When it comes to life insurance, understanding the maximum amount of coverage available is crucial for ensuring adequate protection for your loved ones. The maximum individual life insurance coverage can vary significantly depending on several factors, including your age, health, lifestyle, and the insurance company's policies. This article will explore the key considerations and factors that determine the upper limit of life insurance coverage, helping you make informed decisions about your financial security.

What You'll Learn

- Legal Limits: Understand the maximum coverage allowed by law for individual life insurance policies

- Policy Types: Explore different policy types and their respective coverage limits

- Age and Health: Age and health factors influence the maximum coverage amount

- Insurance Company Policies: Each insurer sets its own maximum coverage limits

- Financial Goals: Determine the maximum coverage needed to meet personal financial objectives

Legal Limits: Understand the maximum coverage allowed by law for individual life insurance policies

The concept of maximum individual life insurance coverage is an important consideration for anyone looking to protect their loved ones financially. While the amount of coverage one can purchase is largely determined by personal preferences and financial situations, there are legal limits imposed by insurance regulators that ensure fair practices and protect consumers. Understanding these legal boundaries is crucial for making informed decisions about life insurance policies.

In the United States, for instance, there is no federal law that sets a specific maximum limit for individual life insurance policies. However, state insurance departments often have their own regulations. For example, in California, the maximum face amount for a life insurance policy is $1,000,000, with some exceptions for policies with a term of less than one year. New York, on the other hand, allows for higher limits, with no specific cap mentioned in the state's insurance regulations. These state-specific limits ensure that insurance companies do not issue policies that could potentially be considered excessive or unreasonable.

When considering the maximum coverage, it's essential to recognize that insurance companies have their own internal guidelines and underwriting standards. These standards often take into account the insured individual's age, health, occupation, and lifestyle factors. For instance, a healthy 30-year-old with no risky hobbies might be eligible for a higher coverage amount compared to someone with pre-existing health conditions. Insurance providers typically have maximum limits for individual policies, which can vary widely. Some companies may offer policies with a maximum coverage amount of $500,000, while others might provide policies with no upper limit, especially for high-net-worth individuals or those with significant financial obligations.

It's worth noting that the legal limits on life insurance coverage are in place to prevent fraud and ensure that policies are not used for unethical purposes. These limits also help insurance companies manage their risk and maintain financial stability. Exceeding these legal boundaries can lead to complications, including potential legal issues and difficulties in policy administration.

In summary, while there is no universal maximum amount for individual life insurance coverage, it is essential to be aware of the legal limits set by your state's insurance department. Additionally, insurance companies have their own maximum limits based on underwriting criteria. Understanding these limits is crucial for making appropriate coverage decisions and ensuring that your life insurance policy aligns with your financial goals and the needs of your beneficiaries. Always consult with insurance professionals to navigate these legal and underwriting complexities effectively.

How to Boost Your Life Insurance with Cash

You may want to see also

Policy Types: Explore different policy types and their respective coverage limits

When considering individual life insurance, understanding the various policy types and their coverage limits is crucial for making an informed decision. The maximum amount of coverage one can obtain depends on several factors, including the type of policy chosen. Here's an overview of different policy types and their respective coverage limits:

Term Life Insurance: This is a straightforward and affordable type of life insurance that provides coverage for a specified term, typically ranging from 10 to 30 years. The coverage amount is fixed and remains the same throughout the term. Term life insurance is ideal for those seeking temporary coverage, often used to cover specific financial obligations like mortgage payments or children's education. The maximum coverage amount for term life insurance can vary widely, but it is generally limited by the policy term. For instance, a 30-year term policy might offer a maximum coverage of $1 million, while a 10-year term could provide a higher limit, such as $500,000.

Whole Life Insurance: In contrast to term life, whole life insurance offers permanent coverage for the entire lifetime of the insured individual. It provides a guaranteed death benefit and accumulates cash value over time. The coverage amount can be customized, and some policies offer a maximum coverage limit that can be increased annually. This type of policy is more expensive than term life but provides long-term financial security. The maximum coverage for whole life insurance is often determined by the insured's age, health, and the policy's terms. For a younger, healthy individual, the maximum coverage could be several million dollars, while older individuals may have lower limits.

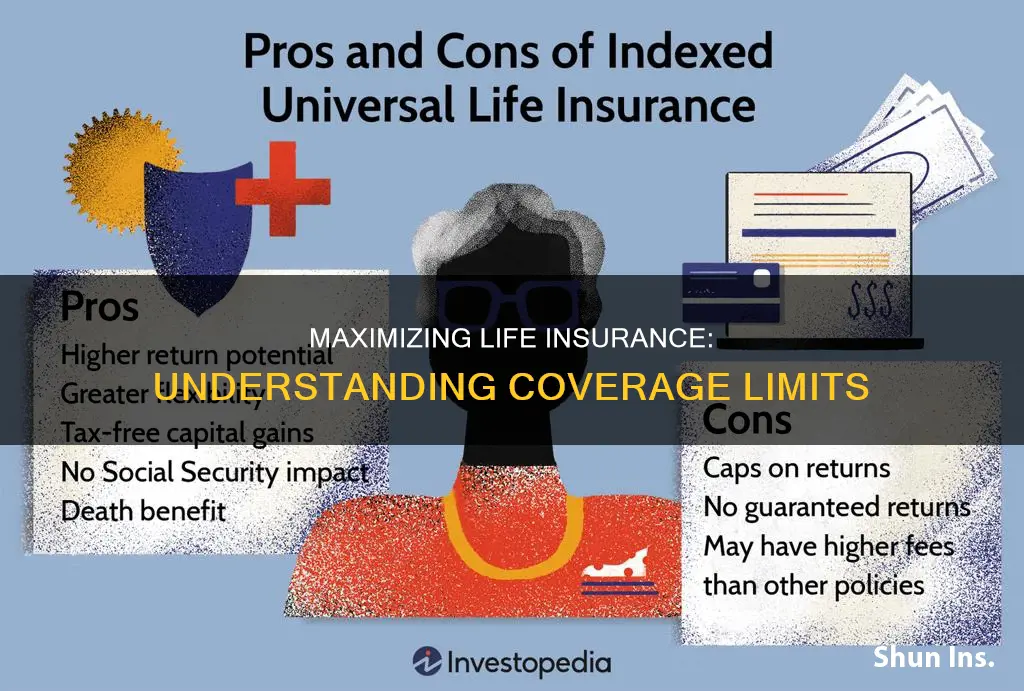

Universal Life Insurance: This policy offers flexible coverage and is designed to provide a death benefit and accumulate cash value. The coverage amount can be adjusted over time, allowing for potential increases or decreases based on the insured's needs. Universal life insurance policies often have no fixed maximum coverage limit, as the insured can continue to increase the benefit amount annually. However, there may be caps on the annual increases, and the overall coverage can be substantial.

Variable Life Insurance: This policy combines permanent coverage with an investment component. The coverage amount can vary based on the performance of the underlying investments. Variable life insurance policies typically have a maximum coverage limit that is determined by the policy's terms and the insured's age. The maximum coverage can be significantly higher than other policy types, especially for younger individuals, as the policy grows with the market.

It's important to note that while these policy types offer different coverage options, the maximum amount of individual life insurance coverage is not a one-size-fits-all concept. It is influenced by individual circumstances, age, health, and financial goals. Consulting with an insurance advisor can help determine the most suitable policy type and coverage limit to meet specific needs.

Group Life Insurance: Cheaper Than Individual Policies?

You may want to see also

Age and Health: Age and health factors influence the maximum coverage amount

Age and health are critical factors that insurance companies consider when determining the maximum amount of individual life insurance coverage they will provide. As individuals age, their risk profile tends to increase, and this directly impacts the insurance premium and the coverage limit. Generally, younger and healthier individuals are offered higher coverage amounts at more competitive rates.

For younger adults, the maximum life insurance coverage can often be substantial. For instance, a 30-year-old in excellent health might be eligible for a policy with a coverage amount of $1 million or more. This is because younger individuals have a longer life expectancy, and their risk of developing health issues that could lead to a claim is lower. Insurance companies are more willing to offer higher limits to these individuals as they present a lower risk of mortality and less likelihood of needing to pay out on a claim in the near future.

As individuals age, the maximum coverage amount typically decreases. For those in their 50s and 60s, the risk of health issues and mortality increases, and insurance companies adjust the coverage limits accordingly. For example, a 55-year-old with a history of chronic health conditions might find that the maximum coverage offered is significantly lower than that of a younger, healthier individual. The insurance provider will consider the individual's overall health, including any pre-existing conditions, and may require additional medical assessments to determine the appropriate coverage amount.

Health factors play a crucial role in determining the maximum coverage. Individuals with a history of serious health issues, such as heart disease, cancer, or diabetes, may face limitations on the amount of life insurance they can obtain. Insurance companies will carefully evaluate the severity and management of these conditions to assess the risk. In some cases, individuals with pre-existing health concerns may be offered lower coverage amounts or may need to undergo additional medical tests to ensure they meet the insurer's health criteria.

It is important to note that age and health are not the only considerations. Insurance companies also look at lifestyle factors, such as smoking status, alcohol consumption, and occupation, which can further impact the maximum coverage amount. Maintaining a healthy lifestyle and managing any existing health conditions can help individuals secure more favorable terms and potentially higher coverage limits.

Single Women: When to Get Life Insurance?

You may want to see also

Insurance Company Policies: Each insurer sets its own maximum coverage limits

When considering the maximum amount of individual life insurance coverage available, it's important to understand that this figure can vary significantly from one insurance company to another. Each insurance provider sets its own limits, which are often influenced by a variety of factors, including the insurer's risk assessment, the individual's health and lifestyle, and the type of policy being offered. This means that while one company may offer a high maximum coverage amount, another might have a lower limit for the same type of policy.

Insurance companies typically have a range of policies, each with its own set of coverage limits. For instance, term life insurance policies usually have a fixed coverage period, and the maximum amount can vary based on the term length. Longer-term policies may offer higher coverage limits, but they also come with higher premiums. On the other hand, permanent life insurance, such as whole life or universal life, often provides coverage for the entire life of the insured and can have much higher maximum coverage amounts, sometimes even unlimited, depending on the insurer and the individual's circumstances.

The process of determining the maximum coverage limit often involves a thorough evaluation of the applicant's health, age, and lifestyle. Insurers may use medical exams, health questionnaires, and even blood tests to assess the risk associated with insuring an individual. Factors such as smoking status, alcohol consumption, and pre-existing medical conditions can significantly impact the maximum coverage amount offered. For instance, a non-smoker with a healthy lifestyle and no significant medical history may be eligible for a much higher coverage limit compared to a smoker with health issues.

It's also worth noting that insurance companies often have different maximum coverage limits for different types of policies. For example, a whole life policy might have a higher maximum coverage amount compared to a term life policy of the same duration. Additionally, some insurers may offer riders or add-ons that can increase the coverage limit temporarily or permanently, providing flexibility to policyholders.

In summary, the maximum amount of individual life insurance coverage is not a standardized figure but rather a variable set by each insurance company based on their own criteria. Prospective policyholders should research and compare different insurers to find the best fit for their needs, ensuring they understand the coverage limits and any associated benefits or restrictions. This approach allows individuals to make informed decisions and select a policy that provides the desired level of protection while also being financially feasible.

Life Storage Insurance: Is It a Requirement?

You may want to see also

Financial Goals: Determine the maximum coverage needed to meet personal financial objectives

When considering individual life insurance, understanding the concept of maximum coverage is crucial for aligning your financial goals with the right policy. The maximum amount of coverage you can purchase is typically determined by various factors, including your age, health, lifestyle, and the insurance company's underwriting guidelines. It's essential to recognize that life insurance is a long-term commitment, and the goal is to ensure your loved ones are financially protected in the event of your passing.

To determine the maximum coverage needed, start by evaluating your personal financial objectives. Consider the following:

- Dependents' Liabilities: If you have a family that relies on your income, calculate the financial obligations your dependents would face if you were no longer around. This includes mortgage or rent payments, children's education costs, ongoing living expenses, and any other regular financial commitments. Multiply these expenses by the number of years you anticipate providing for your family to get an estimate of the total coverage required. For instance, if your annual expenses amount to $50,000 and you plan to support your family for 20 years, the target coverage might be $1 million.

- Debt and Assets: Identify and sum up all your debts, including mortgages, car loans, student loans, and credit card debt. Also, consider the value of your assets, such as real estate, investments, and business interests. The maximum coverage should ideally cover these debts and assets to ensure your beneficiaries can inherit a debt-free estate and benefit from any valuable possessions.

- Income Replacement: Life insurance can replace a portion of your income to maintain your family's standard of living. Multiply your annual income by the number of years you expect to provide financial support. For instance, if your annual income is $100,000 and you plan to support your family for 30 years, the target coverage could be $3 million. This ensures that your family can maintain their current lifestyle even if you're no longer earning.

- Long-Term Financial Goals: Consider any long-term financial goals you have for your family. This could include funding your children's college education, starting a business, or ensuring a comfortable retirement for your spouse. Calculate the costs associated with these goals and determine how much life insurance is necessary to achieve them.

It's important to remember that the maximum coverage is not a fixed number but rather a flexible guideline. You can adjust your policy as your financial situation and goals evolve. Regularly reviewing and updating your life insurance coverage ensures that you remain protected throughout your life's journey.

Understanding Life Insurance Agents: Are They Fiduciaries?

You may want to see also

Frequently asked questions

The maximum coverage amount can vary significantly depending on several factors, including the insurance company, your age, health, lifestyle, and the type of policy you choose. Generally, term life insurance policies offer higher coverage amounts compared to permanent life insurance. For instance, a 30-year-old in excellent health might be able to secure a coverage amount of $1 million or more, while a 60-year-old with some health conditions may have a limit of $500,000 or less. It's essential to consult with insurance professionals to understand the specific limits and options available to you.

Yes, there are often legal and regulatory limits to the amount of life insurance coverage an individual can purchase. In the United States, for example, the Internal Revenue Service (IRS) imposes a limit of $1 million on the death benefit of a life insurance policy for federal estate tax purposes. Additionally, insurance companies may have their own internal limits based on their underwriting guidelines and risk assessment. These limits are in place to ensure that the insurance company can financially support the policy and to protect the interests of both the insurer and the policyholder.

Determining the appropriate coverage amount involves considering various financial and personal factors. Start by calculating your current and future expenses, including mortgage or rent, children's education costs, outstanding debts, and any other financial obligations. Also, factor in your income, savings, and assets. It's a good practice to have a coverage amount that is at least equal to your annual income or a multiple of your annual income. Consulting with a financial advisor or insurance specialist can provide personalized guidance based on your unique circumstances.