When it comes to life insurance, determining the most common amount can be a bit tricky, as it largely depends on individual circumstances and financial goals. However, many financial advisors and insurance companies suggest that the most frequently chosen life insurance amount is typically around $250,000 to $500,000. This range often provides a good balance between coverage for immediate family expenses, such as mortgage payments, college tuition, and funeral costs, and the potential to leave a substantial inheritance for beneficiaries. It's important to note that the ideal policy amount should be tailored to one's specific needs, considering factors like income, debts, and the number of dependents.

What You'll Learn

- Common Policy Amounts: Most policies offer $100,000, $250,000, $500,000, $1 million, or more

- Individual Needs: The amount varies based on personal circumstances, income, and financial obligations

- Industry Standards: Insurance companies often suggest specific amounts based on industry norms and guidelines

- Cost and Affordability: Premiums influence the chosen amount, ensuring it's financially viable for the policyholder

- Tax Implications: Higher amounts may have tax consequences, impacting the overall cost and value

Common Policy Amounts: Most policies offer $100,000, $250,000, $500,000, $1 million, or more

When it comes to life insurance, the amount of coverage provided by a policy is a crucial aspect to consider. The most common life insurance amounts offered by insurance companies typically fall within a specific range, providing a safety net for individuals and their families in the event of the insured's passing. These standard policy amounts are designed to cater to various financial needs and often reflect the average coverage requirements of policyholders.

The most prevalent life insurance policy amounts are $100,000, $250,000, $500,000, and $1 million. These figures are widely recognized as the standard coverage levels that many insurance providers offer. For instance, a $100,000 policy is a popular choice for individuals seeking basic coverage, ensuring that their loved ones have a financial cushion to cover immediate expenses after their passing. Similarly, a $250,000 policy provides a more substantial safety net, which can be significant for families with higher living costs or those with dependent children.

As the financial needs of individuals and families grow, so do the desired life insurance amounts. A $500,000 policy is often sought after to cover substantial debts, such as mortgages or business loans, and to provide a more comprehensive financial security blanket. For high-net-worth individuals or those with substantial assets, a $1 million policy is a common choice, ensuring that their estate can be settled efficiently and that their beneficiaries are adequately provided for.

It's important to note that these common policy amounts are not set in stone and can vary based on individual circumstances, risk assessments, and the insurance company's policies. Some insurance providers may offer higher coverage amounts, especially for those with specific needs or occupations. Additionally, term life insurance, which provides coverage for a specified period, often allows for more flexibility in choosing policy amounts.

In summary, the most common life insurance amounts offered by policies are typically $100,000, $250,000, $500,000, and $1 million. These standard coverage levels cater to a wide range of financial needs and provide a safety net for individuals and their families. When selecting a life insurance policy, it is essential to consider one's unique circumstances and consult with an insurance professional to determine the appropriate amount of coverage.

Whole Life Insurance: An Investment or Security?

You may want to see also

Individual Needs: The amount varies based on personal circumstances, income, and financial obligations

When it comes to life insurance, the amount of coverage an individual needs can vary significantly based on their unique personal circumstances, income, and financial obligations. This is because different people have different financial needs and priorities, and life insurance is a tool to protect against various risks and ensure financial security for one's loved ones.

For instance, a young professional with no dependents might consider a lower life insurance policy, as their immediate financial responsibilities may be limited. However, a family with a mortgage, children, and significant debt would likely require a higher coverage amount to ensure that their financial obligations are met in the event of the primary breadwinner's untimely death. The amount of life insurance needed is often determined by the individual's role in providing for their family and the potential impact of their death on their loved ones' financial well-being.

Income is another critical factor. Higher earners may require more substantial life insurance to cover potential loss of income and to ensure that their family can maintain their standard of living. For example, a high-income earner with a substantial salary and bonuses might need a policy that can replace a significant portion of their income, whereas a lower-income individual might focus on ensuring their family can cover essential expenses and any outstanding debts.

Additionally, personal circumstances such as health, lifestyle, and occupation play a role. Individuals with certain medical conditions or those who engage in high-risk activities may need to consider the potential impact on their life insurance premiums and coverage amounts. For instance, a person with a history of chronic illness might require a more comprehensive policy to account for potential medical expenses and reduced life expectancy.

In summary, the most common life insurance amount is not a one-size-fits-all figure. It is essential to assess individual needs, considering personal circumstances, income, and financial obligations, to determine the appropriate coverage. This ensures that the policy provides the necessary financial protection and peace of mind for the individual and their family.

Life Insurance: Does Your Weight Matter?

You may want to see also

Industry Standards: Insurance companies often suggest specific amounts based on industry norms and guidelines

When it comes to life insurance, industry standards often recommend a coverage amount that is equivalent to 5 to 10 times the annual income of the policyholder. For example, if an individual earns $60,000 per year, a life insurance policy with a coverage amount of $300,000 to $600,000 might be suggested. This range is considered a standard practice and helps ensure that the beneficiary can maintain their standard of living and cover essential expenses in the event of the insured's death.

These guidelines are not set in stone and can vary depending on the insurance company and the specific circumstances of the individual. Some companies may offer higher coverage amounts, especially for those with higher-risk profiles or unique financial needs. On the other hand, some insurers might suggest lower coverage levels for individuals with certain health conditions or a lower risk profile.

It's important to note that industry standards provide a general framework, and the most suitable life insurance amount should be tailored to the individual's specific situation. Factors such as family size, number of dependents, long-term financial goals, and existing debt obligations play a crucial role in determining the appropriate coverage. For instance, a young, healthy individual with no dependents might opt for a lower coverage amount, while a family with young children and substantial mortgage payments may require a higher policy limit.

In summary, industry standards offer a valuable reference point for life insurance coverage, but they should be considered as a starting point for personalized advice. Consulting with a financial advisor or insurance professional can help individuals navigate these guidelines and make informed decisions based on their unique circumstances and risk factors.

How to Surrender Your Life Insurance Policy?

You may want to see also

Cost and Affordability: Premiums influence the chosen amount, ensuring it's financially viable for the policyholder

When considering life insurance, understanding the most common coverage amounts can provide valuable insights for policyholders. According to various sources, the average life insurance policy typically covers a range of $100,000 to $250,000. However, it's important to note that this is just an average, and the ideal amount can vary significantly based on individual circumstances.

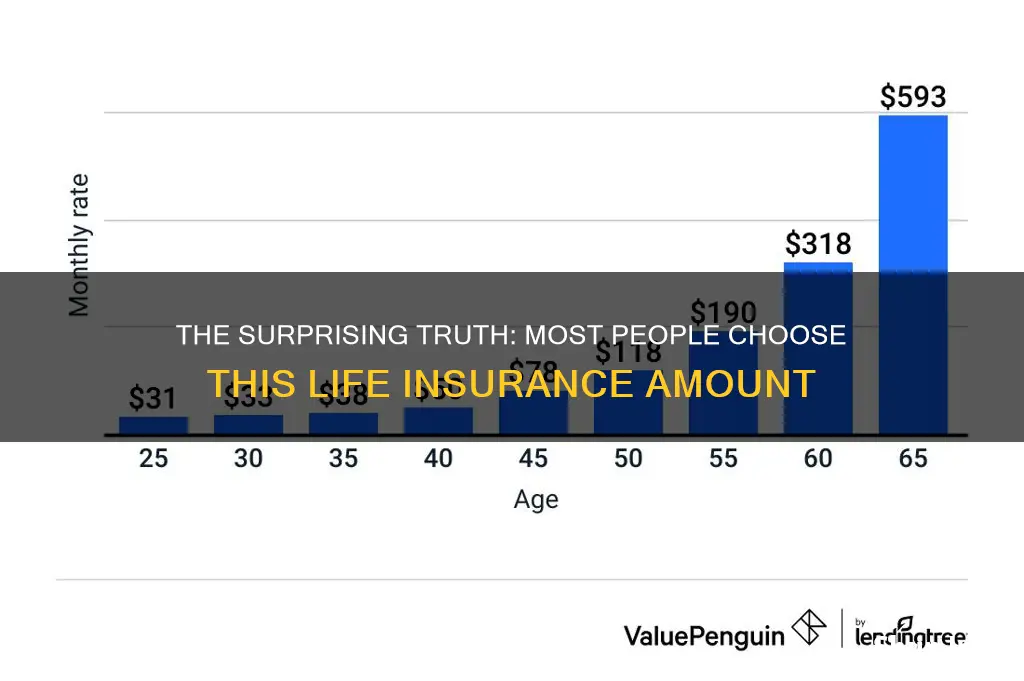

The cost of life insurance is a critical factor in determining the chosen coverage amount. Premiums, which are the regular payments made by the policyholder, directly impact the affordability of the policy. Higher coverage amounts generally result in higher premiums, making it essential to find a balance between the desired protection and financial feasibility. For instance, a policy with a $500,000 death benefit might require more substantial premiums compared to a $100,000 policy, especially for a 30-year-old in good health.

To ensure financial viability, policyholders should consider their income, expenses, and long-term financial goals. A common approach is to choose a coverage amount that is equivalent to 10 to 15 times the annual income. This means if an individual earns $60,000 per year, they might opt for a life insurance policy with a death benefit of $600,000 to $900,000. This strategy provides a substantial safety net for loved ones while remaining affordable in the long term.

Additionally, the age and health of the policyholder play a significant role in determining premiums. Younger individuals often benefit from lower rates due to their longer life expectancy and reduced health risks. As individuals age, premiums tend to increase, making it more crucial to plan and choose the right coverage amount early on.

In summary, the most common life insurance amount can vary, but it's essential to consider the cost and affordability of premiums. By evaluating personal financial situations, income, and health, individuals can make informed decisions to select a coverage amount that provides adequate protection without straining their finances. It is always advisable to consult with a financial advisor or insurance professional to tailor a policy that best suits one's needs and budget.

Understanding Loss Ratio: A Key Metric in Life Insurance

You may want to see also

Tax Implications: Higher amounts may have tax consequences, impacting the overall cost and value

When considering life insurance, understanding the tax implications of higher coverage amounts is crucial for making informed financial decisions. The most common life insurance amount varies depending on individual needs and circumstances, but it often aligns with the value of one's assets or the cost of living expenses for a specific period. For instance, a typical term life insurance policy might cover an amount equal to 10 to 20 times the annual income of the insured individual. However, the tax consequences of a higher coverage amount can significantly impact the overall cost and value of the policy.

Tax laws regarding life insurance can be complex and may vary by jurisdiction. In many countries, life insurance proceeds received by the beneficiary upon the insured's death are generally tax-free. This means that the death benefit is not subject to income tax, providing a significant financial advantage. However, this tax-free status typically applies to the death benefit up to a certain amount, often referred to as the 'exclusion amount' or 'tax-free threshold'. Any amount exceeding this threshold may be subject to taxation.

For higher coverage amounts, the tax implications can become more significant. When the death benefit exceeds the exclusion amount, the excess amount may be subject to income tax. This can result in the beneficiary having to pay taxes on the entire death benefit, reducing the overall value of the policy. Additionally, if the insured individual pays premiums on a higher coverage amount, the increased premium payments may also be subject to taxation, further impacting the overall cost.

It is essential to consult with a tax professional or financial advisor to understand the specific tax rules and exclusions in your region. They can provide personalized advice on how to structure the life insurance policy to minimize tax consequences. Strategies such as splitting the coverage amount between multiple policies or utilizing different types of insurance products may help manage tax implications effectively.

In summary, while higher life insurance coverage amounts can provide increased financial protection, they may also lead to tax consequences for both the insured and the beneficiary. Being aware of these tax implications is vital to ensure that the overall cost and value of the policy align with your financial goals and objectives. Proper planning and professional guidance can help navigate these complexities and make the most of your life insurance investment.

Ask for Life Insurance Business: Strategies for Success

You may want to see also

Frequently asked questions

The most common life insurance amount varies depending on the type of policy and the insurer. However, a popular choice for many individuals is a coverage amount of $250,000. This amount provides a substantial financial safety net for beneficiaries and is often considered a standard in the industry.

$250,000 is a common amount because it offers a good balance between affordability and coverage. It typically covers essential expenses like mortgage payments, education costs, and outstanding debts, ensuring that the family's financial obligations are met in the event of the insured's passing.

Yes, other popular coverage amounts include $100,000 and $500,000. $100,000 is often chosen for smaller families or those with fewer financial dependents, while $500,000 provides more extensive coverage for larger families or individuals with significant financial responsibilities.

The amount you can choose is often determined by the insurer's guidelines and your personal circumstances. Insurers may have minimum and maximum coverage limits, and they will assess your risk profile to determine the most suitable amount for you. It's essential to review the policy details and consult with a financial advisor to ensure you have adequate coverage.