Employer-provided life insurance can be a valuable benefit for employees, but it's important to understand the tax implications. The minimum taxable amount of employer life insurance refers to the value of the insurance benefit that is subject to taxation. This amount is typically based on the face value of the policy, which is the death benefit amount. When an employer provides life insurance to an employee, the value of the policy above a certain threshold is generally not taxable to the employee. This threshold is set by the Internal Revenue Service (IRS) and is adjusted annually. Understanding this minimum taxable amount is crucial for both employers and employees to ensure compliance with tax laws and to maximize the benefits of this valuable employee benefit.

What You'll Learn

- Taxable Basis: The minimum taxable value of employer-provided life insurance is the policy's cash surrender value

- Exclusion Limits: Employers can exclude up to a certain amount from employees' income

- Policy Value: The minimum taxable amount is typically the policy's face value or cash value

- Taxable Income: Only the excess over the policy's face value is taxable

- Plan Type: Different insurance plans have varying tax implications for the minimum taxable amount

Taxable Basis: The minimum taxable value of employer-provided life insurance is the policy's cash surrender value

The concept of taxable basis for employer-provided life insurance is an important consideration for both employers and employees. When an employer offers life insurance as a benefit, the value of this coverage can have tax implications for the employee. Understanding the minimum taxable amount is crucial to ensure compliance with tax regulations.

The taxable basis for employer-provided life insurance is typically determined by the cash surrender value of the policy. This value represents the amount the insurance company would pay out if the policy were surrendered or canceled. It is essential to recognize that the cash surrender value is not the same as the death benefit, which is the amount paid out upon the insured individual's death.

When an employee receives life insurance from their employer, the tax authorities consider the cash surrender value as a form of taxable income. This is because the employer is providing a benefit that has a monetary value, and this value is subject to taxation. The minimum taxable amount is essentially the cash surrender value of the policy, which can vary depending on the policy's terms and the insured individual's age, health, and other factors.

It is worth noting that the tax treatment of employer-provided life insurance can differ from country to country and even within different regions. Therefore, it is advisable to consult the specific tax laws and regulations in your jurisdiction to determine the exact taxable basis. Employers should also provide clear and accurate information to their employees regarding the tax implications of the life insurance benefit.

In summary, the minimum taxable amount of employer-provided life insurance is based on the policy's cash surrender value. This value represents the potential monetary benefit an employee would receive if the policy were surrendered, and it is subject to taxation. Understanding this taxable basis is essential for both employers and employees to ensure compliance with tax laws and to make informed decisions regarding their benefits.

Universal Life Insurance: Does It Expire or Endure?

You may want to see also

Exclusion Limits: Employers can exclude up to a certain amount from employees' income

When it comes to employer-provided life insurance, understanding the tax implications is crucial for both employers and employees. One important aspect to consider is the concept of "exclusion limits," which refers to the maximum amount of life insurance coverage that employers can exclude from an employee's taxable income. This exclusion is a significant benefit for employees, as it means they don't have to pay taxes on the value of the insurance policy up to a certain threshold.

The Internal Revenue Service (IRS) sets these exclusion limits, and they are designed to encourage employers to offer group life insurance as a benefit while also providing tax advantages for employees. For the tax year 2023, the exclusion limit for group life insurance is $50,000. This means that if an employer provides a life insurance policy with a death benefit of up to $50,000, the entire value of the policy can be excluded from the employee's taxable income.

It's important to note that this exclusion limit applies to the total death benefit of the policy, not the annual premium payments. For instance, if an employee pays $1,000 annually for a life insurance policy with a $50,000 death benefit, the entire $50,000 death benefit can be excluded from taxation. However, if the death benefit exceeds this limit, only the first $50,000 of the death benefit will be excluded, and the excess amount may be subject to taxation.

Employers should be aware that there are certain requirements and conditions to meet these exclusion limits. The insurance policy must be a group policy, meaning it covers a group of employees, and it should be provided by the employer as a fringe benefit. Additionally, the coverage must be provided without any employee contribution, and the employer should not receive any consideration for providing the insurance.

Understanding these exclusion limits is essential for employees as it directly impacts their take-home pay. By excluding a portion of the life insurance value from taxation, employees can keep more of their earnings, which can be particularly beneficial for high-income earners or those with significant financial obligations. It is recommended that employees review their pay stubs or consult with a tax professional to ensure they are aware of the excluded amount and its impact on their overall tax liability.

Life Insurance Payouts During a Pandemic: What You Need to Know

You may want to see also

Policy Value: The minimum taxable amount is typically the policy's face value or cash value

When it comes to employer-provided life insurance, understanding the tax implications is crucial for both the employer and the employee. The minimum taxable amount of employer life insurance is an important concept to grasp, as it determines the portion of the policy's value that may be subject to taxation. This is particularly relevant for tax purposes and can impact the overall cost and benefits of the insurance coverage.

The policy value is a key factor in determining the minimum taxable amount. Typically, the minimum taxable amount is equal to the policy's face value or cash value. The face value of a life insurance policy is the amount that the insurer agrees to pay out upon the death of the insured individual. This is a straightforward and commonly understood concept. However, for policies with a higher cash value, such as those with an investment component, the cash value can also be considered the minimum taxable amount. This is because the cash value represents the accumulated savings or investment within the policy, which can be withdrawn or borrowed against.

It's important to note that the tax treatment of employer-provided life insurance can vary depending on the jurisdiction and specific tax laws. In some cases, the entire policy value may be exempt from taxation, especially if the insurance is considered a group policy. However, in other instances, only a portion of the policy's value may be taxable, and this is where the concept of the minimum taxable amount comes into play.

For employees, understanding the minimum taxable amount is essential as it can affect their overall compensation and benefits package. If the policy value exceeds the minimum taxable amount, the excess may be subject to taxation, which could impact the net benefit of the insurance coverage. Therefore, employees should be aware of the policy's value and any potential tax implications to make informed decisions regarding their insurance benefits.

In summary, the minimum taxable amount of employer life insurance is typically tied to the policy's face value or cash value. This ensures that the tax authorities can accurately assess the taxable portion of the policy, providing clarity for both employers and employees in managing their insurance benefits and tax obligations.

When to Renew Your Illinois Life Insurance License

You may want to see also

Taxable Income: Only the excess over the policy's face value is taxable

When it comes to employer-provided life insurance, understanding the tax implications is crucial for both the employer and the employee. The key point to note is that the tax treatment of this benefit is based on the excess amount over the policy's face value.

The face value of a life insurance policy is the predetermined amount that the insurance company will pay out in the event of the insured's death. When an employer provides life insurance as a benefit, the policy is typically owned by the employer, and the coverage is extended to the employees. The tax rules consider the policy's face value as a form of compensation, but only the excess amount above this value is taxable.

For example, let's say an employer offers a life insurance policy with a face value of $50,000. If the employee's salary is $40,000, and the employer contributes $10,000 towards the policy premium, the excess amount over the face value is $0. In this case, the entire $10,000 contribution is taxable as it is considered a form of additional compensation. However, if the face value were $100,000 and the employer's contribution was $50,000, the excess amount would be $50,000, and only this excess would be subject to taxation.

It's important to note that the tax treatment may vary depending on the jurisdiction and specific tax laws. Some countries or regions might exempt a certain amount of the policy's face value from taxation, especially if the insurance is considered a group benefit. In such cases, only the excess amount above the exempt limit would be taxable.

Understanding these tax implications is essential for employers to ensure compliance with tax regulations and for employees to be aware of the value of their benefits. By recognizing that only the excess over the policy's face value is taxable, individuals can better comprehend the true value of their employer-provided life insurance coverage.

Disability Insurance Exam: Double Duty for Life Insurance

You may want to see also

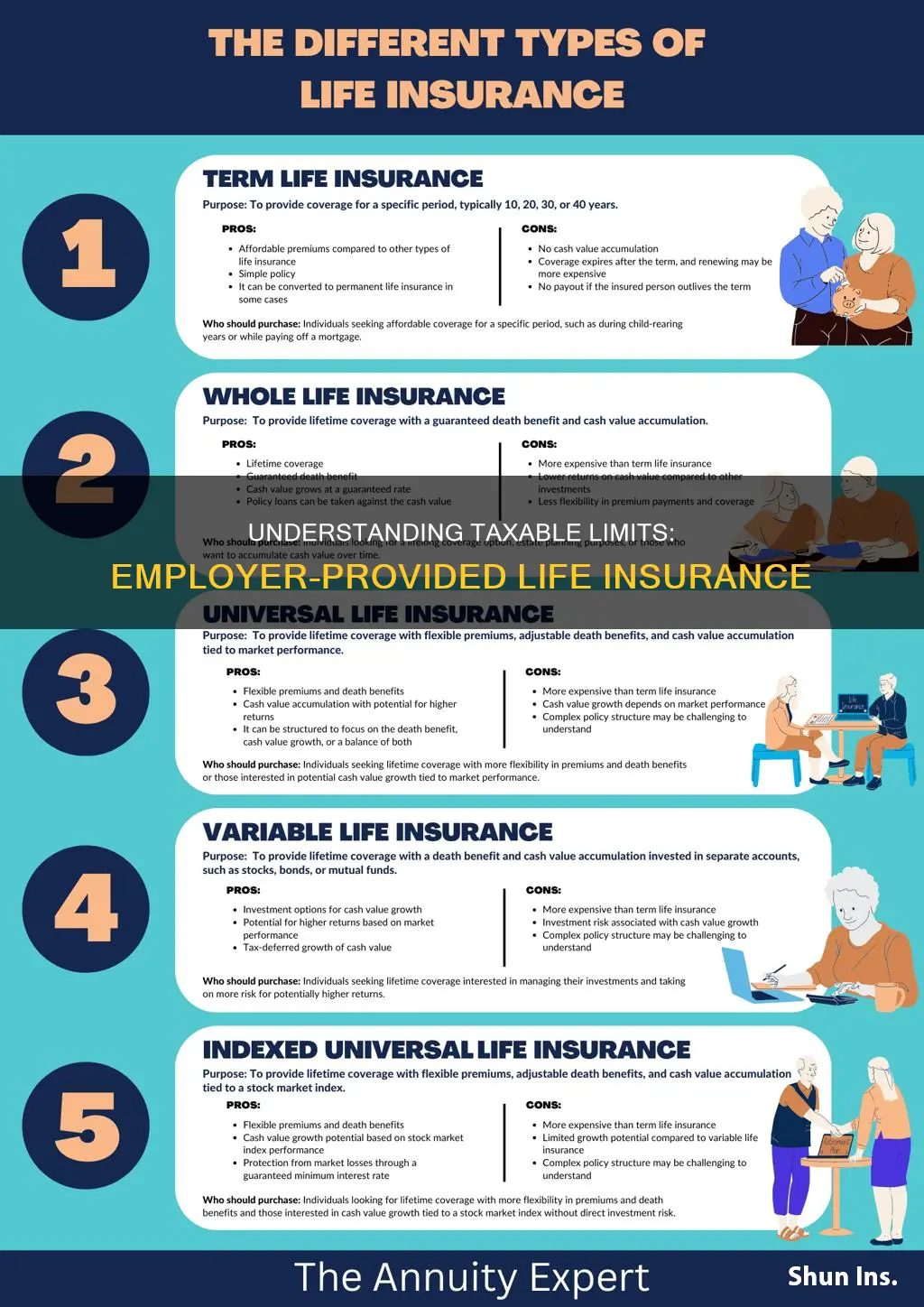

Plan Type: Different insurance plans have varying tax implications for the minimum taxable amount

When it comes to employer-provided life insurance, the tax treatment can vary depending on the type of plan. Understanding these differences is crucial for both employers and employees to ensure compliance with tax regulations and to make informed decisions about their benefits. Here's a breakdown of how different insurance plans handle the minimum taxable amount:

Term Life Insurance: This is a straightforward plan where the employer provides coverage for a specified term, typically one to ten years. The key advantage is that the premiums for term life insurance are generally not taxable to the employee if certain conditions are met. The Internal Revenue Service (IRS) allows employers to provide term life insurance with a death benefit of up to $50,000 per year without any tax implications for the employee. This means that the employer can pay the premiums for this coverage without it being considered taxable income for the employee. However, if the death benefit exceeds this limit, the excess amount may be taxable.

Whole Life Insurance: In contrast, whole life insurance plans offer permanent coverage and accumulate cash value over time. The tax treatment here is more complex. While the premiums for whole life insurance can be tax-deductible for the employer, the same rules regarding the death benefit apply. If the employer pays for whole life insurance with a death benefit exceeding the $50,000 limit, the excess amount may be taxable for the employee. Additionally, the cash value accumulation within the policy could be subject to taxation if the employee surrenders or withdraws the funds.

Group Universal Life (GUL): GUL plans provide permanent life insurance coverage with a fixed death benefit and guaranteed premiums. Similar to whole life insurance, the tax treatment of GUL can be intricate. Employers can deduct the premiums for GUL plans, but the tax implications for the employee depend on the death benefit amount. If the death benefit is within the $50,000 limit, it remains tax-free. However, any excess over this limit may be taxable for the employee.

Variable Universal Life (VUL): VUL plans offer flexible coverage with an investment component. The tax treatment for VUL is generally favorable for both the employer and the employee. Employers can deduct the premiums, and the death benefit is typically not taxable if it adheres to the $50,000 limit. The investment portion of VUL policies can grow tax-deferred, providing potential tax advantages for the employee.

In summary, the tax implications for the minimum taxable amount of employer-provided life insurance vary based on the plan type. Term life insurance offers a relatively simple tax-free arrangement, while whole life, GUL, and VUL plans require more careful consideration of the death benefit amounts to ensure compliance with tax regulations. Employers should consult tax professionals to navigate these complexities and provide the best benefits package for their employees.

Understanding Life Insurance: A Comprehensive Business Model Overview

You may want to see also

Frequently asked questions

The minimum taxable amount of employer life insurance is generally considered to be the amount that exceeds the employee's annual salary. This means that if an employee's annual salary is $50,000, any employer-provided life insurance coverage above this amount could be subject to taxation.

The taxable value is typically calculated as the excess of the insurance benefit over the employee's compensation, including salary, bonuses, and other forms of remuneration. For example, if an employee's total compensation is $60,000 and the employer provides a life insurance policy with a benefit of $100,000, the taxable value would be $40,000 ($100,000 - $60,000).

Yes, there are some exceptions. If the employer provides life insurance as a form of compensation for services rendered, and the coverage is reasonable and in line with industry standards, it may be exempt from taxation. Additionally, if the insurance is provided as a group policy for all employees, and the coverage is not excessive, it might also be exempt from taxation. It's important to consult tax regulations and seek professional advice for specific cases.