Life insurance is a crucial financial tool, and understanding the process of replacement policies in Louisiana is essential for residents. When an individual passes away, their life insurance policy can provide financial security to their loved ones. In Louisiana, the replacement process involves several steps, including reviewing the policy, assessing the beneficiary's needs, and choosing a suitable replacement plan. This process ensures that the insured's family receives the intended financial support during a difficult time. It is a complex procedure that requires careful consideration of various factors, including the policy's terms, the insured's age, and the beneficiary's financial goals.

What You'll Learn

- Life Insurance Claims Process: The steps for filing a claim after a policyholder's death in Louisiana

- Beneficiary Designation: How to name beneficiaries and ensure proper distribution of benefits

- Policy Review: Regularly assessing and updating life insurance policies to meet changing needs

- Death Verification: Methods for proving the death of the insured individual to initiate the claim

- Financial Assistance: Understanding the financial support available to beneficiaries through life insurance in Louisiana

Life Insurance Claims Process: The steps for filing a claim after a policyholder's death in Louisiana

The life insurance claims process in Louisiana is a structured procedure designed to provide financial support to the beneficiaries of a deceased policyholder. When a policyholder's death is confirmed, the claims process ensures a smooth transition of benefits to the intended recipients. Here's an overview of the steps involved:

Step 1: Notify the Insurance Company

The first step is to inform the life insurance company about the policyholder's death. This can be done by contacting the insurance provider directly. Provide them with the necessary details, including the full name of the deceased, their policy number, and the date of death. The insurance company will then initiate the claims process.

Step 2: Gather Required Documents

The insurance company will request specific documents to verify the policyholder's death and the identity of the beneficiaries. These documents typically include a certified copy of the death certificate, a valid identification document of the deceased, and any additional paperwork required by the insurance provider. It is essential to provide these documents promptly to avoid delays in the process.

Step 3: File the Claim

Once the necessary documentation is submitted, the insurance company will review the claim. They will assess the validity of the claim, verify the information provided, and confirm the death of the policyholder. If the claim is approved, the insurance company will proceed to the next step. In Louisiana, the insurance provider has a specific timeframe to settle the claim, ensuring a timely resolution.

Step 4: Payment and Distribution

After the claim is approved, the insurance company will disburse the death benefit as per the policy terms. The payment is typically made to the primary beneficiary or beneficiaries designated in the policy. If there are multiple beneficiaries, the insurance company will distribute the proceeds according to the specified distribution percentages or as per the legal requirements in Louisiana.

Step 5: Notification to Beneficiaries

The insurance company is responsible for notifying the beneficiaries about the claim settlement. They will provide information regarding the amount received and any further actions or requirements. It is advisable for beneficiaries to keep records of all communication and correspondence with the insurance provider during this process.

Understanding the life insurance claims process is crucial for beneficiaries to ensure a smooth and efficient settlement. By following these steps, policyholders' families can receive the intended financial support during a challenging time.

Life Insurance Coverage for Grandchildren: What You Need to Know

You may want to see also

Beneficiary Designation: How to name beneficiaries and ensure proper distribution of benefits

When it comes to life insurance, one of the most crucial aspects is ensuring that your beneficiaries are correctly identified and that the distribution of benefits proceeds smoothly. This process is a fundamental part of life insurance replacement, especially in states like Louisiana, where specific regulations may apply. Here's a comprehensive guide on how to navigate beneficiary designation effectively:

Understanding Beneficiary Designation:

Beneficiary designation is a legal process that allows you to specify who will receive the proceeds from your life insurance policy upon your death. This is a critical step as it ensures that your loved ones receive the intended financial support during a challenging time. When you purchase a life insurance policy, you typically have the option to name beneficiaries, and this choice is often made during the application process or at a later date. It's essential to understand that you can change beneficiaries at any time, providing flexibility as your life circumstances evolve.

Naming Beneficiaries:

When naming beneficiaries, you have several options, and the choice depends on your personal preferences and the relationships you want to honor. Here are some common beneficiary types:

- Spouse: Typically, a spouse is the first choice for a primary beneficiary, especially if you are married and wish to provide financial security for your partner.

- Children: You can name your children as beneficiaries, ensuring their financial well-being, especially if you want to provide for their education or future needs.

- Parents or Other Relatives: In some cases, you might choose to benefit your parents or other relatives, especially if you wish to leave a legacy within your family.

- Charities or Organizations: Life insurance policies also allow you to designate charities or non-profit organizations as beneficiaries, which can be a meaningful way to support causes you care about.

Ensuring Proper Distribution:

To ensure that the distribution of benefits goes smoothly, consider the following steps:

- Review and Update Regularly: Life circumstances change, and so should your beneficiary designations. Review your policy periodically to ensure that the beneficiaries listed are still appropriate. Major life events like marriages, births, or deaths of loved ones may trigger the need for updates.

- Provide Multiple Contact Information: When naming beneficiaries, include their current contact details, including addresses and phone numbers. This ensures that the insurance company can reach them in case of any policy-related communications.

- Consider Dependency and Needs: When selecting beneficiaries, consider the financial needs and dependency of each individual. For example, a minor child might require a guardian or a trust to manage the funds, while an adult spouse may need immediate financial support.

- Be Specific and Clear: Clearly specify the percentage or amount you intend for each beneficiary. This clarity helps prevent potential disputes among beneficiaries and ensures that your wishes are honored.

In Louisiana, as in other states, the process of life insurance replacement and beneficiary designation is a critical aspect of estate planning. By carefully naming beneficiaries and following the necessary legal procedures, you can provide financial security for your loved ones and ensure that your wishes are respected during the claims process. It is always advisable to consult with a financial advisor or insurance professional to ensure that your beneficiary designations align with your overall financial plan.

Vaping and Life Insurance: What They Can and Can't See

You may want to see also

Policy Review: Regularly assessing and updating life insurance policies to meet changing needs

Life insurance is a crucial financial tool that provides security and peace of mind for individuals and their families. However, as life circumstances change, the effectiveness of a life insurance policy can diminish over time. Regular policy reviews are essential to ensure that your life insurance coverage remains relevant and adequate to meet your evolving needs. This process involves a comprehensive assessment of your current policy and its alignment with your current life situation.

The primary purpose of a policy review is to evaluate whether your existing life insurance policy still serves its intended purpose. Over time, various life events can occur, such as marriage, the birth of children, career advancements, or changes in financial status. These events can significantly impact the amount of coverage you require. For instance, a young professional with a growing family might need to increase their policy's death benefit to cover potential future expenses, such as college tuition or mortgage payments. Conversely, a retiree may consider reducing their coverage as their financial obligations decrease.

During a policy review, you should carefully examine the following aspects:

- Coverage Amount: Assess whether the death benefit of your policy is sufficient to cover your current and future financial obligations. This includes expenses like funeral costs, outstanding debts, mortgage payments, and any other specific financial goals you may have.

- Policy Type: Evaluate if the type of life insurance you have (term, whole life, universal life, etc.) still suits your needs. Different policy types offer varying benefits and costs, and changes in your life might make a different type more advantageous.

- Premiums: Review the premium payments and ensure they are manageable within your current budget. If your income has increased, you might consider increasing your premium payments to build up the policy's cash value faster.

- Riders and Add-ons: Check for any additional riders or add-ons to your policy that might no longer be necessary or beneficial. These can include critical illness coverage, accidental death benefits, or long-term care riders.

Regular policy reviews are essential to ensure that your life insurance remains a valuable asset. By reassessing your policy periodically, you can make informed decisions about adjustments, ensuring that your loved ones are protected in the event of your passing. It also allows you to optimize your policy's benefits, potentially saving money on premiums and maximizing the value of your investment. Remember, life insurance is a long-term commitment, and staying proactive in reviewing and updating your policy will contribute to a more secure and stable future for your family.

Life Insurance, Immigration Status, and Material Misstatement

You may want to see also

Death Verification: Methods for proving the death of the insured individual to initiate the claim

The process of life insurance replacement in Louisiana involves several steps, and one crucial aspect is death verification, which is essential to initiate the claim and ensure the rightful distribution of the insurance benefits. Here are some methods to prove the death of the insured individual:

- Medical Certificates and Death Records: The most common and widely accepted method is to obtain a medical certificate from a licensed physician or a coroner. This certificate should confirm the death and provide details about the cause and time of death. In Louisiana, the Office of Public Health is responsible for maintaining death records, and a certified copy of the death certificate is often required. These documents serve as official proof of the insured's demise.

- Autopsy Reports: In cases where the cause of death is uncertain or suspicious, an autopsy may be performed. Autopsy reports provide a detailed analysis of the body's condition and can offer valuable information to support the claim. These reports are typically prepared by medical examiners or pathologists and can be crucial evidence in complex death verification processes.

- Witness Testimonies: Eyewitness accounts can be powerful tools in death verification. Statements from individuals who saw the insured person's body or witnessed the circumstances surrounding their death can provide valuable insights. These testimonies should be documented and verified to ensure their reliability and accuracy.

- Police or Law Enforcement Reports: When the death occurs under suspicious circumstances or involves potential criminal activity, law enforcement agencies play a vital role. Police reports detailing the incident, including the time, place, and circumstances of the death, can be essential evidence. These reports often include statements from officers, witnesses, and any relevant findings, providing a comprehensive overview of the situation.

- Legal Documentation: In some cases, legal proceedings may be necessary to establish the insured's death. This could involve court orders or decrees, especially in situations where there is a dispute regarding the insured's passing. Legal documentation can provide a formal and binding verification of the death, ensuring a fair and transparent process.

The insurance company will typically request these death verification documents as part of the claims process. It is essential to gather and provide accurate and comprehensive evidence to ensure a smooth and timely settlement of the life insurance policy. The methods mentioned above aim to provide a clear and legally recognized proof of the insured's death, allowing the insurance provider to initiate the replacement process and fulfill the policy's obligations.

Life Insurance in the Philippines: A Step-by-Step Guide

You may want to see also

Financial Assistance: Understanding the financial support available to beneficiaries through life insurance in Louisiana

Life insurance is a crucial financial tool that provides security and peace of mind to individuals and their loved ones. In the state of Louisiana, understanding the process of life insurance replacement and the financial assistance available to beneficiaries is essential for those who have lost a loved one. When an insured individual passes away, the life insurance policy comes into effect, offering financial support to the designated beneficiaries. This financial assistance can be a vital source of comfort during a difficult time, helping to cover various expenses and ensure the well-being of the family.

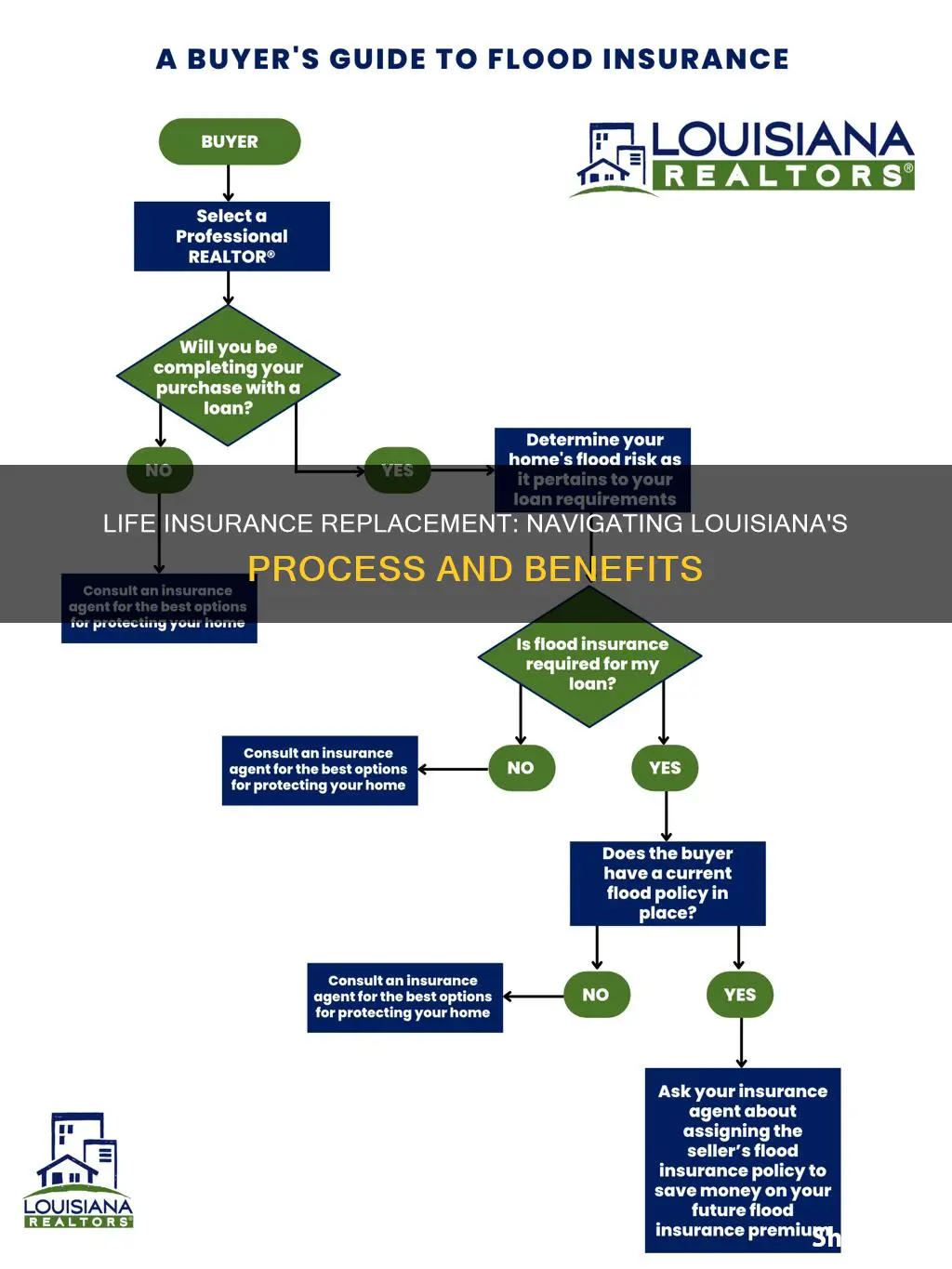

In Louisiana, the process of life insurance replacement typically begins with the notification of the insurance company by the beneficiary. The beneficiary, who is usually the spouse, children, or designated recipient in the policy, must promptly inform the insurance provider about the insured's passing. This step is crucial as it triggers the claims process and allows the insurance company to initiate the necessary procedures. The insurance company will then review the policy, verify the details, and confirm the eligibility of the beneficiary to receive the death benefit.

The financial assistance provided by life insurance policies in Louisiana can vary depending on the type of policy and the terms agreed upon. Typically, the death benefit is paid out as a lump sum or in installments, as specified in the policy. This amount can be used to cover funeral expenses, outstanding debts, mortgage payments, or any other financial obligations left by the deceased. It provides a safety net for the beneficiaries, ensuring they have the necessary resources to manage their affairs and make important decisions during the grieving process.

It is important for beneficiaries to understand their rights and the steps involved in claiming the death benefit. Insurance companies in Louisiana are required to provide clear and concise information regarding the claims process, including the necessary documentation and timelines. Beneficiaries should carefully review the policy documents and communicate with the insurance provider to ensure a smooth and efficient settlement. Additionally, seeking legal or financial advice can be beneficial to navigate any complexities and protect the interests of the beneficiaries.

Furthermore, Louisiana's insurance regulations may offer additional protections and support to beneficiaries. These regulations could include provisions for contested claims, where the insurance company must provide a fair and timely resolution if there are disputes regarding the policy or the beneficiary's rights. Understanding these legal aspects can empower beneficiaries to seek the financial assistance they are entitled to. Overall, life insurance replacement in Louisiana provides a vital financial safety net, ensuring that beneficiaries receive the necessary support to honor their loved ones' memory and manage their financial affairs effectively.

Life Insurance Tax in Canada: What You Need to Know

You may want to see also