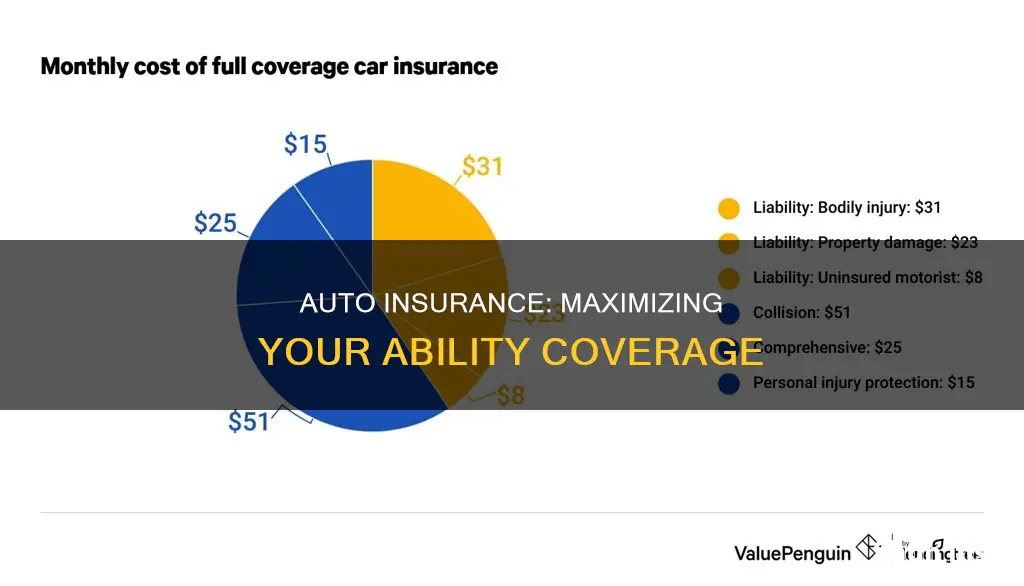

Auto insurance coverage limits refer to the maximum amount an insurer will pay in the event of a loss covered under your insurance policy. In the US, each state has different coverage limits and requirements. For example, in Texas, the minimum coverage is $30,000 per person and $60,000 per accident in bodily injury liability coverage, while in New York, the minimum coverage is $25,000 per person and $50,000 per accident. These coverage limits are important because they determine the maximum amount your insurer will pay out for a claim, and if the costs exceed your coverage limit, you may be responsible for any remaining expenses.

| Characteristics | Values |

|---|---|

| Bodily injury liability coverage per person | $15,000 - $100,000 |

| Bodily injury liability coverage per accident | $30,000 - $300,000 |

| Property damage liability coverage per accident | $5,000 - $50,000 |

| Medical payments coverage | $2,000 - $5,000 |

| Uninsured/underinsured motorist coverage per person | $15,000 |

| Uninsured/underinsured motorist coverage per accident | $30,000 - $300,000 |

| Uninsured motorist property damage | $3,500 |

| Comprehensive deductible | $250 |

| Collision deductible | $500 |

What You'll Learn

Bodily injury liability coverage

The amount of Bodily Injury Liability Coverage you need depends on your state's requirements and your personal circumstances. Most states have minimum Bodily Injury Liability limits that you must meet to register your vehicle. These limits are usually expressed in a "per person/per accident" format, such as "$100,000/$300,000". In this example, the policy will cover up to $100,000 in medical expenses per injured person, with a maximum of $300,000 total for all injuries caused in a single accident.

It is important to note that state-mandated minimums may not provide sufficient coverage in the event of a serious accident. Therefore, it is recommended to assess your needs and consider purchasing higher limits for added protection. You can use online coverage calculators to determine the appropriate amount of coverage for your situation.

Florida Auto Insurance: Understanding Liability Minimums

You may want to see also

Property damage liability coverage

Most states in the US require a minimum amount of property damage liability coverage, which is usually set at $25,000. However, this can vary by state, and it is important to check the specific requirements for your state. While liability-only insurance is the cheapest option, it may not provide sufficient coverage in the event of a major accident. Therefore, it is recommended to purchase more coverage than the state-mandated minimum to ensure you have adequate financial protection.

When deciding on the amount of property damage liability coverage you need, consider factors such as whether you own a home or other valuable items, whether you drive in high-traffic areas, and whether there are a lot of expensive vehicles in your area. If you answered yes to any of these questions, you may want to increase your coverage to protect yourself financially in the event of an accident. Additionally, consider adding an umbrella insurance policy, which can provide additional coverage on top of your standard car insurance.

Auto Insurance: Age Discrimination?

You may want to see also

Personal injury protection (PIP)

In a no-fault state, if a policyholder is injured in a car accident, their own PIP coverage will pay for their medical care, regardless of who was at fault. This means that policyholders can receive benefits even if the other driver is uninsured or underinsured. PIP also covers lost income, childcare, and funeral expenses related to the accident.

The minimum and maximum coverage limits for PIP vary by state and insurance company. For example, in New York, the minimum coverage limit for PIP is $10,000, while the maximum can be up to $50,000 per person. In Florida, the minimum PIP coverage required is $10,000, and the maximum is usually no more than $25,000.

It is important to note that PIP is not a substitute for liability insurance, which covers injuries and property damage caused to a third party when the policyholder is at fault. Liability insurance is required in all states, while PIP is only mandatory in select states.

Insurance Risks: Driving Without a License

You may want to see also

Medical payments coverage

MedPay is especially useful if you do not have health insurance or if your health insurance has high out-of-pocket costs. While auto liability insurance is required by law in most states, it typically does not cover medical expenses for you or your passengers. By adding MedPay to your auto policy, you can ensure that medical expenses resulting from an accident will be covered.

It is important to note that MedPay is not offered in every state, and some states may offer personal injury protection (PIP) coverage instead. PIP is similar to MedPay in that it covers medical bills after an accident, but it also includes coverage for lost wages, which MedPay does not. Additionally, PIP limits and costs are typically much higher than those of MedPay.

When determining how much medical payments coverage to purchase, it is essential to consider the amount your health insurance will cover for accident-related injuries. If your health insurance does not cover the full cost of potential medical expenses from a car accident, MedPay can help fill the gap. Keep in mind that the coverage amount you choose will impact your MedPay premium, with higher coverage resulting in a higher cost.

In summary, medical payments coverage is a valuable addition to your auto insurance policy, providing peace of mind and financial protection in the event of a car accident. By understanding the limits and exclusions of your auto insurance policy, you can make informed decisions about the level of medical payments coverage that best suits your needs.

Best Auto Insurance Options for Seniors

You may want to see also

Uninsured/underinsured motorist coverage

In the unfortunate event of an accident with an uninsured driver, uninsured motorist bodily injury (UMBI) coverage will pay for medical bills for both you and your passengers. Additionally, uninsured motorist property damage (UMPD) coverage will compensate for any damage caused to your vehicle.

Similarly, if you are involved in an accident with a driver who has insufficient insurance, underinsured motorist bodily injury (UIMBI) coverage will take care of medical expenses for you and your passengers, while underinsured motorist property damage (UIMPD) coverage will address vehicle repairs.

It is worth noting that some states may require a deductible for UMPD/UIMPD coverage, but UMBI/UIMBI typically does not include a deductible. Therefore, even if you have health insurance, it is beneficial to have UMBI and UIMBI coverage to protect your passengers and cover lost wages, which may not be included in your health insurance plan.

When determining the amount of uninsured/underinsured motorist coverage you need, it is generally advisable to match the limits of your liability coverage. For instance, if your liability coverage is $50,000 per person and $100,000 per accident, you should consider the same limits for UMBI and UIMBI. Regarding UMPD coverage, you can select a limit that aligns with the value of your vehicle.

Auto Insurance Reinstatement: Understanding the Process and Cost

You may want to see also

Frequently asked questions

The maximum ability coverage on auto insurance, also known as the insurance limit, is the maximum amount that an insurer will pay out for a claim. This amount is stated in the insurance policy.

In New York, the minimum auto insurance coverage is $25,000 per person and $50,000 per accident for bodily injury liability, and $10,000 for property damage liability.

In Texas, the minimum auto insurance coverage is $30,000 per person and $60,000 per accident for bodily injury liability, and $25,000 per accident for property damage liability.

The recommended auto insurance coverage is higher than the state minimums. It is suggested to have at least $100,000 per person and $300,000 per accident for bodily injury liability, and $50,000 for property damage liability.

When choosing your auto insurance coverage, consider the value of your car, the amount you can comfortably afford to spend out of pocket, your ability to pay for medical expenses, and whether you have any other assets you want to protect with insurance coverage.