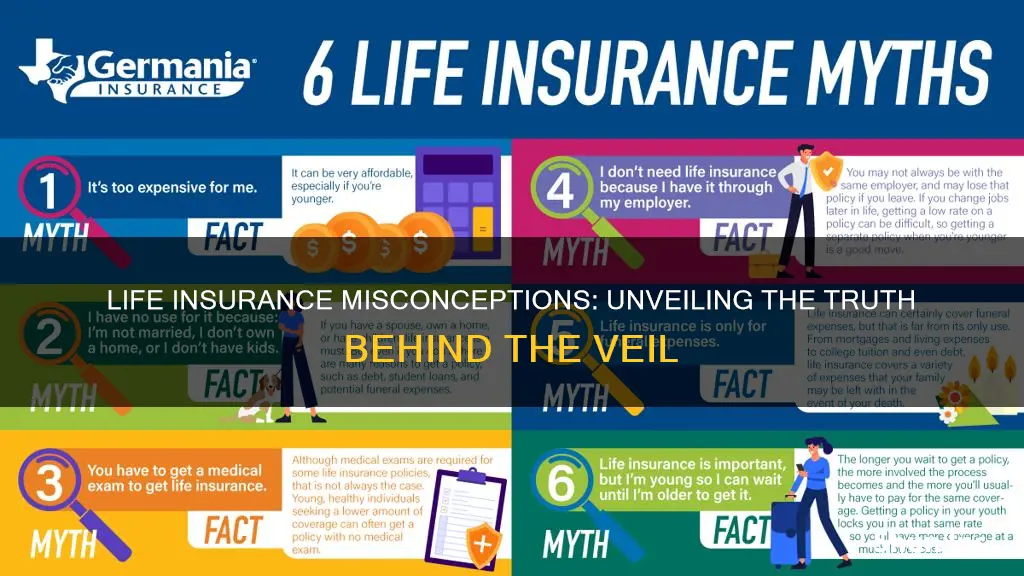

- Misconception: Life insurance is only for the wealthy

- Complexity: It's not just about death; it covers living expenses too

- Misunderstanding: Term life is the only option, ignoring permanent plans

- Cost: Many think it's too expensive, ignoring long-term savings

- Misinformation: People assume it's a one-time purchase, not a lifelong commitment

Misconception: Life insurance is only for the wealthy

Life insurance is a crucial financial tool that provides a safety net for individuals and their families, offering peace of mind and financial security. However, there are several misconceptions about life insurance that often deter people from considering it, one of which is the belief that it is only for the wealthy. This misconception can be harmful, as it suggests that life insurance is an unaffordable luxury, which is simply not true.

The idea that life insurance is exclusively for the wealthy is a common misunderstanding. In reality, life insurance is designed to be accessible to people from all walks of life, regardless of their financial status. It is a versatile product that can be tailored to suit various budgets and needs. Many affordable life insurance options are available, such as term life insurance, which provides coverage for a specified period, often at lower premiums compared to permanent life insurance. This type of policy is ideal for those who want coverage for a specific goal, like protecting their family during the years when they are financially dependent on the breadwinner.

Furthermore, life insurance is not just about the wealthy; it is about ensuring financial stability for loved ones. It can be a vital tool for anyone who has people who depend on their income, such as a spouse, children, or other family members. The primary purpose of life insurance is to provide financial support in the event of the insured's death, ensuring that the remaining family members can maintain their standard of living and cover essential expenses. For example, a middle-income family with a mortgage, children's education fees, and daily living expenses can greatly benefit from life insurance. The policy can help cover these costs, providing a financial cushion during a difficult time.

Another aspect to consider is that life insurance can be a valuable investment. Some life insurance policies offer investment components, allowing policyholders to grow their money over time. This feature can be particularly beneficial for those who want to save for long-term goals, such as retirement or their children's future. By combining insurance with investment, individuals can secure their family's financial future while also potentially building wealth.

In summary, life insurance is not exclusive to the wealthy; it is a practical and affordable way to protect your loved ones and secure their financial future. It is essential to dispel the myth that life insurance is only for the affluent, as it can provide invaluable support to anyone who wants to ensure their family's well-being. With various policy options available, life insurance can be tailored to meet individual needs, making it an accessible and beneficial financial decision for all.

Connecticut Attorneys: Licensed for Life Insurance?

You may want to see also

Complexity: It's not just about death; it covers living expenses too

Many people mistakenly believe that life insurance is solely a tool for providing financial security in the event of a tragic death. While this is a crucial aspect, it is just one piece of the puzzle. The complexity of life insurance lies in its ability to offer financial protection and support throughout an individual's entire life, not just at the end of it.

One often overlooked aspect is the living benefit of life insurance. This feature allows policyholders to access a portion of their death benefit while they are still alive, providing financial assistance for various needs. For instance, if a policyholder is diagnosed with a critical illness, they can use the funds to cover medical expenses, ongoing treatments, and even daily living costs. This can be a lifeline for individuals facing serious health challenges, ensuring they have the financial means to manage their condition and maintain their standard of living.

Furthermore, life insurance can provide financial security during periods of unemployment or career transitions. If a policyholder loses their job or decides to pursue a different career path, the insurance policy can offer a steady income to cover living expenses and support their transition. This aspect is particularly valuable in today's volatile job market, where financial stability is essential for peace of mind.

The living benefits of life insurance extend beyond medical emergencies and career changes. It can also provide financial support for education, home improvements, or starting a business. For families, it can ensure that children's education funds are available, or it can contribute to the down payment on a new home. These flexible uses of the policy's benefits demonstrate the comprehensive nature of life insurance, which goes far beyond its traditional role of providing for dependents after an individual's passing.

In summary, life insurance is a complex and versatile financial tool. It offers not only a safety net for loved ones in the event of death but also a range of living benefits that can provide financial security and support during various life events. Understanding this complexity is essential for individuals to make informed decisions about their insurance needs and ensure they have the right coverage to protect themselves and their families.

Infidelity's Impact: Life Insurance and Cheating

You may want to see also

Misunderstanding: Term life is the only option, ignoring permanent plans

Many people mistakenly believe that term life insurance is the only viable option when it comes to life coverage, often due to its lower cost and simplicity. Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years, and it is designed to offer financial protection during that time. While it is an excellent choice for many, it is crucial to understand that term life insurance is not the only type of coverage available. Ignoring permanent life insurance plans can lead to missing out on valuable benefits and long-term financial security.

Permanent life insurance, also known as whole life or universal life, offers lifelong coverage and provides a range of advantages. One of the key benefits is the accumulation of cash value over time, which can be borrowed against or withdrawn as needed. This feature allows policyholders to build a substantial financial asset that can be used for various purposes, such as funding education, starting a business, or providing financial security for loved ones. Unlike term life, permanent plans do not have an expiration date, ensuring that your loved ones are protected throughout your entire life.

The misconception that term life is the only option often stems from its affordability and suitability for specific needs. Term life is ideal for individuals who want coverage for a defined period, such as covering mortgage payments or providing financial support for children's education. However, it may not be the best choice for those seeking long-term financial planning and the peace of mind that comes with lifelong coverage. Permanent life insurance offers flexibility and the potential for long-term savings, making it a comprehensive solution for those who want both coverage and an investment component.

When considering life insurance, it is essential to evaluate your financial goals and long-term needs. Permanent life insurance can be tailored to fit various budgets and can provide a sense of security that term life alone may not offer. It allows individuals to build a financial cushion that can be passed on to beneficiaries or used for personal financial goals. By understanding the differences between term and permanent life insurance, you can make an informed decision that aligns with your unique circumstances and ensures your loved ones' financial well-being.

In summary, while term life insurance is a valuable and cost-effective option, it is essential to recognize that permanent life insurance plans offer more than just temporary coverage. By exploring the benefits of permanent life insurance, individuals can make a more informed choice, ensuring they have the right level of protection and financial security for their loved ones' future. This understanding can empower people to make the best decision regarding their life insurance needs.

Life Insurance: Changing Policies Whenever You Want

You may want to see also

Cost: Many think it's too expensive, ignoring long-term savings

Many people often overlook the long-term financial benefits of life insurance, mistakenly believing it to be an unnecessary expense. The primary misconception is that life insurance is too costly, especially when compared to other forms of savings or investments. However, this notion fails to consider the comprehensive nature of life insurance and its potential to provide financial security for one's loved ones.

The cost of life insurance can vary significantly depending on several factors, including age, health, lifestyle, and the amount of coverage required. While it is true that younger, healthier individuals may find life insurance premiums more affordable, it is essential to understand that this coverage becomes increasingly valuable as one ages. As individuals progress through life, their financial responsibilities and commitments often grow, making life insurance a crucial safety net. For instance, a young professional might opt for a term life insurance policy to cover their mortgage or provide for their children's education. Over time, as their financial situation improves, they can transition to a permanent life insurance policy, which offers both death benefit coverage and a cash value component, allowing for long-term savings.

The idea that life insurance is a one-time expense is a common misconception. In reality, life insurance can serve as a powerful tool for long-term financial planning. Term life insurance, for instance, provides coverage for a specific period, typically 10, 20, or 30 years, and is often more affordable for younger individuals. This type of policy can be an excellent way to secure financial obligations during the most critical years of one's life. As individuals age, they may consider converting to a permanent life insurance policy, which offers lifelong coverage and a cash value accumulation, providing a source of savings that can be borrowed against or withdrawn.

Furthermore, the cost-effectiveness of life insurance becomes evident when considering the potential financial loss that could arise without it. A sudden death or critical illness can leave a family in a dire financial situation, facing medical bills, mortgage payments, or the loss of a primary income earner. Life insurance can provide the necessary financial support to cover these expenses, ensuring that loved ones are protected and that long-term financial goals remain on track. It is a way to manage risk and provide peace of mind, knowing that your family's financial future is secure.

In summary, the notion that life insurance is too expensive is often based on a short-term perspective. By understanding the long-term value and flexibility of different life insurance policies, individuals can make informed decisions that align with their financial goals and provide a safety net for their loved ones. It is a valuable tool that should not be overlooked due to initial cost concerns.

Locating Your SBI Life Insurance Customer ID

You may want to see also

Misinformation: People assume it's a one-time purchase, not a lifelong commitment

Many people mistakenly believe that purchasing life insurance is a one-time decision, similar to buying a house or a car. However, this is a common misconception that can lead to significant financial and personal consequences. Life insurance is not a one-time purchase but rather a lifelong commitment, and its importance evolves over time.

As individuals progress through different life stages, their insurance needs can change. For example, young families may require term life insurance to provide financial security for their children's future, while older individuals might opt for permanent life insurance to ensure their estate is protected and to leave a legacy for their beneficiaries. The needs of a single parent with young children are vastly different from those of a retiree, and the insurance policies should reflect these changes.

The misconception that life insurance is a one-time purchase can lead to inadequate coverage. Life insurance policies are designed to adapt to an individual's changing circumstances. As one's income, family size, and financial obligations evolve, so should the insurance coverage. Regular reviews of the policy are essential to ensure that it remains relevant and effective. For instance, a young professional might start with a basic term policy and then upgrade to a more comprehensive plan as they advance in their career and start a family.

Furthermore, life insurance is not just about providing financial support in the event of an untimely death. It also offers other benefits, such as tax-free cash value accumulation in permanent policies, which can be borrowed against or withdrawn for various financial needs. This aspect of life insurance is often overlooked, leading people to view it solely as a death benefit, which is a critical component but not the only reason to have this coverage.

In summary, life insurance is a dynamic financial tool that should be reviewed and adjusted periodically to meet the evolving needs of the insured. It is not a one-size-fits-all purchase but rather a lifelong commitment that provides financial security and peace of mind. Understanding this aspect of life insurance is crucial for making informed decisions and ensuring that one's loved ones are adequately protected.

Airline Insurance: Credit Card Coverage for Travelers

You may want to see also

Frequently asked questions

Life insurance is a financial tool designed to provide financial security and peace of mind to individuals and their loved ones. It offers a safety net by ensuring that a designated beneficiary receives a payout in the event of the insured person's death. This payout can help cover various expenses, such as funeral costs, outstanding debts, mortgage payments, or daily living expenses, ensuring that the family's financial obligations are met and their long-term goals are protected.

When you purchase a life insurance policy, you agree to pay a premium (a fixed amount of money) to the insurance company regularly. In return, the insurance company promises to pay out a death benefit (a lump sum of money) to your chosen beneficiary if you pass away during the term of the policy. The death benefit can be a fixed amount or an adjustable sum based on the policy's terms. The insurance company assesses your risk based on factors like age, health, lifestyle, and family medical history to determine the premium and policy terms.

No, life insurance is not exclusively for those with families. While it can provide essential financial support to a family in the event of the breadwinner's death, it is also valuable for individuals. Young adults starting their careers, single people, and even retirees can benefit from life insurance. For young adults, it can be a way to build financial security and pay off student loans. Single individuals can use it to cover potential debts or leave a financial legacy. Retirees may consider term life insurance to ensure their estate is protected if they pass away.

There are several types of life insurance policies, each with unique features and benefits:

- Term Life Insurance: This is a temporary policy that provides coverage for a specified period, such as 10, 20, or 30 years. It offers high coverage amounts at relatively low costs and is ideal for individuals who want temporary financial protection for a specific period.

- Permanent Life Insurance: This type of policy provides lifelong coverage and includes a cash value component that grows over time. It offers a death benefit and can be used for various financial goals, such as long-term savings or investment. Examples include whole life and universal life insurance.

- Universal Life Insurance: This is a type of permanent life insurance that offers flexibility in premium payments and death benefit amounts. It provides a guaranteed death benefit and allows policyholders to adjust their coverage as their needs change.

- Whole Life Insurance: A permanent policy with a fixed premium and death benefit, offering consistent coverage and a cash value that accumulates over time.

Yes, life insurance can be a tax-efficient investment strategy. The death benefit paid out upon the insured's death is generally not subject to income tax for the beneficiary. Additionally, the cash value in permanent life insurance policies can grow tax-free, providing a potential source of tax-free funds for policyholders. However, it's essential to consult with a financial advisor to understand the tax implications and ensure that life insurance is used appropriately within a comprehensive financial plan.