Term insurance is a type of life insurance that provides a death benefit to the policyholder's family in the event of their untimely demise. It is a pure life insurance product that offers a high sum assured at affordable premiums. The minimum age to purchase term insurance is typically 18 years old, although this may vary depending on the insurer. Most term insurance providers do not sell new policies to individuals over 65 years old, and some may not provide coverage to anyone over 75. It is recommended to purchase term insurance early in life to enjoy lower premiums and longer coverage.

| Characteristics | Values |

|---|---|

| Minimum age to buy term insurance | 18 years |

| Maximum age to buy term insurance | 60-75 years |

What You'll Learn

The minimum age for term insurance is 18 years old

The minimum age to purchase term insurance is 18 years old. This is the age at which an individual is legally allowed to sign contracts and is considered mature enough to understand the conditions of coverage. While the minimum age is standard across insurance providers, the maximum age for buying term insurance varies and is typically between 60 and 65 years old. Some plans may even be available for individuals above 65.

Term insurance is a pure risk protection plan that provides financial security for your loved ones in case of your untimely demise. It is recommended to buy term insurance at an early age as the premiums are lower, and you can lock in these rates for the whole policy term. Additionally, when you are young, you are relatively healthier and free from medical ailments, allowing you to opt for a higher sum assured. This enables you to choose optimal coverage that meets your and your family's financial needs.

Term insurance is beneficial at different stages of life. In your 20s, it helps your parents against financial uncertainties and debts. In your 30s, it ensures financial stability as you take on more responsibilities, such as buying a home or starting a family. In your 40s, it secures your family's future, especially your children's education, as education costs are rising. Finally, in your 50s, it provides peace of mind and relieves financial strain on your loved ones as you near retirement and face increased health risks.

Supplemental Insurance: Understanding Its Role and Relationship with Short-Term Coverage

You may want to see also

The maximum age is typically 60 or 65 years old

The maximum age for term insurance is typically 60 or 65 years old, though it can vary between insurance companies and their respective policies. Some providers may offer coverage up to 70 or 75 years of age if the policy is purchased earlier. It's important to note that the maximum age limit for term insurance is usually different from the maximum coverage age, which often extends up to 99 or 100 years.

When considering term insurance, it's crucial to understand the concept of maximum maturity age. This age determines the maximum policy tenure you can choose. For example, if you're 40 years old and the maximum maturity age is 65, you can get a maximum coverage tenure of 25 years. Even if a policy offers a longer tenure, your coverage would terminate once you reach the maximum maturity age.

The maximum age limit for term insurance is influenced by several factors, including health risks associated with insuring older individuals, policy terms, and death benefit amounts. Additionally, insurance companies employ different strategies, resulting in variations in age limits across the industry.

While term insurance is primarily designed for individuals below retirement age, some companies offer term plans specifically tailored for senior citizens over 60. These plans acknowledge the increasing life expectancy and changing employment landscape, ensuring that retirees can also benefit from financial protection.

When deciding on term insurance, it's essential to consider your age and overall health condition, as these factors significantly impact your eligibility and premium rates. Younger individuals generally enjoy lower premiums due to their lower risk profile, while older applicants may face higher costs because of increased health risks and shorter life expectancies.

Understanding the Art of Calculating Sum Assured in Term Insurance

You may want to see also

The minimum and maximum age limits vary between insurers

The minimum age to buy term insurance varies between insurers, with the most common minimum age being 18 years. This is the age at which an individual is considered to be of legal age to sign contracts and understand the conditions of coverage.

The maximum age limit for term insurance also differs between insurers, with the most common maximum age being 65 years. Some insurers may allow the purchase of a term plan up to the age of 60 or 70, while others may offer coverage up to 75 years of age if purchased at a younger age.

It is important to note that term insurance is not available for individuals below the minimum age or above the maximum age specified by the insurer. The age restrictions are in place to help insurers accurately evaluate risk by considering age-related variables such as health, life expectancy, and the probability of claims.

Additionally, the age at which an individual purchases term insurance can impact the cost of the policy. Younger individuals typically pay lower premiums due to their lower risk of death or illness, while older individuals may have to pay higher premiums as they are more likely to develop health issues.

Therefore, it is advisable to purchase term insurance at a younger age to take advantage of lower premiums and ensure coverage for a longer period.

The Role of a Short-Term Insurance Ombudsman: Resolving Disputes and Protecting Consumers' Rights

You may want to see also

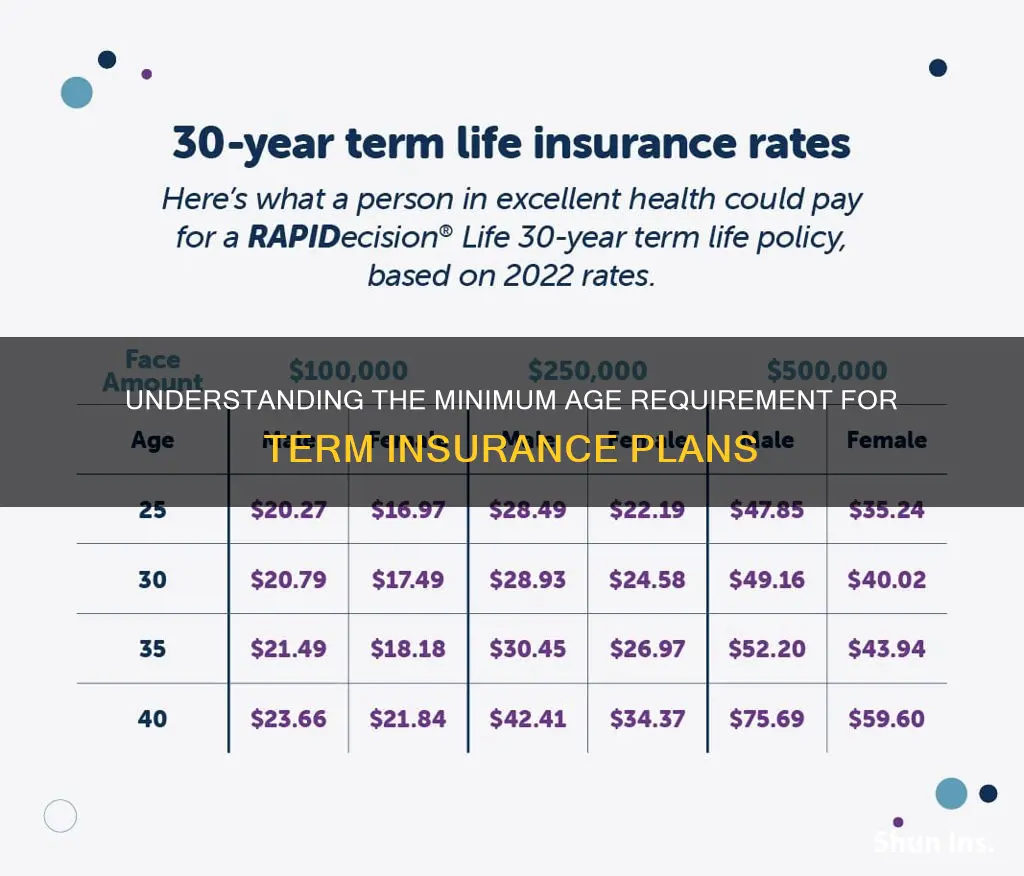

Buying term insurance at a younger age results in lower premiums

The cost of term insurance rises as you get older, so purchasing it when you're younger can result in significant savings. This is because insurance companies base premiums on the likelihood of paying out a claim, which increases with age. By purchasing term insurance early, you can lock in lower rates for the duration of the policy.

Premiums Increase with Age

The premium for term insurance typically rises by about 8% to 10% for every year of age. This increase reflects the rising risk of illness and death as people get older. The older you are when you purchase a policy, the more likely you are to become ill or die while covered, resulting in higher premiums.

Health is a Major Factor

Health is a critical factor in determining life insurance premiums. Insurers will closely examine your medical history, pre-existing conditions, and lifestyle choices when setting premiums. Since younger individuals are generally healthier, they are considered lower-risk and offered lower premiums.

Term Insurance Offers High Coverage at Low Premiums

Term insurance provides a high sum assured at relatively affordable premiums. It is a pure life insurance product, without investment or savings components, making it a cost-effective option for young individuals.

Benefits of Buying Term Insurance at a Younger Age

Optimum Sum Assured

When you're young and healthy, insurers are more likely to offer higher coverage amounts, ensuring your family's financial security.

Financial Stability

Buying term insurance early provides financial stability and peace of mind. In the unfortunate event of your premature death, your family will be taken care of financially.

Lock in Lower Premiums

By purchasing term insurance at a younger age, you can lock in lower premiums for the entire policy term. Premiums tend to increase with age, so buying early can result in significant savings.

Minimum Age for Term Insurance

The minimum age to purchase term insurance is typically 18 years. This age restriction ensures that individuals who purchase insurance are of legal age to sign contracts and understand the policy terms.

Term Insurance for Different Age Groups

Benefits for Younger Individuals

Term insurance offers lower premiums and financial protection for younger individuals, providing peace of mind while they pursue their careers and save for the future.

Benefits for Middle-Aged Individuals

Middle-aged individuals can benefit from term insurance by securing coverage for their dependents and paying off mortgages. Buying term insurance at this age locks in lower premiums and provides coverage for a longer term.

Benefits for Older Individuals

Older individuals can benefit from term insurance by ensuring their loved ones' financial stability. It can help pay off debts and outstanding loans, relieving financial strain on the family.

Selecting the Right Term Insurance: A Comprehensive Guide to Making the Best Choice

You may want to see also

Term insurance is not mandatory but is recommended for financial dependents

Term insurance is a type of life insurance that provides a financial safety net for your loved ones in the event of your untimely death. While it is not mandatory, it is highly recommended for individuals who have financial dependents, such as spouses, children, or ageing parents. Here are four to six paragraphs explaining why term insurance is beneficial for those with financial dependents:

Term insurance is designed to protect your loved ones financially in your absence. If you are the primary breadwinner in your family, your sudden demise could leave them struggling to meet their daily expenses and other financial obligations. With term insurance, you can ensure they receive a lump-sum payout, also known as a death benefit, which can help cover their living costs, pay off any debts, and maintain their standard of living. This can be especially crucial if your dependents are young children or if you have ageing parents who rely on your financial support.

The cost of term insurance is generally affordable, offering high coverage amounts at relatively low premiums. By purchasing term insurance early in life, you can lock in lower rates and ensure coverage for a longer period. Premiums tend to increase with age, as insurers consider older individuals to be at higher risk of health issues and death. Therefore, buying term insurance early on is a wise financial decision, as it provides peace of mind and ensures your loved ones are taken care of, no matter what happens.

When deciding on the amount of term insurance coverage, it is recommended to consider your age and income. A common guideline is to opt for a sum assured that is 10 to 20 times your annual income. This ensures that your dependents will have sufficient funds to maintain their lifestyle and meet future expenses, such as education costs for children or retirement needs for ageing parents. Additionally, term insurance plans often offer flexibility, allowing you to choose between lump-sum or staggered payouts to meet your family's needs.

Term insurance is particularly beneficial for young individuals with financial dependents, as it provides high coverage at low premiums. Insurers consider young people to be at lower risk of death or illness, resulting in more affordable rates. By purchasing term insurance early, you can secure coverage for a longer period, often until retirement age or even up to 99 years. This means your loved ones will be protected throughout the stages of their lives when they are most vulnerable financially, such as during their childhood or retirement.

While term insurance is not a legal requirement, it is a valuable tool for financial planning and protection. If you have people who rely on your income, such as a spouse, children, or ageing parents, term insurance can provide them with financial security in the event of your untimely death. It ensures they can maintain their standard of living, cover essential expenses, and achieve important milestones, such as education or retirement, without the burden of financial stress. Therefore, while not mandatory, term insurance is highly recommended for anyone with financial dependents to protect their loved ones and provide peace of mind.

The Intricacies of BBP Insurance Coverage: Understanding the Basics

You may want to see also

Frequently asked questions

The minimum age to buy term insurance is typically 18 years.

You can purchase term insurance for your children as long as they meet the minimum age requirement, which is usually 18 years.

The ideal term plan policy period depends on your age, goals, and financial needs. It's recommended to choose a policy period that covers you until your retirement or until you've achieved your financial goals.

Buying term insurance at an early age offers several benefits, including lower premiums, higher coverage, and financial stability for your family in case of unforeseen events.

The maximum age limit for term insurance is typically between 60 and 65 years, but it can vary depending on the insurance provider and their policies. Some companies may offer coverage up to 70 or 75 years of age.