Ordinary life insurance, while a valuable financial tool, has a significant limitation: it is not suitable for everyone. One major constraint is that it typically requires a medical examination and health history review, which can be a barrier for individuals with pre-existing health conditions or those who lead high-risk lifestyles. This process can lead to higher premiums or even denial of coverage, making it less accessible to certain demographics. Additionally, the coverage amount may not fully reflect the individual's needs, especially for those with complex financial situations or those seeking long-term care insurance. Understanding these limitations is crucial for consumers to make informed decisions about their insurance needs.

What You'll Learn

- High Premiums: Life insurance can be expensive, especially for older individuals or those with health issues

- Limited Coverage: Policies may not provide sufficient coverage for all financial needs and goals

- Expiration: Term life insurance policies typically have an expiration date, requiring renewal or replacement

- Health Restrictions: Pre-existing conditions or lifestyle factors may lead to higher premiums or policy exclusions

- Complexity: Understanding the fine print and policy terms can be challenging for the average consumer

High Premiums: Life insurance can be expensive, especially for older individuals or those with health issues

The high cost of life insurance is a significant limitation, particularly for individuals who fall into certain demographic or health-related categories. As people age, the risk of developing health issues increases, and this is a critical factor in determining insurance premiums. Older individuals often face higher insurance rates because they are statistically more likely to require medical attention and have a reduced life expectancy. This demographic factor alone can significantly impact the overall cost of coverage.

For instance, a 60-year-old individual with a history of chronic health conditions may find that their life insurance premiums are substantially higher compared to a younger, healthier counterpart. The insurance company's assessment of risk is based on various factors, including age, medical history, lifestyle choices, and overall health status. These considerations are essential in calculating the premium, as they directly influence the likelihood of making payouts.

Furthermore, the presence of pre-existing health conditions can further exacerbate the issue of high premiums. Conditions such as heart disease, diabetes, or cancer can significantly increase the likelihood of early mortality or frequent medical interventions. As a result, insurance providers may view these individuals as high-risk, leading to more expensive insurance policies. This limitation can be particularly challenging for those who already have limited financial resources or are on a fixed income.

There are strategies that individuals can employ to mitigate the impact of high premiums. One approach is to maintain a healthy lifestyle, which can include regular exercise, a balanced diet, and avoiding harmful habits like smoking. These measures can improve overall health and potentially lower insurance rates. Additionally, individuals can explore different types of life insurance policies, such as term life insurance or whole life insurance, each with its own set of advantages and cost structures.

In summary, the high cost of life insurance, especially for older individuals and those with health issues, is a significant limitation. It is essential to understand these factors and explore potential solutions to ensure that life insurance remains accessible and affordable for all. By being proactive and making informed decisions, individuals can navigate this limitation and secure the necessary financial protection for themselves and their loved ones.

Disclosure Statements: Life Insurance's Fine Print

You may want to see also

Limited Coverage: Policies may not provide sufficient coverage for all financial needs and goals

The primary limitation of ordinary life insurance is its potential to fall short of comprehensive financial coverage, which can be a significant concern for individuals and families. Life insurance is designed to provide financial protection and peace of mind by offering a payout in the event of the insured's death. However, the coverage provided by these policies is often limited and may not adequately address all financial needs and goals.

One of the main reasons for this limitation is the standardized nature of life insurance policies. These policies typically offer a set amount of coverage, which may not be sufficient for individuals with complex financial situations or those with substantial assets, liabilities, or dependents. For example, a young, healthy individual with no significant financial obligations might find that the coverage provided by a standard life insurance policy is more than enough to secure their loved ones' financial future. However, for those with larger families, substantial debts, or specific long-term financial goals, the coverage may be inadequate.

The limited coverage can also be attributed to the fact that life insurance policies are often based on a one-size-fits-all approach. Insurers use standardized rates and assumptions to calculate premiums, which may not accurately reflect the unique circumstances of each individual. As a result, some people might pay higher premiums without receiving the level of coverage they need. This can be particularly challenging for those with pre-existing health conditions or risky lifestyles, who may face higher insurance rates but still require more extensive coverage.

To address this limitation, individuals should carefully assess their financial needs and goals before purchasing life insurance. It is essential to consider factors such as income replacement, debt repayment, education costs, and future expenses when determining the appropriate coverage amount. Consulting with a financial advisor or insurance specialist can help individuals navigate these complexities and ensure they have the right level of protection. Additionally, some insurance companies offer customizable policies, allowing policyholders to tailor the coverage to their specific requirements.

In summary, the major limitation of ordinary life insurance is its potential to provide insufficient coverage for all financial needs and goals. This can be addressed by carefully evaluating individual circumstances, seeking professional advice, and exploring customizable policy options to ensure that life insurance adequately supports one's financial objectives. Understanding and mitigating this limitation is crucial for making informed decisions about life insurance coverage.

Cholesterol and Life Insurance: What's the Connection?

You may want to see also

Expiration: Term life insurance policies typically have an expiration date, requiring renewal or replacement

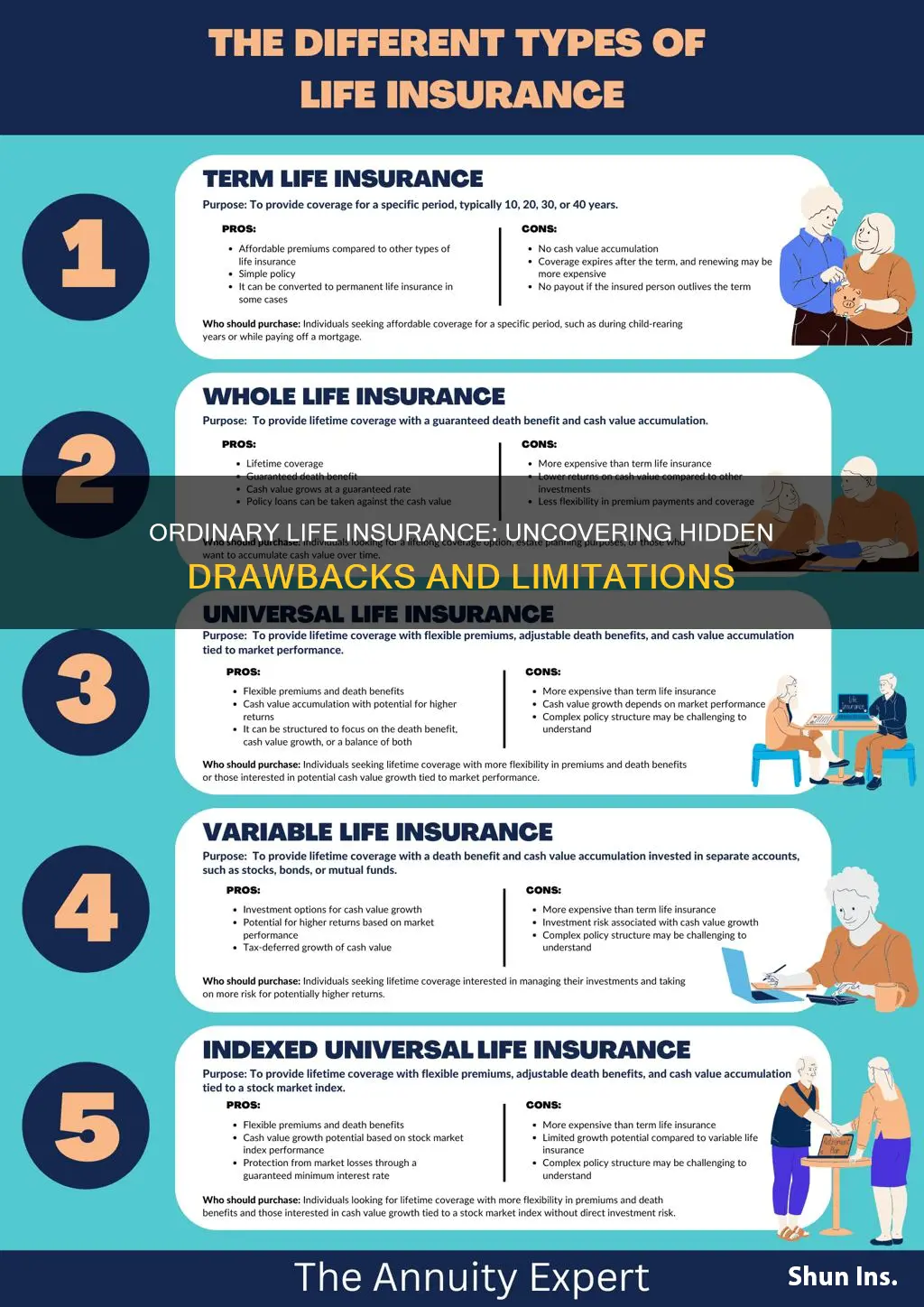

The primary limitation of ordinary or term life insurance is its finite nature, which can be a significant concern for individuals and families relying on this coverage. Term life insurance is designed to provide protection for a specific period, often 10, 20, or 30 years, after which the policy expires. This expiration date is a critical aspect that sets term insurance apart from permanent life insurance.

As the policy term ends, the insurance coverage also ceases, leaving the insured individual and their beneficiaries without the financial safety net that the policy provided. This can be a major drawback, especially if the insured person's financial responsibilities or obligations remain unchanged. For instance, a parent with young children who relies on life insurance to ensure financial security for their family in the event of their untimely death might face a challenging situation when the policy expires.

Renewal or Replacement: To address this limitation, individuals must decide whether to renew their term life insurance policy or replace it with a new one. Renewal typically involves re-applying for coverage, which may include a medical examination and an assessment of the insured's current health and lifestyle. If the insured's health has deteriorated or they have acquired new risk factors, the premium could increase significantly, making the policy less affordable.

In some cases, individuals may choose to convert their term life insurance into a permanent policy, such as whole life or universal life insurance, which offers lifelong coverage. This decision should be made carefully, considering the potential costs and benefits of permanent insurance, as it may not be the most cost-effective option for everyone.

Planning for the Future: The expiration of a term life insurance policy highlights the importance of long-term financial planning. It is crucial to assess one's financial needs and goals regularly and adjust insurance coverage accordingly. For those approaching the end of their term policy, it is advisable to review their insurance needs and consider extending coverage or exploring alternative insurance products that better suit their evolving circumstances.

In summary, the expiration date of term life insurance policies is a significant limitation, requiring careful consideration and planning. It is essential to understand the implications of this finite coverage and make informed decisions to ensure that individuals and their families remain protected against financial risks.

NAFLD: High-Risk Life Insurance and Your Health

You may want to see also

Health Restrictions: Pre-existing conditions or lifestyle factors may lead to higher premiums or policy exclusions

The concept of ordinary life insurance, while providing a safety net for loved ones, is not without its limitations, particularly when it comes to health-related factors. One of the primary concerns for insurance providers is the potential impact of pre-existing medical conditions and lifestyle choices on the insured individual's health and longevity. These factors can significantly influence the terms and cost of life insurance policies.

Pre-existing conditions, such as chronic illnesses, heart disease, or a history of cancer, often raise red flags for insurers. These conditions may increase the risk of early mortality or require ongoing medical treatment, which can lead to higher insurance premiums or even policy exclusions. For instance, individuals with a history of diabetes might face challenges in obtaining comprehensive life insurance coverage, as the condition could impact their life expectancy and overall health. Similarly, those with a sedentary lifestyle or a history of smoking may also be viewed as higher-risk candidates, potentially resulting in less favorable policy terms.

Lifestyle factors play a crucial role in determining insurance eligibility and rates. Unhealthy habits like excessive alcohol consumption, drug use, or extreme sports participation can all contribute to an individual's risk profile. Insurers often consider these factors when assessing the likelihood of a claim, and as a result, individuals engaging in such activities may be offered higher premiums or may not qualify for certain types of coverage. For example, a person with a history of frequent skydiving might find it challenging to secure a standard life insurance policy, as the activity is considered high-risk.

In some cases, insurance companies may require a medical examination or a detailed health questionnaire to assess the insured's risk. This process helps them understand the individual's health status and make informed decisions about policy terms. During this evaluation, insurers might uncover pre-existing conditions or lifestyle choices that could impact the policy's affordability or availability. It is essential for individuals to be transparent about their health history to avoid any surprises or complications when making a claim.

Understanding these health restrictions is vital for anyone considering life insurance. It highlights the importance of maintaining a healthy lifestyle and managing pre-existing conditions effectively. While these factors can present challenges, they also emphasize the need for individuals to take proactive steps towards improving their health, which can, in turn, lead to more favorable insurance outcomes. Being aware of these limitations allows people to make informed decisions and potentially explore alternative insurance options that better suit their specific circumstances.

Life Insurance Contracts: What Provisions Are Required?

You may want to see also

Complexity: Understanding the fine print and policy terms can be challenging for the average consumer

The complexity of life insurance policies can often be a significant barrier for many consumers. When purchasing life insurance, it is crucial to thoroughly understand the fine print and policy terms to ensure you are making an informed decision. This is especially important as life insurance policies can be intricate and filled with technical jargon, making it challenging for the average person to fully comprehend the coverage they are purchasing.

One of the primary reasons for this complexity is the extensive list of policy terms and conditions. These terms can vary significantly between different insurance providers and even within the same company's offerings. For instance, a term like "convertibility" might refer to the option to convert a term policy into a permanent one, but it could also mean something entirely different in another policy. Without a clear understanding of these terms, consumers may struggle to compare policies and make an informed choice.

Additionally, life insurance policies often include various riders and add-ons that can further complicate matters. These riders provide additional benefits or coverage but can also introduce new conditions and exclusions. For example, a "waiver of premium" rider might offer to pay your premiums if you become disabled, but it could also have specific requirements and limitations that are not immediately apparent. Understanding these riders is essential to ensure you receive the coverage you need and expect.

The fine print in life insurance policies is where many potential issues and limitations are hidden. This includes details about coverage limits, exclusions, and waiting periods. For instance, a policy might have a high coverage limit, but it could also have a lengthy waiting period before the full benefit is paid out. These details are crucial as they can significantly impact the value and effectiveness of the policy. Without a thorough understanding, consumers may be surprised by unexpected limitations or delays in receiving their insurance benefits.

To navigate this complexity, consumers should take the time to carefully review and ask questions about the policy. It is advisable to seek clarification on any terms or riders that are unclear. Additionally, comparing policies from different providers can help identify any discrepancies in coverage and terms, ensuring you make an informed decision. While life insurance can be a complex product, being proactive and well-informed can help mitigate the potential limitations and ensure you receive the protection you require.

IPTIQ Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

One of the main limitations of ordinary life insurance is that it typically offers a fixed death benefit, which may not keep up with the rising cost of living over time. This means that the financial protection provided by the policy might not be sufficient to cover the beneficiary's long-term expenses, especially in the event of a significant increase in living costs or medical expenses.

Ordinary life insurance policies often lack the flexibility to adapt to changing circumstances. Once the policy is in force, adjusting the coverage or increasing the death benefit can be challenging and may require a full medical examination, which can be costly and time-consuming. This rigidity can be a significant disadvantage for individuals who need more customizable and adaptable insurance solutions.

Yes, there can be tax consequences associated with life insurance. Generally, the death benefit received by the beneficiary is not subject to income tax. However, if the policy pays out to the owner or an irrevocable trust, the death benefit may be subject to income tax as ordinary income. Additionally, if the policy has accumulated cash value, withdrawals or loans against the policy may be taxable events, potentially impacting the overall tax efficiency of the insurance product.