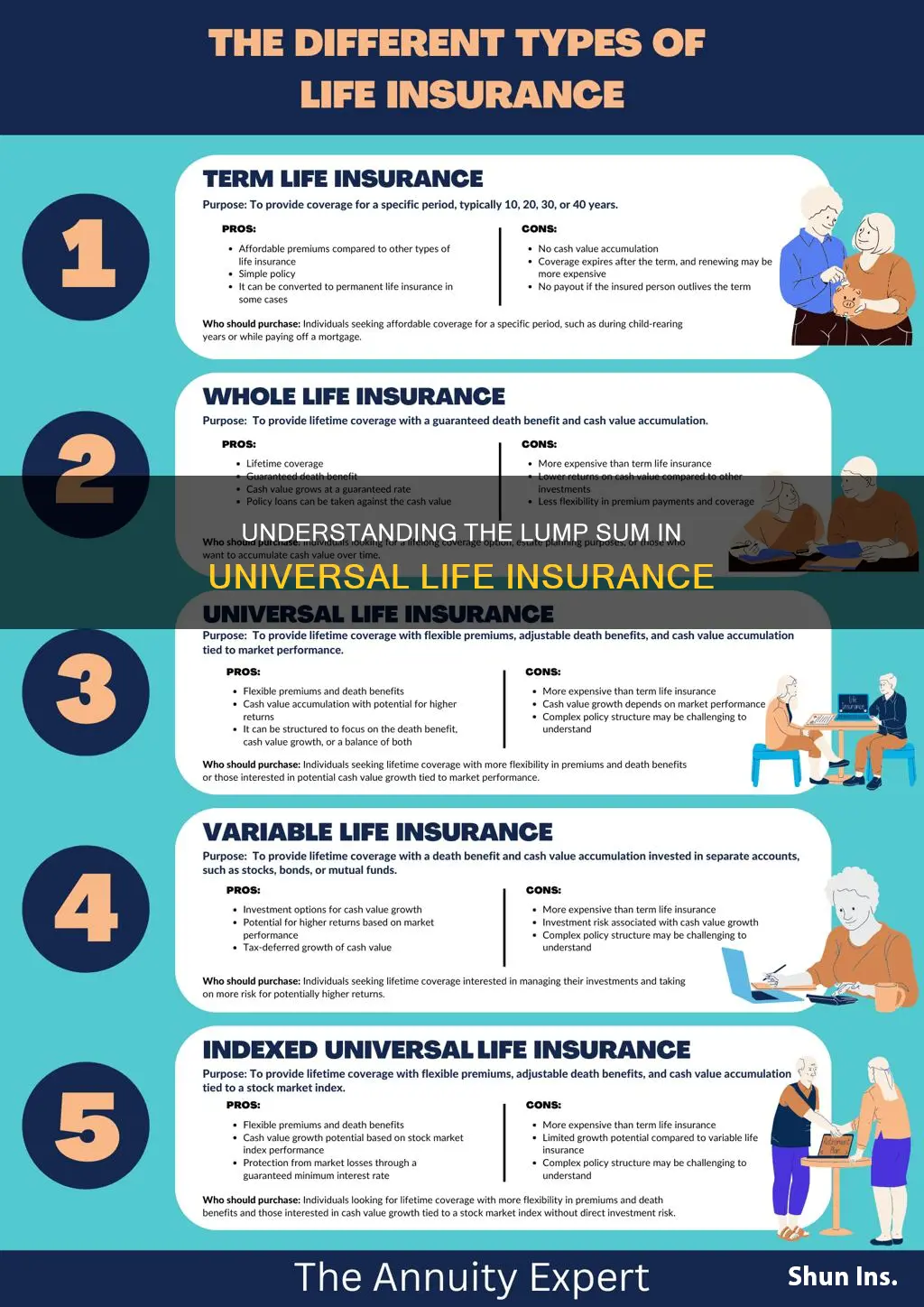

Universal life insurance is a type of permanent life insurance that offers a unique feature known as a lump sum. This term refers to the initial amount of money that is invested in the policy when it is first purchased. The lump sum is a key component of universal life insurance, as it determines the policy's cash value, which grows over time through interest and investment returns. Understanding the concept of the lump sum is essential for policyholders, as it directly impacts the policy's performance, including its ability to provide death benefits and potential cash value accumulation.

What You'll Learn

- Definition: The lump sum is a fixed amount paid out upon the policyholder's death

- Benefits: It offers a guaranteed death benefit, providing financial security

- Investment: This sum is invested, growing over time

- Flexibility: Policyholders can adjust the lump sum amount

- Tax Advantages: Tax-deferred growth and potential tax-free withdrawals

Definition: The lump sum is a fixed amount paid out upon the policyholder's death

The lump sum in universal life insurance is a crucial component of this type of insurance policy. When an individual purchases a universal life insurance policy, they agree to pay regular premiums to the insurance company. In return, the insurance company promises to provide a death benefit to the policyholder's beneficiaries upon their passing. This death benefit is a fixed amount, known as the lump sum.

Upon the death of the policyholder, the insurance company is obligated to pay out this lump sum to the designated beneficiaries. The amount is predetermined and agreed upon at the time of policy purchase. This feature provides financial security and peace of mind to the policyholder's loved ones, ensuring that a specified sum is available to cover various expenses and financial obligations that may arise following the policyholder's death.

It is important to understand that the lump sum in universal life insurance is a fixed amount, meaning it remains constant throughout the life of the policy. This is in contrast to other types of life insurance, where the death benefit may vary based on factors such as investment performance or policy adjustments. The lump sum is a guaranteed benefit, offering stability and predictability in an otherwise uncertain situation.

The lump sum can be used for various purposes, such as covering funeral expenses, paying off debts, providing financial support to dependents, or even funding future educational expenses. It is a significant financial resource that can help ease the financial burden on the policyholder's family during a difficult time.

In summary, the lump sum in universal life insurance is a fixed amount paid out to beneficiaries upon the policyholder's death. It provides financial security and peace of mind, ensuring that a predetermined sum is available to cover essential expenses and obligations. Understanding this aspect of universal life insurance is crucial for individuals considering this type of coverage to ensure they have adequate financial protection for their loved ones.

Understanding Face Amount Life Insurance Benefits

You may want to see also

Benefits: It offers a guaranteed death benefit, providing financial security

Universal life insurance is a type of permanent life insurance that offers a unique feature known as the "lump sum" or "cash value." This aspect of the policy provides several advantages, particularly in terms of financial security and flexibility. One of the key benefits is the guaranteed death benefit, which is a cornerstone of this insurance type.

When you purchase a universal life insurance policy, you are essentially investing in a flexible financial instrument. The lump sum component allows you to build up cash value over time, which can be borrowed against or withdrawn as needed. This cash value is a result of the policy's investment performance and the premiums you pay. As you make regular payments, a portion of each premium goes towards building this cash reserve.

The guaranteed death benefit is a critical feature, ensuring that your beneficiaries receive a specified amount upon your passing. This benefit is typically equal to the policy's cash value plus any additional amounts you have paid in. The beauty of this guarantee is that it provides financial security for your loved ones, regardless of market fluctuations or changes in the policy's investment performance. It offers a stable and reliable source of funds when it matters most.

In addition to the death benefit, the lump sum in universal life insurance provides flexibility. Policyholders can adjust their premiums and death benefits to align with their changing financial circumstances. This adaptability is particularly useful for those who want to ensure their insurance coverage remains appropriate over time without the need for frequent policy adjustments.

Furthermore, the cash value accumulation can be a valuable asset. It can be used to secure a loan, providing immediate access to funds for various purposes, such as education expenses or business ventures. This feature also allows policyholders to build a substantial cash reserve, which can be utilized for retirement planning or other long-term financial goals. The guaranteed death benefit, coupled with the flexibility and potential for cash accumulation, makes universal life insurance a powerful tool for financial security and planning.

Becoming an Independent Life Insurance Distributor: A Guide

You may want to see also

Investment: This sum is invested, growing over time

The lump sum in universal life insurance is a crucial component of this financial product, offering policyholders a unique opportunity to invest their money and potentially grow their wealth over time. When you purchase a universal life insurance policy, a portion of your premium payments is allocated as a lump sum, which is then invested by the insurance company. This investment strategy is designed to provide a steady growth rate, allowing your money to accumulate and potentially increase in value.

This investment aspect of universal life insurance is a key differentiator from traditional term life insurance. With the lump sum, you are essentially providing the insurance company with a sum of money that they can use to invest in various financial instruments, such as stocks, bonds, or mutual funds. The goal is to generate returns that can be used to pay future insurance premiums, ensuring the policy remains in force and providing coverage for the insured individual.

The investment strategy employed by the insurance company is typically diversified, aiming to balance risk and return. This diversification helps to protect the policyholder's investment to some extent, as it minimizes the impact of any single investment's poor performance. Over time, the lump sum can grow, and the policyholder benefits from this growth, which can be used for various financial goals, such as retirement planning, education funding, or building an emergency fund.

One of the advantages of this investment approach is the potential for long-term growth. Universal life insurance policies often have a long-term focus, allowing the lump sum to compound over many years. This compounding effect can significantly increase the value of the investment, providing policyholders with a substantial financial asset. Additionally, the investment strategy may offer flexibility, allowing policyholders to access their funds through various means, such as policy loans or withdrawals, providing financial flexibility when needed.

In summary, the lump sum in universal life insurance is an investment vehicle that allows policyholders to grow their money over time. This investment strategy, managed by the insurance company, offers a potential for wealth accumulation and provides a unique financial tool for individuals seeking both insurance coverage and investment opportunities. Understanding the investment aspect of universal life insurance is essential for making informed financial decisions and maximizing the benefits of this comprehensive insurance product.

Transamerica Life Insurance: Is the Company Still Operational?

You may want to see also

Flexibility: Policyholders can adjust the lump sum amount

Universal life insurance offers policyholders a unique feature that provides flexibility and control over their insurance policy: the ability to adjust the lump sum amount. This feature is a significant advantage for those who want to customize their insurance coverage to fit their changing needs and financial goals.

The lump sum in universal life insurance refers to a portion of the policy's cash value that can be borrowed or withdrawn by the policyholder. This lump sum amount is typically a fixed percentage of the policy's total cash value, and it can be increased or decreased by the policyholder at their discretion. By adjusting this amount, policyholders can effectively manage their insurance policy's value and ensure it aligns with their financial objectives.

One of the key benefits of this flexibility is the ability to access funds during financial emergencies or unexpected expenses. Policyholders can borrow against the lump sum without disrupting their regular insurance coverage. This feature provides a safety net and financial security, allowing individuals to address urgent financial needs without having to surrender their policy or take out a loan with potentially higher interest rates.

Additionally, the adjustability of the lump sum amount enables policyholders to optimize their investment strategy. As financial goals and priorities evolve, individuals can modify the lump sum to align with their current financial situation. For example, a policyholder may choose to increase the lump sum during periods of higher income to build up the policy's cash value more rapidly. Conversely, they might opt to reduce the lump sum during times of lower income to conserve cash flow while still maintaining adequate insurance coverage.

This level of flexibility is particularly valuable for those who want to maximize the benefits of universal life insurance. By regularly reviewing and adjusting the lump sum, policyholders can ensure that their insurance policy remains a dynamic and effective financial tool that adapts to their changing circumstances. This feature empowers individuals to take an active role in managing their insurance and financial well-being.

Understanding Life Insurance Provisions: What You Need to Know

You may want to see also

Tax Advantages: Tax-deferred growth and potential tax-free withdrawals

Universal life insurance offers a unique feature that can significantly benefit policyholders: tax advantages. One of the key advantages is the potential for tax-deferred growth of the cash value in the policy. When you invest in a universal life insurance policy, the cash value, which is the investment component of the policy, grows tax-deferred. This means that any earnings or interest accrued on the policy's investment are not subject to annual income taxes as they would be in a traditional savings account or investment portfolio. Over time, this tax-deferred growth can accumulate substantial savings, providing a significant financial benefit.

The tax-deferred nature of universal life insurance allows your money to grow faster. Instead of paying taxes on the interest earned each year, the earnings are reinvested, and the policy's value increases. This compound growth can result in a substantial increase in the policy's cash value, which can be used for various purposes, such as funding education, starting a business, or providing financial security for retirement. As the policy's value grows, it becomes a valuable asset that can be utilized to meet your financial goals.

Another tax advantage of universal life insurance is the potential for tax-free withdrawals. When you take a withdrawal from the policy's cash value, you typically won't owe income tax on the amount withdrawn, provided certain conditions are met. This is because the cash value has already been grown tax-deferred, and the subsequent withdrawals are considered returns of your own money plus any earnings. As long as the policy is in force and you have not borrowed against the cash value, withdrawals can be tax-free, allowing you to access your funds without incurring additional tax liabilities.

The tax-free withdrawals can be particularly beneficial when you need to access funds for various financial needs. Whether it's making a large purchase, funding a business venture, or covering unexpected expenses, the ability to withdraw money tax-free can provide financial flexibility. Additionally, the tax-free nature of these withdrawals ensures that you retain more of your hard-earned money, allowing you to achieve your financial objectives more efficiently.

In summary, universal life insurance provides tax advantages through tax-deferred growth and the potential for tax-free withdrawals. By allowing your money to grow tax-free, the policy's cash value can accumulate significant savings over time. The tax-free withdrawals enable you to access your funds without incurring additional tax liabilities, providing financial flexibility and security. Understanding these tax benefits is essential when considering universal life insurance as a comprehensive financial planning tool.

Canceling Tokio Marine Life Insurance: A Step-by-Step Guide

You may want to see also

Frequently asked questions

In universal life insurance, a lump sum refers to a fixed amount of money that is paid out as a single, large payment upon the death of the insured individual. This is in contrast to the more common term life insurance, where the death benefit is typically a regular, periodic payment.

The lump sum amount is calculated based on the insured's age, health, and the insurance company's underwriting guidelines. It is a predetermined value that represents the financial benefit provided to the policyholder's beneficiaries when the insured person passes away.

One significant advantage is the potential for a higher payout compared to term life insurance. Additionally, the lump sum can be used to cover various expenses, such as funeral costs, outstanding debts, or even as a financial legacy for beneficiaries.

Typically, the lump sum amount is set at the time of policy issuance and cannot be changed or adjusted during the policy's lifetime. However, some policies may offer options to increase or decrease the death benefit, but these changes usually require a medical examination and may be subject to certain conditions.

Yes, there can be tax considerations. In many jurisdictions, the lump sum death benefit may be subject to income tax for the beneficiaries. The tax treatment can vary, so it's essential to consult with a financial advisor or tax professional to understand the specific tax implications in your region.